|

PFN712S-PUBLIC FINANCE-1ST OPP- JUNE 2024 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCI En CE Ano TECH n OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: 07BECO LEVEL: 7

COURSE CODE: PFN712S

COURSE NAME: PUBLIC FINANCE

SESSION: JUNE 2024

DURATION: 3 HOURS

PAPER:THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) MRS. LAVINIA HOFNI

MODERATOR: MR. HANRY MBAHA

INSTRUCTIONS

1. This paper consists of 4 sections A, B, C and D

2. Answer ALL questions.

3. Number your answers in accordance with the question paper.

4. Start each Section answer on a new page.

5. Write clearly and legibly

PERMISSIBLE MATERIALS

1. Pen, pencil, and eraser

2. Ruler

3. Calculator

THIS EXAMNATION PAPER CONSISTS OF 7 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

SECTION A

20MARKS

QUESTION 1

[20 Marks)

Chose one possible answer for each question.

1.1 Which is the main point on the basis of which public finance can be separated from

private finance:

(2 Marks)

A. Price policy

B. Secrecy

C. Borrowings

D. Elasticity in income

1.2 Among the following canons of taxation which one has been given by Adam Smith:

(2 Marks)

A. Canon of Uniformity

B. canon of diversity

C. Canon of productivity

D. canon of equity

1.3 The burden of direct taxes is borne by:

A. on whom it is levied

B. none of these

C. poor person

D. Rich person

(2 Marks)

1.4 A pure private good is:

A. All choices are correct.

B. rival in consumption and subject to exclusion.

C. nonrival in consumption and subject to exclusion.

D. rival in consumption and not subject to exclusion.

(2 Marks)

1.5 In a public goods context, it is difficult to measure impact on real income because:

(2 Marks)

A. public goods are generally free to the public.

B. they make up a small perceJ?tage of total GDP.

C. inflation decreases the value of the good

D. it is hard to measure how people value the public good.

1.6 Externalities can be positive because:

A. there is no concept for marginal benefit.

B. positive externalities are subsidies.

C. marginal damages do not last over time.

D. utility can be impacted positively as well as negatively.

(2 Marks)

2

|

3 Page 3 |

▲back to top |

1.7 A ........ Tax is based on the taxpayer's ability to pay. It imposes a lower tax rate on low-

income earners than on those with a higher income.

(2 Marks)

A. Regressive

B. Propmiional

C. Progressive

D. All of the above

1.8 Pareto efficient is:

(2 Marks)

A. A concept commonly used in economics, is an economic situation in which it is impossible

to make one party better off.

B. When all person cannot be made better off without worsening the condition of other persons.

C. if the only way to make one person better off is to make another person worse off.

D. All of the above

1.9 Movement from an inefficient allocation to an efficient allocation in the Edgeworth Box

will:

(2 Marks)

A. Decrease the utility of all individuals.

B. Increase the utility of all individuals.

C. Increase the utility of one individual but cannot decrease the utility of any individual.

D. Increase the utility of at least one individual but may decrease the level of utility of another

person.

1.10 The marginal rate of substitution is:

A. The slope of the Pareto curve

B. The slope of the utility possibilities curve

C. The slope of the contract curve

D. The slope of the indifference curve

(2 Marks)

3

|

4 Page 4 |

▲back to top |

SECTIONB

20MARKS

QUESTION 1

[20 Marks]

Indicate whether T/F in the answer booklet provided.

1.1 Government purchases of goods and services for current consumption are classed as

government investment.

(2 Marks)

1.2 The source of employment income is determined as the place where the services are rendered,

irrespective of the residency of the person making the payment or the place from where the

payment is made.

(2 Marks)

1.3 Market failure refers to a situation where the market does not lead to a desired outcome/result.

(2 Marks)

1.4 Negative externalities such as pollution, noise and smoking can be corrected by imposing

legislation or taxes.

(2 Marks)

1.5 Edgeworth Box is an analytical device used to model welfare economic theory. (2 Marks)

1.6 Lack of data does not prevent policymakers from assessing the potential impact of major

changes to the tax system.

(2 Marks)

1.7 The Ministiy of Finance in Namibia is the nation's main tax collecting authority. (2 Marks)

1.8 Externalities (third parties' effects) can never be positive.

(2 Marks)

1.9 There are no gains from trade or reallocation when there is Pareto Efficient. (2 Marks)

1.10 VAT is levied on the difference between the purchase cost of an asset and the price at which

it can be sold.

(2 Marks)

4

|

5 Page 5 |

▲back to top |

SECTIONC

30MARKS

QUESTION 1

[10 Marks]

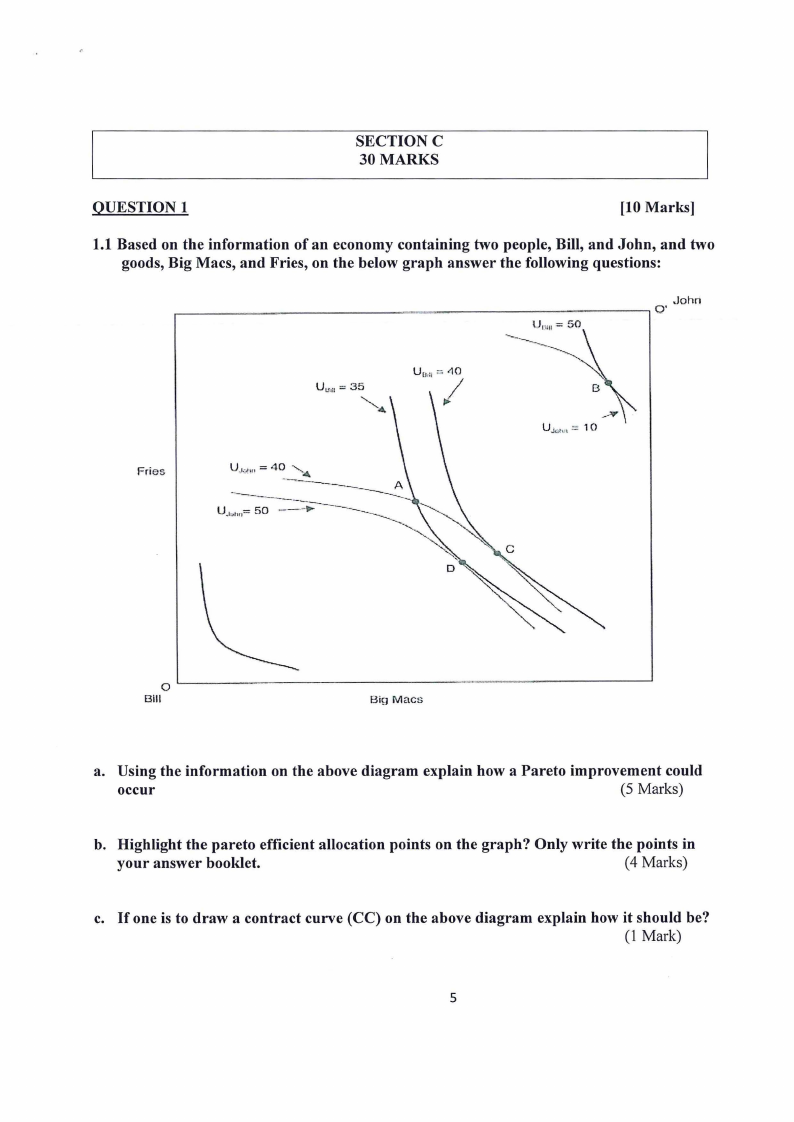

1.1 Based on the information of an economy containing two people, Bill, and John, and two

goods, Big Macs, and Fries, on the below graph answer the following questions:

~---------------------------,0'

.John

----u-"-'-"--=---.s.-.o.-..-._-_

Fries

0

Bill

Big Macs

a. Using the information on the above diagram explain how a Pareto improvement could

occur

(5 Marks)

b. Highlight the pareto efficient allocation points on the graph? Only write the points in

your answer booklet.

(4 Marks)

c. If one is to draw a contract curve (CC) on the above diagram explain how it should be?

(1 Mark)

5

|

6 Page 6 |

▲back to top |

OUESTION2

[10 Marks]

2.1 In light of Mechanistic view of public finance, discuss the concept of Externalities and

how this view manifest itself?

( 10 Marks)

OUESTION3

[10 Marks]

3.1 An externality is defined as a cost or benefit related to the production or consumption of

some good that is imposed on second or third parties (people not participating in the

market transaction). With the aid of a diagram draw a negative production externality and

shade with clear markings the dead weight loss.

( 10 Marks)

6

|

7 Page 7 |

▲back to top |

SECTIOND

30MARKS

QUESTION 1

[10 Marks]

1.1 The government prepares the budget to fulfil certain national objectives. Mention and

discuss S(five) objectives of a national budget.

(IO Marks)

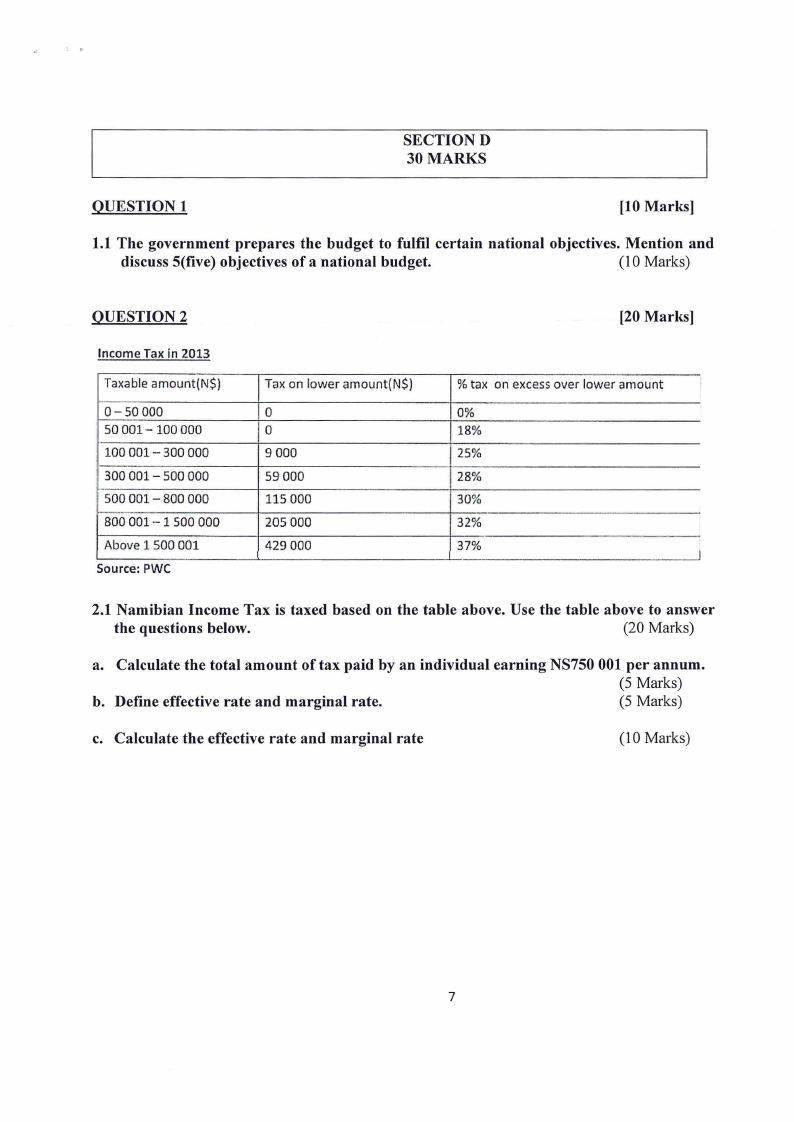

QUESTION 2

Income Tax in 2013

Taxable arnount(N$)

0-50 000

so001- 100 000

I 100 001 - 300 000

· 300 001 - 500 000

500 001- 800 000

800 001 - 1 500 000

Above 1 500 001

Source: PWC

Tax on lower arnount{N$)

0

0

9 ODO

59000

115 ODO

205 000

429 000

[20 Marks]

% tax on excess over lower amount

0%

18%

25%

28%

30%

32%

37%

I

2.1 Namibian Income Tax is taxed based on the table above. Use the table above to answer

the questions below.

(20 Marks)

a. Calculate the total amount of tax paid by an individual earning NS750 001 per annum.

(5 Marks)

b. Define effective rate and marginal rate.

(5 Marks)

c. Calculate the effective rate and marginal rate

(10 Marks)

7