|

FIM601S - FINANCIAL MATHEMATICS 2 -2ND OPP - JULY 2023 |

|

1 Page 1 |

▲back to top |

/

nAmlBIA UnlVERSITY

OF SCIEnCE

FACULTYOF HEALTH,NATURAL RESOURCESAND APPLIEDSCIENCES

SCHOOLOF NATURALAND APPLIEDSCIENCES

DEPARTMENTOF MATHEMATICS, STATISTICSAND ACTUARIALSCIENCE

QUALIFICATION:Bachelor of science; Bachelor of science in Applied Mathematics and Statistics

QUALIFICATIONCODE: 07BSAM

LEVEL: 6

COURSECODE: FIM601S

COURSENAME: FINANCIAL MATHEMATICS 2

SESSION:JULY 2023

PAPER:THEORY

DURATION: 3 HOURS

MARKS: l'fJO

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

DrV. Katoma

Mrs. H.Y Nkalle

MODERATOR:

Prof. A.S. Eegunjobi

INSTRUCTIONS

• Answer ALL the questions in the booklet provided.

• Show clearly all the steps used in the calculations.

• All written work must be done in blue or black ink and sketches

must be done in pencil.

PERMISSIBLEMATERIALS

• Non-programmable calculator without a cover.

THIS QUESTION PAPERCONSISTSOF 3 PAGES{Including this front page)

1

|

2 Page 2 |

▲back to top |

, i'

Question 1 [25]

1.1 What is derivative? Mention two (2) purposes of derivatives.

[3]

1.2 Mention four (4) elements under fixed interest government borrowings.

[4]

1.3 Suppose a stock that pays no dividend is worth N$60.00. The annual compounding

interest rate is 5%. What is the one-year forward price of the stock?

[4]

1.4 Consider a Put Option with a strike of N$500.00.

(a) What would be the payoff to the buyer if the spot price at the expiration date is

N$ 550.00?

[4]

(b) What would be the payoff to the buyer if the spot price at the expiration date is

N$ 450.00?

[3]

1.5 Consider a 3 x 9 FRAfor £2000.00 with an FRArate of 5%. Suppose the reference rate is

LIBORand the 6-month LIBORon the effective date is 6%. Assume ACT/360 and the loan is

for a period of 120 days. Find how much the borrower receives from the lender on the

effective date.

[7]

Question 2 [25]

= = 2.1 Consider the cash-flow sequences e (e0, ••• , en) and m (m 0, ••• , mn). When is the

cashflow "e" preferable to "m"?

[4]

2.2 Consider the net cash flow sequences

A = (SO,51, -4), B = (50,528, -22), at time = t 0,1,2. Suppose the net present value

for A is 108 and that of Bis 594 at time 2. Find the internal rate of return for.each outlay.

Suppose the interest of both cash flows is 7%, which one is a more viable investment?

[7]

2.3 VK Investment cc has an existing debt of N$ 2000000 on which it makes annual payments

at an annual effective rate of LIBORplus 0.5%. VK Investment cc decides to enter a swap with

a notional amount of N$ 2000000 on which it makes annual payments at a fixed annual

effective rate of 3% in exchange for receiving annual payments at the annual effective LIBOR

rate. The annual effective LIBORrates over the first and second years of the swap contract

are 2.5% and 4% respectively. VK Investment cc does not make or receive any other payments.

Calculate the net interest payment that VK Investment cc makes in the second year.

[10]

2.4 Explain the dangers of derivatives

[5]

2

|

3 Page 3 |

▲back to top |

Question 3 [25]

3.1 Suppose a certificate of deposit is issued with a face value of N$ 500000.00 and a

coupon of 6% for 90 days. After 30 days, its yield has fallen to 5.75%. What is the price?

[8]

3.2 Consider the cash flow sequence, a= (5, 9,20,4,2), b = (6,7,3,1,36) at time t =

0, ...,4. Find the Net Present Value (NPV) of the cash flow assuming an interest rate of 7%.

[6]

3.3 Suppose a loan size of l0 is repaid by nm equal installments of size x at times

~,~, ..,. = mm

m n. Suppose the interest rate charged is io/oper annum effective. Find an

expression for the capital repayment for the k th installment.

[5]

3.4 Calculate the present value of an annuity of amount N$ 100.00 paid annually for 5 years

at the rate of interest of 9%.

[5]

Question 4 [25]

4.1 An investment of N$ 200.00 returns N$ 120.00 at the end of 1st year and N$ 100.00 at

the end of 2nd year. What is the internal rate of return (/ RR)?

[5]

4.2 Explain the difference between a negotiable and non-negotiable financial instrument

and give an example

[3]

4.3 Frans is considering a project which requires an amount of N$3000.00 and another

amount of N$1000.00 after one year. In two years', time, when the project ends, she

expects an inflow of N$4500.00. what is the internal rate of return (/ RR) of this project? Is

the above Investment profitable? Assume that Frans can lend and borrow at the same fixed

rate of 7.13% per annum.

[9]

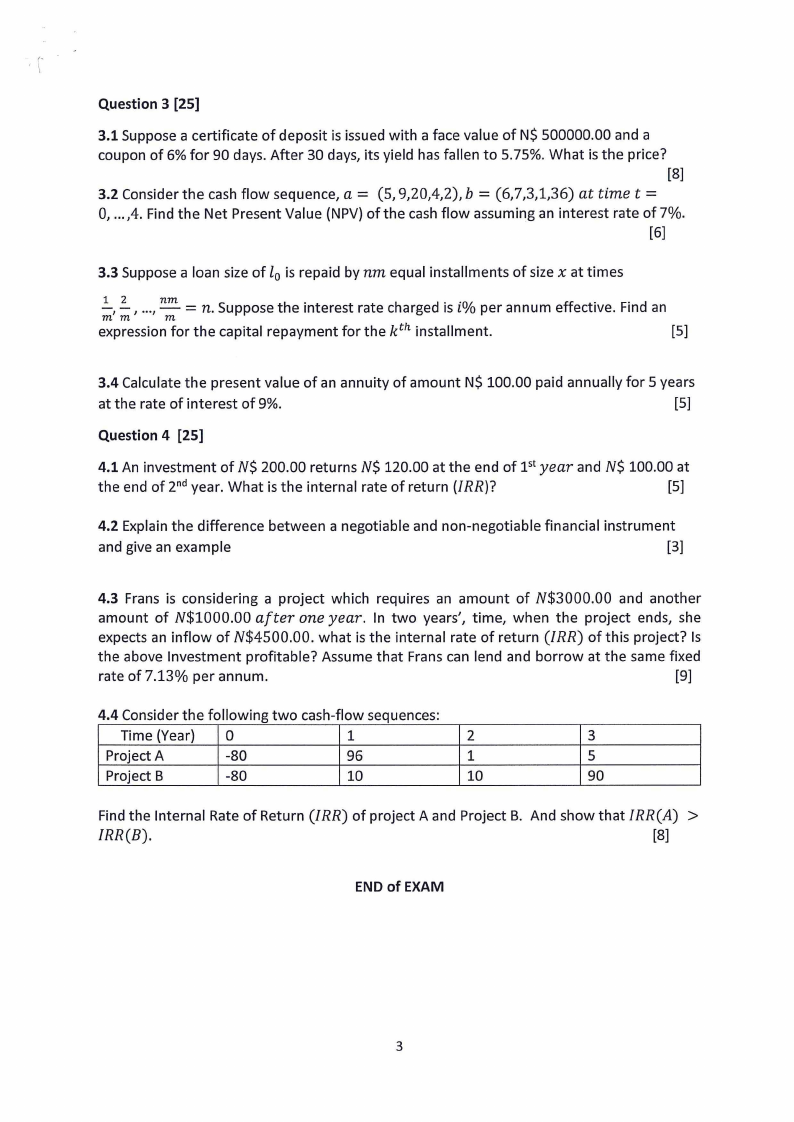

4.4 Consider the following two cash-flow sequences:

Time (Year) 0

1

2

3

Project A

-80

96

1

5

Project B

-80

10

10

90

Find the Internal Rate of Return (IRR) of project A and Project B. And show that IRR(A) >

IRR(B).

[8]

ENDof EXAM

3