|

GTA711S-TAXATION 310-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

|

2 Page 2 |

▲back to top |

|

3 Page 3 |

▲back to top |

|

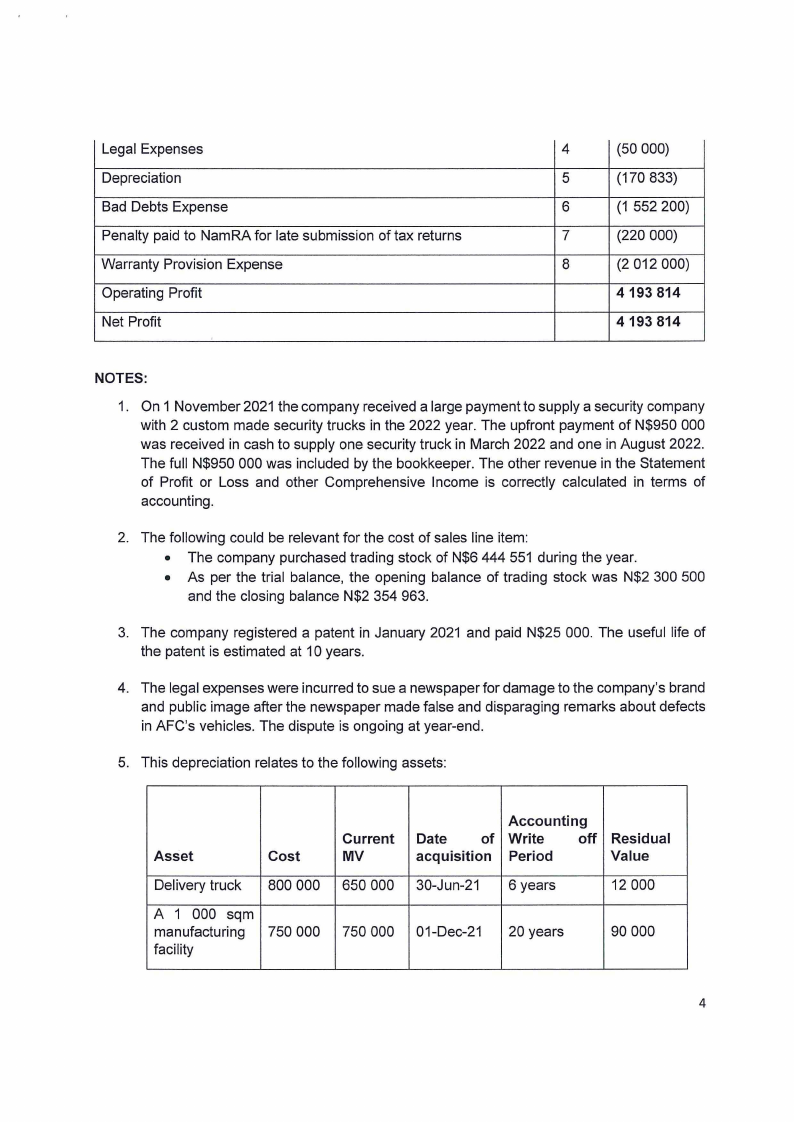

4 Page 4 |

▲back to top |

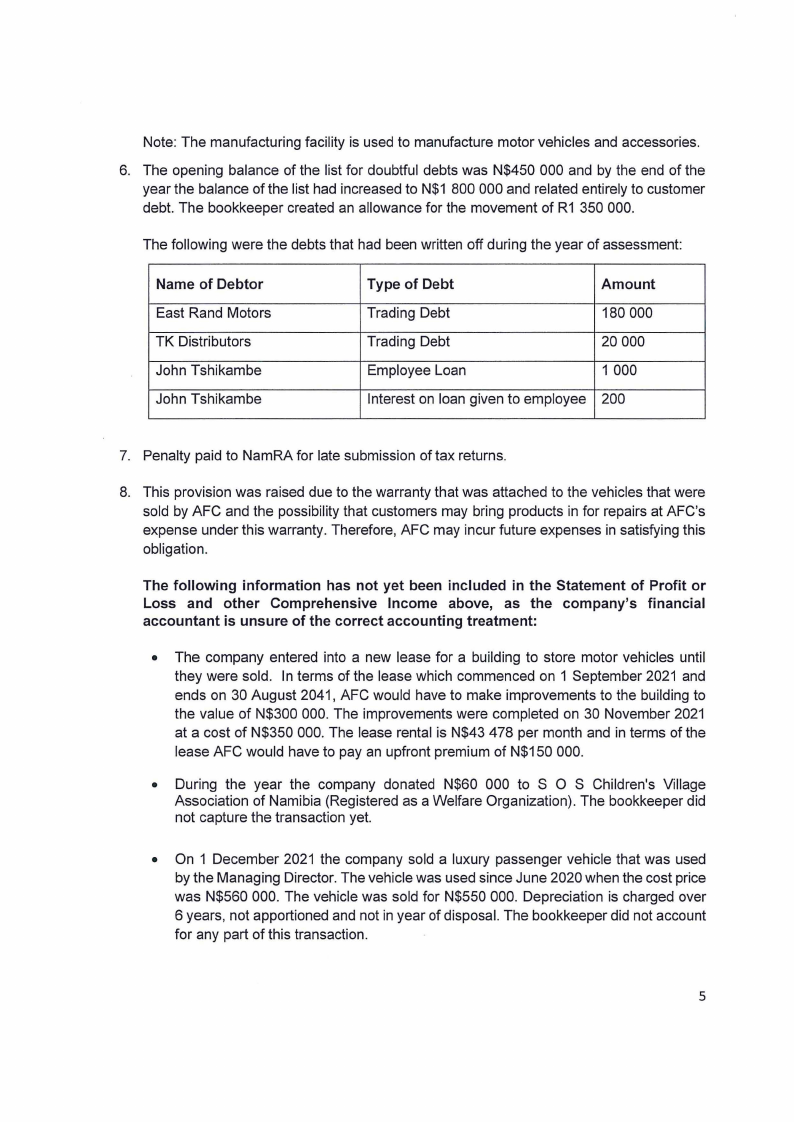

|

5 Page 5 |

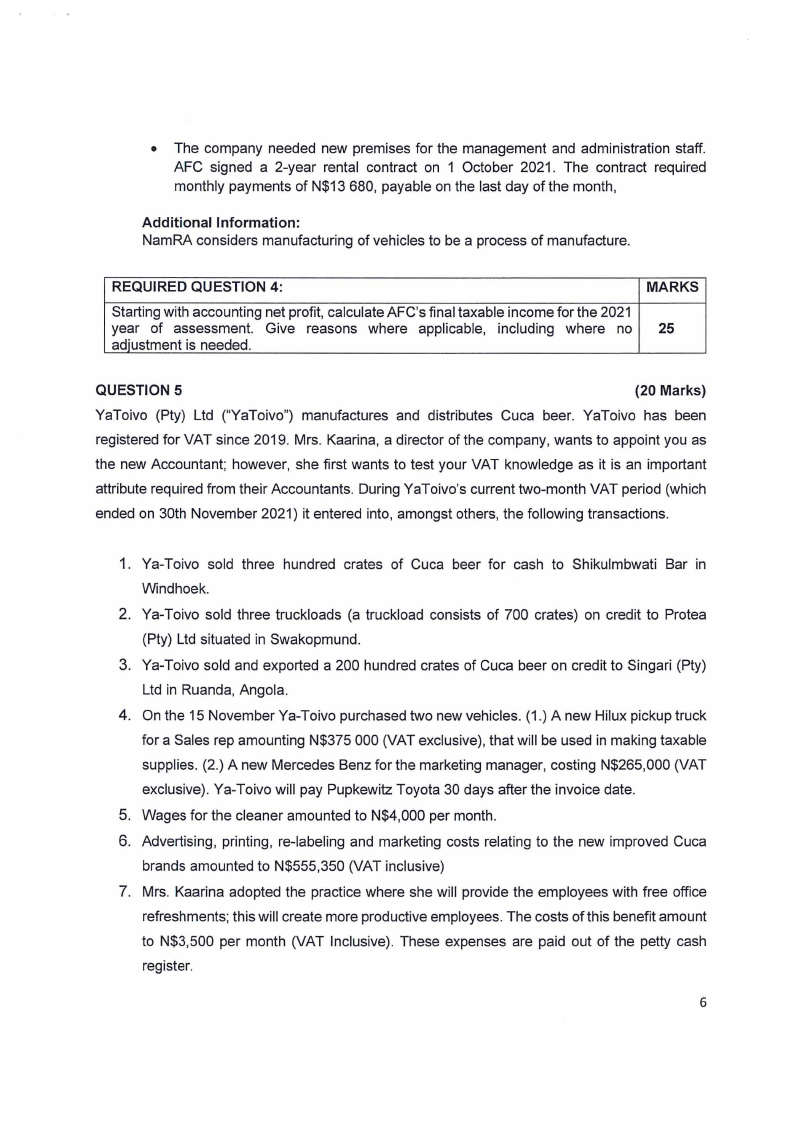

▲back to top |

|

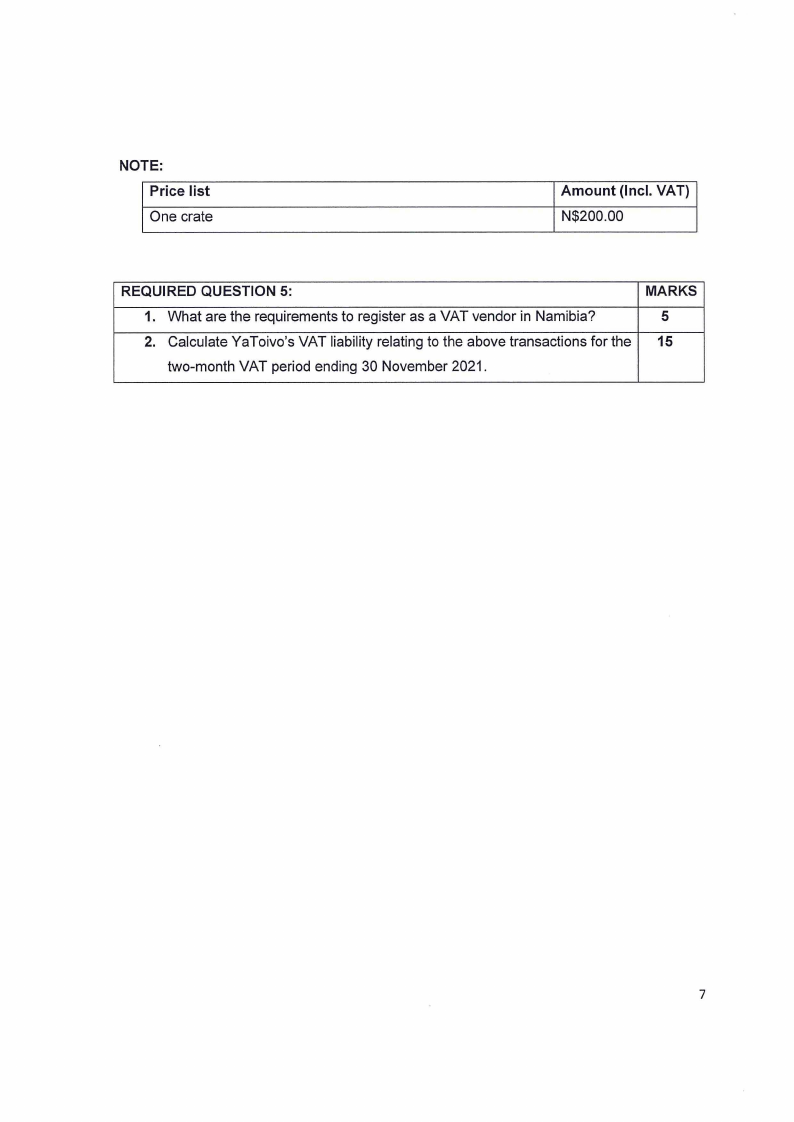

6 Page 6 |

▲back to top |

|

7 Page 7 |

▲back to top |

|

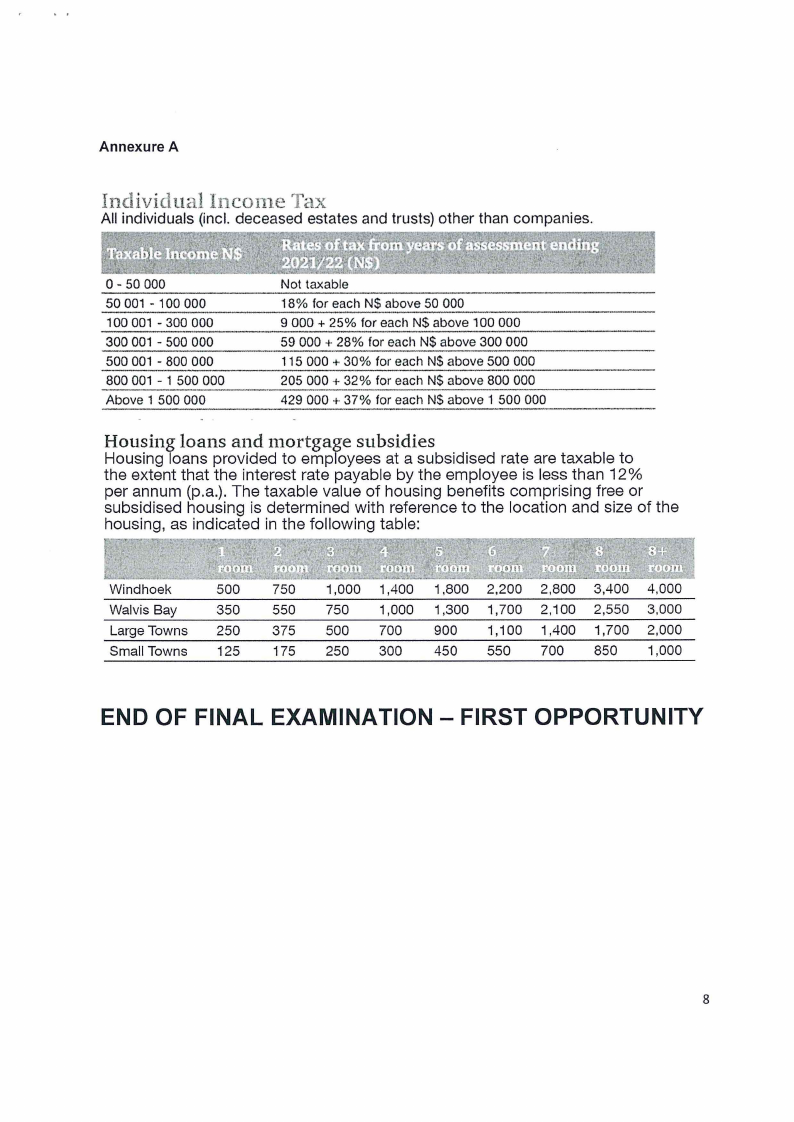

8 Page 8 |

▲back to top |

|

9 Page 9 |

▲back to top |

|

10 Page 10 |

▲back to top |