|

AME820S- ADVANCED MACROECONOMICS- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS ACCOUNTING AND FINANCE

QUALIFICATION:

BACHELOR OF ECONOMICS HONOURS DEGREE

QUALIFICATION CODE:

08HECO LEVEL:

8

COURSE CODE:

AME820S COURSE NAME: ADV AN CED MACROECONOMICS

SESSION:

NOV 2023 PAPER:

THEORY

DURATION:

3 HOURS MARKS:

100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER (S)

Prof. T. Sunde

MODERATOR:

Dr Reinhold Kamati

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number all the answers.

PERMISSIBLE MATERIALS

I.Ruler

2. Calculator

THIS QUESTION PAPER CONSISTS OF 3 PAGES INCLUDING THE COVER PAGE

1

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 marks]

a) Why is it important to learn about macroeconomics, and how does an increase in

unemployment negatively impact society's well-being? Include at least five such impacts

m your response.

[15]

b) Explain a demand and supply model for bread, identifying all the endogenous variables

and two exogenous variables. Also, briefly describe how prices behave in the short and

long run.

[1 O]

QUESTION 2

[25 marks]

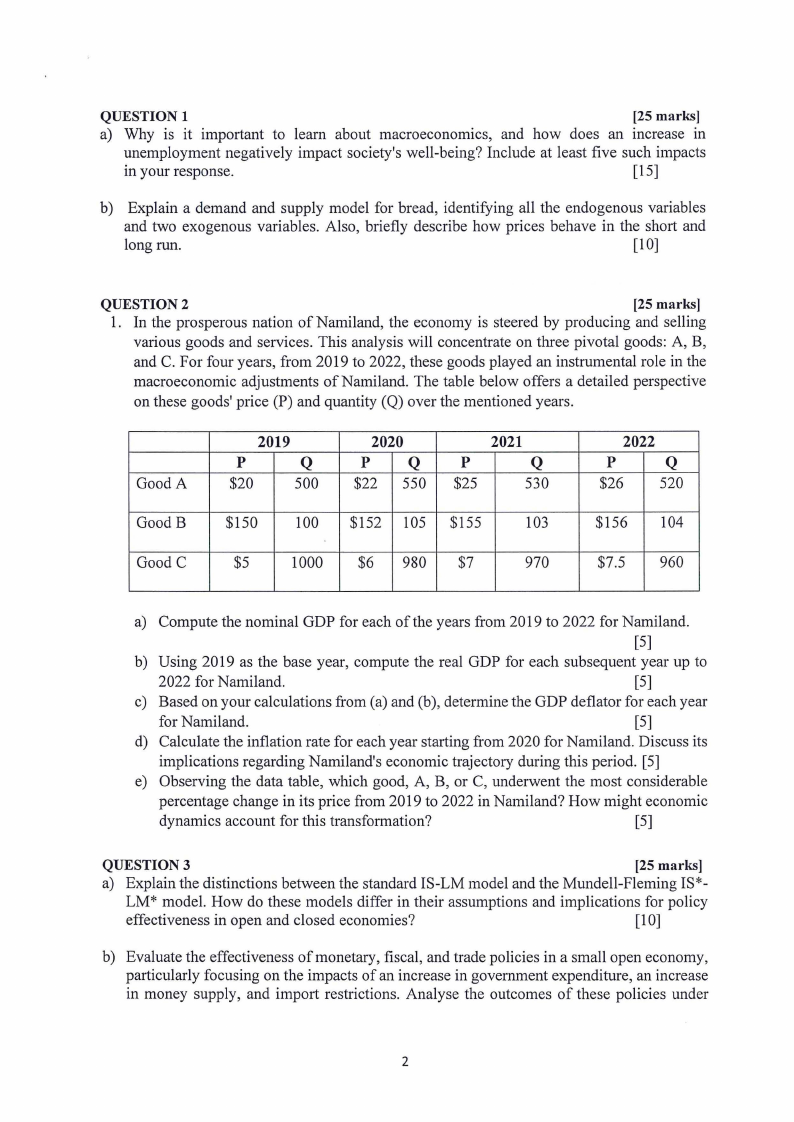

1. In the prosperous nation of Namiland, the economy is steered by producing and selling

various goods and services. This analysis will concentrate on three pivotal goods: A, B,

and C. For four years, from 2019 to 2022, these goods played an instrumental role in the

macroeconomic adjustments of Namiland. The table below offers a detailed perspective

on these goods' price (P) and quantity (Q) over the mentioned years.

Good A

2019

p

Q

$20

500

2020

p

Q

$22 550

2021

p

Q

$25

530

2022

p

Q

$26

520

GoodB

$150

100 $152 105 $155

103

$156 104

GoodC

$5

1000 $6 980 $7

970

$7.5 960

a) Compute the nominal GDP for each of the years from 2019 to 2022 for Namiland.

[5]

b) Using 2019 as the base year, compute the real GDP for each subsequent year up to

2022 for Namiland.

[5]

c) Based on your calculations from (a) and (b), determine the GDP deflator for each year

for Namiland.

[5]

d) Calculate the inflation rate for each year starting from 2020 for Namiland. Discuss its

implications regarding Namiland's economic trajectory during this period. [5]

e) Observing the data table, which good, A, B, or C, underwent the most considerable

percentage change in its price from 2019 to 2022 in Namiland? How might economic

dynamics account for this transformation?

[5]

QUESTION 3

[25 marks]

a) Explain the distinctions between the standard IS-LM model and the Mundell-Fleming IS*-

LM* model. How do these models differ in their assumptions and implications for policy

effectiveness in open and closed economies?

[1 O]

b) Evaluate the effectiveness of monetary, fiscal, and trade policies in a small open economy,

particularly focusing on the impacts of an increase in government expenditure, an increase

in money supply, and import restrictions. Analyse the outcomes of these policies under

2

|

3 Page 3 |

▲back to top |

both floating and fixed exchange rate systems, and consider their implications for economic

stability, growth, and international trade.

[ 15]

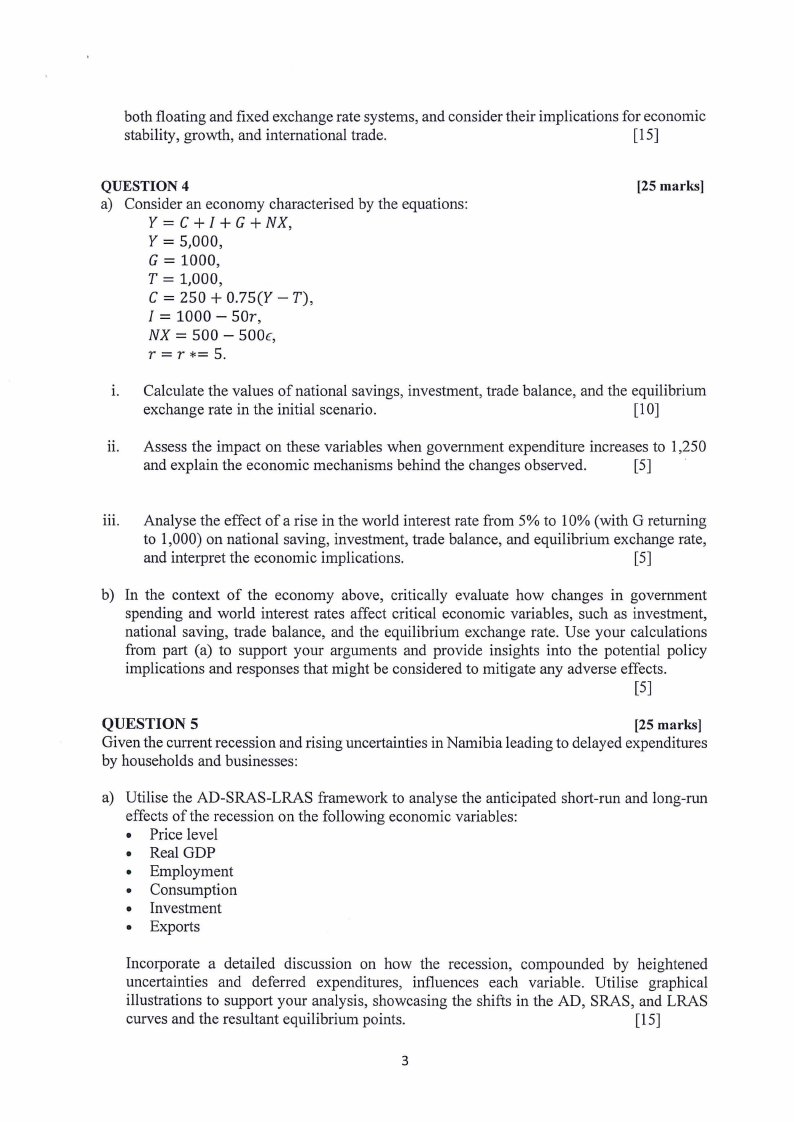

QUESTION 4

a) Consider an economy characterised by the equations:

Y = C +I+ G + NX,

Y = 5,000,

G = 1000,

T = 1,000,

C = 250 + 0.75(Y - T),

I = 1000 - 50r,

NX = 500 - 5001:,

r = r *= 5.

[25 marks)

1. Calculate the values of national savings, investment, trade balance, and the equilibrium

exchange rate in the initial scenario.

[10]

11. Assess the impact on these variables when government expenditure increases to 1,250

and explain the economic mechanisms behind the changes observed.

[5]

m. Analyse the effect of a rise in the world interest rate from 5% to 10% (with G returning

to 1,000) on national saving, investment, trade balance, and equilibrium exchange rate,

and interpret the economic implications.

[5]

b) In the context of the economy above, critically evaluate how changes in government

spending and world interest rates affect critical economic variables, such as investment,

national saving, trade balance, and the equilibrium exchange rate. Use your calculations

from pai1 (a) to support your arguments and provide insights into the potential policy

implications and responses that might be considered to mitigate any adverse effects.

[5]

QUESTION 5

[25 marks]

Given the current recession and rising unce11ainties in Namibia leading to delayed expenditures

by households and businesses:

a) Utilise the AD-SRAS-LRAS framework to analyse the anticipated short-run and long-run

effects of the recession on the following economic variables:

• Price level

• Real GDP

• Employment

• Consumption

• Investment

• Exports

Incorporate a detailed discussion on how the recession, compounded by heightened

uncertainties and deferred expenditures, influences each variable. Utilise graphical

illustrations to support your analysis, showcasing the shifts in the AD, SRAS, and LRAS

curves and the resultant equilibrium points.

[15]

3

|

4 Page 4 |

▲back to top |

b) Enumerate the policy measures available to the Bank of Namibia to counteract the

recessionary pressures in the short run. Evaluate each policy option's potential effectiveness

and limitations, considering Namibia's specific economic and institutional context.

[5]

c) Extend your analysis to explore the long-term implications of these policy choices.

Consider the impacts on inflation, unemployment, fiscal balance, and external trade.

Discuss the potential trade-offs and challenges the Bank of Namibia might face m

balancing short-term recovery eff01is with long-term economic stability and growth.

[5]

4