|

GFA712S- FINANCIAL ACCOUNTING 320- 2ND OPP- NOV 2023 |

|

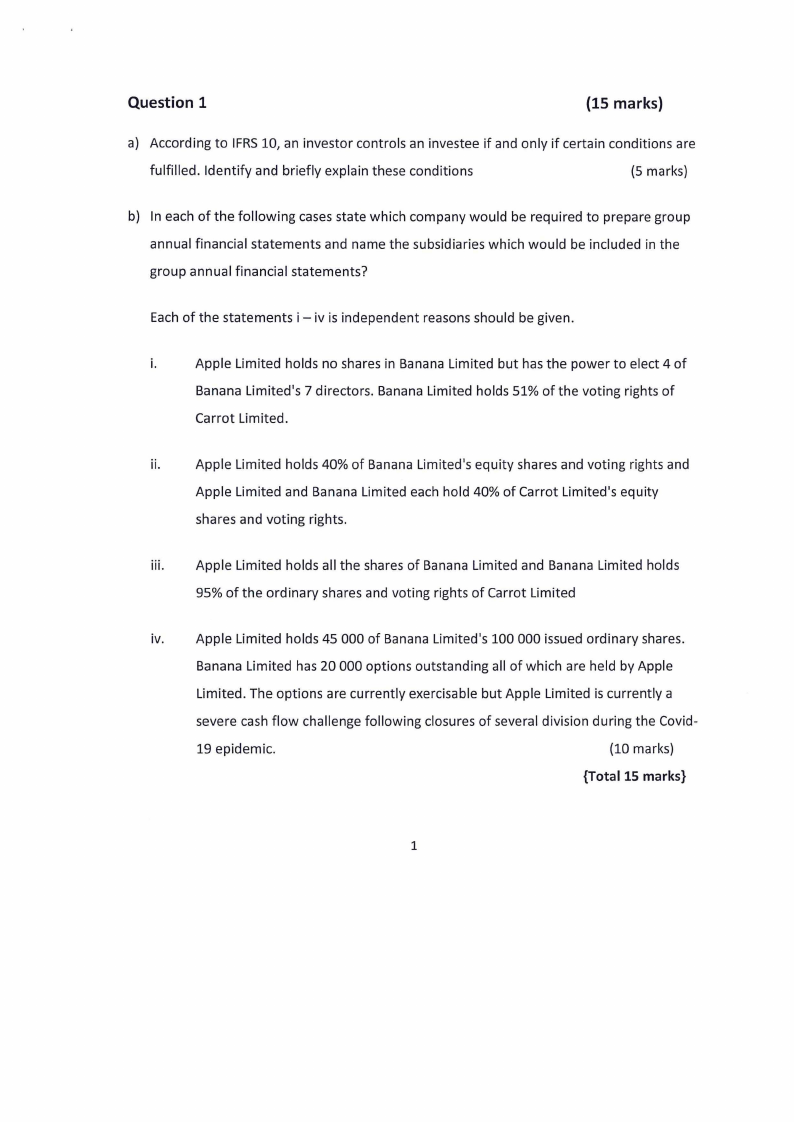

1 Page 1 |

▲back to top |

|

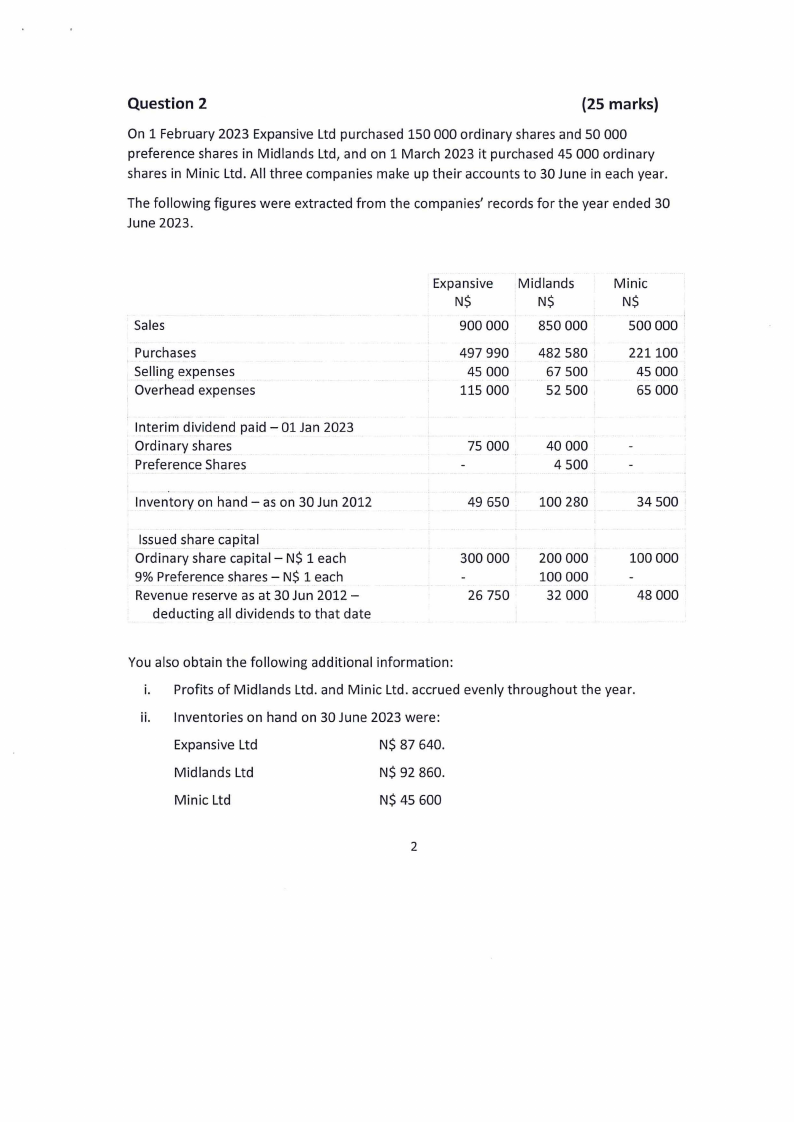

2 Page 2 |

▲back to top |

|

3 Page 3 |

▲back to top |

|

4 Page 4 |

▲back to top |

|

5 Page 5 |

▲back to top |

|

6 Page 6 |

▲back to top |

|

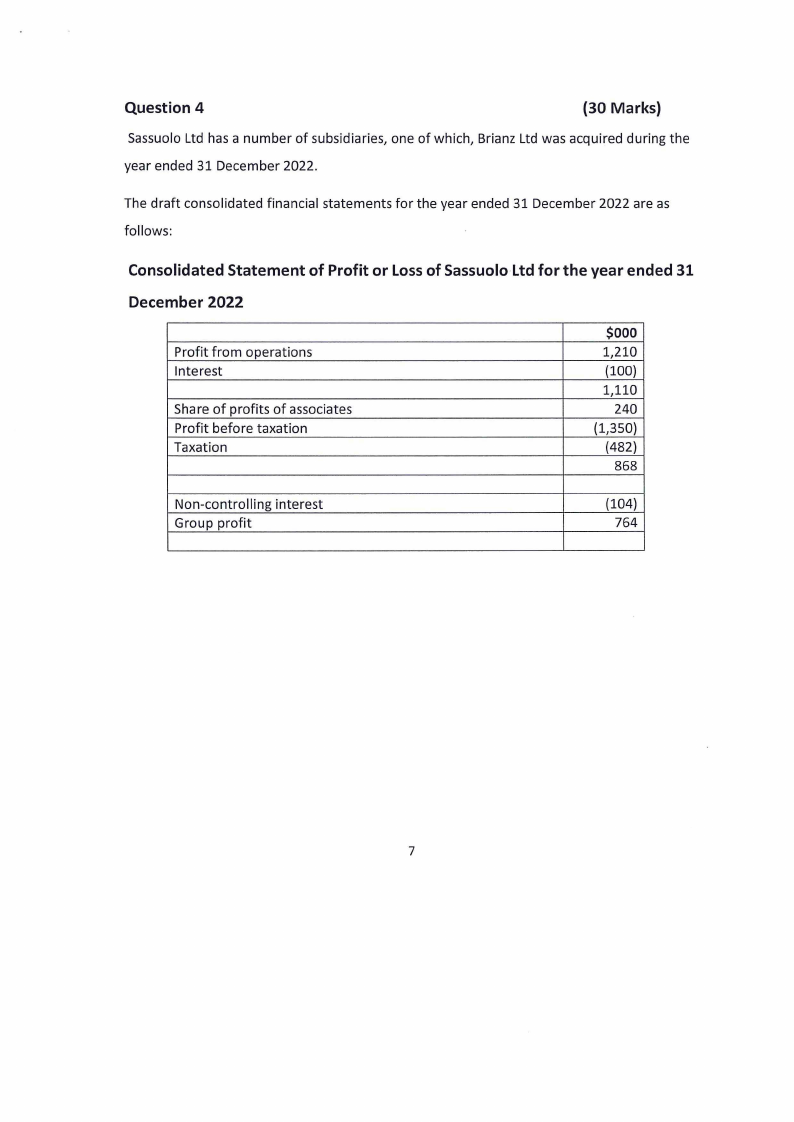

7 Page 7 |

▲back to top |

|

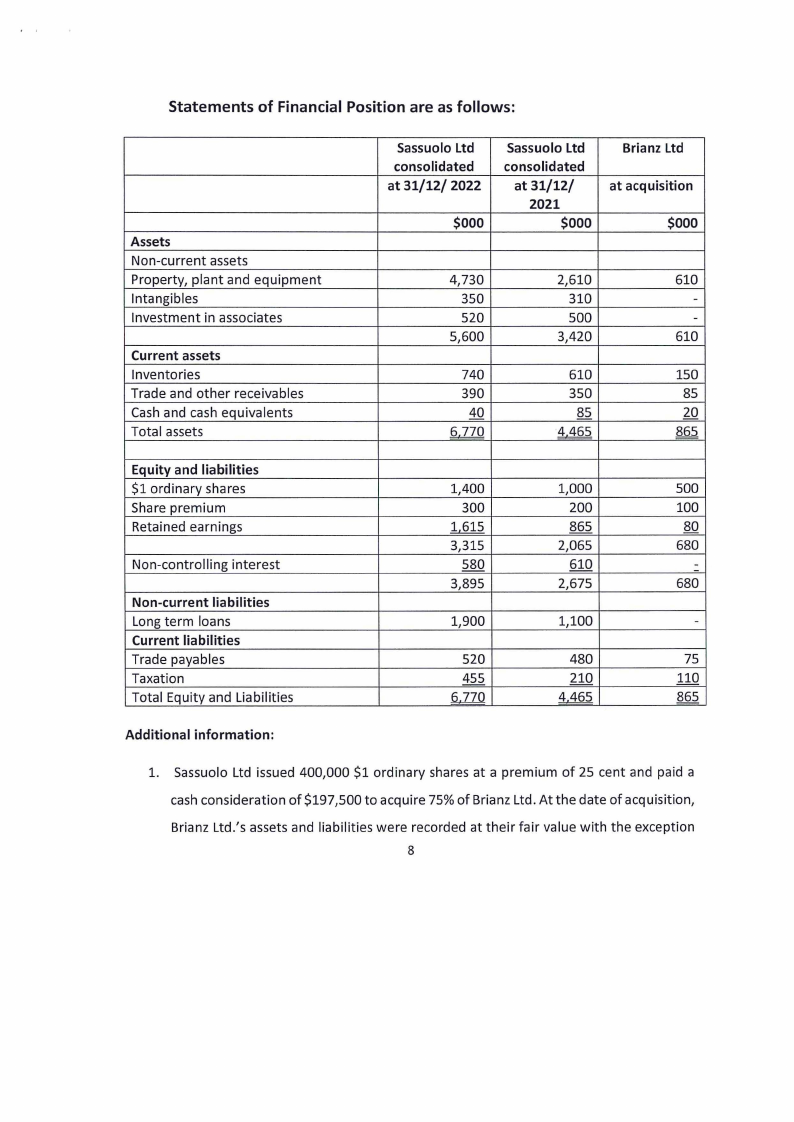

8 Page 8 |

▲back to top |

|

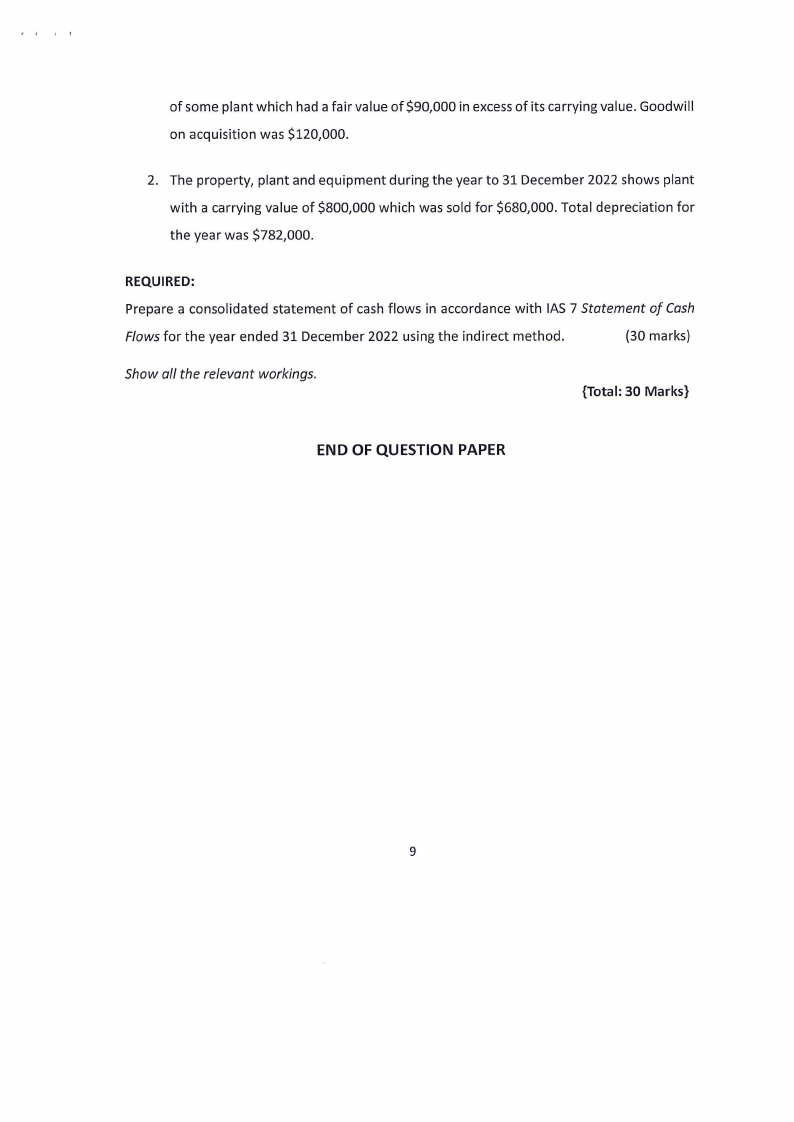

9 Page 9 |

▲back to top |

|

10 Page 10 |

▲back to top |