|

GTA711S-TAXATION 310-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 0?BOAC

LEVEL: 7

COURSE: TAXATION 310

COURSE CODE: GTA711S

SESSION: JUNE 2022

PAPER: THEORY & APPLICATION

DURATION: 180 MINUTES

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

Mrs. Z van der Walt; Ms Y. Andrew & Mr Y. Elago

MODERATOR:

Mrs F. Haimbala

INSTRUCTIONS TO CANDIDATES

1. This paper consists of 6 pages (excluding the cover page).

2. Answer all the questions in the answer book in blue or black ink.

3. Round off all amounts to the nearest Namibian Dollar, where applicable.

4. The names of people or businesses used throughout this examination paper do not reflect

the reality and may be purely coincidental.

5. Questions relating to the examination paper may be raised in the initial 30 minutes after the

commencement of the paper. Thereafter, candidates should use their own initiative to deal

with any perceived error or ambiguities and any assumptions made by the candidates

should be clearly stated.

|

2 Page 2 |

▲back to top |

QUESTION 1

(15 Marks)

Kanye Kim has been a cattle farmer in Karibib district in Namibia all his life. His main source of income

is the sale of milk from the dairy that he has on his farm. Ninety five percent of Kanye's income is

obtained from selling milk to Namibia Diaries. He concluded the following transactions during the 2022

year of assessment:

Due to heavy rains and flooding during January 2022, part of Kanye's fence around his property was

destroyed. He was underinsured and the full damage was not covered. He also did not have the cash on

hand to repair the fence. Due to the urgency of the matter, Kanye decided to sell some of his cattle to

cover the repair of the fence. In order to obtain the best price, Kanye took 10 cattle to the local stud fair,

to show the quality of his herd of cattle to the attending farming community. He placed an advertisement

in the local paper, as well as the nationally published Farmer's Weekly. On 15 February 2022 he sold 20

cattle at N$8 000 each to a neighbouring cattle farmer.

REQUIRED QUESTION 1:

MARKS

Discuss with reference to case law whether the sale of the cattle was capital or revenue in the

hands of Kanye Kim in terms of the Gross Income definition.

15

QUESTION 2

(25 Marks)

Mr Thomas Gold, trading as "Gold Ideas" sells and repairs jewellery in the local mall and is a registered

Value-added Tax ("VAT") vendor. The following receipts, accruals and expenditure relates to his two -

month VAT period ending 30 November 2021. Gold Ideas only makes taxable supplies. All amounts are

inclusive of VAT, unless stated otherwise.

Receipts and accruals:

Sales

Repairs

Interest

Indemnity award (note 1)

207 000

29 900

5 175

51 750

Expenditure:

Bad debts (note 2)

13 225

1

|

3 Page 3 |

▲back to top |

Bank charges

Depreciation (note 3)

Insurance premiums (note 4)

Fuel

Printing and stationery

Purchases (note 5)

Salaries and wages

Rentals (note 6)

920

19 145

3 450

2 990

1 564

160 425

41 400

13 294

Notes

1. The indemnity award of N$51 750 was received from Mr Gold's insurer for two expensive

watches that were stolen from his shop in August 2021.

2. Bad debts of N$13 225 written off by Gold Ideas, comprise of the following:

a. N$10 350 owing by one of his long-outstanding customers from a credit sale. The

customer has since emigrated and Mr Gold is unable to trace the customer.

b. N$2 875 was lent to an employee, who has since left town without repaying the loan.

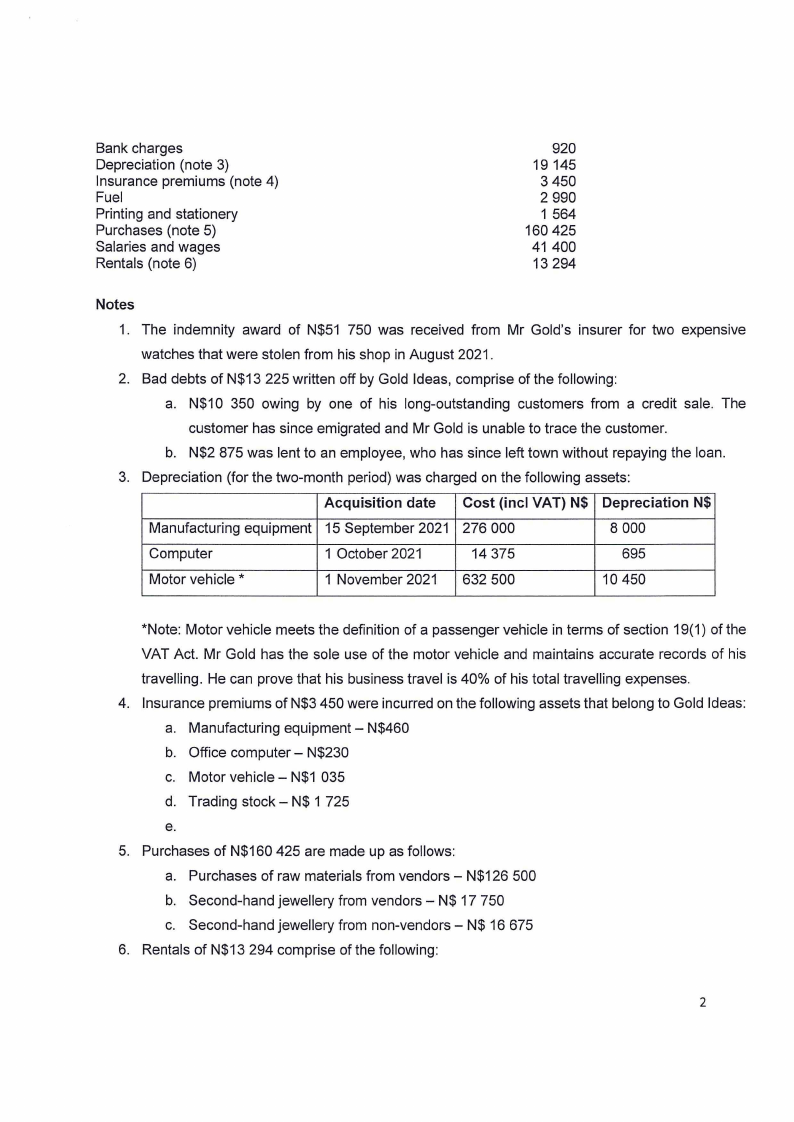

3. Depreciation (for the two-month period) was charged on the following assets:

Acquisition date Cost (incl VAT) N$ Depreciation N$

Manufacturing equipment 15 September 2021 276 000

8 000

Computer

1 October 2021

14 375

695

Motor vehicle *

1 November 2021 632 500

10 450

*Note: Motor vehicle meets the definition of a passenger vehicle in terms of section 19(1) of the

VAT Act. Mr Gold has the sole use of the motor vehicle and maintains accurate records of his

travelling. He can prove that his business travel is 40% of his total travelling expenses.

4. Insurance premiums of N$3 450 were incurred on the following assets that belong to Gold Ideas:

a. Manufacturing equipment - N$460

b. Office computer - N$230

c. Motor vehicle - N$1 035

d. Trading stock - N$ 1 725

e.

5. Purchases of N$160 425 are made up as follows:

a. Purchases of raw materials from vendors - N$126 500

b. Second-hand jewellery from vendors - N$ 17 750

c. Second-hand jewellery from non-vendors - N$ 16 675

6. Rentals of N$13 294 comprise of the following:

2

|

4 Page 4 |

▲back to top |

a. Shop premises - N$ 10 925

b. Cash register - N$ 1 495

c. Tea urn - N$ 874 (located in the shop for himself and employees to make tea)

REQUIRED QUESTION 2:

Determine the Value-added tax payable or refundable of Gold Ideas for the

two-month period ending 30 November 2021. Where no VAT is applicable,

state the reasons thereof.

MARKS

25

QUESTION 3

(30 Marks)

Fitness-2-Go (Pty) Ltd ('Fitness-2-Go') is a local manufacturer and supplier of gym and fitness

equipment. The company's year-end is 31 December. Fitness-2-Go is not an approved

manufacturer.

Fitness-2-Go has started its operations in January 2012 and has since inception grown

considerably.

The following relates to the current year of assessment:

1. The company made sales of N$13,800,000 and total purchases of NS$9,800,000.

2. The closing inventory amounted to NS$350,000 and the opening inventory N$100,000.

3. Running operating expenditure in the production of income was NS$3,080,000 of which

N$2,000,000 related to salaries for the manufacturing team as well as support staff and

management of the company.

4. Fitness-2-Go has leased two properties, one which is used for its manufacturing activities

in Walvis Bay and the other for its head office in Windhoek. During the current year of

assessment Fitness-2-Go has built its own offices in the Central Business District (CBD)

of Windhoek. The date of completion of the building was 31 July 2021 costing Fitness-2-

Go N$3,300,000. Fitness-2-Go was only able to move into the building on 01 September

2021. The monthly lease rental of its prior head office was NS$16,500. Assume that the

prior rental contract ended 31 August 2021.

5. The manufacturing building was leased as from 01 July 2012. The lease term is 20 years.

as part of the lease agreement, a lease premium of N$20,000 was payable upon inception

of the lease as well as monthly rentals of N$15,000. The lease contract also stipulated

that the lessee needs to make improvements to the value of N$750,000. The actual

improvements had a cost of only N$550,000 which was completed 02 January 2014.

3

|

5 Page 5 |

▲back to top |

6. As the manufacturing site is outside of Windhoek, Fitness-2-Go provides temporary

housing for management who need to do periodic site visits to the manufacturing site.

Thus, Fitness-2-Go has as from June 2012 also constructed housing for the management

of the company close to the manufacturing site. The ownership of the properties all

belongs to Fitness-2-Go and the total cost of construction of three houses was

N$1,350,000 in total.

7. As Fitness-2-Go manufactures gym and fitness equipment, they had acquired as part of

their business plan a patent to fully automatize (make fully automatic) the production of

the equipment. The patent cost Fitness-2-Go N$680,000 acquired from an American

software developer. The expected useful life of the patent at the date of acquisition of 31

March 2019 was 35 years. Another patent already acquired in August of 2012 was

renewed at the cost of NS150,000 on 15 September 2021.

8. During the year Fitness-2-Go had created a provision for bad debts of N$120,000 (During

2020, N$80,000) based on the historic experience of defaulting debtors. Of the debtors,

N$100,000 went bad in the current year of assessment.

9. Fitness-2-Go took out a 'Key-man Policy' on Sven Goethe, the chief operations officer, a

resident of Germany on 1 February 2021, paying a monthly premium of N$4,500.

10. As part of their business activities, Fitness-2-Go had the following asset transactions:

a) Manufacturing machinery acquired in March 2017 at a cost of N$1,200,000

b) Motor Vehicle no. 1 was acquired in April 2017 at a cost of N$350,000.

• Motor vehicle no. 1 was sold during the current year at a selling price of

N$100,000.

c) Motor Vehicle no. 2 was acquired on 01 July 2020 at a cost of N$450,000.

• During the current year of assessment, the motor vehicle no. 2 was taken out

of use to donate it to a former employee of the company as a gift for his long

service.

• The market value at the date of donation was N$200,000.

d) Motor Vehicle no. 3 was acquired in April 2021 at a cost of N$550,000.

e) Furniture and Fittings acquired in August of 2020 at a cost of N$60,000.

NOTE: IGNORE VAT

4

|

6 Page 6 |

▲back to top |

REQUIRED QUESTION 3:

Calculate the taxable income of Fitness-2-Go (Pty) Ltd for the 2021 year of

assessment. Give reasons where applicable, including where no adjustment is

required.

MARKS

30

QUESTION 4

(30 Marks)

Veronica, aged 40, with no dependants, is about get a revised employment contract and has

approached you to clarify some of the tax aspects of the various options she is considering.

She has been offered a package equivalent to a cost to her employer of N$400 000 per annum.

The following are included in the total cost to company package offered to her:

a) A cash salary of N$400 000 per annum.

b) Membership of a non-contributory provident fund. The employer will contribute N$40

000 per annum to the fund, and her cash salary will be reduced accordingly.

c) Veronica receives an interest free home loan of N$200 000 at an interest rate of 7%

from her employer in terms of an approved housing scheme. Assume the official interest

rate is 12%.

d) She receives the use of a company car. The car will have a cost-equal to the retail

market value (including VAT) - of no greater than 40% of gross annual salary.

Veronica's cash salary will be reduced by the cost of leasing the car, which is expected

to be N$4 000 per month, and all running expenses, which are expected to be N$1 500

(excluding VAT) per month.

e) Free meals in a staff canteen. Veronica's salary will be reduced by N$200 per month.

E{:),The acquisition of a flat currently owned by the company. The employer (the company)

· owns a number of flats. The employer will sell a flat (with a market value of N$490 000)

to Veronica for N$200 000. Her salary will be reduced by N$4 000 per month, i.e.,

equivalent to the rental cost of a similar flat.

5

|

7 Page 7 |

▲back to top |

REQUIRED QUESTION 4:

1.Discuss the normal tax aspects of each of the items listed for the 2022

year of assessment.

2.Calculate Veronica's normal tax liability for the 2022 year of assessment

assuming she accepts the offer.

MARKS

10

20

6

|

8 Page 8 |

▲back to top |

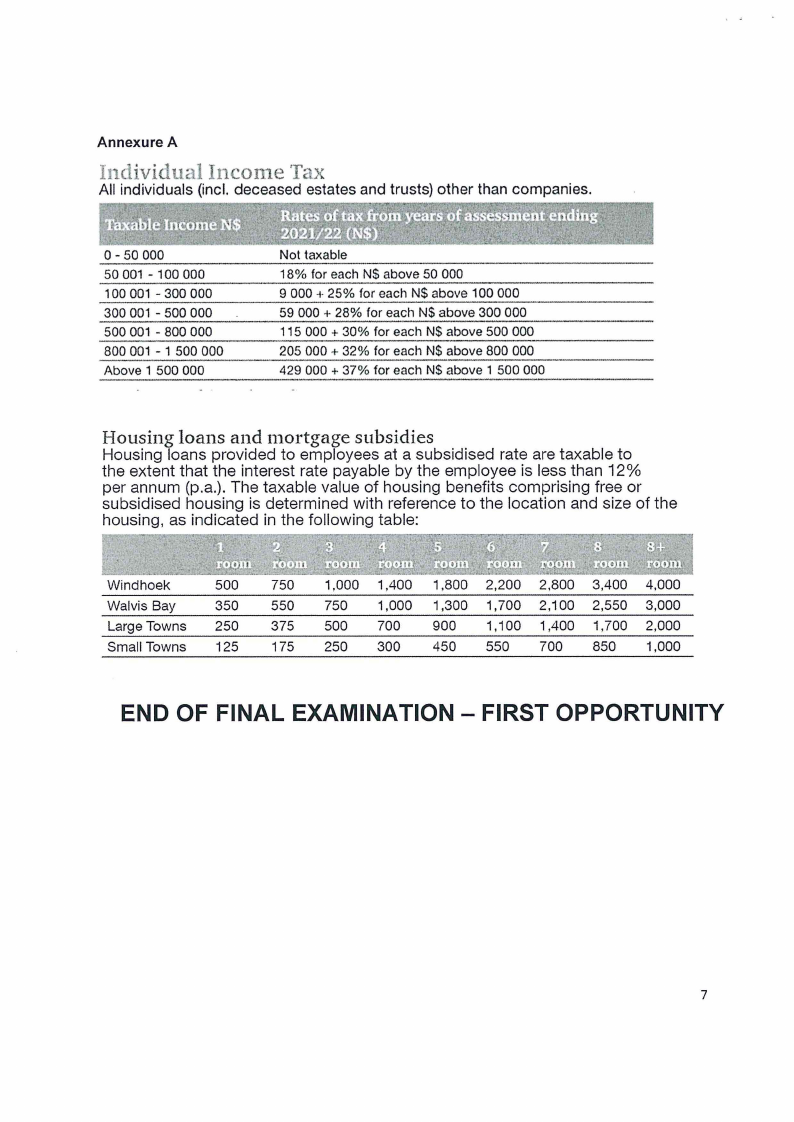

AnnexureA

Individu·· 1 Inco1ne T, x

All individuals (incl. deceased estates and trusts) other than companies.

0 - 50 000

50 001 - 100 000

100 001 - 300 000

300 001 - 500 000

500 001 - 800 000

800 001 - 1 500 000

Above 1 500 000

Not taxable

18% for each NS above 50 000

9 000 + 25% for eacl1 N$ above 100 000

59 000 + 28% for eact1 N$ above 300 000

115 000 + 30% for each N$ above 500 000

205 000 + 32% for each N$ above 800 000

429 000 + 37% for each NS above 1 500 000

Housing loans and 111ortgage subsidies

Housing loans provided to employees at a subsidised rate are taxable to

the extent that the interest rate payable by the employee is less than 12%

per annum (p.a.). The taxable value of housing benefits comprising free or

subsidised housing is determined with reference to the location and size of the

housing, as indicated in the following table:

Windhoek

500

750

1,000 1,400 1,800 2,200 2,800 3,400 4,000

Walvis Bay

350

550

750 1,000 1,300 1,700 2,100 2,550 3,000

Large Towns

250

375

500 700

900

1,100 1,400 1,700 2,000

Small Towns

125

175

250 300

450

550

700

850

1,000

END OF FINAL EXAMINATION - FIRST OPPORTUNITY

7