|

FAC611S- FINANCIAL ACCOUNTING 201- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTING AND FINANCE

QUALIFICATION:BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

LEVEL: 6

COURSECODE: FAC6115

COURSENAME: FINANCIALACCOUNTING201

DATE:JULY2023

DURATION: 3 HOURS

PAPER:THEORYAND CALCULATIONS

MARKS: 100

SECONDOPPORTUNITYEXAMINATION PAPER

EXAMINER(S) Dr. A. Simasiku, Mr C. Mahindi, Mr. C. Simasiku and Ms. S. lfugula

MODERATOR: Dr. D. Kamotho

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page.

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

THIS QUESTION PAPERCONSISTSOF 5 PAGES(excluding this front page)

|

2 Page 2 |

▲back to top |

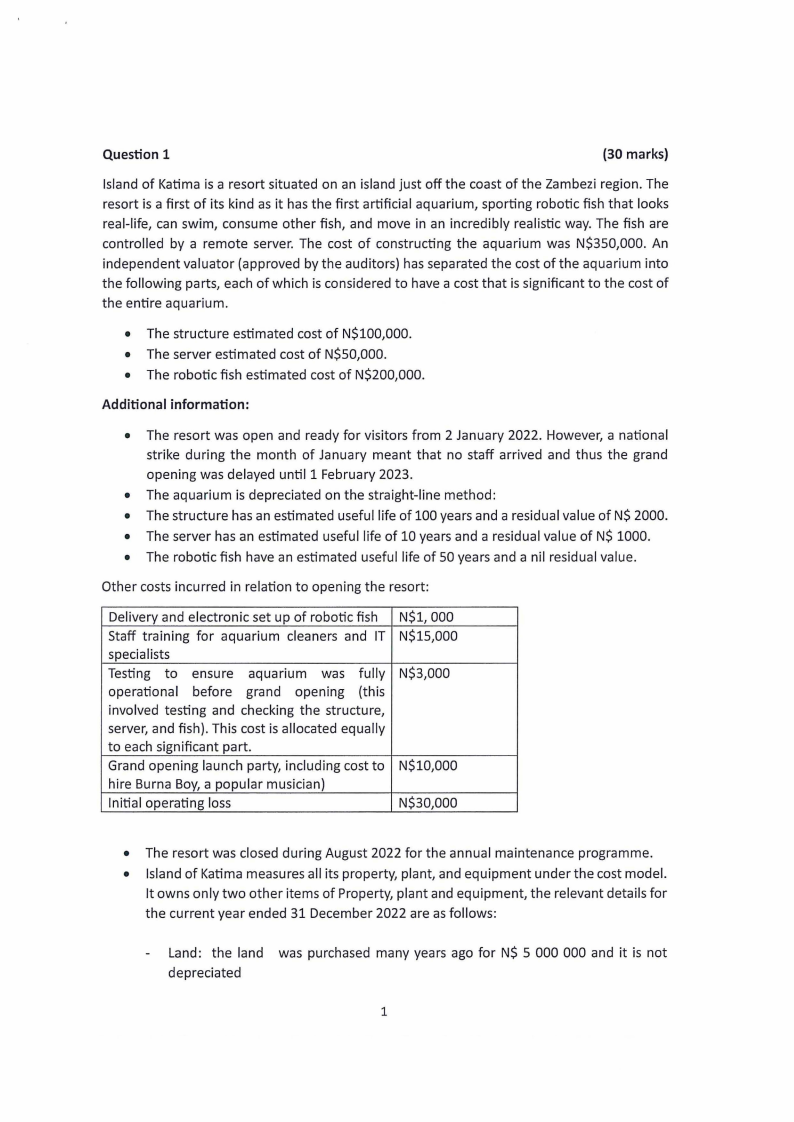

Question 1

(30 marks)

Island of Katima is a resort situated on an island just off the coast of the Zambezi region. The

resort is a first of its kind as it has the first artificial aquarium, sporting robotic fish that looks

real-life, can swim, consume other fish, and move in an incredibly realistic way. The fish are

controlled by a remote server. The cost of constructing the aquarium was N$350,000. An

independent valuator (approved by the auditors) has separated the cost of the aquarium into

the following parts, each of which is considered to have a cost that is significant to the cost of

the entire aquarium.

• The structure estimated cost of N$100,000.

• The server estimated cost of N$50,000.

• The robotic fish estimated cost of N$200,000.

Additional information:

• The resort was open and ready for visitors from 2 January 2022. However, a national

strike during the month of January meant that no staff arrived and thus the grand

opening was delayed until 1 February 2023.

• The aquarium is depreciated on the straight-line method:

• The structure has an estimated useful life of 100 years and a residual value of N$ 2000.

• The server has an estimated useful life of 10 years and a residual value of N$ 1000.

• The robotic fish have an estimated useful life of 50 years and a nil residual value.

Other costs incurred in relation to opening the resort:

Delivery and electronic set up of robotic fish

Staff training for aquarium cleaners and IT

specialists

Testing to ensure aquarium was fully

operationa I before grand opening (this

involved testing and checking the structure,

server, and fish). This cost is allocated equally

to each significant part.

Grand opening launch party, including cost to

hire Burna Boy, a popular musician)

Initial operating loss

N$1,000

N$15,000

N$3,000

N$10,000

N$30,000

• The resort was closed during August 2022 for the annual maintenance programme.

• Island of Katima measures all its property, plant, and equipment under the cost model.

It owns only two other items of Property, plant and equipment, the relevant details for

the current year ended 31 December 2022 are as follows:

Land: the land was purchased many years ago for N$ 5 000 000 and it is not

depreciated

1

|

3 Page 3 |

▲back to top |

Building: construction of the building was complete on 1 January 2021 at a cost of

N$12 000 000 and it is depreciated on the reducing balance at a rate of 5% per

annum. Its residual value is N$2 000 000.

Required

(a) Using Katima's general journal, show ALLthe related journal entries for year ended 31

December 2022.

(18)

(b) Disclose the Property, Plant and Equipment note in the financial statement's of

Katima Island for the year ended 31 December 2022.

(12)

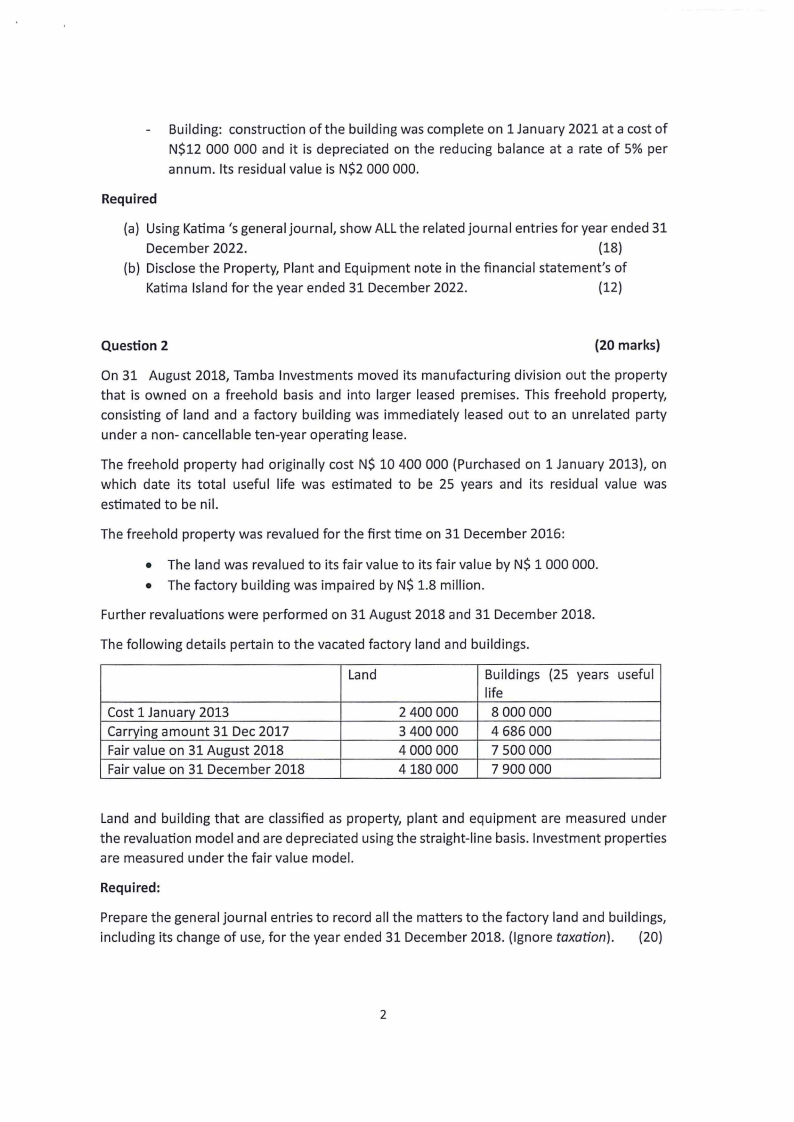

Question 2

(20 marks)

On 31 August 2018, Tamba Investments moved its manufacturing division out the property

that is owned on a freehold basis and into larger leased premises. This freehold property,

consisting of land and a factory building was immediately leased out to an unrelated party

under a non- cancellable ten-year operating lease.

The freehold property had originally cost N$ 10 400 000 (Purchased on 1 January 2013), on

which date its total useful life was estimated to be 25 years and its residual value was

estimated to be nil.

The freehold property was revalued for the first time on 31 December 2016:

• The land was revalued to its fair value to its fair value by N$ 1 000 000.

• The factory building was impaired by N$ 1.8 million.

Further revaluations were performed on 31 August 2018 and 31 December 2018.

The following details pertain to the vacated factory land and buildings.

Cost 1 January 2013

Carrying amount 31 Dec 2017

Fair value on 31 August 2018

Fair value on 31 December 2018

Land

2 400 000

3 400 000

4 000 000

4180 000

Buildings (25 years useful

life

8 000 000

4 686 000

7 500 000

7 900 000

Land and building that are classified as property, plant and equipment are measured under

the revaluation model and are depreciated using the straight-line basis. Investment properties

are measured under the fair value model.

Required:

Prepare the general journal entries to record all the matters to the factory land and buildings,

including its change of use, for the year ended 31 December 2018. (Ignore taxation). (20)

2

|

4 Page 4 |

▲back to top |

Question 3

(25 marks)

Kikiki Limited is a manufacturing company that owns various items of machinery. As a result

of new technology in the manufacturing industry, Kikiki Limited now expects to earn less

revenue from two items of machinery. The carrying amount of the two items on 31 December

2022 were as follows:

Machine ABC

Machine XYZ

8 500 000

7 500 000

Management determined the fair value less cost of disposal of machine ABC to be

N$8,000,000 and that the of machine XYZto be N$7,400,000 on 31 December 2022.

Kikiki Limited is of the opinion that machine ABCwill generate net cash inflows of N$2,100,000

per annum over the next five years and this was confirmed in the most recent cash flow

budget for management. Machine ABC can be disposed of for a net amount of N$150,000 at

the end of its useful life.

The budgeted net cash inflows for the next five years from Machine XYZ{that occur at the end

of each year) are as follows.

2023

2024

2025

2026

2027

N$

1900 000

1950 000

2 050 000

2 000 000

1800 000

An appropriate discount rate is 10%.

10%

Year 1

0.909

Year 2

0.826

Year 3

0.751

Year 4

0.683

Year 5

0.621

Present value annuity for five years

I 3.791

REQUIRED:

Calculate the impairment loss for BOTH machines to be recognised by Kikiki Limited for the

year ended 31 December 2022. Show all your workings.

{25)

3

|

5 Page 5 |

▲back to top |

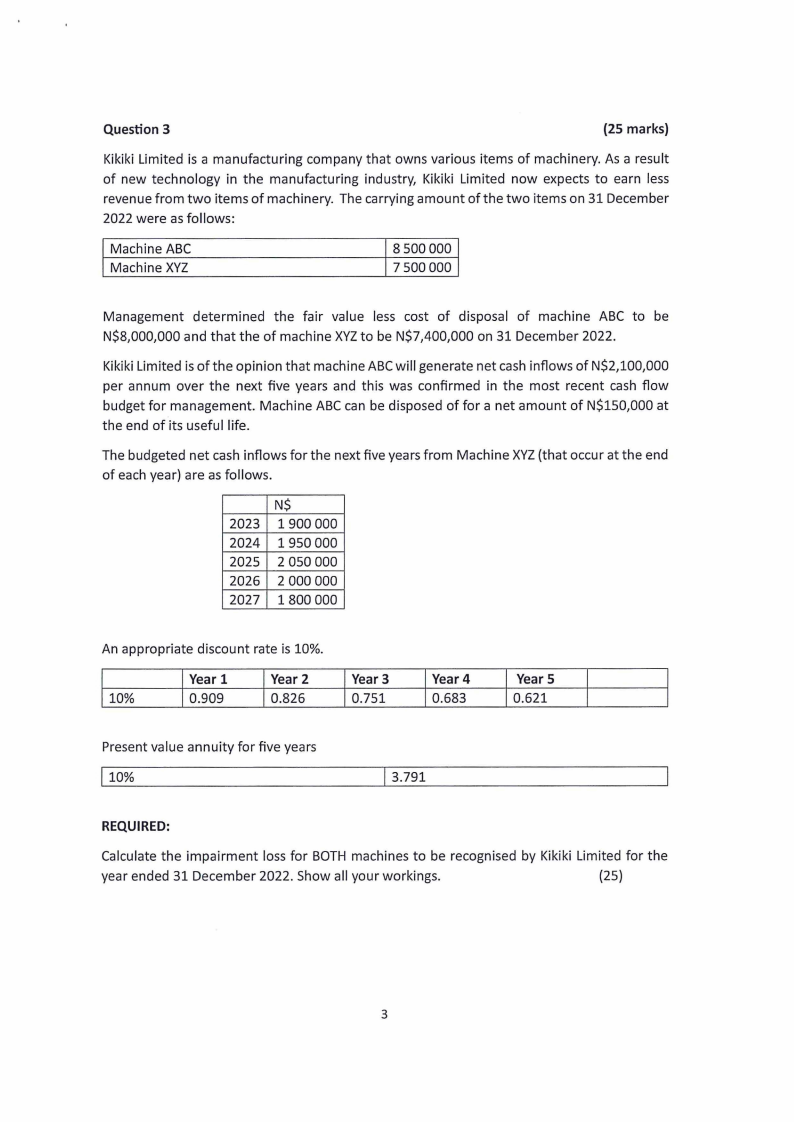

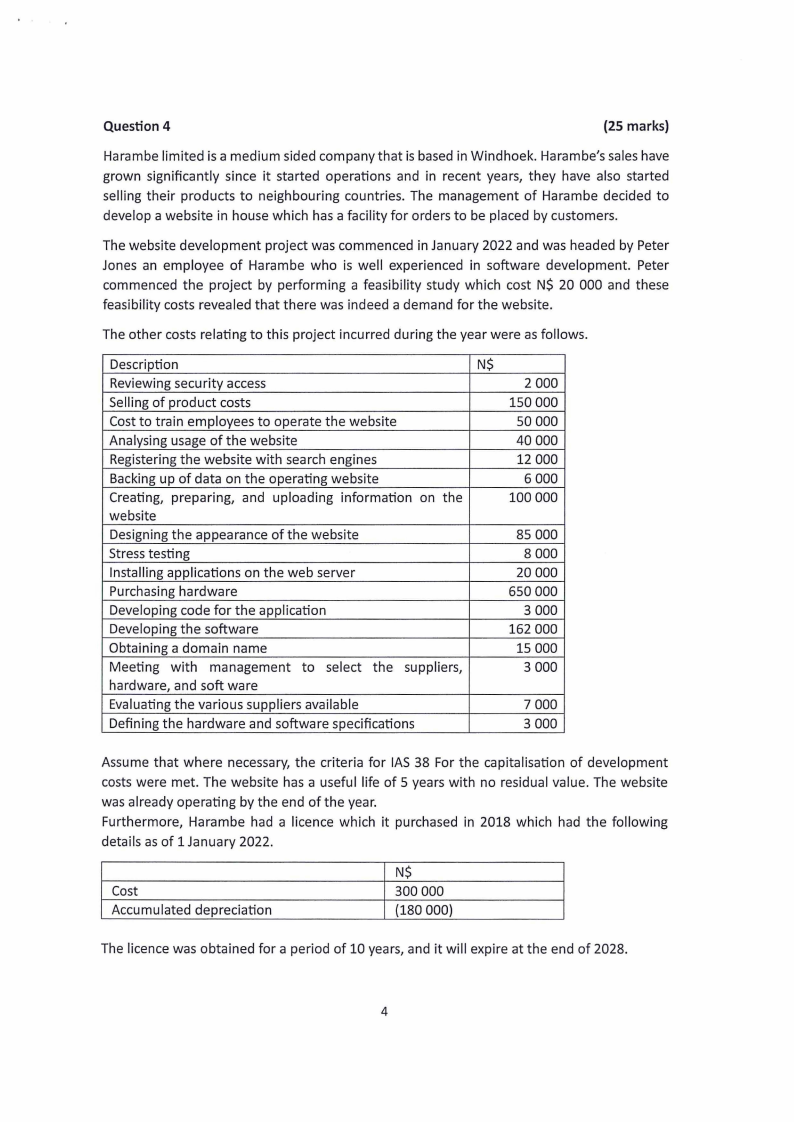

Question 4

(25 marks)

Harambe limited is a medium sided company that is based in Windhoek. Harambe's sales have

grown significantly since it started operations and in recent years, they have also started

selling their products to neighbouring countries. The management of Harambe decided to

develop a website in house which has a facility for orders to be placed by customers.

The website development project was commenced in January 2022 and was headed by Peter

Jones an employee of Harambe who is well experienced in software development. Peter

commenced the project by performing a feasibility study which cost N$ 20 000 and these

feasibility costs revealed that there was indeed a demand for the website.

The other costs relating to this project incurred during the year were as follows.

Description

N$

Reviewing security access

2 000

Selling of product costs

150 000

Cost to train employees to operate the website

50 000

Analysing usage of the website

40000

Registering the website with search engines

12 000

Backing up of data on the operating website

6 000

Creating, preparing, and uploading information on the

100 000

website

Designing the appearance of the website

85 000

Stress testing

8 000

Installing applications on the web server

20 000

Purchasing hardware

650 000

Developing code for the application

3 000

Developing the software

162 000

Obtaining a domain name

15 000

Meeting with management to select the suppliers,

3 000

hardware, and soft ware

Evaluating the various suppliers available

7 000

Defining the hardware and software specifications

3 000

Assume that where necessary, the criteria for IAS 38 For the capitalisation of development

costs were met. The website has a useful life of 5 years with no residual value. The website

was already operating by the end of the year.

Furthermore, Harambe had a licence which it purchased in 2018 which had the following

details as of 1 January 2022.

Cost

Accumulated depreciation

N$

300 000

(180 000)

The licence was obtained for a period of 10 years, and it will expire at the end of 2028.

4

|

6 Page 6 |

▲back to top |

Assume that the year-end of Harambe is 31 December 2022 and all intangible assets are

amortised on the straight-line basis.

Required

(a) With regard to the website development, determine the following.

Costs to be expensed.

Costs to be capitalised to the website costs (intangible asset)

(17)

(b) With regard to all the transactions above, prepare the following notes in the annual

financial statements of Haram be for the year ended 31 December 2022

i.

Profit before tax note

(5)

ii.

Intangible asset note

(3)

END OF EXAMINATION QUESTION PAPER!

I-

i

.'I •...

I

'.

.-,:!.,.:.}:, '.·

''I!

_/

5