FTL821S - FINANCIAL TECHNIQUES FOR LOGISTICS AND OPERATIONS MANAGEMENT - 2ND OPP - JAN 2023

|

FTL821S - FINANCIAL TECHNIQUES FOR LOGISTICS AND OPERATIONS MANAGEMENT - 2ND OPP - JAN 2023 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVE RS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF COMMERCE,HUMANSCIENCEAND EDUCATION

DEPARTMENT OF MARKETING, LOGISTICSAND SPORTMANAGEMENT

QUALIFICATION: BACHELOR OF LOGISTICS AND SUPPLY CHAIN MANAGEMENT HONOURS

QUALIFICATION CODE: 08LSCH

COURSE CODE: FTL821S

LEVEL: 8

COURSE NAME: FINANCIAL TECHNIQUES FOR LOGISTICS

MANAGEMENT OPERATIONS

SESSION: JANUARY 2023

PAPER: THEORY AND PRACTICAL

DURATION: 180 MINUTES

MARKS: 100

SUPPLEMENTARY/ SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Mr. Twiitedululeni Nakweenda

MODERATOR

Mr. Johannes Ndjuluwa

INSTRUCTIONS

1. This question paper consists of six pages including this cover page.

2. There are six questions in this paper, and all are compulsory.

3. Start with the question that you understand best, and please number all your answers

clearly, and correctly.

4. Avoid any form of academic dishonesty.

5. Where applicable, please show all your workings.

6. Students should use their intuitions to deal with any perceived ambiguities, and all

assumptions made should clearly be indicated as such.

7. For qualitative answers, the number of marks allocated should serve as the basis for the

length of your answer.

8. Unless otherwise stated, round off all your final answers to two decimal places.

9. The use of Financial Calculators or PV/FV is permitted.

10. Strictly, no pencil work shall be marked.

THE PAPERCONSISTOF 5 PAGESINCLUDING THIS COVERPAGE+ 1 PAGEOF PV & FV TABLES

|

2 Page 2 |

▲back to top |

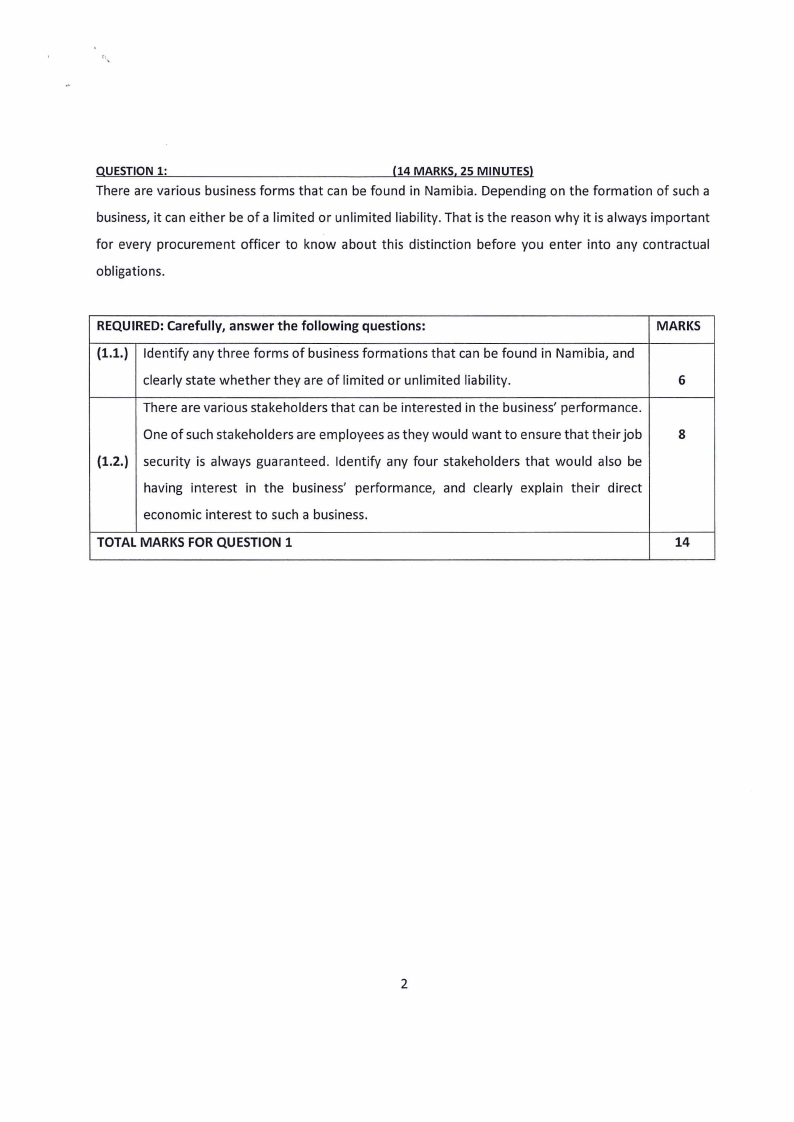

QUESTION 1:

(14 MARKS, 25 MINUTES)

There are various business forms that can be found in Namibia. Depending on the formation of such a

business, it can either be of a limited or unlimited liability. That is the reason why it is always important

for every procurement officer to know about this distinction before you enter into any contractual

obligations.

REQUIRED: Carefully, answer the following questions:

MARKS

(1.1.) Identify any three forms of business formations that can be found in Namibia, and

clearly state whether they are of limited or unlimited liability.

6

There are various stakeholders that can be interested in the business' performance.

One of such stakeholders are employees as they would want to ensure that their job

8

(1.2.) security is always guaranteed. Identify any four stakeholders that would also be

having interest in the business' performance, and clearly explain their direct

economic interest to such a business.

TOTAL MARKS FOR QUESTION 1

14

2

|

3 Page 3 |

▲back to top |

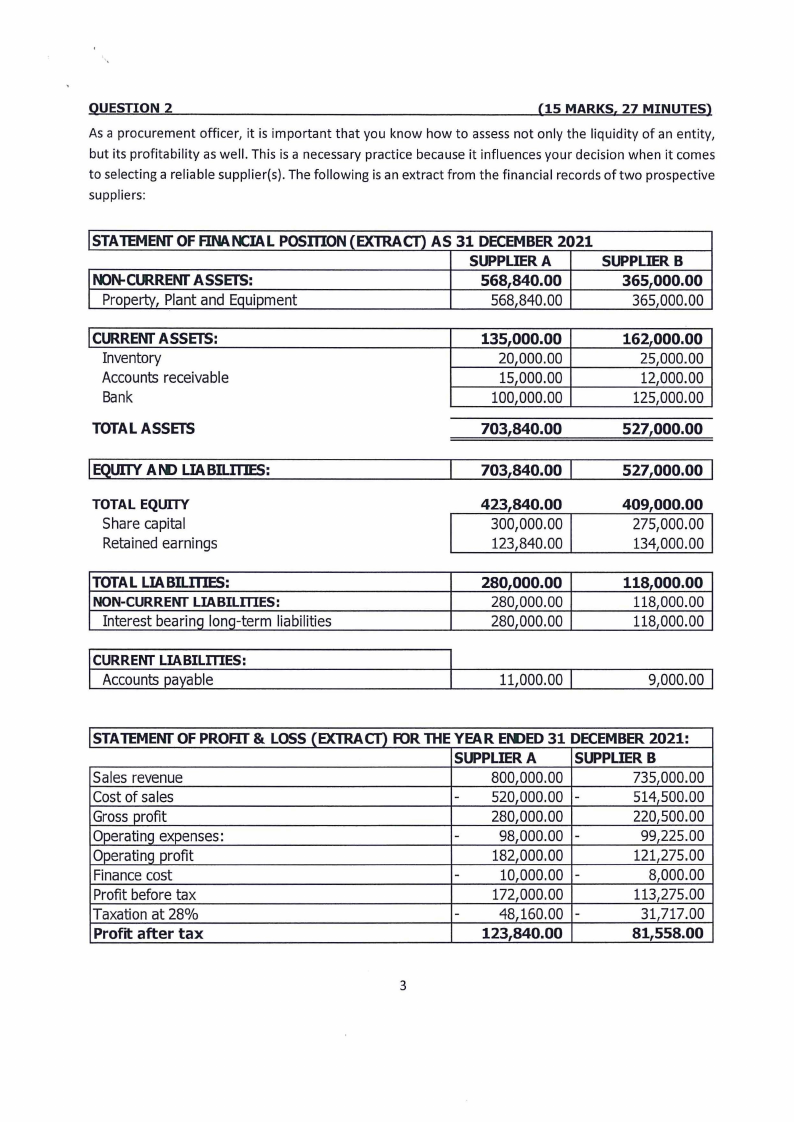

QUESTION 2

(15 MARKS, 27 MINUTES)

As a procurement officer, it is important that you know how to assessnot only the liquidity of an entity,

but its profitability as well. This is a necessary practice because it influences your decision when it comes

to selecting a reliable supplier(s). The following is an extract from the financial records of two prospective

suppliers:

STATEMENTOF FINAl'CIAL POSffiON (EXTRACT) AS 31 DECEMBER2021

SUPPLIERA

N>N-ClRRENTASSETS:

568,840.00

Property, Plant and Equipment

568,840.00

SUPPLIERB

365,000.00

365,000.00

!CURRENTASSETS:

Inventory

Accounts receivable

Bank

TOTALASSETS

IEQlITTYAN) LIABILITIES:

TOTAL EQUITY

Share capital

Retained earnings

135,000.00

20,000.00

15,000.00

100,000.00

703,840.00

103,840.00 1

423,840.00

300,000.00

123,840.00

162,000.00

25,000.00

12,000.00

125,000.00

527,000.00

s21,ooo.oo 1

409,000.00

275,000.00

134,000.00

TOTAL LIABILITIES:

NON-CURRENTLIABILmES:

Interest bearing long-term liabilities

280,000.00

280,000.00

280,000.00

118,000.00

118,000.00

118,000.00

CURRENT LIABILmES:

Accounts payable

I 11,000.00

I 9,000.00

STATEMENTOF PRORT & LOSS(EXTRACT}FORTHEYEAR EN>ED31 DECEMBER2021:

SUPPLIERA

SUPPLIERB

Sales revenue

Cost of sales

800,000.00

- 520,000.00 -

735,000.00

514,500.00

Gross profit

280,000.00

220,500.00

Operating expenses:

-

98,000.00 -

99,225.00

Operating profit

182,000.00

121,275.00

Finance cost

-

10,000.00 -

8,000.00

Profit before tax

Taxation at 28%

172,000.00

-

48,160.00 -

113,275.00

31,717.00

Profit after tax

123,840.00

81,558.00

3

|

4 Page 4 |

▲back to top |

REOURED: For each Suoolier, calculate the following ratios:

(2.1.) (i) Current ratio, and (ii) Quick ratio

(2.2.) (i) Gross orofit maroin, and (ii) Net profit margin

(2.3.) Based on your answers obtained in (2.1) to (2.2), which one of the two Suppliers

MARKS

6

4

5

would you recommend to your organization, and why?

TOTAL MARKS FOR QUESTION 2

15

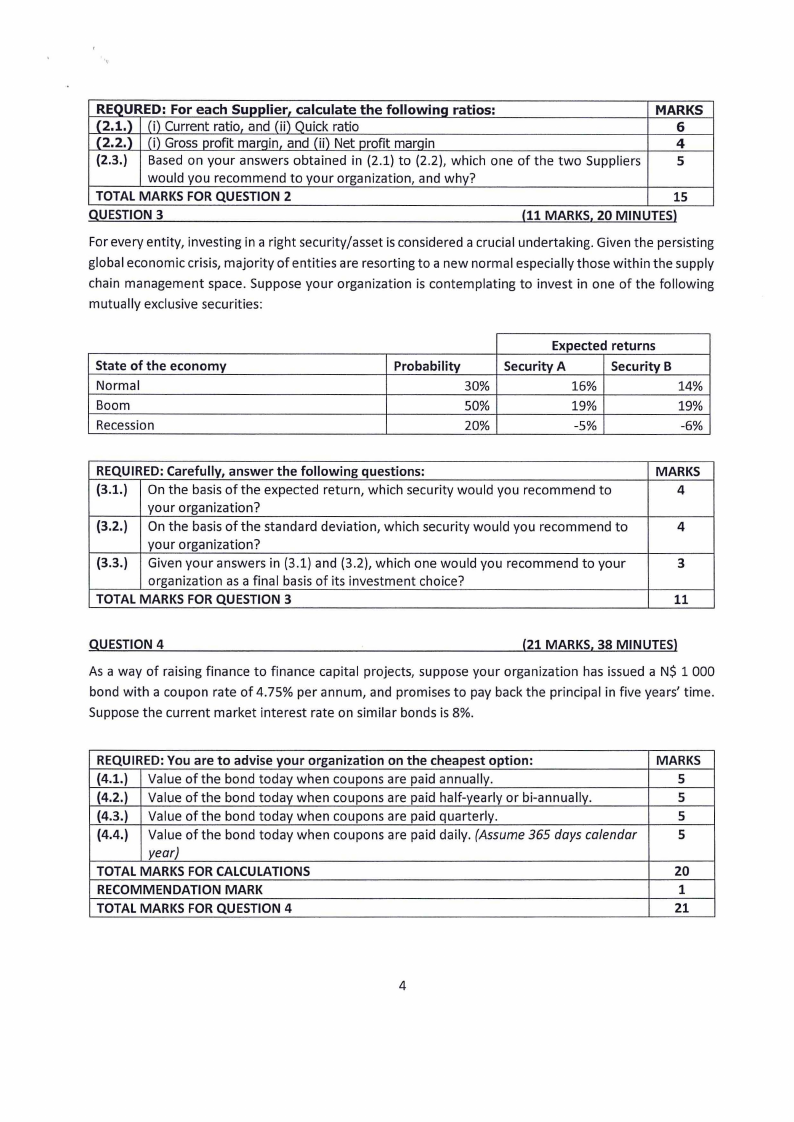

QUESTION 3

(11 MARKS, 20 MINUTES)

For every entity, investing in a right security/asset is considered a crucial undertaking. Given the persisting

global economic crisis, majority of entities are resorting to a new normal especially those within the supply

chain management space. Suppose your organization is contemplating to invest in one of the following

mutually exclusive securities:

State of the economy

Normal

Boom

Recession

Probability

30%

50%

20%

Expected returns

Security A

Security B

16%

14%

19%

19%

-5%

-6%

REQUIRED: Carefully, answer the following questions:

(3.1.) On the basis of the expected return, which security would you recommend to

your organization?

{3.2.) On the basis of the standard deviation, which security would you recommend to

your organization?

{3.3.) Given your answers in (3.1) and (3.2), which one would you recommend to your

organization as a final basis of its investment choice?

TOTAL MARKS FOR QUESTION 3

MARKS

4

4

3

11

QUESTION 4

(21 MARKS, 38 MINUTES)

As a way of raising finance to finance capital projects, suppose your organization has issued a N$ 1 000

bond with a coupon rate of 4.75% per annum, and promises to pay back the principal in five years' time.

Suppose the current market interest rate on similar bonds is 8%.

REQUIRED: You are to advise your organization on the cheapest option:

(4.1.) Value of the bond today when coupons are paid annually.

(4.2.) Value of the bond today when coupons are paid half-yearly or bi-annually.

(4.3.) Value of the bond today when coupons are paid quarterly.

(4.4.) Value of the bond today when coupons are paid daily. (Assume 365 days calendar

year)

TOTAL MARKS FOR CALCULATIONS

RECOMMENDATION MARK

TOTAL MARKS FOR QUESTION 4

MARKS

5

5

5

5

20

1

21

4

|

5 Page 5 |

▲back to top |

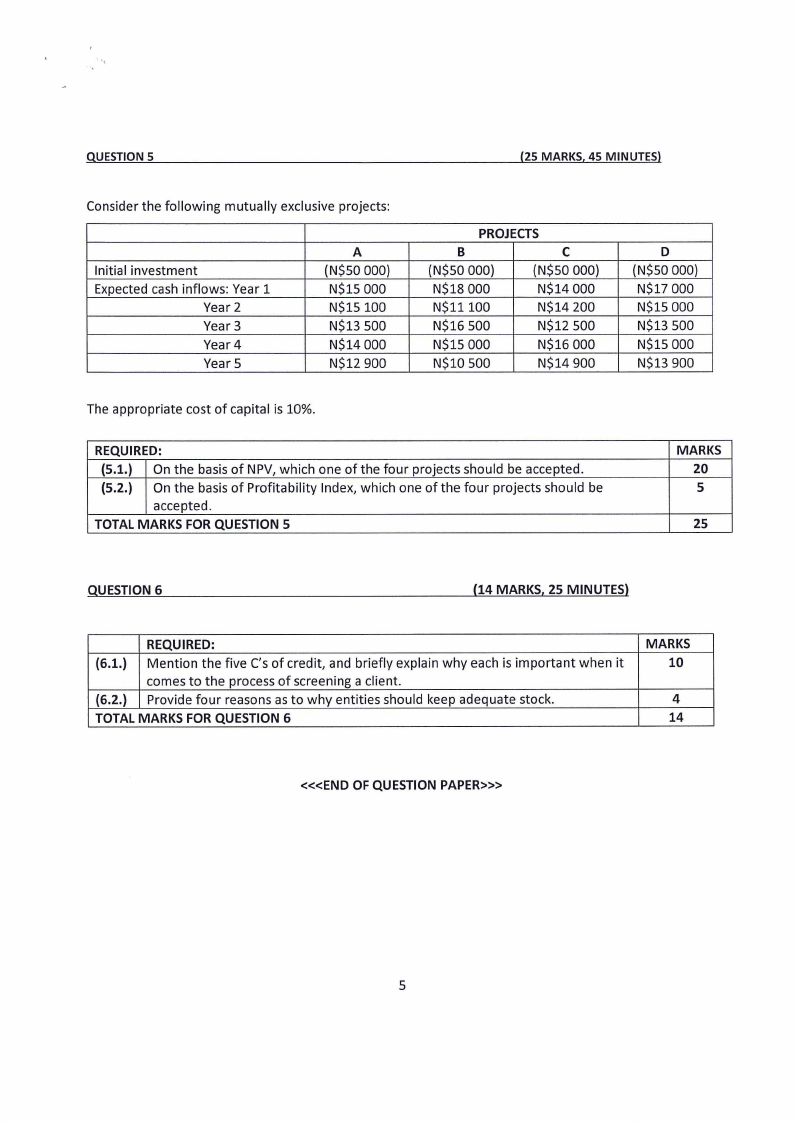

QUESTION 5

(25 MARKS, 45 MINUTES)

Consider the following mutually exclusive projects:

Initial investment

Expected cash inflows: Year 1

Year 2

Year3

Year4

Year 5

A

(N$50 000)

N$15 000

N$15 100

N$13 500

N$14 000

N$12 900

PROJECTS

B

C

(N$50 000)

(N$50 000)

N$18 000

N$14 000

N$11100

N$14 200

N$16 500

N$12 500

N$15 000

N$16 000

N$10 500

N$14 900

D

(N$50 000)

N$17 000

N$15 000

N$13 500

N$15 000

N$13 900

The appropriate cost of capital is 10%.

REQUIRED:

(5.1.) On the basis of NPV, which one of the four projects should be accepted.

(5.2.) On the basis of Profitability Index, which one of the four projects should be

accepted.

TOTAL MARKS FOR QUESTION 5

MARKS

20

5

25

QUESTION 6

(14 MARKS, 25 MINUTES)

REQUIRED:

(6.1.) Mention the five C's of credit, and briefly explain why each is important when it

comes to the process of screening a client.

(6.2.) Provide four reasons as to why entities should keep adequate stock.

TOTAL MARKS FOR QUESTION 6

MARKS

10

4

14

<«END OF QUESTION PAPER>»

5

|

6 Page 6 |

▲back to top |

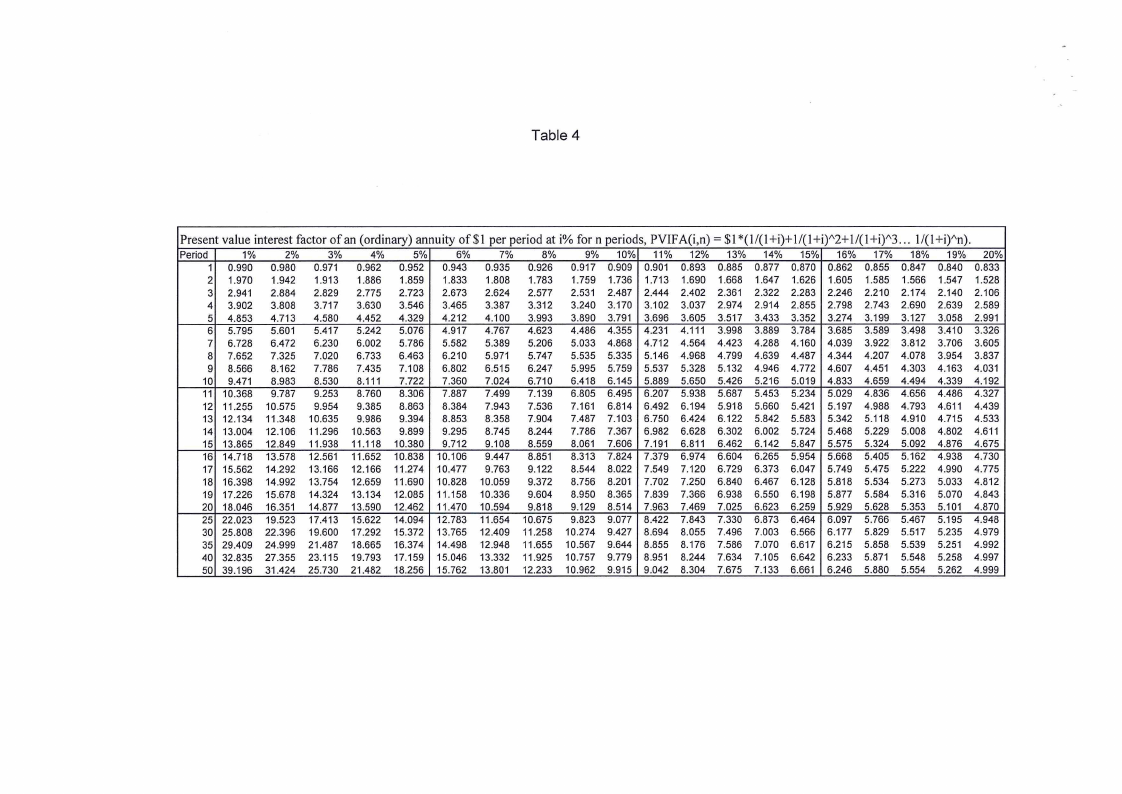

Table 4

Present value interest factor of an (ordinary) annuity of $1 per period at i¾ for n periods, PVIFA(i,n) = $1 *(1/(1+i)+ 1/(1+i)"2+ l/(l+i)"3 ... 1/(1+i)"n).

Period

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

25

30

35

40

50

1%

0.990

1.970

2.941

3.902

4.853

5.795

6.728

7.652

8.566

9.471

10.368

11.255

12.134

13.004

13.865

14.718

15.562

16.398

17.226

18.046

22.023

25.808

29.409

32.835

39.196

2%

0.980

1.942

2.884

3.808

4.713

5.601

6.472

7.325

8.162

8.983

9.787

10.575

11.348

12.106

12.849

13.578

14.292

14.992

15.678

16.351

19.523

22.396

24.999

27.355

31.424

3%

0.971

1.913

2.829

3.717

4.580

5.417

6.230

7.020

7.786

8.530

9.253

9.954

10.635

11.296

11.938

12.561

13.166

13.754

14.324

14.877

17.413

19.600

21.487

23.115

25.730

4%

0.962

1.886

2.775

3.630

4.452

5.242

6.002

6.733

7.435

8.111

8.760

9.385

9.986

10.563

11.118

11.652

12.166

12.659

13.134

13.590

15.622

17.292

18.665

19.793

21.482

5%

0.952

1.859

2.723

3.546

4.329

5.076

5.786

6.463

7.108

7.722

8.306

8.863

9.394

9.899

10.380

10.838

11.274

11.690

12.085

12.462

14.094

15.372

16.374

17.159

18.256

6%

0.943

1.833

2.673

3.465

4.212

4.917

5.582

6.210

6.802

7.360

7.887

8.384

8.853

9.295

9.712

10.106

10.477

10.828

11.158

11.470

12.783

13.765

14.498

15.046

15.762

7%

0.935

1.808

2.624

3.387

4.100

4.767

5.389

5.971

6.515

7.024

7.499

7.943

8.358

8.745

9.108

9.447

9.763

10.059

10.336

10.594

11.654

12.409

12.948

13.332

13.801

8%

0.926

1.783

2.577

3.312

3.993

4.623

5.206

5.747

6.247

6.710

7.139

7.536

7.904

8.244

8.559

8.851

9.122

9.372

9.604

9.818

10.675

11.258

11.655

11.925

12.233

9%

0.917

1.759

2.531

3.240

3.890

4.486

5.033

5.535

5.995

6.418

6.805

7.161

7.487

7.786

8.061

8.313

8.544

8.756

8.950

9.129

9.823

10.274

10.567

10.757

10.962

10%

0.909

1.736

2.487

3.170

3.791

4.355

4.868

5.335

5.759

6.145

6.495

6.814

7.103

7.367

7.606

7.824

8.022

8.201

8.365

8.514

9.077

9.427

9.644

9.779

9.915

11%

0.901

1.713

2.444

3.102

3.696

4.231

4.712

5.146

5.537

5.889

6.207

6.492

6.750

6.982

7.191

7.379

7.549

7.702

7.839

7.963

8.422

8.694

8.855

8.951

9.042

12%

0.893

1.690

2.402

3.037

3.605

4.111

4.564

4.968

5.328

5.650

5.938

6.194

6.424

6.628

6.811

6.974

7.120

7.250

7.366

7.469

7.843

8.055

8.176

8.244

8.304

13%

0.885

1.668

2.361

2.974

3.517

3.998

4.423

4.799

5.132

5.426

5.687

5.918

6.122

6.302

6.462

6.604

6.729

6.840

6.938

7.025

7.330

7.496

7.586

7.634

7.675

14%

0.877

1.647

2.322

2.914

3.433

3.889

4.288

4.639

4.946

5.216

5.453

5.660

5.842

6.002

6.142

6.265

6.373

6.467

6.550

6.623

6.873

7.003

7.070

7.105

7.133

15%

0.870

1.626

2.283

2.855

3.352

3.784

4.160

4.487

4.772

5.019

5.234

5.421

5.583

5.724

5.847

5.954

6.047

6.128

6.198

6.259

6.464

6.566

6.617

6.642

6.661

16%

0.862

1.605

2.246

2.798

3.274

3.685

4.039

4.344

4.607

4.833

5.029

5.197

5.342

5.468

5.575

5.668

5.749

5.818

5.877

5.929

6.097

6.177

6.215

6.233

6.246

17% 18%

0.855 0.847

1.585 1.566

2.210 2.174

2.743 2.690

3.199 3.127

3.589 3.498

3.922 3.812

4.207 4.078

4.451 4.303

4.659 4.494

4.836 4.656

4.988 4.793

5.118 4.910

5.229 5.008

5.324 5.092

5.405 5.162

5.475 5.222

5.534 5.273

5.584 5.316

5.628 5.353

5.766 5.467

5.829 5.517

5.858 5.539

5.871 5.548

5.880 5.554

19%

0.840

1.547

2.140

2.639

3.058

3.410

3.706

3.954

4.163

4.339

4.486

4.611

4.715

4.802

4.876

4.938

4.990

5.033

5.070

5.101

5.195

5.235

5.251

5.258

5.262

20%

0.833

1.528

2.106

2.589

2.991

3.326

3.605

3.837

4.031

4.192

4.327

4.439

4.533

4.611

4.675

4.730

4.775

4.812

4.843

4.870

4.948

4.979

4.992

4.997

4.999