|

AEM520S - AGRICULTURAL ECONOMICS - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

3

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF NATURAL RESOURCE AND SPATIAL SCIENCES

DEPARTMENT OF AGRICULTURE & NATURAL RESOURCES SCIENCES

QUALIFICATION: BACHELOR OF AGRICULTURE/BACHELOR OF REGIONAL AND RURAL DEVELOPMENT .

QUALIFICATION CODE: 27BAGR/07BRRD | LEVEL: 5

COURSE CODE: AEM520S

COURSE NAME: AGRICULTURAL ECONOMICS

DATE: January 2020

PAPER: THEORY

DURATION: 3 Hours

MARKS: 100

SECOND OPPORTUNITY/SUPPLEMENTARY EXAMINATION QUESTION PAPER

EXAMINER(S)

M. Lubinda

MODERATOR:

C. Kalumbu

INSTRUCTIONS

Answer ALL four (4) questions.

Read all the questions carefully before answering.

Number your answers.

Make sure your student number appears on the answering script.

PERMISSIBLE MATERIALS

1. Examination paper.

2. Examination script.

3. Calculator

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Agricultural Economics

AEM5208S

QUESTION ONE

[MARKS]

a. Explain the four basic economic concepts that are used to analyze and understand

(4)

individual choices.

b. The study of Agricultural Economics involves the use of theories, models, and concepts

as aids for analyzing and understanding complex relationships and phenomena in the

real world. Comparative Advantage is one such concept. What is comparative

(6)

advantage? Describe how you would use the concept of comparative advantage to

explain trade between within or between countries.

c. Consider the market for imported onions by the following demand and supply functions:

P = 4000 —0.2Q

P=1000+0.8Q

Where P is the market price of onions (in NS per ton), and Q is the quantity demanded

and supplied of imported onions.

i. State the price range in which imported onions will be sold and bought in the

market.

(2)

ii. | Suppose the government, suppose the government sets the price of imported

onions at NS 2000 per ton. Would this price control create a shortage or surplus

(4)

in the market? Calculate the magnitude of the shortage or surplus in the market.

iii. Estimate the benefits in monetary terms that would accrue to the consumers as

a result of the price control.

(5)

iv. Compute the cost of this price control on the Namibian society. (hint: the cost

%

of the price control is the deadweight loss)

(4)

TOTAL MARKS

[25]

Second Opportunity Examination

Page 2 of 5

January 2020

|

3 Page 3 |

▲back to top |

Agricultural Economics

AEMS5208S

QUESTION TWO

[MARKS]

a. Discuss the application and use of the elasticity concept in economics. Your discussion

should focus on the application and use of the elasticity in the assessment of the

responsiveness of consumers to changes in income, prices, and prices of related

(10)

goods.

b. Explain how you would use the market model to assess the desirability of a tax policy

from an economic efficiency perspective.

(5)

c. Suppose you are the Policy Analyst at the Ministry of Agriculture, and you have been

tasked to analyze and quantify the responsiveness of consumers to the introduction

of an NS500 excise tax on each ton of imported onions. Suppose you know that the

monthly demand and supply of imported onions, before the introduction of the tax,

can be represented by the following functions.

P = 4000 - 0.2Q

P = 1000+ 0.8Q

Where P is the market price of onions (in NS per ton), and Q is the quantity demanded

and supplied of imported onions. Use this information to answer the questions below.

i. | Determine the equilibrium price and quantity before the introduction of the

excis; e tax.

(2)

i. Estimate the equilibrium price and quantity after the introduction of the

(2)

excise tax.

iii. | Estimate the price elasticity of demand between the equilibrium price before

and after the introduction of the excise tax. Is the demand for imported onions

(6)

elastic, unit elastic, or elastic? Show all your calculations and explain your

answer.

TOTAL MARKS

[25]

Second Opportunity Examination

Page 3 of5

January 2020

|

4 Page 4 |

▲back to top |

Agricultural Economics

AEMS5208

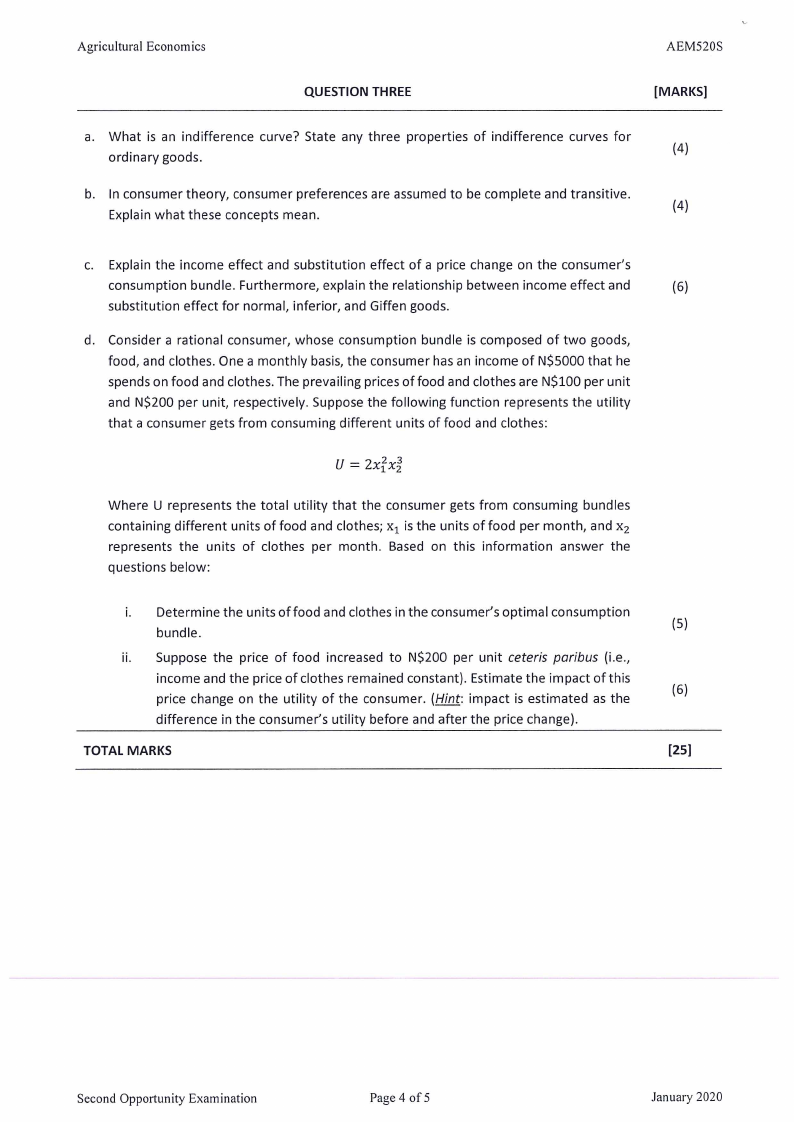

QUESTION THREE

[MARKS]

a. What is an indifference curve? State any three properties of indifference curves for

ordinary goods.

(4)

b. In consumer theory, consumer preferences are assumed to be complete and transitive.

Explain what these concepts mean.

(4)

c. Explain the income effect and substitution effect of a price change on the consumer’s

consumption bundle. Furthermore, explain the relationship between income effect and

(6)

substitution effect for normal, inferior, and Giffen goods.

d. Consider a rational consumer, whose consumption bundle is composed of two goods,

food, and clothes. One a monthly basis, the consumer has an income of NS5000 that he

spends on food and clothes. The prevailing prices of food and clothes are NS100 per unit

and NS200 per unit, respectively. Suppose the following function represents the utility

that a consumer gets from consuming different units of food and clothes:

U —= 2xJ7xy233

Where U represents the total utility that the consumer gets from consuming bundles

containing different units of food and clothes; x, is the units of food per month, and x

represents the units of clothes per month. Based on this information answer the

questions below:

i. Determine the units of food and clothes in the consumer’s optimal consumption

bundle.

(5)

ii. | Suppose the price of food increased to NS$200 per unit ceteris paribus (i.e.,

income and the price of clothes remained constant). Estimate the impact of this

price change on the utility of the consumer. (Hint: impact is estimated as the

(6)

difference in the consumer’s utility before and after the price change).

TOTAL MARKS

[25]

Second Opportunity Examination

Page 4 of5

January 2020

|

5 Page 5 |

▲back to top |

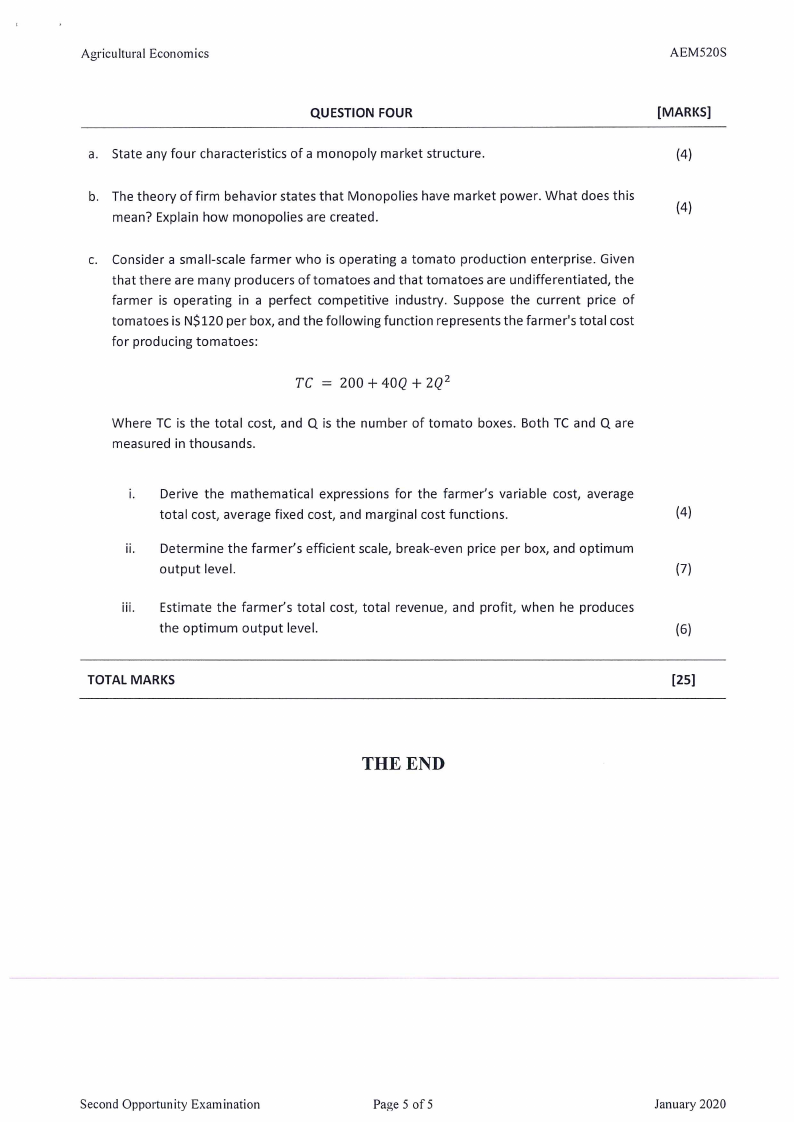

Agricultural Economics

AEM5208

QUESTION FOUR

a. State any four characteristics of a monopoly market structure.

[MARKS]

(4)

b. The theory of firm behavior states that Monopolies have market power. What does this

mean? Explain how monopolies are created.

(4)

c. Consider a small-scale farmer who is operating a tomato production enterprise. Given

that there are many producers of tomatoes and that tomatoes are undifferentiated, the

farmer is operating in a perfect competitive industry. Suppose the current price of

tomatoes is NS120 per box, and the following function represents the farmer's total cost

for producing tomatoes:

TC = 200+ 40Q + 2Q?

Where TC is the total cost, and Q is the number of tomato boxes. Both TC and Q are

measured in thousands.

i. Derive the mathematical expressions for the farmer’s variable cost, average

total cost, average fixed cost, and marginal cost functions.

(4)

i. Determine the farmer’s efficient scale, break-even price per box, and optimum

output level.

(7)

iii.

Estimate the farmer’s total cost, total revenue, and profit, when he produces

the optimum output level.

(6)

TOTAL MARKS

[25]

THE END

Second Opportunity Examination

Page 5 of 5

January 2020

|

6 Page 6 |

▲back to top |