|

BAC512C_BUSINESS_ACCOUNTING_1B_CATS_1ST_OPP_JUNE_2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA

UnlVERSITY

OF SCIEnCE Ano

TECHnOLOGY

HP-65B

HAROLDPUPKEWITZ

GraduateSchoolof Business

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

HAROLD PUPKEWITZGRADUATESCHOOLOF BUSINESS

QUALIFICATION: DIPLOMA IN BUSINESSPROCESSMANAGEMENT

QUALIFICATION CODE: 06DBPM

COURSECODE: BAC521C

LEVEL: 6

COURSENAME: BUSINESSACCOUNTING lB

SESSION:JULY2023

PAPER:PAPER2

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Lameck Odada

MODERATOR Hendrina Kangala

INSTRUCTIONS

1. This question paper comprises FOUR (4) questions.

2. Answer ALLthe questions and in blue or black ink. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with whole numbers in all your calculations and only round off only final answers

to two (2) decimal places where necessary unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 7 PAGES(including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[20 MARKS]

For questions 1.1- 1.10, just write the answer only (the correct letter chosen) in your answer book and

not on the question paper. Do not copy the question again

1.1 An opportunity cost is

a) the difference between the total cost of one alternative and the total cost of another

alternative.

b) the benefit forgone when one alternative is selected rather than another.

c) a cost that is saved by not adopting a given alternative.

d) a cost that continues to be incurred even when there is no alternative.

1.2 At the Economic Order Quantity (EOQ) point,

a) the holding cost and ordering cost are equal.

b) the holding costs and ordering costs are high.

c) the inventory is at the minimum level.

d) the inventory is at the maximum level.

1.3 In inventory control, the minimum inventory level is

a) the maximum stock level to be maintained.

b) the minimum stock level to be maintained.

c) the average stock level to be maintained.

d) the most economic stock level to be maintained.

1.4 Overhead cost is made up of

a) all indirect cost

b) all direct cost

c) direct and indirect cost

d) all unspecified cost

1.5 Idle time is ----

a) time spent by workers in a factory.

b) time spent by workers in the office.

c) time spent by workers off their work.

d) All of the above.

1.6 Overtime is----

a) actual hours being more than normal time

b) actual hours being less than the standard time

1

|

3 Page 3 |

▲back to top |

c) standard hours being more than actual hours

d) actual hours being less than planned hours

1.7 Allotment of overhead incurred for a particular cost centre to a specific cost centre is referred to

as

a) allotment

b) primary allocation

c) allocation

d) secondary allocation

1.8 A profit centre is a responsibility centre

a) that sells its output outside the company.

b) whose manager is responsible for both revenue and costs.

c) that provides a service to another responsibility centre.

d) within an investment centre.

1.9 An extra inventory carried in stock during periods where the demand is uncertain and/ or lead

time is uncertain is referred to as

a) extra inventory.

b) maximum inventory.

c) safety inventory.

d) minimum inventory.

1.10 Which of the following is an advantage of FIFOmethod of valuing inventory

a) Easyto understand and operate.

b) Helps to avoid deterioration and obsolescence.

c) Value of the closing inventory of materials will reflect the current market prices

d) All of the above

2

|

4 Page 4 |

▲back to top |

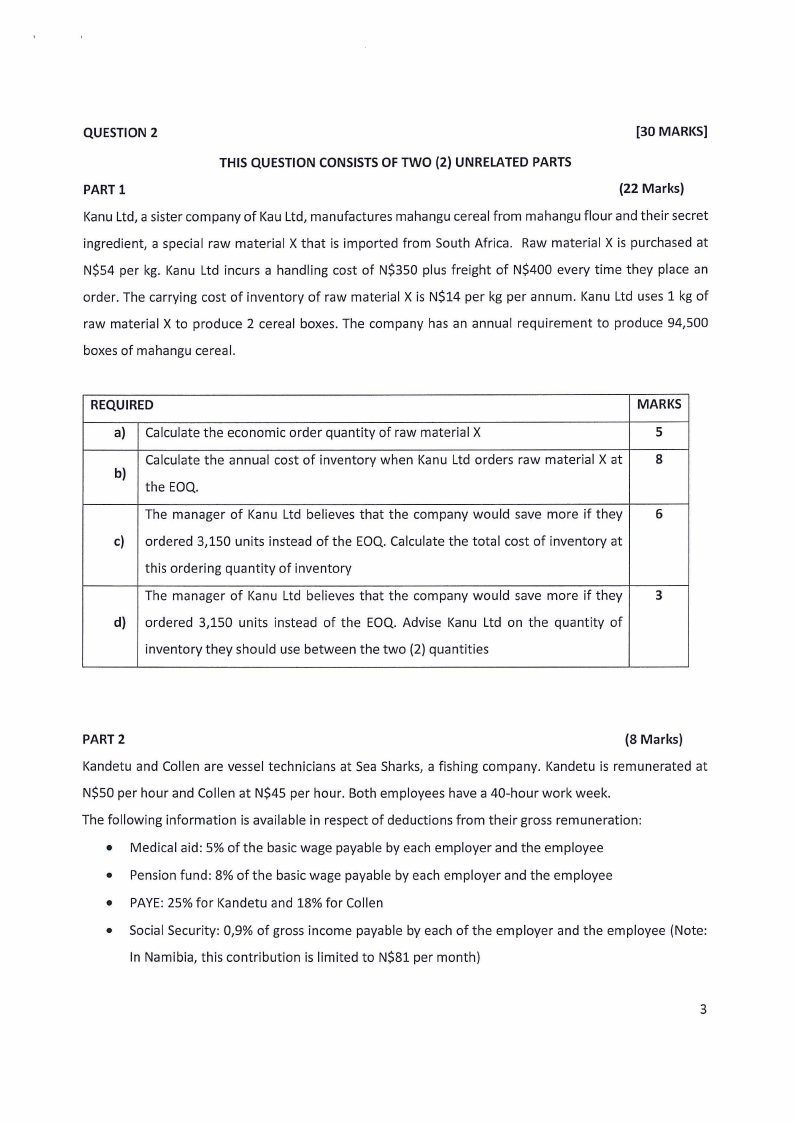

QUESTION 2

[30 MARKS]

THIS QUESTION CONSISTS OF TWO {2) UNRELATED PARTS

PARTl

{22 Marks)

Kanu Ltd, a sister company of Kau Ltd, manufactures mahangu cereal from mahangu flour and their secret

ingredient, a special raw material X that is imported from South Africa. Raw material X is purchased at

N$54 per kg. Kanu Ltd incurs a handling cost of N$350 plus freight of N$400 every time they place an

order. The carrying cost of inventory of raw material Xis N$14 per kg per annum. Kanu Ltd uses 1 kg of

raw material X to produce 2 cereal boxes. The company has an annual requirement to produce 94,500

boxes of mahangu cereal.

REQUIRED

MARKS

a) Calculate the economic order quantity of raw material X

5

Calculate the annual cost of inventory when Kanu Ltd orders raw material X at

8

b)

the EOQ.

The manager of Kanu Ltd believes that the company would save more if they

6

c) ordered 3,150 units instead of the EOQ. Calculate the total cost of inventory at

this ordering quantity of inventory

The manager of Kanu Ltd believes that the company would save more if they

3

d) ordered 3,150 units instead of the EOQ. Advise Kanu Ltd on the quantity of

inventory they should use between the two (2) quantities

PART2

(8 Marks)

Kandetu and Collen are vessel technicians at Sea Sharks, a fishing company. Kandetu is remunerated at

N$50 per hour and Collen at N$45 per hour. Both employees have a 40-hour work week.

The following information is available in respect of deductions from their gross remuneration:

• Medical aid: 5% of the basic wage payable by each employer and the employee

• Pension fund: 8% of the basic wage payable by each employer and the employee

• PAYE:25% for Kandetu and 18% for Collen

• Social Security: 0,9% of gross income payable by each of the employer and the employee (Note:

In Namibia, this contribution is limited to N$81 per month)

3

|

5 Page 5 |

▲back to top |

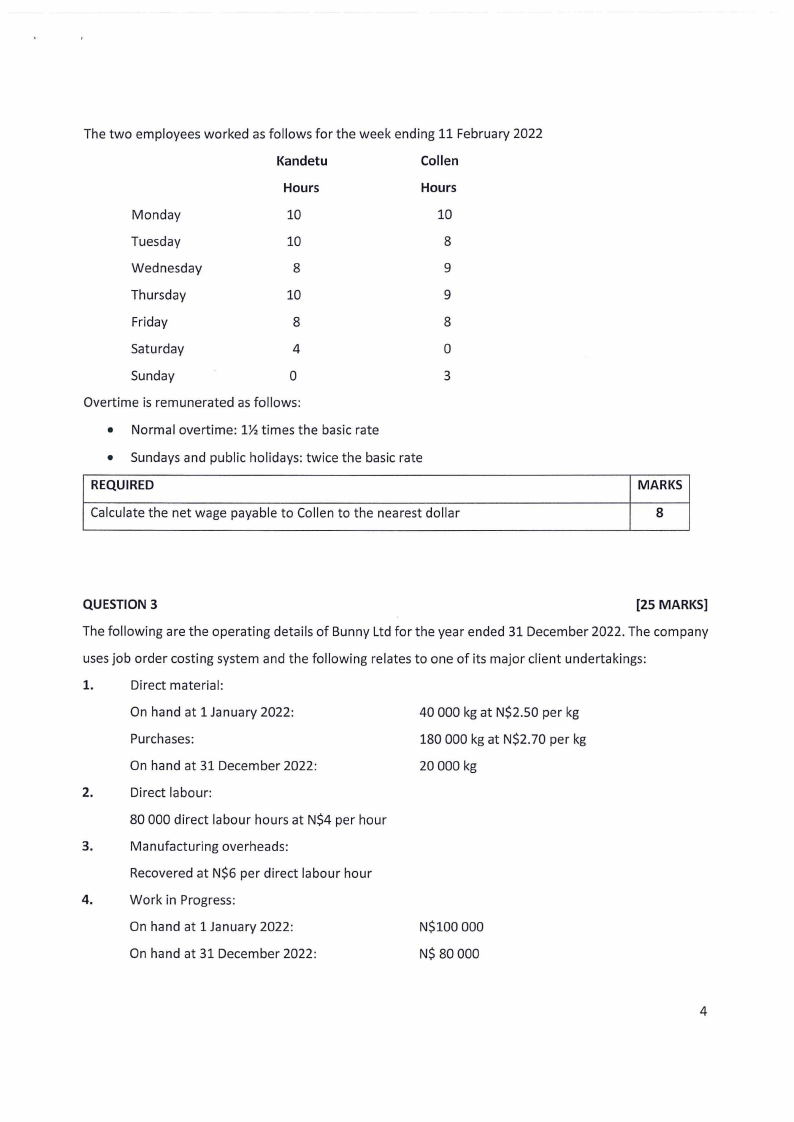

The two employees worked as follows for the week ending 11 February 2022

Kandetu

Collen

Hours

Hours

Monday

10

10

Tuesday

10

8

Wednesday

8

9

Thursday

10

9

Friday

8

8

Saturday

4

0

Sunday

0

3

Overtime is remunerated as follows:

• Normal overtime: 1½ times the basic rate

• Sundays and public holidays: twice the basic rate

REQUIRED

Calculate the net wage payable to Collen to the nearest dollar

MARKS

8

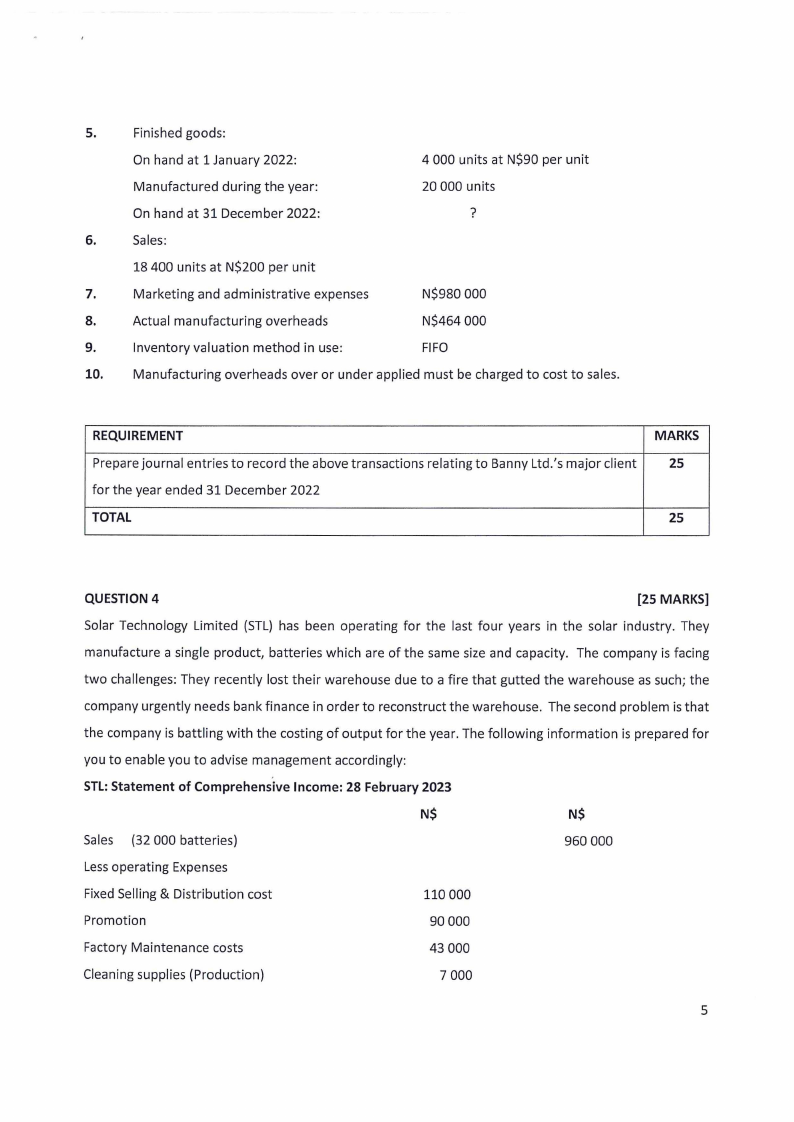

QUESTION 3

[25 MARKS]

The following are the operating details of Bunny Ltd for the year ended 31 December 2022. The company

uses job order costing system and the following relates to one of its major client undertakings:

1.

Direct material:

On hand at 1 January 2022:

40 000 kg at N$2.50 per kg

Purchases:

180 000 kg at N$2.70 per kg

On hand at 31 December 2022:

20 000 kg

2.

Direct labour:

80 000 direct labour hours at N$4 per hour

3.

Manufacturing overheads:

Recovered at N$6 per direct labour hour

4.

Work in Progress:

On hand at 1 January 2022:

N$100 000

On hand at 31 December 2022:

N$ 80 000

4

|

6 Page 6 |

▲back to top |

5.

Finished goods:

On hand at 1 January 2022:

4 000 units at N$90 per unit

Manufactured during the year:

20 000 units

On hand at 31 December 2022:

?

6.

Sales:

18 400 units at N$200 per unit

7.

Marketing and administrative expenses

N$980 000

8.

Actual manufacturing overheads

N$464 000

9.

Inventory valuation method in use:

FIFO

10. Manufacturing overheads over or under applied must be charged to cost to sales.

REQUIREMENT

Prepare journal entries to record the above transactions relating to Banny Ltd.'s major client

for the year ended 31 December 2022

TOTAL

MARKS

25

25

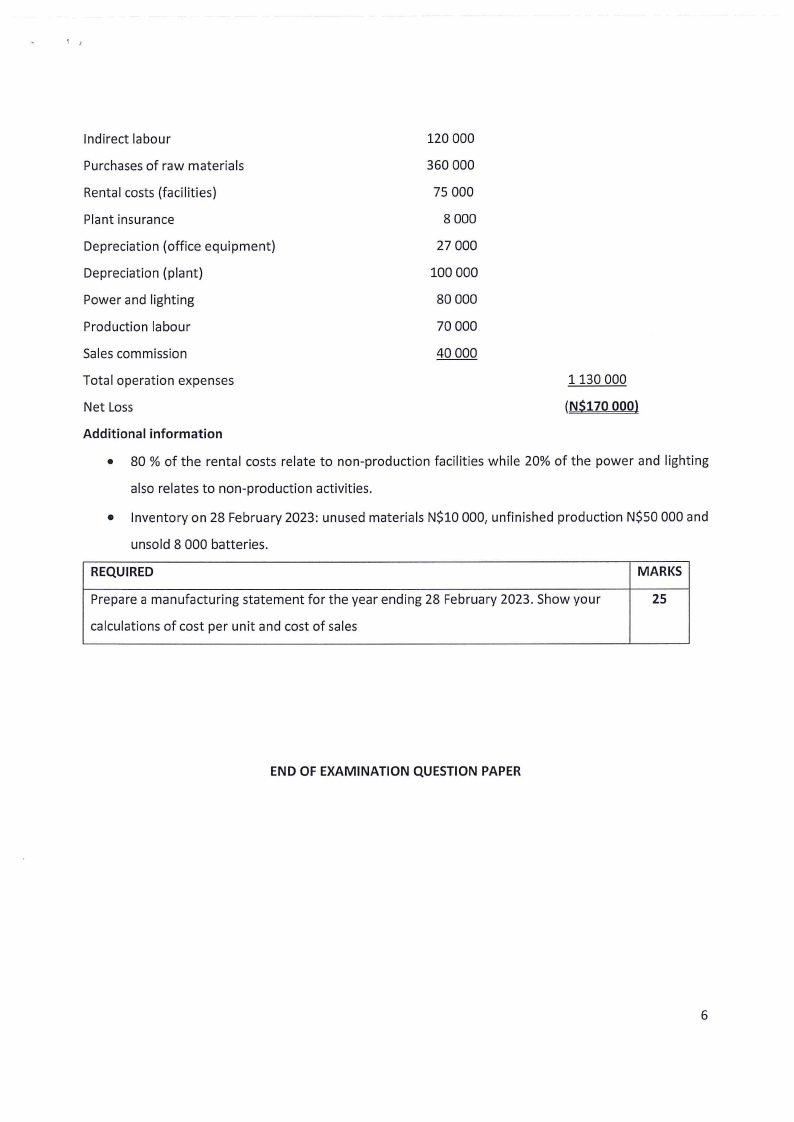

QUESTION 4

[25 MARKS]

Solar Technology Limited (STL) has been operating for the last four years in the solar industry. They

manufacture a single product, batteries which are of the same size and capacity. The company is facing

two challenges: They recently lost their warehouse due to a fire that gutted the warehouse as such; the

company urgently needs bank finance in order to reconstruct the warehouse. The second problem is that

the company is battling with the costing of output for the year. The following information is prepared for

you to enable you to advise management accordingly:

STL:Statement of Comprehensive Income: 28 February 2023

N$

N$

Sales (32 000 batteries)

960 000

Lessoperating Expenses

Fixed Selling & Distribution cost

110 000

Promotion

90 000

Factory Maintenance costs

43 000

Cleaning supplies (Production)

7 000

5

|

7 Page 7 |

▲back to top |

I,

Indirect labour

Purchases of raw materials

Rental costs (facilities)

Plant insurance

Depreciation (office equipment)

Depreciation (plant)

Power and lighting

Production labour

Sales commission

Total operation expenses

Net Loss

120 000

360 000

75 000

8 000

27 000

100 000

80 000

70 000

40 000

1130 000

{N$170 000)

Additional information

• 80 % of the rental costs relate to non-production facilities while 20% of the power and lighting

also relates to non-production activities.

• Inventory on 28 February 2023: unused materials N$10 000, unfinished production N$50 000 and

unsold 8 000 batteries.

REQUIRED

Prepare a manufacturing statement for the year ending 28 February 2023. Show your

MARKS

25

calculations of cost per unit and cost of sales

END OF EXAMINATION QUESTION PAPER

6