|

FAR811S-ADVANCED FINACIAL ACCOUNTING-2ND OPP- JULY 2024 |

|

1 Page 1 |

▲back to top |

n Am ·1BI A U n IVE RSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING HONOURS

QUALIFICATION CODE: 08 BOAH

COURSE CODE: FAR 811S

SESSION: Jul/Aug 2024

LEVEL: 8

COURSE NAME: ADVANCEDFINANCIALACCOUNTING

AND REPORTING

PAPER: THEORYAND CALCULATIONS

DURATION: 3 hours

MARKS: 100

EXAMINER(S)

SUPPLEMENTARY ASSESSMENT - 2nd Opportunity

D W Kamotho

MODERATOR: Dr E Wealth

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only.

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. No programmable calculators are allowed.

5. Questions relating to the paper may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

6. Any resemblance to any people, places, organisations or anything is purely coincidental.

THIS QUESTION PAPER CONSISTS OF 8 PAGES (Including the front page)

|

2 Page 2 |

▲back to top |

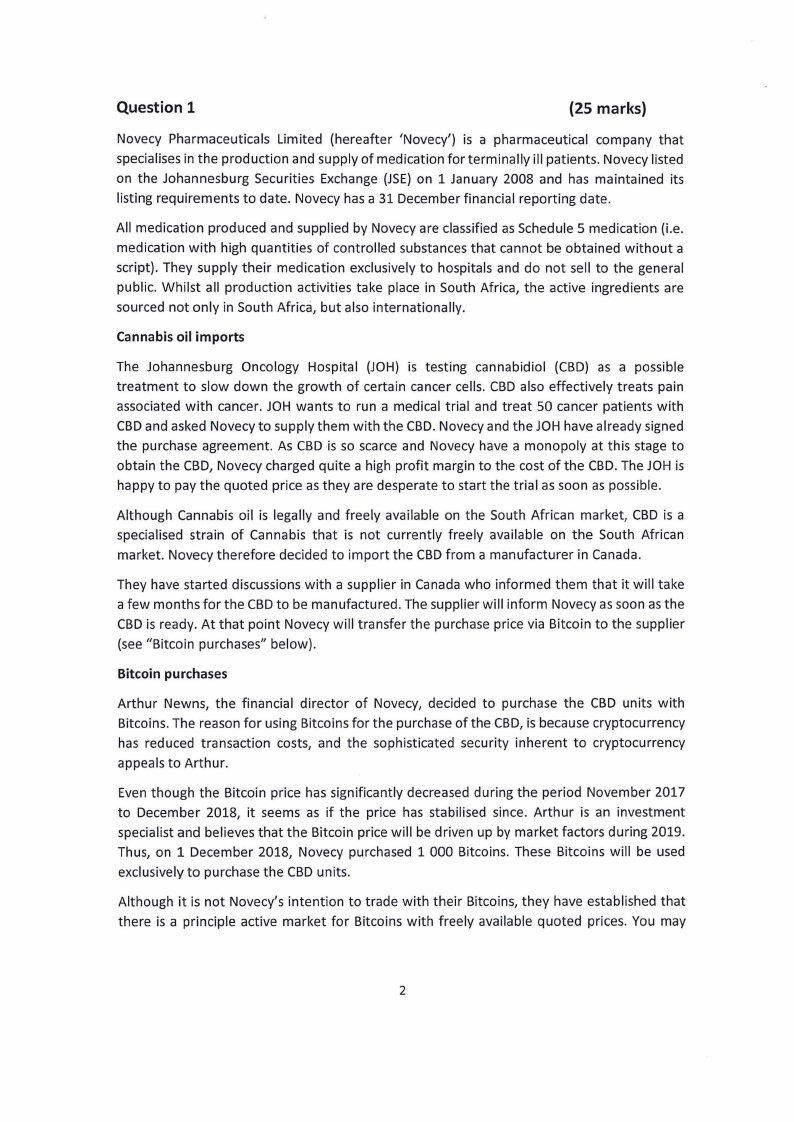

Question 1

{25 marks)

Novecy Pharmaceuticals Limited (hereafter 'Novecy') is a pharmaceutical company that

specialises in the production and supply of medication for terminally ill patients. Novecy listed

on the Johannesburg Securities Exchange (JSE)on 1 January 2008 and has maintained its

listing requirements to date. Novecy has a 31 December financial reporting date.

All medication produced and supplied by Novecy are classified as Schedule 5 medication (i.e.

medication with high quantities of controlled substances that cannot be obtained without a

script). They supply their medication exclusively to hospitals and do not sell to the general

public. Whilst all production activities take place in South Africa, the active ingredients are

sourced not only in South Africa, but also internationally.

Cannabis oil imports

The Johannesburg Oncology Hospital (JOH) is testing cannabidiol (CBD) as a possible

treatment to slow down the growth of certain cancer cells. CBD also effectively treats pain

associated with cancer. JOH wants to run a medical trial and treat 50 cancer patients with

CBDand asked Novecy to supply them with the CBD.Novecy and the JOH have already signed

the purchase agreement. As CBD is so scarce and Novecy have a monopoly at this stage to

obtain the CBD, Novecy charged quite a high profit margin to the cost of the CBD.The JOH is

happy to pay the quoted price as they are desperate to start the trial as soon as possible.

Although Cannabis oil is legally and freely available on the South African market, CBD is a

specialised strain of Cannabis that is not currently freely available on the South African

market. Novecy therefore decided to import the CBDfrom a manufacturer in Canada.

They have started discussions with a supplier in Canada who informed them that it will take

a few months for the CBDto be manufactured. The supplier will inform Novecy as soon as the

CBD is ready. At that point Novecy will transfer the purchase price via Bitcoin to the supplier

(see "Bitcoin purchases" below).

Bitcoin purchases

Arthur Newns, the financial director of Novecy, decided to purchase the CBD units with

Bitcoins. The reason for using Bitcoins for the purchase of the CBD, is because cryptocurrency

has reduced transaction costs, and the sophisticated security inherent to cryptocurrency

appeals to Arthur.

Even though the Bitcoin price has significantly decreased during the period November 2017

to December 2018, it seems as if the price has stabilised since. Arthur is an investment

specialist and believes that the Bitcoin price will be driven up by market factors during 2019.

Thus, on 1 December 2018, Novecy purchased 1 000 Bitcoins. These Bitcoins will be used

exclusively to purchase the CBD units.

Although it is not Novecy's intention to trade with their Bitcoins, they have established that

there is a principle active market for Bitcoins with freely available quoted prices. You may

2

|

3 Page 3 |

▲back to top |

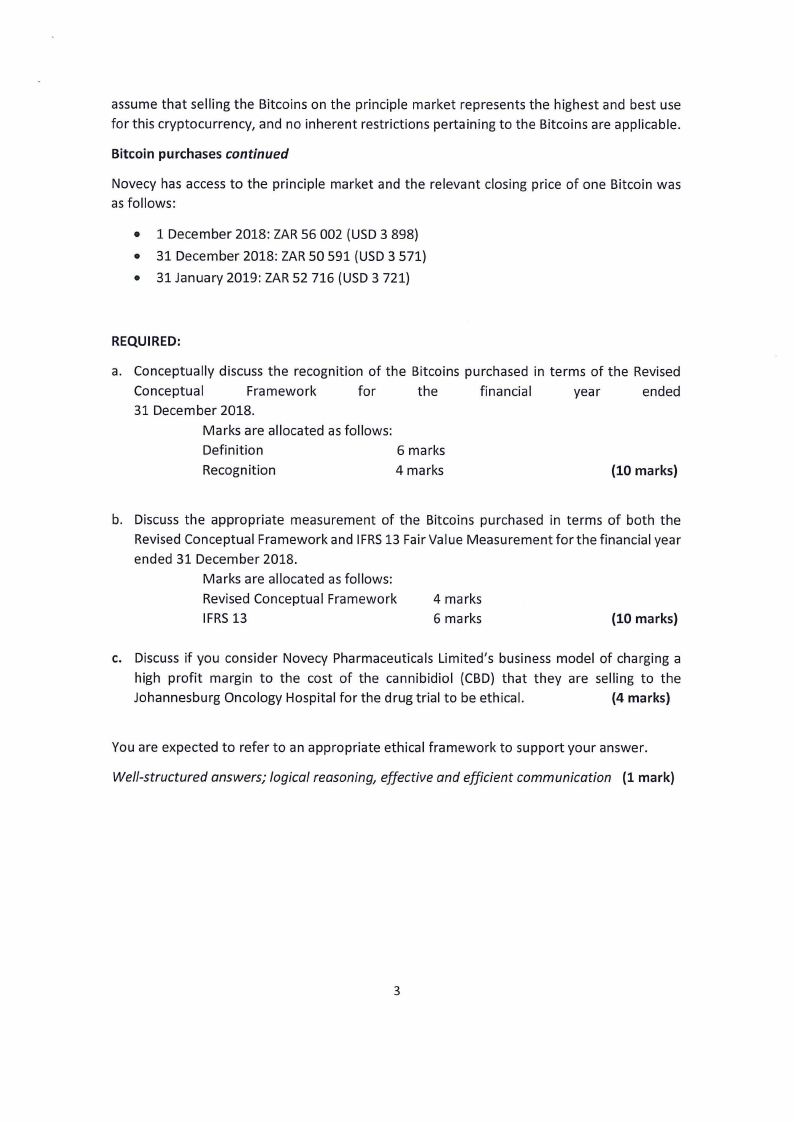

assume that selling the Bitcoins on the principle market represents the highest and best use

for this cryptocurrency, and no inherent restrictions pertaining to the Bitcoins are applicable.

Bitcoin purchases continued

Novecy has access to the principle market and the relevant closing price of one Bitcoin was

as follows:

• 1 December 2018: ZAR 56 002 (USD 3 898)

• 31 December 2018: ZAR 50 591 (USD 3 571)

• 31 January 2019: ZAR 52 716 (USD 3 721)

REQUIRED:

a. Conceptually discuss the recognition of the Bitcoins purchased in terms of the Revised

Conceptual

Framework

for

the

financial

year

ended

31 December 2018.

Marks are allocated as follows:

Definition

6 marks

Recognition

4 marks

(10 marks)

b. Discuss the appropriate measurement of the Bitcoins purchased in terms of both the

Revised Conceptual Framework and IFRS13 Fair Value Measurement for the financial year

ended 31 December 2018.

Marks are allocated as follows:

Revised Conceptual Framework

4 marks

IFRS13

6 marks

(10 marks)

c. Discuss if you consider Novecy Pharmaceuticals Limited's business model of charging a

high profit margin to the cost of the cannibidiol (CBD) that they are selling to the

Johannesburg Oncology Hospital for the drug trial to be ethical.

(4 marks)

You are expected to refer to an appropriate ethical framework to support your answer.

We/I-structured answers; logical reasoning, effective and efficient communication (1 mark)

3

|

4 Page 4 |

▲back to top |

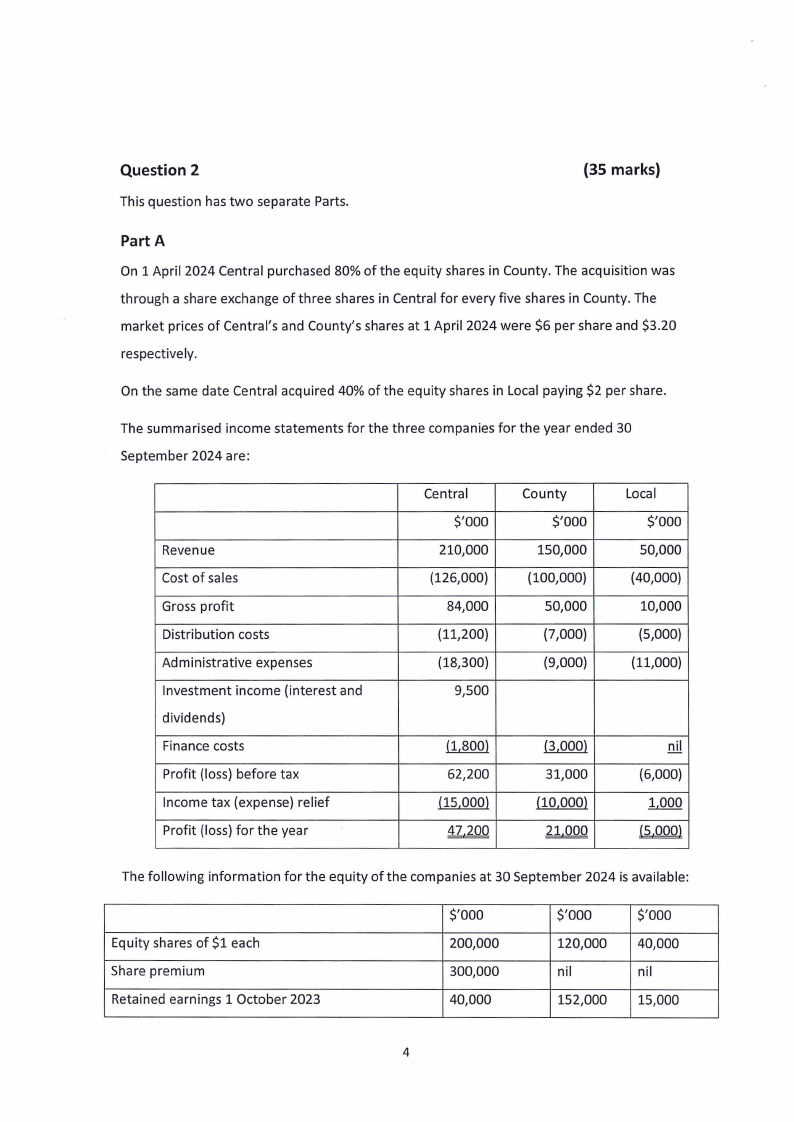

Question 2

This question has two separate Parts.

(35 marks)

Part A

On 1 April 2024 Central purchased 80% of the equity shares in County. The acquisition was

through a share exchange of three shares in Central for every five shares in County. The

market prices of Central's and County's shares at 1 April 2024 were $6 per share and $3.20

respectively.

On the same date Central acquired 40% of the equity shares in Local paying $2 per share.

The summarised income statements for the three companies for the year ended 30

September 2024 are:

Revenue

Cost of sales

Gross profit

Distribution costs

Administrative expenses

Investment income (interest and

dividends)

Finance costs

Profit (loss) before tax

Income tax (expense) relief

Profit (loss) for the year

Central

$'000

210,000

(126,000)

84,000

(11,200)

(18,300)

9,500

County

$'000

150,000

{100,000)

50,000

(7,000)

(9,000)

Local

$'000

50,000

(40,000)

10,000

(5,000)

(11,000)

{1,800)

62,200

{15,000)

47,200

{3,000}

31,000

{10,000)

21,000

nil

(6,000)

1,000

(5,0QQ)

The following information for the equity of the companies at 30 September 2024 is available:

Equity shares of $1 each

Share premium

Retained earnings 1 October 2023

$'000

200,000

300,000

40,000

$'000

120,000

nil

152,000

$'000

40,000

nil

15,000

4

|

5 Page 5 |

▲back to top |

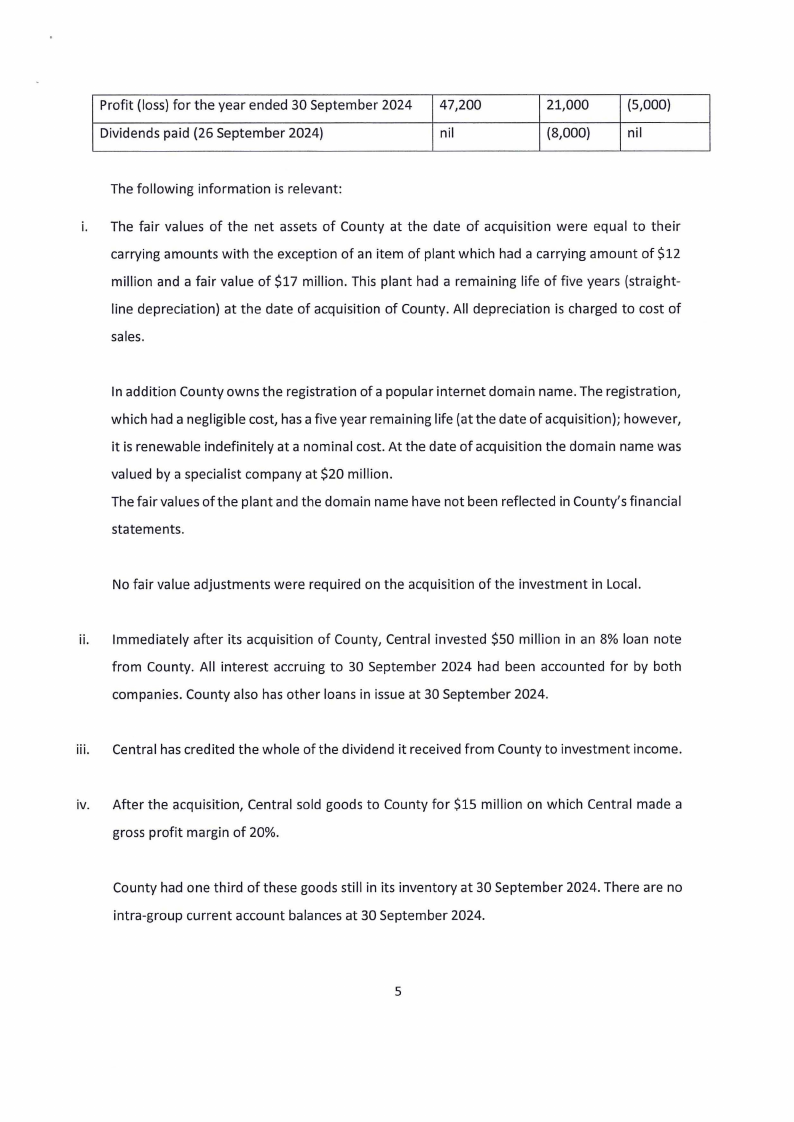

Profit (loss) for the year ended 30 September 2024

Dividends paid (26 September 2024)

47,200

nil

21,000

(8,000)

(5,000)

nil

The following information is relevant:

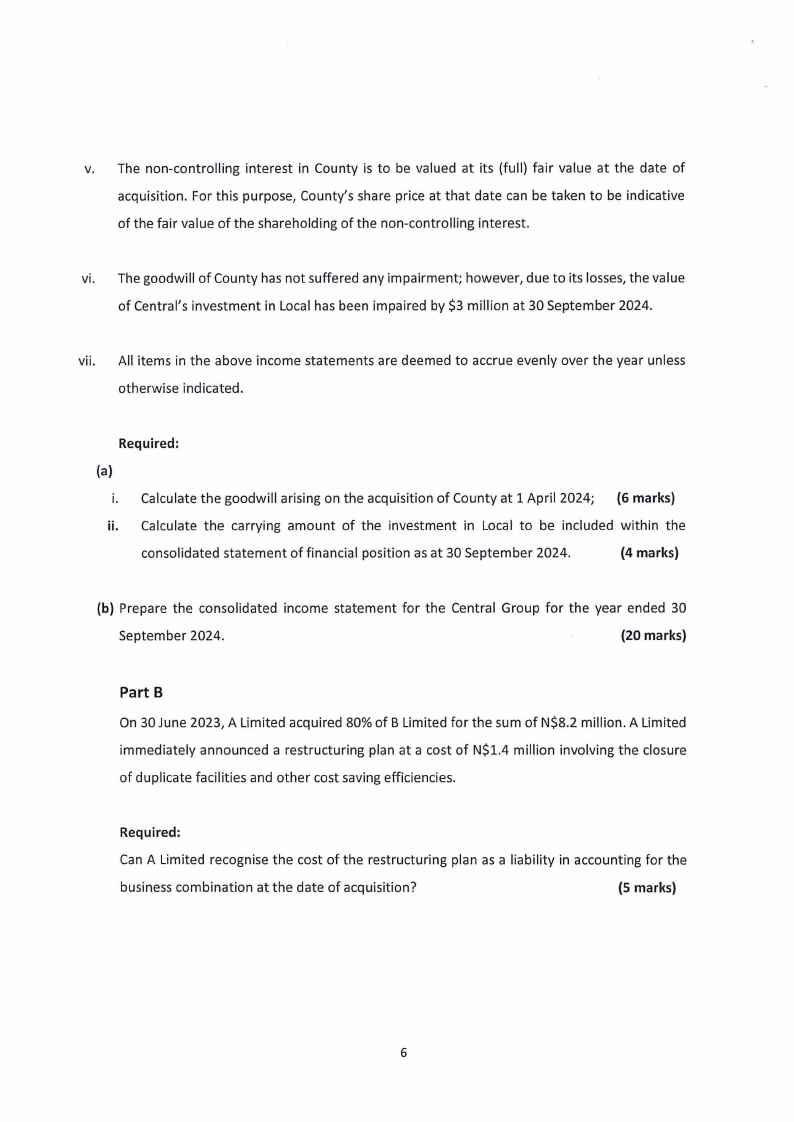

i. The fair values of the net assets of County at the date of acquisition were equal to their

carrying amounts with the exception of an item of plant which had a carrying amount of $12

million and a fair value of $17 million. This plant had a remaining life of five years (straight-

line depreciation) at the date of acquisition of County. All depreciation is charged to cost of

sales.

In addition County owns the registration of a popular internet domain name. The registration,

which had a negligible cost, has a five year remaining life (at the date of acquisition); however,

it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was

valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in County's financial

statements.

No fair value adjustments were required on the acquisition of the investment in Local.

ii. Immediately after its acquisition of County, Central invested $50 million in an 8% loan note

from County. All interest accruing to 30 September 2024 had been accounted for by both

companies. County also has other loans in issue at 30 September 2024.

iii. Central has credited the whole of the dividend it received from County to investment income.

iv. After the acquisition, Central sold goods to County for $15 million on which Central made a

gross profit margin of 20%.

County had one third of these goods still in its inventory at 30 September 2024. There are no

intra-group current account balances at 30 September 2024.

5

|

6 Page 6 |

▲back to top |

v. The non-controlling interest in County is to be valued at its (full) fair value at the date of

acquisition. For this purpose, County's share price at that date can be taken to be indicative

of the fair value of the shareholding of the non-controlling interest.

vi. The goodwill of County has not suffered any impairment; however, due to its losses, the value

of Central's investment in Local has been impaired by $3 million at 30 September 2024.

vii. All items in the above income statements are deemed to accrue evenly over the year unless

otherwise indicated.

Required:

(a)

i. Calculate the goodwill arising on the acquisition of County at 1 April 2024; (6 marks)

ii. Calculate the carrying amount of the investment in Local to be included within the

consolidated statement of financial position as at 30 September 2024.

(4 marks)

(b) Prepare the consolidated income statement for the Central Group for the year ended 30

September 2024.

(20 marks)

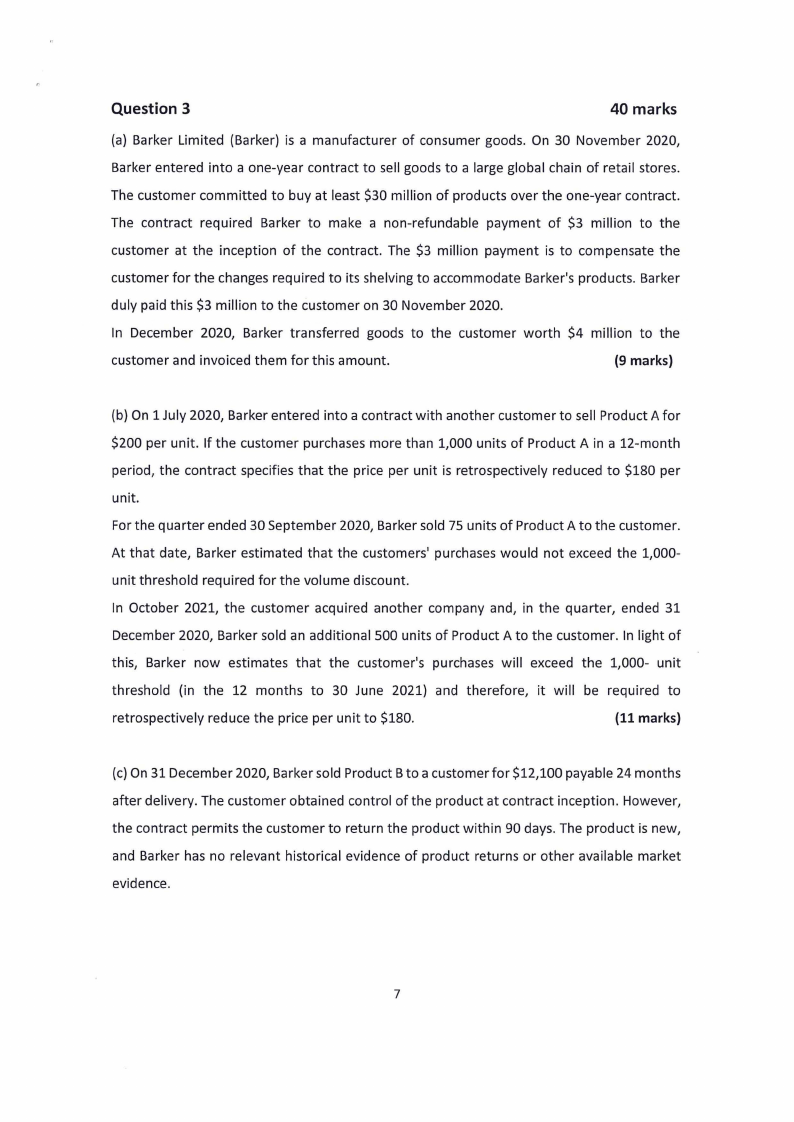

Part B

On 30 June 2023, A Limited acquired 80% of B Limited for the sum of N$8.2 million. A Limited

immediately announced a restructuring plan at a cost of N$1.4 million involving the closure

of duplicate facilities and other cost saving efficiencies.

Required:

Can A Limited recognise the cost of the restructuring plan as a liability in accounting for the

business combination at the date of acquisition?

(5 marks)

6

|

7 Page 7 |

▲back to top |

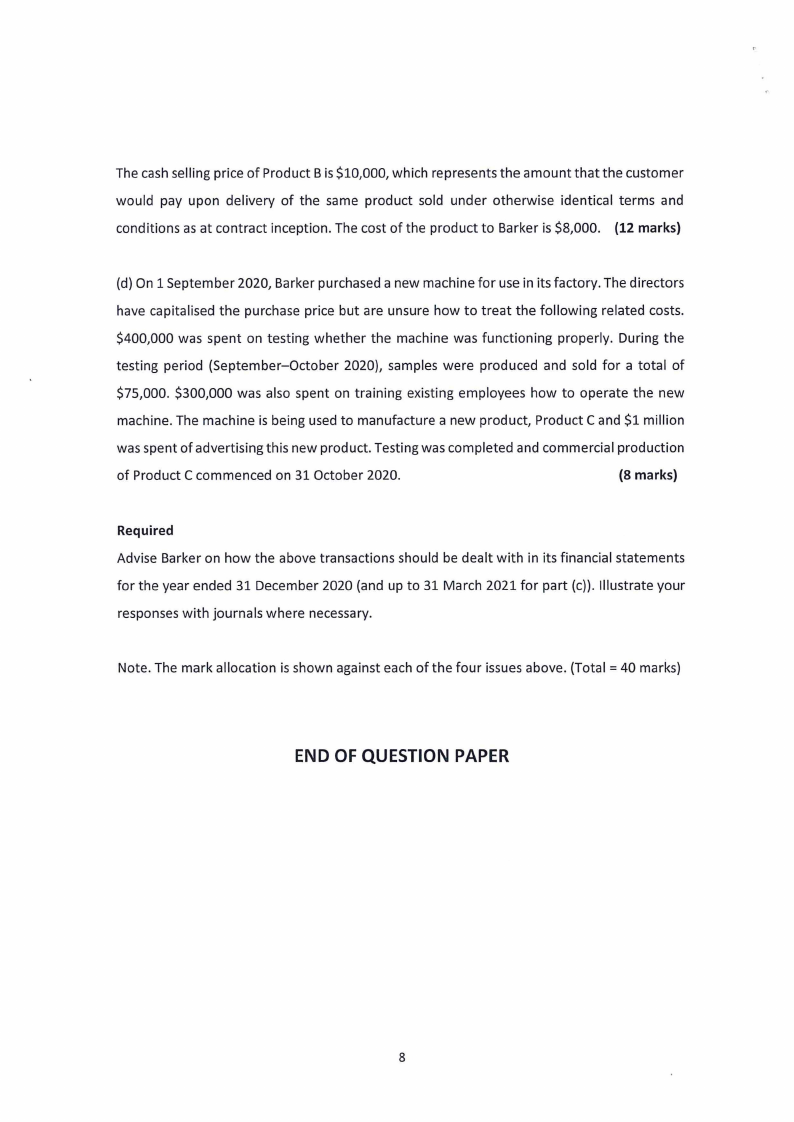

Question 3

40 marks

(a) Barker Limited (Barker) is a manufacturer of consumer goods. On 30 November 2020,

Barker entered into a one-year contract to sell goods to a large global chain of retail stores.

The customer committed to buy at least $30 million of products over the one-year contract.

The contract required Barker to make a non-refundable payment of $3 million to the

customer at the inception of the contract. The $3 million payment is to compensate the

customer for the changes required to its shelving to accommodate Barker's products. Barker

duly paid this $3 million to the customer on 30 November 2020.

In December 2020, Barker transferred goods to the customer worth $4 million to the

customer and invoiced them for this amount.

(9 marks)

(b) On 1 July 2020, Barker entered into a contract with another customer to sell Product A for

$200 per unit. If the customer purchases more than 1,000 units of Product A in a 12-month

period, the contract specifies that the price per unit is retrospectively reduced to $180 per

unit.

For the quarter ended 30 September 2020, Barker sold 75 units of Product A to the customer.

At that date, Barker estimated that the customers' purchases would not exceed the 1,000-

unit threshold required for the volume discount.

In October 2021, the customer acquired another company and, in the quarter, ended 31

December 2020, Barker sold an additional 500 units of Product A to the customer. In light of

this, Barker now estimates that the customer's purchases will exceed the 1,000- unit

threshold (in the 12 months to 30 June 2021) and therefore, it will be required to

retrospectively reduce the price per unit to $180.

(11 marks)

(c) On 31 December 2020, Barker sold Product B to a customer for $12,100 payable 24 months

after delivery. The customer obtained control of the product at contract inception. However,

the contract permits the customer to return the product within 90 days. The product is new,

and Barker has no relevant historical evidence of product returns or other available market

evidence.

7

|

8 Page 8 |

▲back to top |

The cash selling price of Product Bis $10,000, which represents the amount that the customer

would pay upon delivery of the same product sold under otherwise identical terms and

conditions as at contract inception. The cost of the product to Barker is $8,000. (12 marks)

(d} On 1 September 2020, Barker purchased a new machine for use in its factory. The directors

have capitalised the purchase price but are unsure how to treat the following related costs.

$400,000 was spent on testing whether the machine was functioning properly. During the

testing period (September-October 2020}, samples were produced and sold for a total of

$75,000. $300,000 was also spent on training existing employees how to operate the new

machine. The machine is being used to manufacture a new product, Product C and $1 million

was spent of advertising this new product. Testing was completed and commercial production

of Product C commenced on 31 October 2020.

(8 marks)

Required

Advise Barker on how the above transactions should be dealt with in its financial statements

for the year ended 31 December 2020 (and up to 31 March 2021 for part (c}}. Illustrate your

responses with journals where necessary.

Note. The mark allocation is shown against each of the four issues above. (Total = 40 marks}

END OF QUESTION PAPER

8