|

BEP712S - SME PROJECTS - 2ND OPP - NOV 2024 |

|

1 Page 1 |

▲back to top |

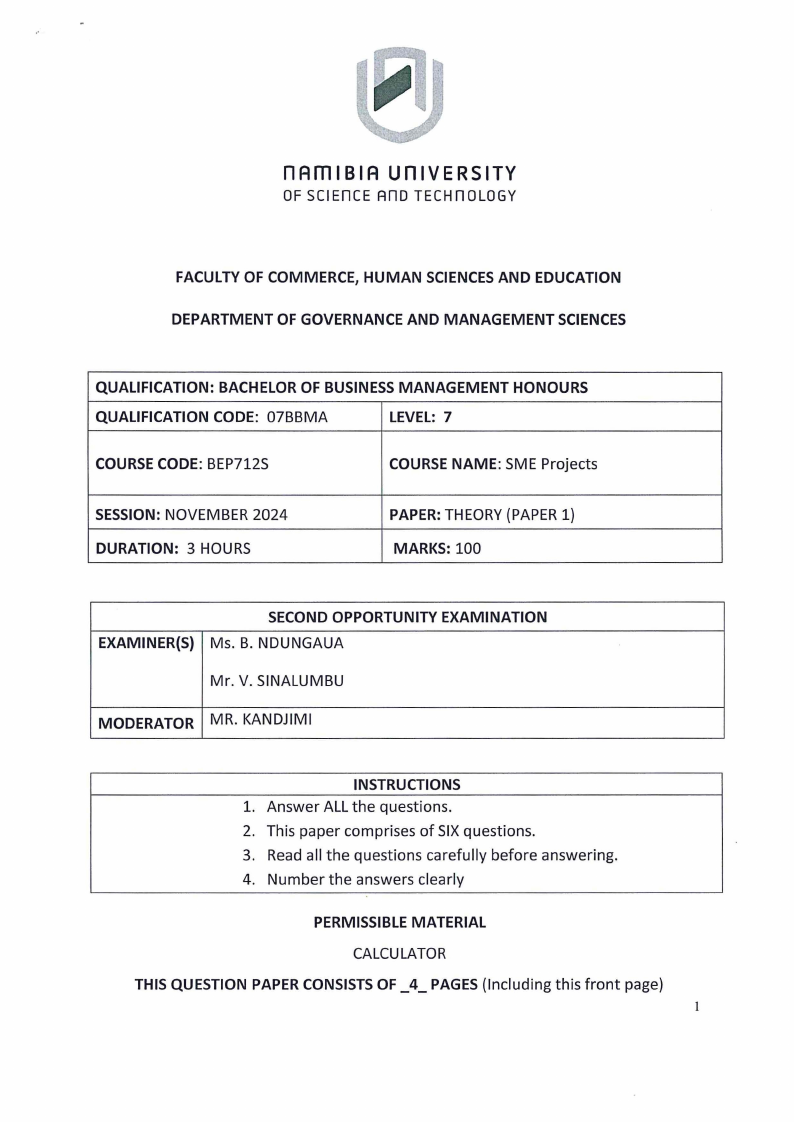

n Am I BI A u n IVE RS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF GOVERNANCE AND MANAGEMENT SCIENCES

QUALIFICATION: BACHELOR OF BUSINESS MANAGEMENT HONOURS

QUALIFICATION CODE: 07BBMA

LEVEL: 7

COURSE CODE: BEP712S

COURSE NAME: SME Projects

SESSION: NOVEMBER 2024

DURATION: 3 HOURS

PAPER: THEORY (PAPER 1)

MARKS: 100

SECOND OPPORTUNITY EXAMINATION

EXAMINER(S) Ms. B. NDUNGAUA

Mr. V. SINALUMBU

MODERATOR MR. KANDJIMI

INSTRUCTIONS

1. Answer ALL the questions.

2. This paper comprises of SIX questions.

3. Read all the questions carefully before answering.

4. Number the answers clearly

PERMISSIBLE MATERIAL

CALCULATOR

THIS QUESTION PAPER CONSISTS OF_ 4_ PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

(20 Marks]

You are required to select one of two appealing project proposals. Using the below

information, which project proposal should be selected?

Project A requires an investment of N$100,000 with an expected annual cash inflow of

N$25,500 for five years while project B requires an investment of N$85,000 with an

expected annual cash inflow of N$45,000 for five years as well. The expected rate of return

is 12%. The company's acceptable payback period is 2 years.

1) Determining the payback periods for each of the projects? (2 marks)

2) Which of the two projects should be selected based on the payback period method?

Explain your decision. (2 marks)

3} Determine the Net Present Value (NPV} of each ofthe projects. (14 marks)

4) Which of the two projects should be accepted based on the NPV? Explain your

decision.

(2 marks)

QUESTION 2

Answer the questions that follow, using the information in tables 1 and 2:

Tabe 1: Total budgeted costs of project A

-· . - .,

Week

TBC 1

2- 3

4

5

6

7

Task 1

40 10 20 10

Task2

50

30 10 10

Task3

30

20 10

Task4

30

15 15

Total

150

Commulative

Note: Amounts are in thousands.

Table 2: Total actual costs of project A byweek 4

.,.

Wee~

1

2

3

4 Total expended

Task 1

13 20 15

48

Task2

32

10

42

Task3

0

Task4

0

Total

Commulative

Note: Amounts are in thousands.

(20 Marks]

2

|

3 Page 3 |

▲back to top |

Questions:

a) Using table 2, how much has been spend by week 4? (2 Marks)

b) Noting that 55% of the work has been completed, calculate the cumulative earned value of

this project. (3 Marks)

c) What is the variance cost at the end of week 4? (3 Marks)

d) What is the cost performance index of this project? (3 Marks)

e) Using both formulae, calculate the forecasted costs at completion. (6 Marks)

f) In order to complete the project on budget, what is the To-Completion Performance Index?

(3 Marks)

QUESTION 3

[18 Marks]

With examples, discuss any six key competencies a project manager should have?

QUESTION 4

[15 Marks]

With the help of a diagram, explain the main phases of the project life cycle. What is delivered

at the end of each phase? {3 marks for the complete diagram and 3 marks for each of the

four phases)

QUESTION 5

[5 Marks]

Discusstwo aspects should be taken into account when pricing your proposal as a

contractor?

3

|

4 Page 4 |

▲back to top |

QUESTION 6

[22 Marks]

a) Calculate the Early Start (ES),Early Finish (EF), Latest Start (LS)and Latest finish (LF)times respectively. Will this project finish in 120

days? [16 marks for start and finish times]. Present vour answers in a proiect schedule.

b) Calculate slack for each activity and identify the critical path. {2 marks for slack and 2 marks for the critical path]

c) Assuming activity F's actual completion is delayed by 5 days, when will activities G's and H's earliest start be? [2 Marks]

Activity A

John 10

Activity B

3 I Anna I 13

Activity D

6 I Sue

5

Activity C

1--~--------1

5 I Lee

__.

5

Activity E

1--~--------1

8 I Mary 15

Activity F

7 j Pet j 1s

Activity G

10 I Shetu I 18

IActivity H

Activity I

I/ I 12 j Kauna 4

11 I Vija I 5

4