|

BAC611C- BUSINESS ACCOUNTING 1B- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA

unrVERSITY

0 F SCIEnCE Ano

TECHnOLOGY

HAROLDPUPKEWITZ

GraduateSchoool f Business

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

HAROLD PUPKEWITZGRADUATESCHOOLOF BUSINESS

QUALIFICATION: DIPLOMA IN BUSINESSPROCESSMANAGEMENT

QUALIFICATIONCODE:06DBPM LEVEL:6

COURSECODE: BAC611C

COURSENAME: BUSINESSACCOUNTING 2A

SESSION:NOVEMBER 2023

PAPER:PAPER1

DURATION: 3 HOURS

MARKS: 100

EXAMINER

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Lameck Odada

MODERATOR Gerhardt Sheehama

INSTRUCTIONS

1. This question paper is made up of four (4) questions.

2. Answer ALLthe questions in blue or black ink only. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with four (4) decimal places in all your calculations and only round off only final

answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 7 PAGES(excluding this front page)

|

2 Page 2 |

▲back to top |

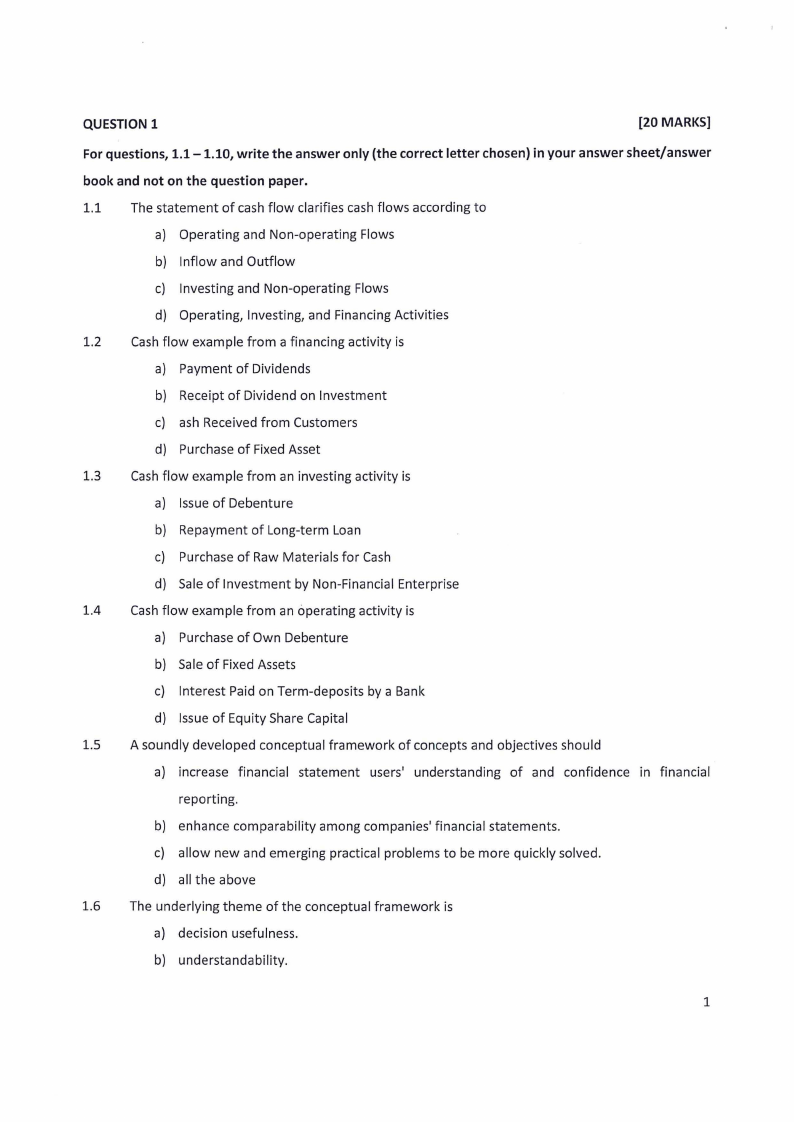

QUESTION 1

[20 MARKS]

For questions, 1.1-1.10, write the answer only (the correct letter chosen) in your answer sheet/answer

book and not on the question paper.

1.1 The statement of cash flow clarifies cash flows according to

a) Operating and Non-operating Flows

b) Inflow and Outflow

c) Investing and Non-operating Flows

d) Operating, Investing, and Financing Activities

1.2 Cashflow example from a financing activity is

a) Payment of Dividends

b) Receipt of Dividend on Investment

c) ash Received from Customers

d) Purchase of Fixed Asset

1.3 Cashflow example from an investing activity is

a) Issue of Debenture

b) Repayment of Long-term Loan

c) Purchase of Raw Materials for Cash

d) Sale of Investment by Non-Financial Enterprise

1.4 Cash flow example from an operating activity is

a) Purchase of Own Debenture

b) Sale of Fixed Assets

c) Interest Paid on Term-deposits by a Bank

d) Issue of Equity Share Capital

1.5 A soundly developed conceptual framework of concepts and objectives should

a) increase financial statement users' understanding of and confidence in financial

reporting.

b) enhance comparability among companies' financial statements.

c) allow new and emerging practical problems to be more quickly solved.

d) all the above

1.6 The underlying theme of the conceptual framework is

a) decision usefulness.

b) understandability.

1

|

3 Page 3 |

▲back to top |

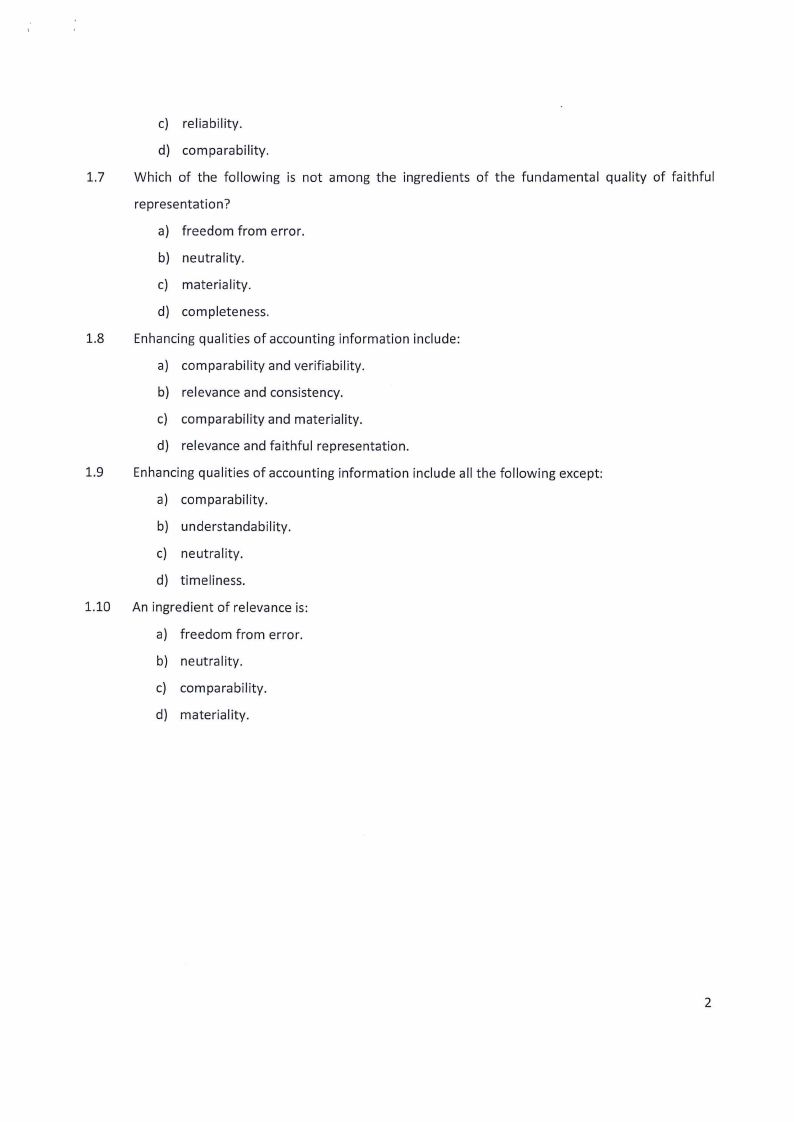

c) reliability.

d) comparability.

1.7 Which of the following is not among the ingredients of the fundamental quality of faithful

representation?

a) freedom from error.

b) neutrality.

c) materiality.

d) completeness.

1.8 Enhancing qualities of accounting information include:

a) comparability and verifiability.

b) relevance and consistency.

c) comparability and materiality.

d) relevance and faithful representation.

1.9 Enhancing qualities of accounting information include all the following except:

a) comparability.

b) understandability.

c) neutrality.

d) timeliness.

1.10 An ingredient of relevance is:

a) freedom from error.

b) neutrality.

c) comparability.

d) materiality.

2

|

4 Page 4 |

▲back to top |

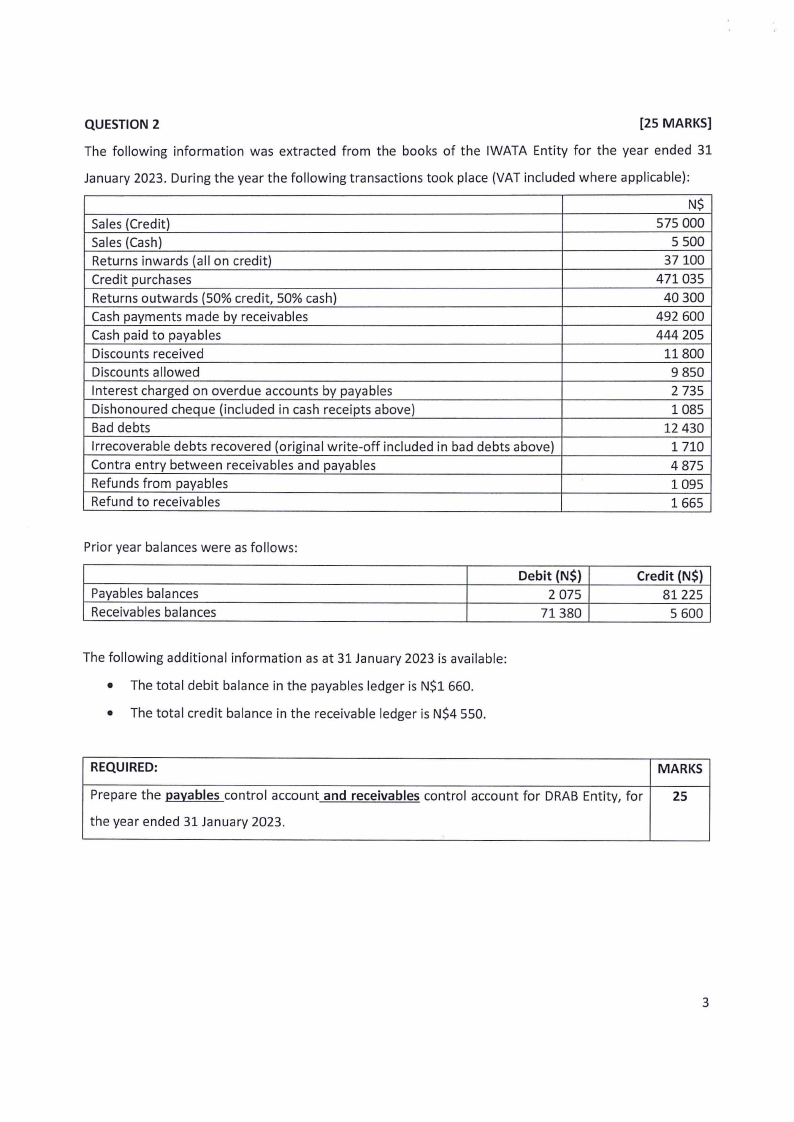

QUESTION 2

[25 MARKS]

The following information was extracted from the books of the IWATA Entity for the year ended 31

January 2023. During the year the following transactions took place (VAT included where applicable):

Sales (Credit)

Sales (Cash)

Returns inwards (all on credit)

Credit purchases

Returns outwards (50% credit, 50% cash)

Cash payments made by receivables

Cash paid to payables

Discounts received

Discounts allowed

Interest charged on overdue accounts by payables

Dishonoured cheque (included in cash receipts above)

Bad debts

Irrecoverable debts recovered (original write-off included in bad debts above)

Contra entry between receivables and payables

Refunds from payables

Refund to receivables

N$

575 000

5 500

37100

471 035

40 300

492 600

444 205

11800

9 850

2 735

1085

12 430

1 710

4 875

1095

1665

Prior year balances were as follows:

Payables balances

Receivables balances

Debit (N$)

2 075

71380

Credit (N$)

81225

5 600

The following additional information as at 31 January 2023 is available:

• The total debit balance in the payables ledger is N$1 660.

• The total credit balance in the receivable ledger is N$4 550.

REQUIRED:

MARKS

Prepare the payables control account and receivables control account for DRAB Entity, for

25

the year ended 31 January 2023.

3

|

5 Page 5 |

▲back to top |

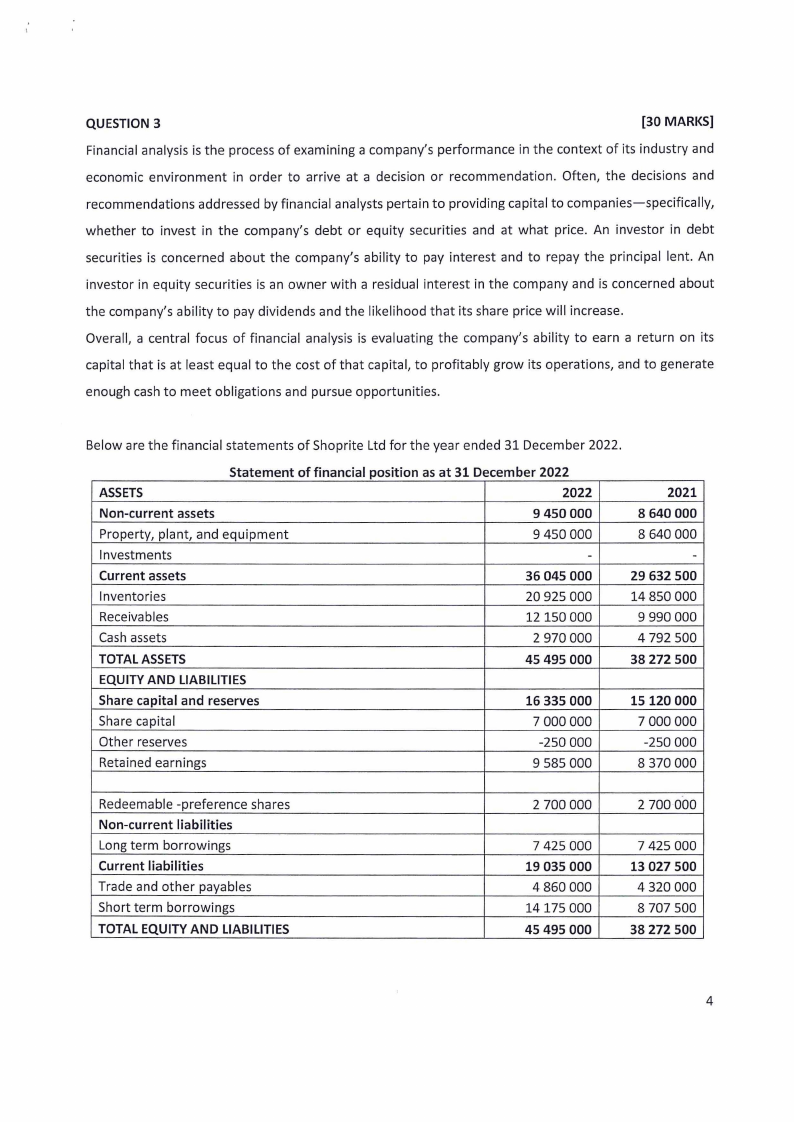

QUESTION 3

[30 MARKS]

Financial analysis is the process of examining a company's performance in the context of its industry and

economic environment in order to arrive at a decision or recommendation. Often, the decisions and

recommendations addressed by financial analysts pertain to providing capital to companies-specifically,

whether to invest in the company's debt or equity securities and at what price. An investor in debt

securities is concerned about the company's ability to pay interest and to repay the principal lent. An

investor in equity securities is an owner with a residual interest in the company and is concerned about

the company's ability to pay dividends and the likelihood that its share price will increase.

Overall, a central focus of financial analysis is evaluating the company's ability to earn a return on its

capital that is at least equal to the cost of that capital, to profitably grow its operations, and to generate

enough cash to meet obligations and pursue opportunities.

Below are the financial statements of Shoprite Ltd for the year ended 31 December 2022.

Statement of financial position as at 31 December 2022

ASSETS

2022

Non-current assets

9 450 000

Property, plant, and equipment

Investments

9 450 000

-

Current assets

36 045 000

Inventories

20 925 000

Receivables

12150 000

Cash assets

2 970 000

TOTAL ASSETS

45 495 000

EQUITY AND LIABILITIES

Share capital and reserves

16 335 000

Share capital

7 000 000

Other reserves

-250 000

Retained earnings

9 585 000

2021

8 640 000

8 640 000

-

29 632 500

14 850 000

9 990 000

4 792 500

38 272 500

15 120 000

7 000 000

-250 000

8 370 000

Redeemable -preference shares

Non-current liabilities

Long term borrowings

Current liabilities

Trade and other payables

Short term borrowings

TOTAL EQUITY AND LIABILITIES

2 700 000

7 425 000

19 035 000

4 860 000

14175 000

45 495 000

2 700 000

7 425 000

13 027 500

4 320 000

8 707 500

38 272 500

4

|

6 Page 6 |

▲back to top |

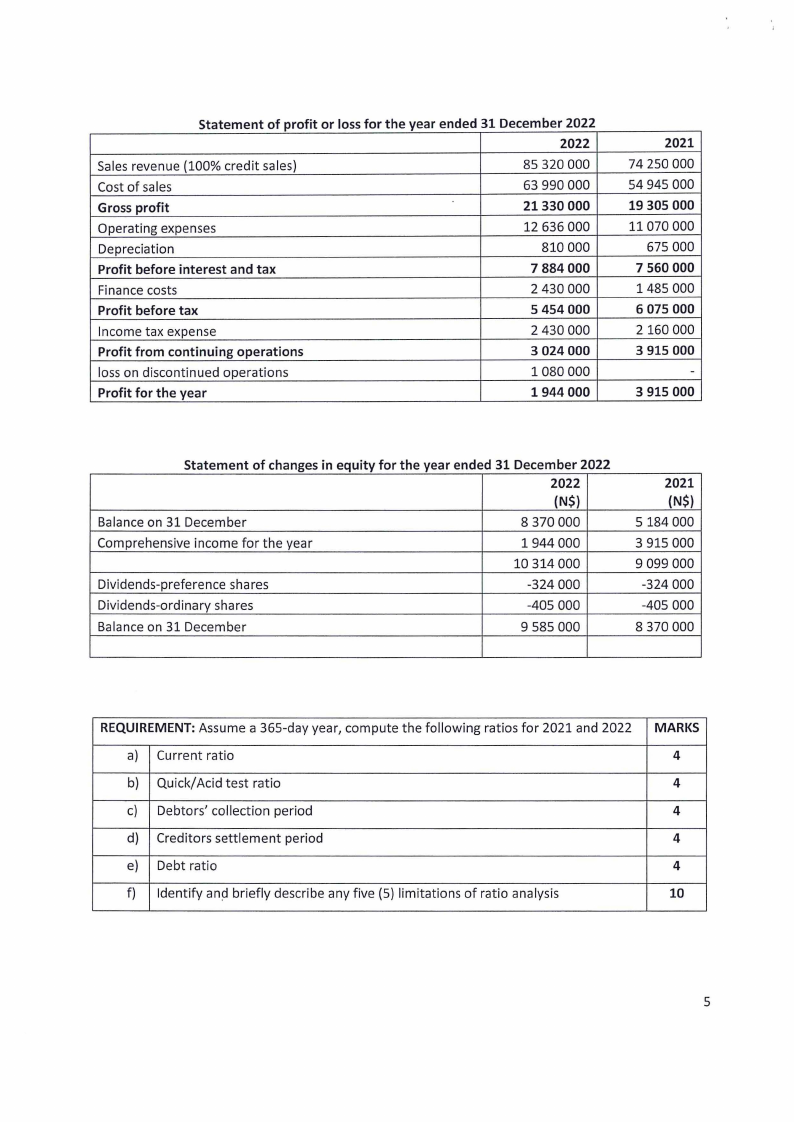

Statement of profit or lossfor the year ended 31 December 2022

2022

Sales revenue (100% credit sales)

85 320 000

Cost of sales

63 990 000

Gross profit

21330 000

Operating expenses

12 636 000

Depreciation

810 000

Profit before interest and tax

7 884 000

Finance costs

2 430 000

Profit before tax

5 454 000

Income tax expense

2 430 000

Profit from continuing operations

3 024 000

loss on discontinued operations

1080 000

Profit for the year

1944 000

2021

74 250 000

54 945 000

19 305 000

11070 000

675 000

7 560 000

1485 000

6 075 000

2 160 000

3 915 000

-

3 915 000

Statement of changes in equity for the year ended 31 December 2022

2022

(N$)

Balance on 31 December

8 370 000

Comprehensive income for the year

1944 000

10 314 000

Dividends-preference shares

-324 000

Dividends-ordinary shares

-405 000

Balance on 31 December

9 585 000

2021

(N$)

5 184 000

3 915 000

9 099 000

-324 000

-405 000

8 370 000

REQUIREMENT: Assume a 365-day year, compute the following ratios for 2021 and 2022

a) Current ratio

b) Quick/ Acid test ratio

c) Debtors' collection period

d) Creditors settlement period

e) Debt ratio

f) Identify and briefly describe any five (5) limitations of ratio analysis

MARKS

4

4

4

4

4

10

5

|

7 Page 7 |

▲back to top |

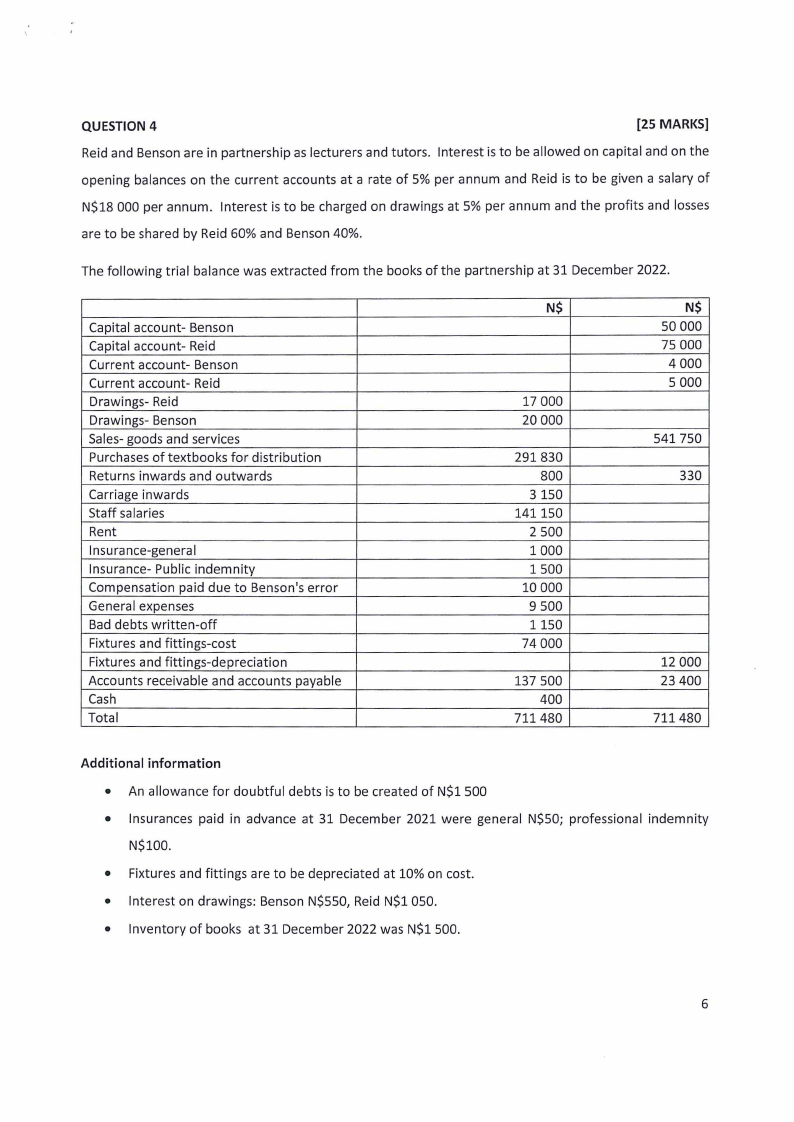

QUESTION 4

[25 MARKS]

Reid and Benson are in partnership as lecturers and tutors. Interest is to be allowed on capital and on the

opening balances on the current accounts at a rate of 5% per annum and Reid is to be given a salary of

N$18 000 per annum. Interest is to be charged on drawings at 5% per annum and the profits and losses

are to be shared by Reid 60% and Benson 40%.

The following trial balance was extracted from the books of the partnership at 31 December 2022.

Capital account- Benson

Capital account- Reid

Current account- Benson

Current account- Reid

Drawings- Reid

Drawings- Benson

Sales-goods and services

Purchases of textbooks for distribution

Returns inwards and outwards

Carriage inwards

Staff salaries

Rent

Insurance-general

Insurance- Public indemnity

Compensation paid due to Benson's error

General expenses

Bad debts written-off

Fixtures and fittings-cost

Fixtures and fittings-depreciation

Accounts receivable and accounts payable

Cash

Total

N$

17 000

20 000

291830

800

3 150

141150

2 500

1000

1500

10000

9 500

1150

74000

137 500

400

711480

N$

50 000

75 000

4000

5 000

541 750

330

12 000

23 400

711480

Additional information

• An allowance for doubtful debts is to be created of N$1 500

• Insurances paid in advance at 31 December 2021 were general N$50; professional indemnity

N$100.

• Fixtures and fittings are to be depreciated at 10% on cost.

• Interest on drawings: Benson N$550, Reid N$1050.

• Inventory of books at 31 December 2022 was N$1 500.

6

|

8 Page 8 |

▲back to top |

REQUIREMENT:

MARKS

a) Prepare the partnership statement of profit and loss

14

b) Prepare the partnership profit and loss appropriation account at 31 December 11

2022

END OF EXAMINATION QUESTION PAPER

7