|

GFA711S- FINANCIAL ACCOUNTING 310- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATIONCODE:07 BOAC

COURSE:FINANCIALACCOUNTING 310

DATE:Jul/Aug 2023

DURATION: 3 HRS

LEVEL:7

COURSECODE:GFA 711S

SESSION:Jun 2023

MARKS: 100

EXAMINER{S)

SECONDOPPORTUNITYEXAMINATION QUESTION PAPER

Kamotho, D.W., Ketjiganda, A., Garas, E., Kamana, R.,

MODERATOR: M Tondota

THIS QUESTION PAPERCONSISTSOF _6_ PAGES(including this front page)

INSTRUCTIONS

1. Answer all the questions in blue or black ink

2. Start each question on a new page in your answer booklet & show all your workings

3. Questions relating to this examination may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

PERMISSIBLEMATERIALS

1. Non programmable scientific or financial calculator

1

|

2 Page 2 |

▲back to top |

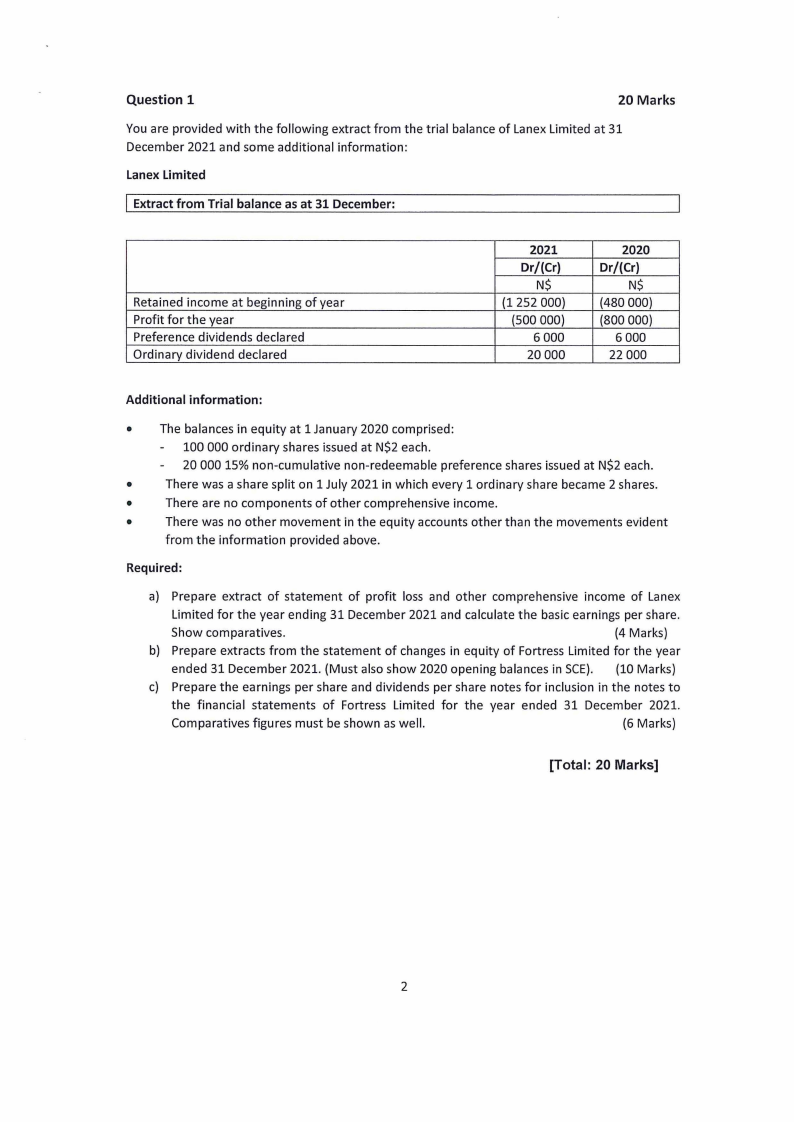

Question 1

20 Marks

You are provided with the following extract from the trial balance of Lanex Limited at 31

December 2021 and some additional information:

Lanex Limited

I Extract from Trial balance as at 31 December:

Retained income at beginning of year

Profit for the year

Preference dividends declared

Ordinary dividend declared

2021

Dr/(Cr)

N$

{1252 000)

(500 000)

6 000

20 000

2020

Dr/(Cr)

N$

(480 000)

(800 000)

6 000

22 000

Additional information:

• The balances in equity at 1 January 2020 comprised:

100 000 ordinary shares issued at N$2 each.

20 000 15% non-cumulative non-redeemable preference shares issued at N$2 each.

•

There was a share split on 1 July 2021 in which every 1 ordinary share became 2 shares.

•

There are no components of other comprehensive income.

•

There was no other movement in the equity accounts other than the movements evident

from the information provided above.

Required:

a) Prepare extract of statement of profit loss and other comprehensive income of Lanex

Limited for the year ending 31 December 2021 and calculate the basic earnings per share.

Show comparatives.

(4 Marks)

b) Prepare extracts from the statement of changes in equity of Fortress Limited for the year

ended 31 December 2021. (Must also show 2020 opening balances in SCE). (10 Marks)

c) Prepare the earnings per share and dividends per share notes for inclusion in the notes to

the financial statements of Fortress Limited for the year ended 31 December 2021.

Comparatives figures must be shown as well.

(6 Marks)

[Total: 20 Marks]

2

|

3 Page 3 |

▲back to top |

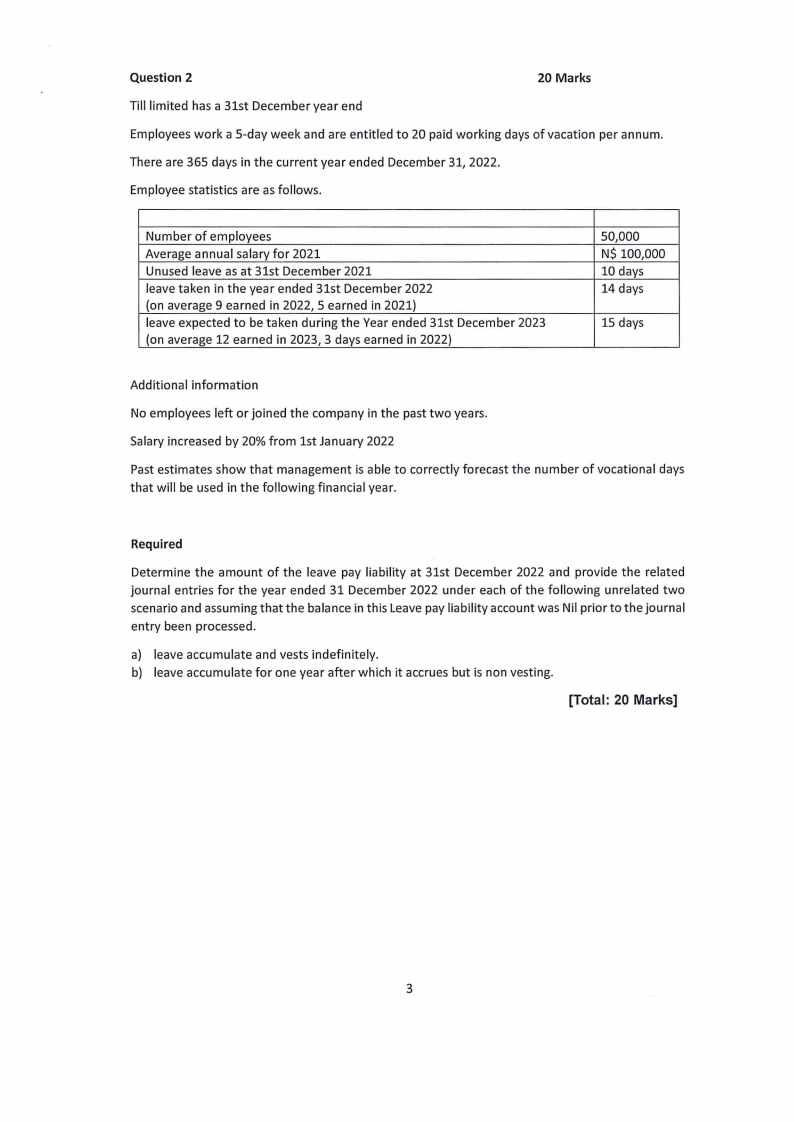

Question 2

20 Marks

Till limited has a 31st December year end

Employees work a 5-day week and are entitled to 20 paid working days of vacation per annum.

There are 365 days in the current year ended December 31, 2022.

Employee statistics are as follows.

Number of employees

Average annual salary for 2021

Unused leave as at 31st December 2021

leave taken in the year ended 31st December 2022

(on average 9 earned in 2022, 5 earned in 2021)

leave expected to be taken during the Year ended 31st December 2023

(on average 12 earned in 2023, 3 days earned in 2022)

50,000

N$ 100,000

10 days

14 days

15 days

Additional information

No employees left or joined the company in the past two years.

Salary increased by 20% from 1st January 2022

Past estimates show that management is able to correctly forecast the number of vocational days

that will be used in the following financial year.

Required

Determine the amount of the leave pay liability at 31st December 2022 and provide the related

journal entries for the year ended 31 December 2022 under each of the following unrelated two

scenario and assuming that the balance in this Leave pay liability account was Nil prior to the journal

entry been processed.

a) leave accumulate and vests indefinitely.

b) leave accumulate for one year after which it accrues but is non vesting.

[Total: 20 Marks]

3

|

4 Page 4 |

▲back to top |

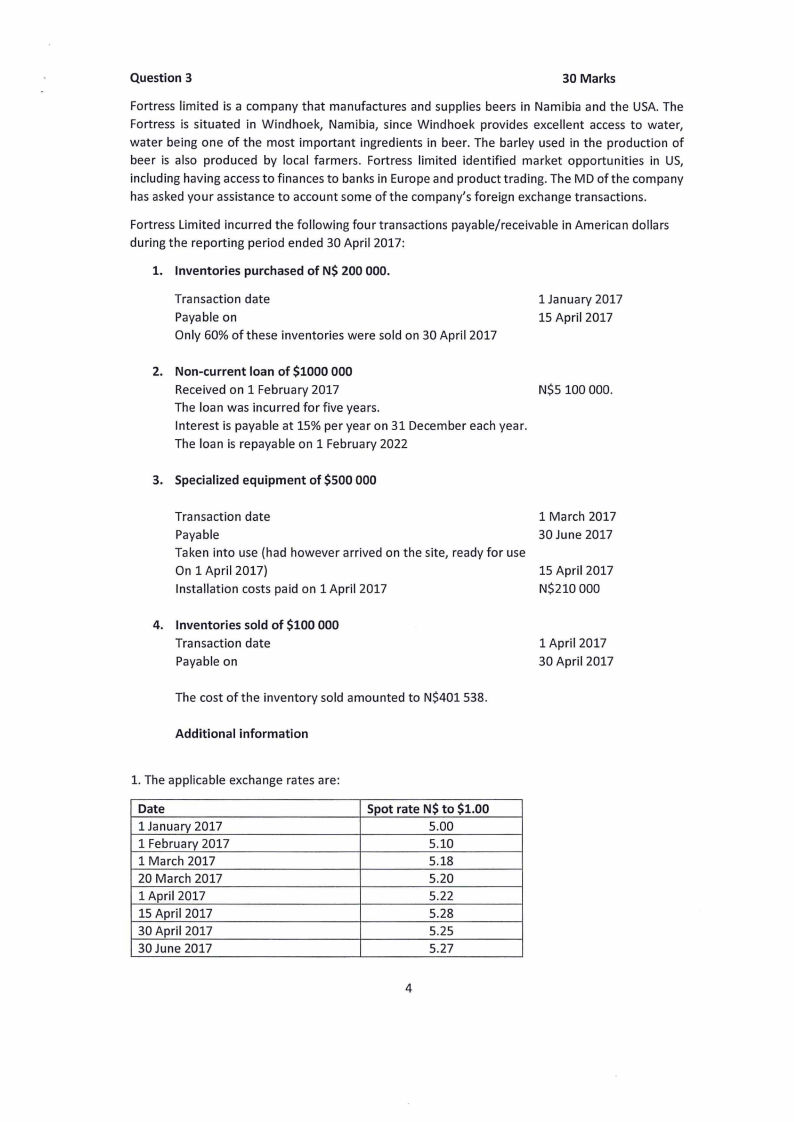

Question 3

30 Marks

Fortress limited is a company that manufactures and supplies beers in Namibia and the USA. The

Fortress is situated in Windhoek, Namibia, since Windhoek provides excellent access to water,

water being one of the most important ingredients in beer. The barley used in the production of

beer is also produced by local farmers. Fortress limited identified market opportunities in US,

including having access to finances to banks in Europe and product trading. The MD of the company

has asked your assistance to account some of the company's foreign exchange transactions.

Fortress Limited incurred the following four transactions payable/receivable in American dollars

during the reporting period ended 30 April 2017:

1. Inventories purchased of N$ 200 000.

Transaction date

Payable on

Only 60% of these inventories were sold on 30 April 2017

1 January 2017

15 April 2017

2. Non-current loan of $1000 000

Received on 1 February 2017

N$5 100 000.

The loan was incurred for five years.

Interest is payable at 15% per year on 31 December each year.

The loan is repayable on 1 February 2022

3. Specializedequipment of $500 000

Transaction date

Payable

Taken into use (had however arrived on the site, ready for use

On 1 April 2017)

Installation costs paid on 1 April 2017

1 March 2017

30 June 2017

15 April 2017

N$210 000

4. Inventories sold of $100 000

Transaction date

Payable on

1 April 2017

30 April 2017

The cost of the inventory sold amounted to N$401 538.

Additional information

1. The applicable exchange rates are:

Date

1 January 2017

1 February 2017

1 March 2017

20 March 2017

1 April 2017

15 April 2017

30 April 2017

30 June 2017

Spot rate N$ to $1.00

5.00

5.10

5.18

5.20

5.22

5.28

5.25

5.27

4

|

5 Page 5 |

▲back to top |

2. The functional currency of Fortress limited is Namibia dollars.

3. The depreciation rate on specialized equipment is 20% per annum, based on the straight-line

method.

4. VAT and taxation may be ignored.

Required:

Journalise (also cash transactions) all the foreign exchange transactions incurred between 1 January

2017 and 30 April 2017, and the results thereof in the General Journal of Fortress limited for the

reporting period ended 30 April 2017.

(30 Marks)

- Journal entries should be dated but journal narrations are not required.

- Complete each transaction's journals separately.

[Total: 30 Marks]

5

|

6 Page 6 |

▲back to top |

Question 4

30 Marks

This question has two separate parts.

Part A

Abby limited entered into a contract with Pro Computer limited for the Lease of twenty-four (24)

laptop computers.

The contract was entered on 1st April 2021 for a two-year period.

Each item is of no value and Abby limited applies the low-value exemption of IFRS16 Leases.

The benefit derived for Abby Limited from the lease agreement is constant over the lease period.

The following amounts are payable to Pro Computers limited per the lease agreement.

• From April 1st 2021 to 31st of March 2022 - N$ 2000 per month

• From 1st of April 2022 to 31st March 2023 - N$ 3,000 per month

Abby Limited has a 31' 1 December year-end.

Part B

BP Limited company is a petroleum company based in Namibia.

It entered into a five-year contract with the Namibia Pipeline Company (NPC) to transport

petroleum products from Walvis Bay to Windhoek through NPCWalvis Bay-Windhoek pipeline.

The contract provided BP limited will have the right of use to use 55% of the pipeline capacity

throughout the Five-Year period.

BP Limited is responsible for the maintenance of the connection to its refinery and depots.

Required:

a) Briefly explain the depreciation implication of the right-of-use asset.

(4 marks)

b) With Reference to the information provided in Part 1, prepare journal entry in the

accounting record of Abby limited for the year ended 31st December 2021.2022 and 2023.

Ignore taxation.

(12 marks)

c) With Reference to information provided in Part B and IFRS 16, discuss whether the

arrangement contains a lease.

(14 marks)

[Total: 30 Marks]

END OF QUESTION PAPER

6