|

CAH610S-COST AND MANAGEMENT ACCOUNTING FOR HOSPITALITY AND TOURISM-1ST OPP-NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmI BIA un IVERSITY

OF SCIEn CE AnD TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF HOSPITALITY AND TOURISM

QUALIFICATION CODE: 07BHOM & 07BOTM

COURSE CODE: CAH610S

DATE: NOVEMBER 2024

LEVEL: 6

COURSE NAME: COST& MANAGEMENT

ACCOUNTING FORHOSPITALITY& TOURISM

PAPER: THEORYAND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

EXAMINER

MODERATOR

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Sheehama, K.G.H.

Odada, L.

INSTRUCTIONS

1. This question paper comprises four (4) questions.

2. Answer ALL the questions in blue or black ink only. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with four (4) decimal places in all your calculations and only round off only final

answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

NON - PROGRAMMABLE CALCUTOR

1. Examination paper

2. Examination script

THIS QUESTION PAPER CONSISTS OF 6 PAGES {INCLUDING THIS FRONT PAGE)

|

2 Page 2 |

▲back to top |

QUESTION 1

(30 MARKS)

Each of the following questions (1.1-1.12) has only ONE correct answer. Please answer

this question ON the answer sheet provided. E.g., 1.1 a

1.1 The following item is NOT a manufacturing overheads cost:

a) Depreciation of plant and equipment

b) Rent of office

c) Indirect labour

d) Indirect material

1.2

Conversion cost can be defined as:

a) The cost of the first stage of the manufacture of a product

b) The total direct labour and manufacturing overhead costs

c) The total direct costs of manufacturing a product

d) The total costs of manufacturing a product

1.3 The following statement is NOT true:

a) Total ordering cost= Cost per order x Number of orders

b) Safety inventory= Minimum inventory

c) conomic order quantity= Reorder level

d) Average inventory = Minimum inventory level + ½ (Economic order

quantity)

1.4 The following item is NOT an example of direct material cost:

a) Cotton

b) Wood

c) Steel

d) Glue

The following details refer to questions 1.5 - 1.6:

Turtle Ltd supplied the following information for the past year:

Direct material used

Indirect labour cost

Direct labour cost

Indirect material used

Depreciation: plant and equipment

Sundry factory overheads

Depreciation: office building

100 000

50 000

200 000

20000

15 000

10 000

5 000

1.5 The prime costs incurred during the year was:

a) N$150 000

b) N$200 000

c) N$250 000

d) N$300 000

1.6 The total manufacturing/production costs of the past year was:

a) N$295 000

b) N$300 000

c) N$395 000

d) N$400 000

2

|

3 Page 3 |

▲back to top |

The following details refer to questions 1.7 and 1.8:

A business has bought and sold identical items of inventory during 2024 as follows:

1/6/24

Bought

1000 units

@ N$100 each

1/9/24

Bought

1000 units

@ N$160 each

5/9/24

Sold

1200 units

@ N$200 each

1.7 Using the first-in, first-out (FIFO) method what is the value of closing inventory.

a) N$128 000

b) N$120 000

c) N$104 000

d) N$100 000

1.8 Using the weighted average method what is the value of the value of closing inventory.

a) N$128 000

b) N$120 000

c) N$104 000

d) N$100 000

1.9 The first-in-first-out(FIFO) method of stock valuation would be most appropriate for:

a) A bicycle components retailer

b) A motor components retailer

c) A construction retailer

d) A food retailer

1.10 A firm produced 5 000 units during the past month and incurred the following costs:

Fixed cost N$8 250; Variable cost N$12 500. The total cost budgeted for the following

month for 3 500 units will be:

a) N$18 000

b) N$17 000

c) N$14 000

d) N$19 000

1.11 Under absorbed overheads occurs when:

a) The amount of actual overheads incurred is less than the overheads that

have been charged to production

b) Actual overheads have fallen in relation to what they were expected to be

c) The amount of budgeted overheads is less than the actual overheads

incurred.

d) The amount of overheads charged to production is lower than the actual

overheads incurred.

1.12 A company has fixed costs of N$600 000 per annum. It manufactures a single

product which it sells for N$200 per unit. Its contribution to sales ratio is 40%.

The company's contribution margin per unit is:

a) N$60

b) N$120

c) N$80

d) N$160

3

|

4 Page 4 |

▲back to top |

1.13 A company manufactures a single product which it sells for N$160 per unit.

Fixed costs are N$76 800 per month and the product has a variable costs to

sales ratio of 60%. The company's contribution margin ratio is:

a) 60%

b) 50%

c) 40%

d) 30%

1.14 Fast-Food Ltd supplied the following details regarding its product:

Selling price per unit

Variable production cost per unit

Variable selling cost per unit

Fixed production cost per year

Fixed selling costs per year

Contribution margin ratio (%):

a) 60%

b) 50%

c) 40%

d) 30%

N$600.00

N$200.00

N$40.00

N$358 000

N$60 000

1.15 Fast-Food Ltd supplied the following details regarding its product:

Selling price per unit

Variable production cost per unit

Variable selling cost per unit

Fixed production cost per year

Fixed selling costs per year

Variable cost ratio(%):

a) 60%

b) 50%

c) 40%

d) 30%

N$600.00

N$200.00

N$40.00

N$358 000

N$60 000

QUESTION 2

(25 Marks)

Just- Phone Ltd management are in dispute asto which method of inventory valuation should

be used. The records currently show that on 31 July 2024 the store had closing balance of 20

"fake-e-phone" worth N$10 000.

The following information regarding the movement of "fake-e-phones" was provided to you

by the store manager during the month of August 2024:

Receipts from suppliers were as follow:

• 2 August: purchased 30 "fake-e-phones" at N$600 per phone.

• 4 August: purchased 10 "fake-e-phones" at a total cost of N$7 000.

• 7 August: purchased 15 "fake-e-phones" at N$750 per phone.

• 10 August: purchased 10 "fake-e-phones" at a total cost of N$8 000.

4

|

5 Page 5 |

▲back to top |

Phones were sold to customers as follow:

• 3 August: sold 25 "fake-e-phones" at N$800 per phone.

• 6 August: sold 20 "fake-e-phones" at N$900 per phone.

• 12 August: sold 30 "fake-e-phones" at N$1200 per phone.

REQUIRED:

Record the above movement of the inventory in the store ledger card of Just -

a)

Phone Ltd by using the Weighted Average Method.

b) Calculate the gross profit/loss of Just - Phone Ltd.

MARKS

17

8

QUESTION 3

(28 MARKS]

KGH Ltd makes and sells one product, the following information is provided:

Actual figures:

Direct material

55 800

Direct labour

59 400

Variable manufacturing overheads

27 000

Variable selling and administrative expenses

8 000

Fixed manufacturing overheads

47 000

Fixed selling and administrative expenses

21 000

Selling price

400

Production units 1 800

Units sold

1 600

KGH Ltd uses machine hours to allocate fixed manufacturing overheads.

The predetermined overhead rate/POR is N$10 per machine hour. Machine hours required

to produce one product is 2.5 and total machine hours incurred during the period are 4 500.

REQUIRED:

c) Calculate the unit product cost using the direct costing method.

d) Calculate the unit product cost using the absorption costing method.

e) Prepare a statement of profit or loss according to the direct costing method.

Prepare a statement of profit or loss according to the absorption costing

f)

method.

MARKS

3

4

8

13

5

|

6 Page 6 |

▲back to top |

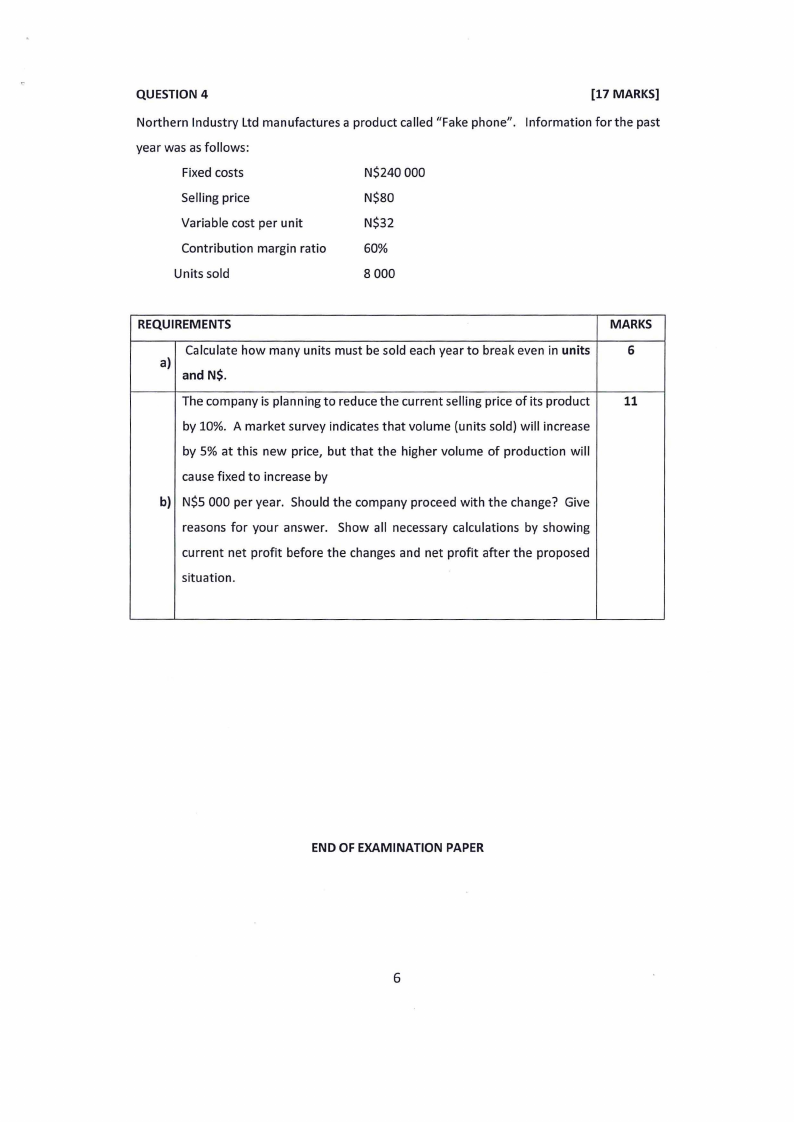

QUESTION 4

[17 MARKS]

Northern Industry Ltd manufactures a product called "Fake phone". Information for the past

year was as follows:

Fixed costs

N$240 000

Selling price

N$80

Variable cost per unit

N$32

Contribution margin ratio

60%

Units sold

8 000

REQUIREMENTS

Calculate how many units must be sold each year to break even in units

a)

and N$.

The company is planning to reduce the current selling price of its product

by 10%. A market survey indicates that volume {units sold) will increase

by 5% at this new price, but that the higher volume of production will

cause fixed to increase by

b} N$5 000 per year. Should the company proceed with the change? Give

reasons for your answer. Show all necessary calculations by showing

current net profit before the changes and net profit after the proposed

situation.

MARKS

6

11

END OF EXAMINATION PAPER

6