|

FIM601S - FINANCIAL MATHEMATICS 2 - 2ND OPP - JULY 2022 |

|

1 Page 1 |

▲back to top |

eo

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF HEALTH, APPLIED SCIENCES & NATURAL RESOURCES

DEPARTMENT OF MATHEMATICS AND STATISTICS

QUALIFICATION: Bachelor of Science in Applied Mathematics and Statistics

QUALIFICATION CODE: 07BAMS

LEVEL: 6

COURSE CODE: FIM601S

COURSE NAME: Financial Mathematics 2

SESSION: JULY 2022

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

SUPPLEMENTARY/ SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Mrs. H. Y. Nkalle

Dr. V. Katoma

MODERATOR:

Prof. A.S. Eegunjobi

INSTRUCTIONS

1. Answer ALL the questions in the booklet provided.

Show clearly all the steps used in the calculations.

3. All written work must be done in blue or black ink and sketches must

be done in pencil.

PERMISSIBLE MATERIALS

1. Non-programmable calculator without a cover.

THIS QUESTION PAPER CONSISTS OF 3 PAGES (Including this front page)

1|Page

|

2 Page 2 |

▲back to top |

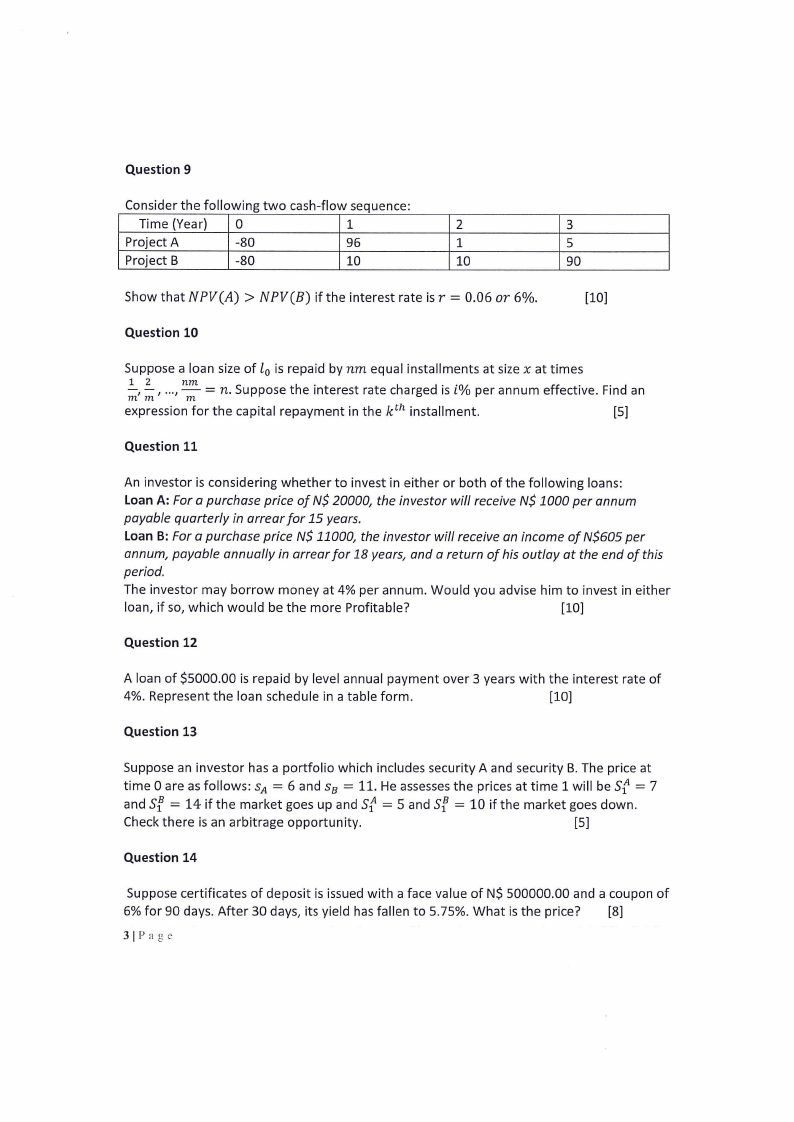

Question 1

1.1 Define the Net Present Value?

[2]

1.2 Define the Internal Rate of Return?

[2]

1.3 Define Discounted Cash flow?

[2]

1.4 Zero-coupon bond?

[2]

Question 2

Name 4 Instruments in the money markets.

[4]

Question 3

Mention 3 ways in which Derivatives are used.

;

[6]

Question 4

(a) Write an expression to give the amount of interest earned from time t to time

t + sinterms ofA only.

(2]

(b) Use (a) to find the annual interest rate, i.e., the interest rate from the t years to

time t + 1 years.

[3]

Question 5

Calculate the present value of an annuity of amount NS 100.00 paid annually for 5 years at

the rate of interest of 9%.

[5]

Question 6

An investment of NS 200.00 returns N$ 120.00 at the end of 1%t year and NS 100.00 at the

end of 2" year, What is the internal rate of return (IRR)?

[5]

Question 7

An investor is able to borrow NS 1000.00 at 8% effective for one year and immediately

invest the NS 1000.00 at 12% effective for the same year. Find the investor’s Internal rate of

return on this Transaction.

[3]

Question 8

Frans is considering a project which requires an amount of N$3000.00 and another amount

of N$1000.00 after one year. In two years’, time, when the project ends, she expects an

inflow of N$4500.00. what is the internal rate of return (JRR) of this project? Is the above

Investment profitable? Assume that Frans can lend and borrow at the same fixed rate of

7.13% per annum.

[10]

2|Page

|

3 Page 3 |

▲back to top |

Question 9

Consider the following two cash-flow sequence:

Time (Year)

0

1

2

3

Project A

-80

96

1

5

Project B

-80

10

10

90

Show that NPV (A) > NPV (B) if the interest rate is r = 0.06 or 6%.

[10]

Question 10

Suppose a loan size of ly is repaid by nm equal installments at size x at times

“, a2 r S = n. Suppose the .interest rate charged bia s ia % per annum effectiv. e. Fi. nd an

expression for the capital repayment in the k“" installment.

[5]

Question 11

An investor is considering whether to invest in either or both of the following loans:

Loan A: For a purchase price of NS 20000, the investor will receive NS 1000 per annum

payable quarterly in arrear for 15 years.

Loan B: For a purchase price NS 11000, the investor will receive an income of NS605 per

annum, payable annually in arrear for 18 years, and a return of his outlay at the end of this

period.

The investor may borrow money at 4% per annum. Would you advise him to invest in either

loan, if so, which would be the more Profitable?

[10]

Question 12

A loan of $5000.00 is repaid by level annual payment over 3 years with the interest rate of

4%. Represent the loan schedule in a table form.

[10]

Question 13

Suppose an investor has a portfolio which includes security A and security B. The price at

time 0 are as follows: s, = 6 and sg = 11. He assesses the prices at time 1 will be Sf = 7

and S? = 14 if the market goes up and Sf = 5 and S? = 10 if the market goes down.

Check there is an arbitrage opportunity.

[5]

Question 14

Suppose certificates of deposit is issued with a face value of NS 500000.00 and a coupon of

6% for 90 days. After 30 days, its yield has fallen to 5.75%. What is the price?

[3]

3|Page

|

4 Page 4 |

▲back to top |

Question 15

Consider the cash flow sequence, a = (5,9,20,4,2),b = (6,7,3,1,36) at time t = 0,...,4.

Find the NPV of the cash flow assuming an interest rate of 7%.

[6]

End of paper

Total marks: 100

4|Page