|

CMA612S-COST AND MANAGEMENT ACCOUNTING 202-1ST OPP-NOV 2024 |

|

1 Page 1 |

▲back to top |

'I

nAmlBIA unlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOF COMMERCE, HUMAN SCIENCEAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTING& FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BGAC

COURSE CODE: CMA612S

LEVEL: 6

COURSE NAME: COST & MANAGEMENT

ACCOUNTING 202

SESSION: NOVEMBER 2024

DURATION: 3 HOURS

PAPER: PRACTICAL AND THEORY

MARKS: 100

FIRSTOPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

M Modestus, H Namwandi & E Kangootui

MODERATOR: p Erkie

INSTRUCTIONS

• This question paper is made up of four (4) questions.

• Answer All the questions in blue or black ink only.

• You are advised to pay due attention to expression and presentation. Failure to do so

will cost you marks.

• Start each question on a new page in your answer booklet and show all yourworkings.

• Questions relating to this paper may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities and any assumption made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 6 PAGES {Including this front page)

1

|

2 Page 2 |

▲back to top |

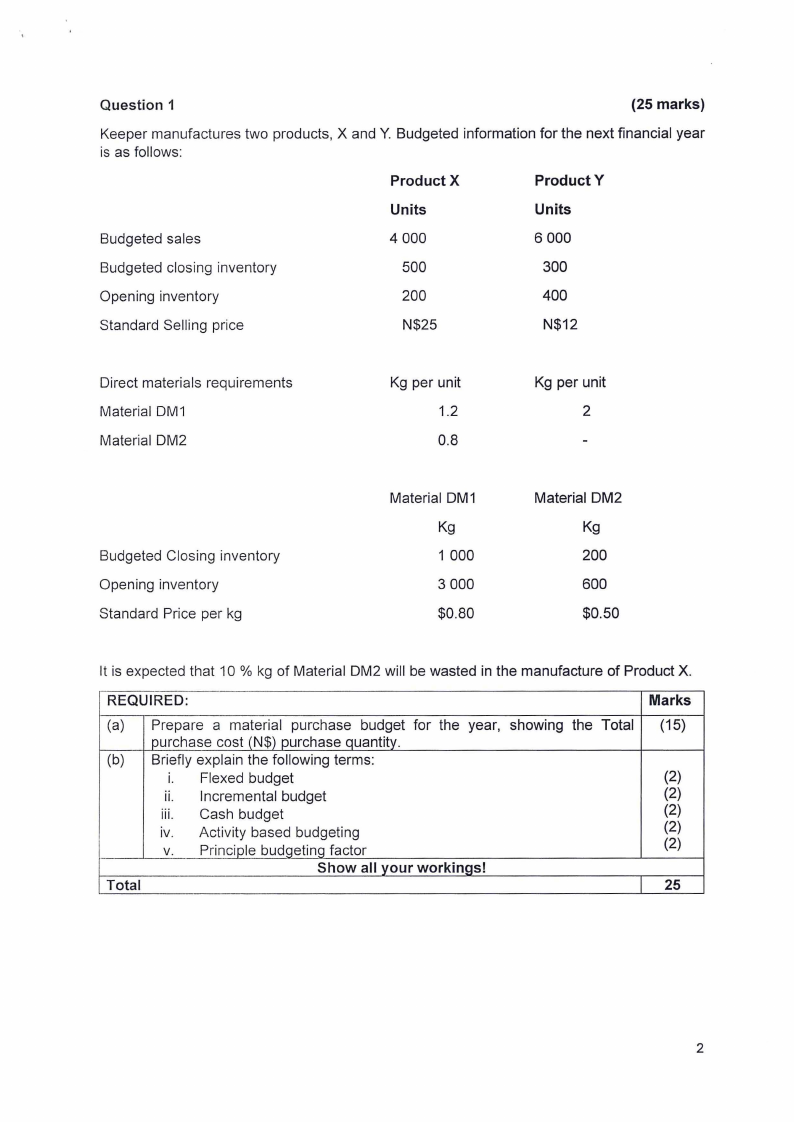

Question 1

(25 marks)

Keeper manufactures two products, X and Y. Budgeted information for the next financial year

is as follows:

Product X

Product Y

Units

Units

Budgeted sales

4 000

6 000

Budgeted closing inventory

500

300

Opening inventory

200

400

Standard Selling price

N$25

N$12

Direct materials requirements

Material DM1

Material DM2

Kg per unit

1.2

0.8

Kg per unit

2

Budgeted Closing inventory

Opening inventory

Standard Price per kg

Material OM 1

Kg

1 000

3 000

$0.80

Material DM2

Kg

200

600

$0.50

It is expected that 10 % kg of Material DM2 will be wasted in the manufacture of Product X.

REQUIRED:

(a) Prepare a material purchase budget for the year, showing the Total

purchase cost (N$) purchase quantitv.

(b) Briefly explain the following terms:

i. Flexed budget

ii. Incremental budget

iii. Cash budget

iv. Activity based budgeting

V. Principle budgeting factor

Show all vour workinas!

Total

Marks

(15)

(2)

(2)

(2)

(2)

(2)

25

2

|

3 Page 3 |

▲back to top |

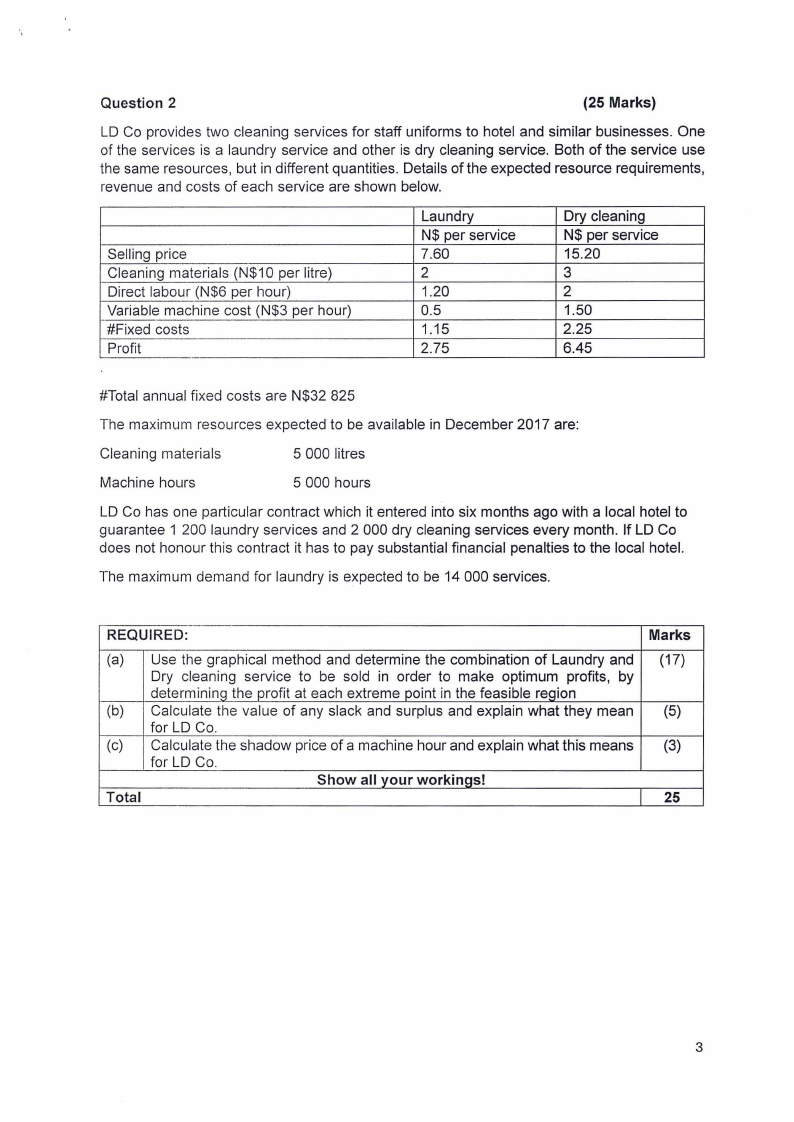

Question 2

(25 Marks)

LO Co provides two cleaning services for staff uniforms to hotel and similar businesses. One

of the services is a laundry service and other is dry cleaning service. Both of the service use

the same resources, but in different quantities. Details of the expected resource requirements,

revenue and costs of each service are shown below.

Selling price

Cleaning materials (N$10 per litre)

Direct labour (N$6 per hour)

Variable machine cost (N$3 per hour)

#Fixed costs

Profit

Laundry

N$ per service

7.60

2

1.20

0.5

1.15

2.75

Dry cleaning

N$ per service

15.20

3

2

1.50

2.25

6.45

#Total annual fixed costs are N$32 825

The maximum resources expected to be available in December 2017 are:

Cleaning materials

5 000 litres

Machine hours

5 000 hours

LO Co has one particular contract which it entered into six months ago with a local hotel to

guarantee 1 200 laundry services and 2 000 dry cleaning services every month. If LO Co

does not honour this contract it has to pay substantial financial penalties to the local hotel.

The maximum demand for laundry is expected to be 14 000 services.

REQUIRED:

(a)

(b)

(c)

Total

Use the graphical method and determine the combination of Laundry and

Dry cleaning service to be sold in order to make optimum profits, by

determining the profit at each extreme point in the feasible region

Calculate the value of any slack and surplus and explain what they mean

for LO Co.

Calculate the shadow price of a machine hour and explain what this means

for LO Co.

Show all your workings!

Marks

(17)

(5)

(3)

25

3

|

4 Page 4 |

▲back to top |

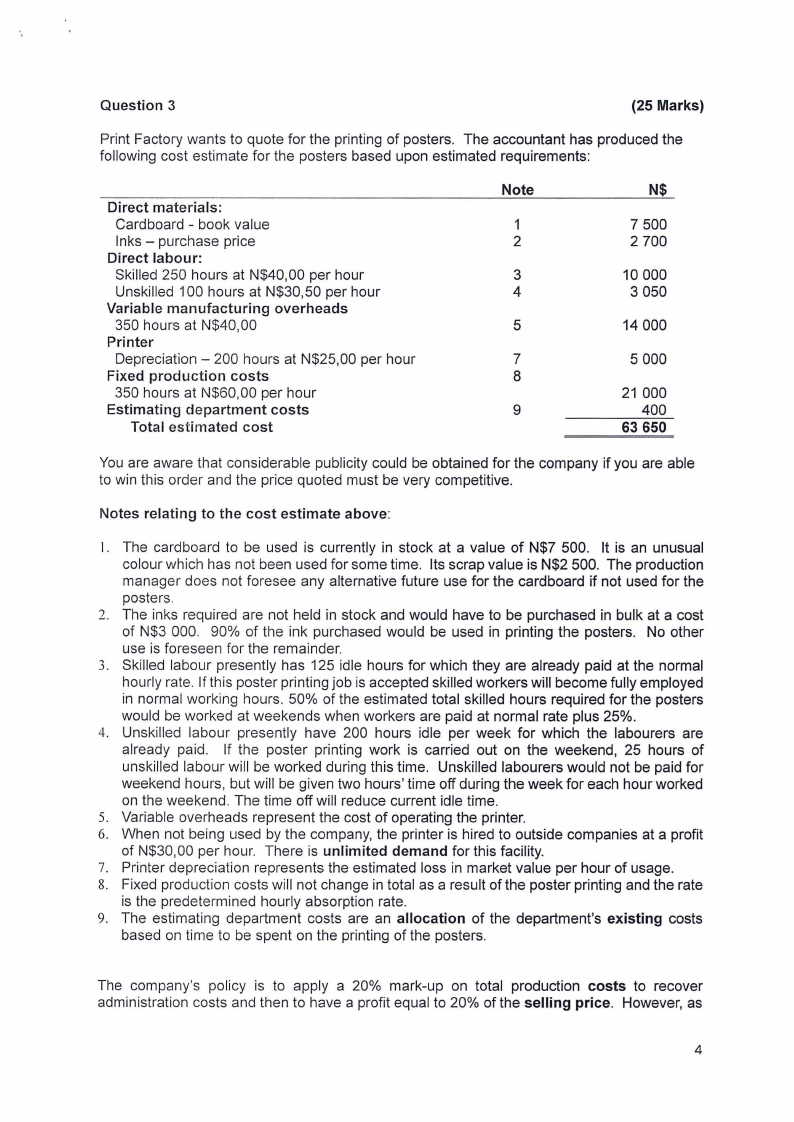

Question 3

(25 Marks)

Print Factory wants to quote for the printing of posters. The accountant has produced the

following cost estimate for the posters based upon estimated requirements:

Direct materials:

Cardboard - book value

Inks - purchase price

Direct labour:

Skilled 250 hours at N$40,00 per hour

Unskilled 100 hours at N$30,50 per hour

Variable manufacturing overheads

350 hours at N$40,00

Printer

Depreciation - 200 hours at N$25,00 per hour

Fixed production costs

350 hours at N$60,00 per hour

Estimating department costs

Total estimated cost

Note

1

2

3

4

5

7

8

9

N$

7 500

2 700

10 000

3 050

14 000

5 000

21 000

400

63 650

You are aware that considerable publicity could be obtained for the company if you are able

to win this order and the price quoted must be very competitive.

Notes relating to the cost estimate above:

I. The cardboard to be used is currently in stock at a value of N$7 500. It is an unusual

colour which has not been used for some time. Its scrap value is N$2 500. The production

manager does not foresee any alternative future use for the cardboard if not used for the

posters.

2. The inks required are not held in stock and would have to be purchased in bulk at a cost

of N$3 000. 90% of the ink purchased would be used in printing the posters. No other

use is foreseen for the remainder.

3. Skilled labour presently has 125 idle hours for which they are already paid at the normal

hourly rate. If this poster printing job is accepted skilled workers will become fully employed

in normal working hours. 50% of the estimated total skilled hours required for the posters

would be worked at weekends when workers are paid at normal rate plus 25%.

4. Unskilled labour presently have 200 hours idle per week for which the labourers are

already paid. If the poster printing work is carried out on the weekend, 25 hours of

unskilled labour will be worked during this time. Unskilled labourers would not be paid for

weekend hours, but will be given two hours' time off during the week for each hour worked

on the weekend. The time off will reduce current idle time.

5. Variable overheads represent the cost of operating the printer.

6. When not being used by the company, the printer is hired to outside companies at a profit

of N$30,00 per hour. There is unlimited demand for this facility.

7. Printer depreciation represents the estimated loss in market value per hour of usage.

8. Fixed production costs will not change in total as a result of the poster printing and the rate

is the predetermined hourly absorption rate.

9. The estimating department costs are an allocation of the department's existing costs

based on time to be spent on the printing of the posters.

The company's policy is to apply a 20% mark-up on total production costs to recover

administration costs and then to have a profit equal to 20% of the selling price. However, as

4

|

5 Page 5 |

▲back to top |

the company would like to secure the order, the mark-up to recover the administration costs

will remain at 20%, but the profit mark-up will be 10% of the selling price.

REQUIRED:

Calculate the minimum selling price that the company should quote for the poster

printing order. Give reasons for your exclusion of all costs given in the question.

Show all your workings!

Total

Marks

(25)

25

Question 4

(25 marks)

Namibia Breweries produces and sells beverages. Namibia Breweries ventured into

production of a home brand wine that it sells to the local market in 5 litre boxes. The

management is concerned about the time it took them to come up with the standard cost of

producing one box. After a long and stressful exercise the standard cost for each 5 litre box of

wine was provided as follows;

N$ per box

Direct materials: 11 litres @ N$2

22

Direct wages: 5 hours @ N$6

30

Variable production overhead

10

Fixed production overhead

20

Standard selling price

120

The variable overhead is incurred in direct proportion to the direct labour hours worked. The

box rate for fixed production overhead is based on an expected annual output of 24 000 boxes

produced at an even rate throughout the year. Assume that each calendar month is equal and

that the budgeted sales volume for September was 2 000 boxes.

The following were actual results recorded during September:

Number of boxes produced and sold: 1 750 boxes.

N$

Sales revenue

218 750

Direct materials: 19 540 litres purchased and used

41 034

Direct labour: 8 722 hours

47 971

Variable production overhead

26 166

Fixed production overhead

37 410

5

|

6 Page 6 |

▲back to top |

REQUIRED:

Marks

(a) Help the management of Namibia Breweries to speed up their standard

setting process by listing two sources of information they can use to set the

following standards:

i. Standard material usage.

(2)

ii. Standard labour rate.

iii. Standard labour times

(2)

(2)

(b) Calculate the operating variances and present them in a statementwhich (19)

reconciles the budQet and actual Qross profit for September.

Show all your workings!

Total

25

THE END

6

|

7 Page 7 |

▲back to top |

,-

I

I

I

I

II

II

I

I

I

I

I

I

I

I

I

I

I-

I-I-

I

I

I

I

I

I

I

I

I

I

----