|

AME820S- ADVANCED MACROECONOMICS- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE RSITV

OF SCIEnCE Ano TECHno LOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS HONOURS DEGREE

QUALIFICATION CODE: 08HECO LEVEL:

8

COURSE CODE:

AME820S COURSE NAME: ADV AN CED MACROECONOMICS

SESSION:

JAN2024

PAPER:

THEORY

DURATION:

3 HOURS MARKS:

100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER (S) Prof. T. Sunde

MODERATOR: Dr Reinhold Kamati

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers.

PERMISSIBLE MATERIALS

I.Ruler

2. Calculator

THIS QUESTION PAPER CONSISTS OF 4 PAGES INCLUDING THE COVER PAGE.

1

|

2 Page 2 |

▲back to top |

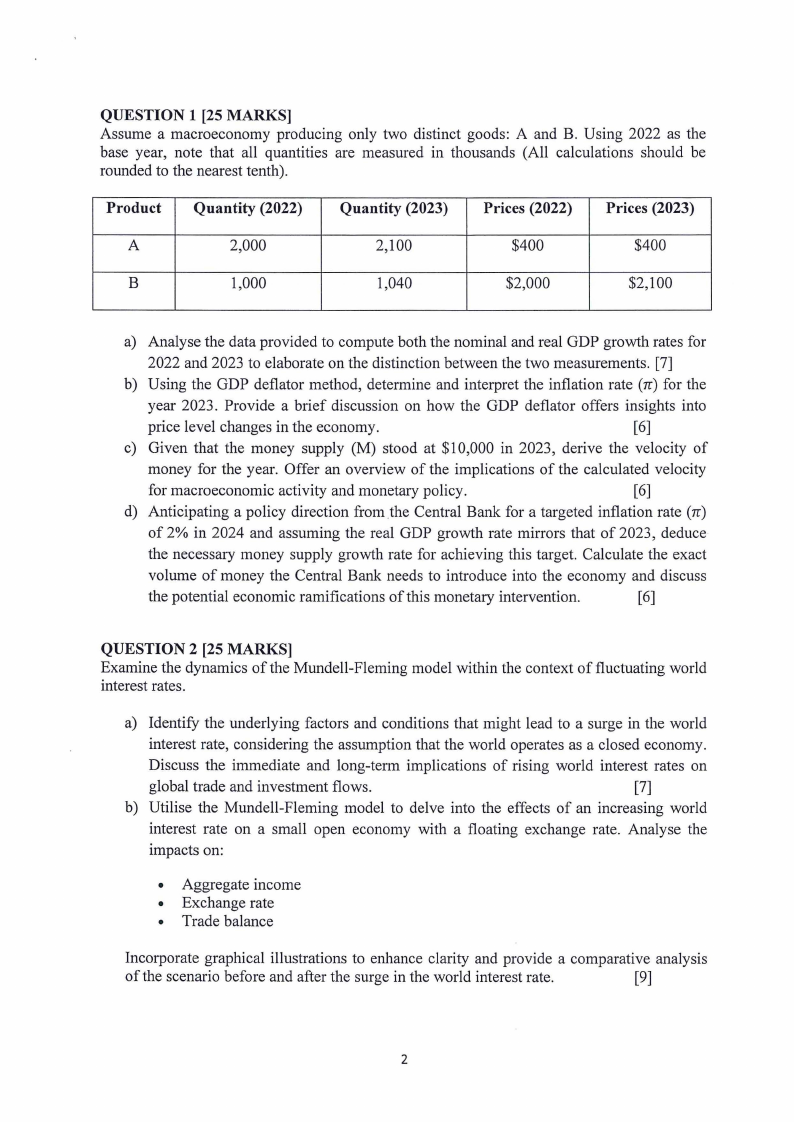

QUESTION 1 [25 MARKS]

Assume a macroeconomy producing only two distinct goods: A and B. Using 2022 as the

base year, note that all quantities are measured in thousands (All calculations should be

rounded to the nearest tenth).

Product Quantity (2022)

Quantity (2023)

Prices (2022)

Prices (2023)

A

2,000

2,100

$400

$400

B

1,000

1,040

$2,000

$2,100

a) Analyse the data provided to compute both the nominal and real GDP growth rates for

2022 and 2023 to elaborate on the distinction between the two measurements. [7]

b) Using the GDP deflator method, determine and interpret the inflation rate (rr) for the

year 2023. Provide a brief discussion on how the GDP deflator offers insights into

price level changes in the economy.

[6]

c) Given that the money supply (M) stood at $10,000 in 2023, derive the velocity of

money for the year. Offer an overview of the implications of the calculated velocity

for macroeconomic activity and monetary policy.

[6]

d) Anticipating a policy direction from .the Central Bank for a targeted inflation rate (rr)

of 2% in 2024 and assuming the real GDP growth rate mirrors that of 2023, deduce

the necessary money supply growth rate for achieving this target. Calculate the exact

volume of money the Central Bank needs to introduce into the economy and discuss

the potential economic ramifications of this monetary intervention.

[6]

QUESTION 2 [25 MARKS]

Examine the dynamics of the Mundell-Fleming model within the context of fluctuating world

interest rates.

a) Identify the underlying factors and conditions that might lead to a surge in the world

interest rate, considering the assumption that the world operates as a closed economy.

Discuss the immediate and long-term implications of rising world interest rates on

global trade and investment flows.

[7]

b) Utilise the Mundell-Fleming model to delve into the effects of an increasing world

interest rate on a small open economy with a floating exchange rate. Analyse the

impacts on:

• Aggregate income

• Exchange rate

• Trade balance

Incorporate graphical illustrations to enhance clarity and provide a comparative analysis

of the scenario before and after the surge in the world interest rate.

[9]

2

|

3 Page 3 |

▲back to top |

c) Contrast the insights from part (b) by evaluating the repercussions of a rising world

interest rate in a scenario where the small open economy operates under a fixed

exchange rate regime.

1. Explore the policy interventions that might be enacted to stabilise the economy.

[3]

ii. Assess the viability and sustainability of maintaining the fixed exchange rate

amidst fluctuating world interest rates.

[3]

111. Discuss potential pressures on foreign reserves and the role of international

financial institutions in such scenarios.

[3]

QUESTION 3 [25 marks]

a) Using the national mcome identity expenditure method, derive the equation

NX = S - I. In four sentences, explain its importance in understanding the relationship

between trade and capital flows.

[5]

b) Elucidate the relevance of the small open economy assumptions in the context of the

Namibian economy. How do these assumptions align with and aid in understanding

the economic dynamics of Namibia?

[5]

c) Given Namibia's part1c1pation m international trade, evaluate how the following

scenarios would affect Namibia's income (Y), investment (I), savings (S), and net

exports (NX).

1. In the wake of escalating tensions between Russia and Ukraine, raising fears

of a third world war, the rest of the world amplifies defence spending. Assess

the consequent effects on Namibia's economic variables.

[5]

11. Namibia reduced defence spending as a fiscal consolidation effort to balance

its budget. Analyse the immediate and potential long-term impacts on the

country's macroeconomic indicators.

[5]

111. The Bank of Namibia increased the repo rate, instigating a wave of pessimism

among the business community. Explore and expound on the ripple effects of

this on Namibia's economic landscape.

[5]

Go to next page.

3

|

4 Page 4 |

▲back to top |

QUESTION 4 [25 marks]

a) Illustrate with a diagram and articulate why interest rates are not determined by

domestic savings and investment in a small open economy. Provide a clear

explanation anchored in the dynamics of capital mobility and global financial

markets.

[9]

b) With the aid of a small open economy model, delineate and expound upon the impacts

of the following policies on the trade balance, savings, investment, and capital flows:

1. Illustrate and clarify how an increase in domestic government spending

influences key economic variables within a small open economy framework.

[4]

11. Utilise the model to explain the macroeconomic effects in the small open

economy when foreign countries have a surge in fiscal spending.

[4]

m. Depict and elucidate the consequences of a rise in the demand for

investment on the small open economy's trade balance, savings, and capital

flows.

[4]

1v. Offer a detailed discourse on how expansionary fiscal policies, both

domestically and internationally, influence the real exchange rate, net

exports, and capital flows in a small, open economy.

[4]

4