|

GTA711S-TAXATION 310-2ND OPP JULY 2024 |

|

1 Page 1 |

▲back to top |

nAm I BIA un IVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES& EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATION CODE: 07BAOC

LEVEL: 7

COURSE CODE: GTA711S

COURSE NAME: TAXATION 310

SESSION: JULY 2024

PAPER: THEORY& APPLICATION

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Mrs. Y van Wyk, Mr. T Elago & Mrs G Uises

MODERATOR: Ms. F Haimbala

INSTRUCTIONS

1. This question paper is made up of FOUR (4) questions.

2. Answer ALL the questions and in blue or black ink.

3. Start each question on a new page in your answer booklet.

4. Draw a line through all unused spaces in your answer booklet.

5. The names of people and businesses used throughout this examination paper do not

reflect reality and may be purely coincidental.

6. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

THIS QUESTION PAPER CONSISTS OF 7 PAGES (excluding this front page)

|

2 Page 2 |

▲back to top |

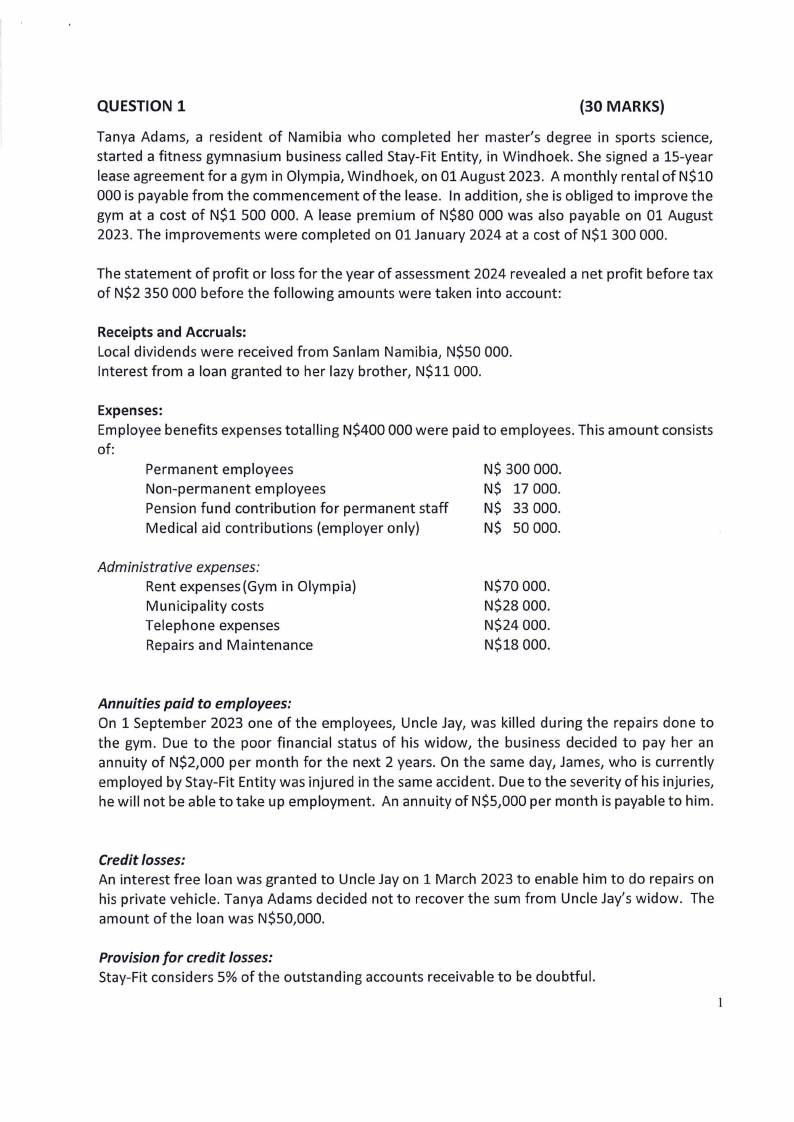

QUESTION 1

(30 MARKS)

Tanya Adams, a resident of Namibia who completed her master's degree in sports science,

started a fitness gymnasium business called Stay-Fit Entity, in Windhoek. She signed a 15-year

lease agreement for a gym in Olympia, Windhoek, on 01 August 2023. A monthly rental of N$10

000 is payable from the commencement of the lease. In addition, she is obliged to improve the

gym at a cost of N$1 500 000. A lease premium of N$80 000 was also payable on 01 August

2023. The improvements were completed on 01 January 2024 at a cost of N$1300 000.

The statement of profit or loss for the year of assessment 2024 revealed a net profit before tax

of N$2 350 000 before the following amounts were taken into account:

Receipts and Accruals:

Local dividends were received from Sanlam Namibia, N$50 000.

Interest from a loan granted to her lazy brother, N$11 000.

Expenses:

Employee benefits expenses totalling N$400 000 were paid to employees. This amount consists

of:

Permanent employees

N$ 300 000.

Non-permanent employees

N$ 17 000.

Pension fund contribution for permanent staff

N$ 33 000.

Medical aid contributions (employer only)

N$ 50 000.

Administrative expenses:

Rent expenses (Gym in Olympia)

Municipality costs

Telephone expenses

Repairs and Maintenance

N$70 000.

N$28 000.

N$24 000.

N$18 000.

Annuities paid to employees:

On 1 September 2023 one of the employees, Uncle Jay, was killed during the repairs done to

the gym. Due to the poor financial status of his widow, the business decided to pay her an

annuity of N$2,000 per month for the next 2 years. On the same day, James, who is currently

employed by Stay-Fit Entity was injured in the same accident. Due to the severity of his injuries,

he will not be able to take up employment. An annuity of N$5,000 per month is payable to him.

Credit losses:

An interest free loan was granted to Uncle Jay on 1 March 2023 to enable him to do repairs on

his private vehicle. Tanya Adams decided not to recover the sum from Uncle Jay's widow. The

amount of the loan was N$50,000.

Provision for credit losses:

Stay-Fit considers 5% of the outstanding accounts receivable to be doubtful.

|

3 Page 3 |

▲back to top |

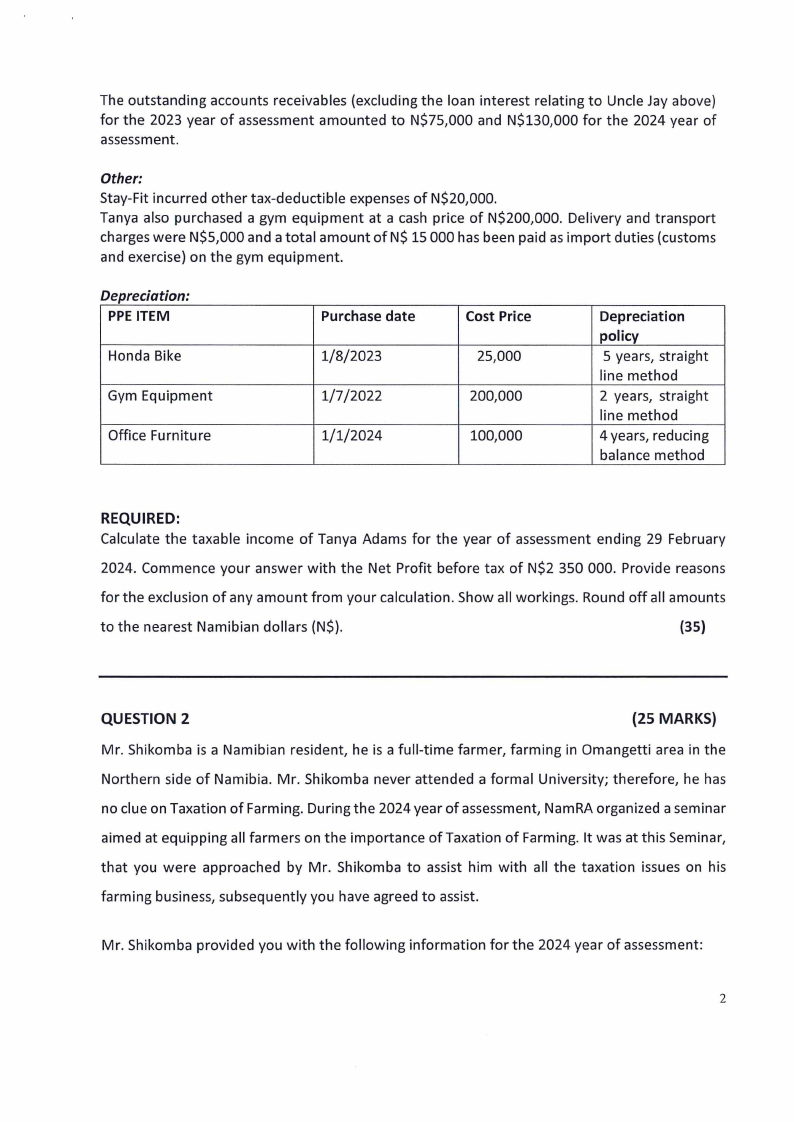

The outstanding accounts receivables (excluding the loan interest relating to Uncle Jay above)

for the 2023 year of assessment amounted to N$75,000 and N$130,000 for the 2024 year of

assessment.

Other:

Stay-Fit incurred other tax-deductible expenses of N$20,000.

Tanya also purchased a gym equipment at a cash price of N$200,000. Delivery and transport

charges were N$5,000 and a total amount of N$ 15 000 has been paid as import duties (customs

and exercise) on the gym equipment.

Depreciation:

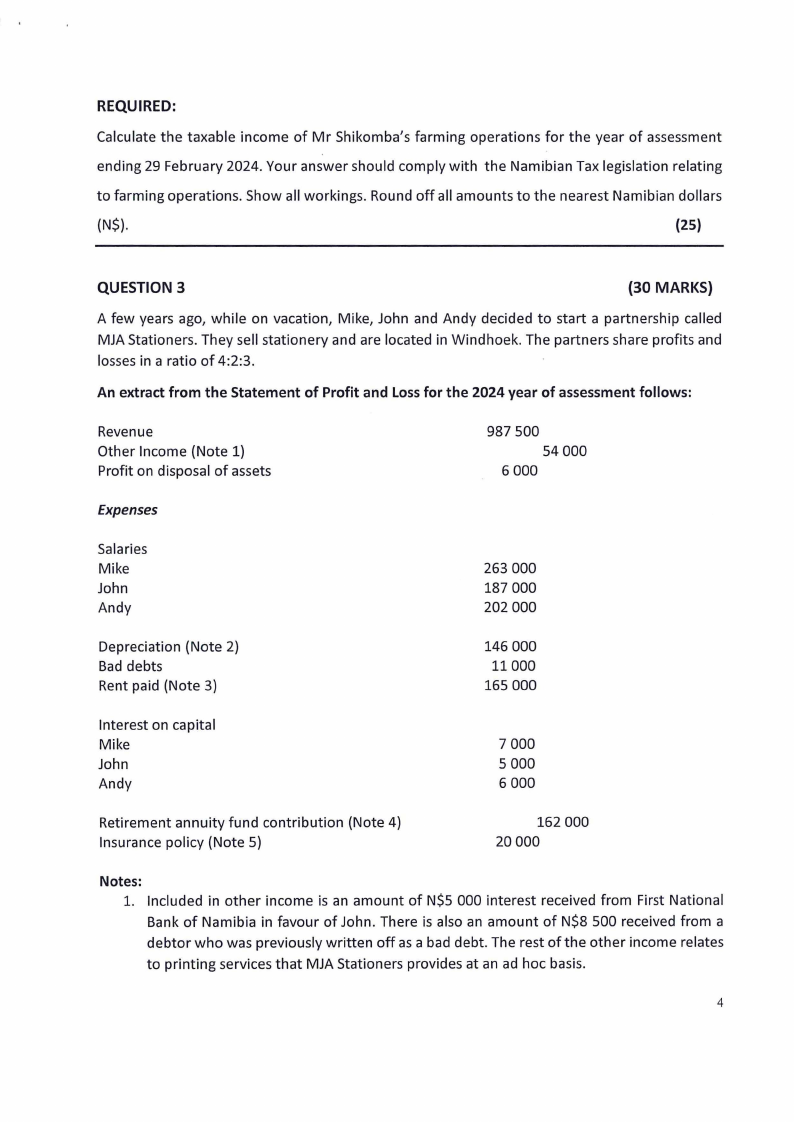

PPE ITEM

Honda Bike

Gym Equipment

Office Furniture

Purchase date

1/8/2023

1/7/2022

1/1/2024

Cost Price

25,000

200,000

100,000

Depreciation

policy

5 years, straight

line method

2 years, straight

line method

4 years, reducing

balance method

REQUIRED:

Calculate the taxable income of Tanya Adams for the year of assessment ending 29 February

2024. Commence your answer with the Net Profit before tax of N$2 350 000. Provide reasons

for the exclusion of any amount from your calculation. Show all workings. Round off all amounts

to the nearest Namibian dollars (N$).

(35)

QUESTION 2

(25 MARKS)

Mr. Shikomba is a Namibian resident, he is a full-time farmer, farming in Omangetti area in the

Northern side of Namibia. Mr. Shikomba never attended a formal University; therefore, he has

no clue on Taxation of Farming. During the 2024 year of assessment, Nam RA organized a seminar

aimed at equipping all farmers on the importance of Taxation of Farming. It was at this Seminar,

that you were approached by Mr. Shikomba to assist him with all the taxation issues on his

farming business, subsequently you have agreed to assist.

Mr. Shikomba provided you with the following information for the 2024 year of assessment:

2

|

4 Page 4 |

▲back to top |

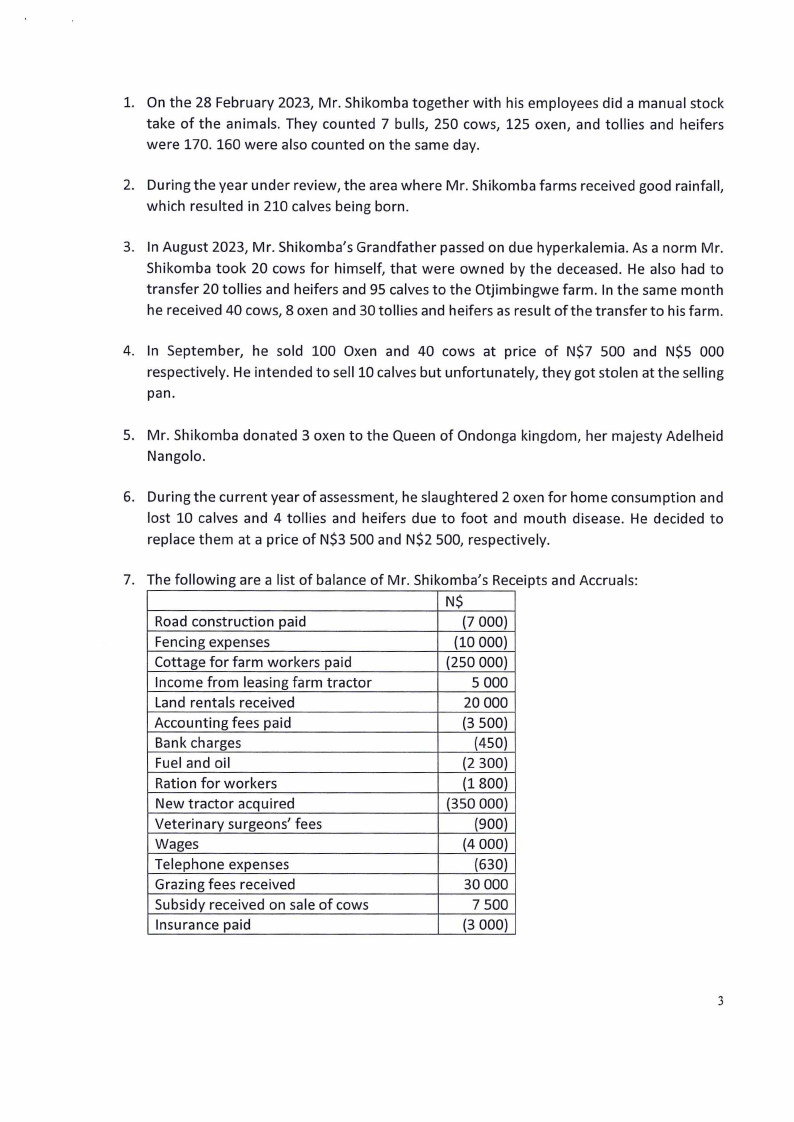

1. On the 28 February 2023, Mr. Shikomba together with his employees did a manual stock

take of the animals. They counted 7 bulls, 250 cows, 125 oxen, and tallies and heifers

were 170. 160 were also counted on the same day.

2. During the year under review, the area where Mr. Shikomba farms received good rainfall,

which resulted in 210 calves being born.

3. In August 2023, Mr. Shikomba's Grandfather passed on due hyperkalemia. As a norm Mr.

Shikomba took 20 cows for himself, that were owned by the deceased. He also had to

transfer 20 tallies and heifers and 95 calves to the Otjimbingwe farm. In the same month

he received 40 cows, 8 oxen and 30 to Ilies and heifers as result of the transfer to his farm.

4. In September, he sold 100 Oxen and 40 cows at price of N$7 500 and N$5 000

respectively. He intended to sell 10 calves but unfortunately, they got stolen at the selling

pan.

5. Mr. Shikomba donated 3 oxen to the Queen of Ondonga kingdom, her majesty Adelheid

Nangolo.

6. During the current year of assessment, he slaughtered 2 oxen for home consumption and

lost 10 calves and 4 tallies and heifers due to foot and mouth disease. He decided to

replace them at a price of N$3 500 and N$2 500, respectively.

7. The following are a list of balance of Mr. Shikomba's Receipts and Accruals:

Road construction paid

N$

(7 000)

Fencing expenses

(10 000)

Cottage for farm workers paid

(250 000)

Income from leasing farm tractor

5 000

Land rentals received

20 000

Accounting fees paid

(3 500)

Bank charges

(450)

Fuel and oil

(2 300)

Ration for workers

(1800)

New tractor acquired

(350 000)

Veterinary surgeons' fees

(900)

Wages

(4 000)

Telephone expenses

(630)

Grazing fees received

30 000

Subsidy received on sale of cows

7 500

Insurance paid

(3 000)

3

|

5 Page 5 |

▲back to top |

REQUIRED:

Calculate the taxable income of Mr Shikomba's farming operations for the year of assessment

ending 29 February 2024. Your answer should comply with the Namibian Tax legislation relating

to farming operations. Show all workings. Round off all amounts to the nearest Namibian dollars

(N$).

(25)

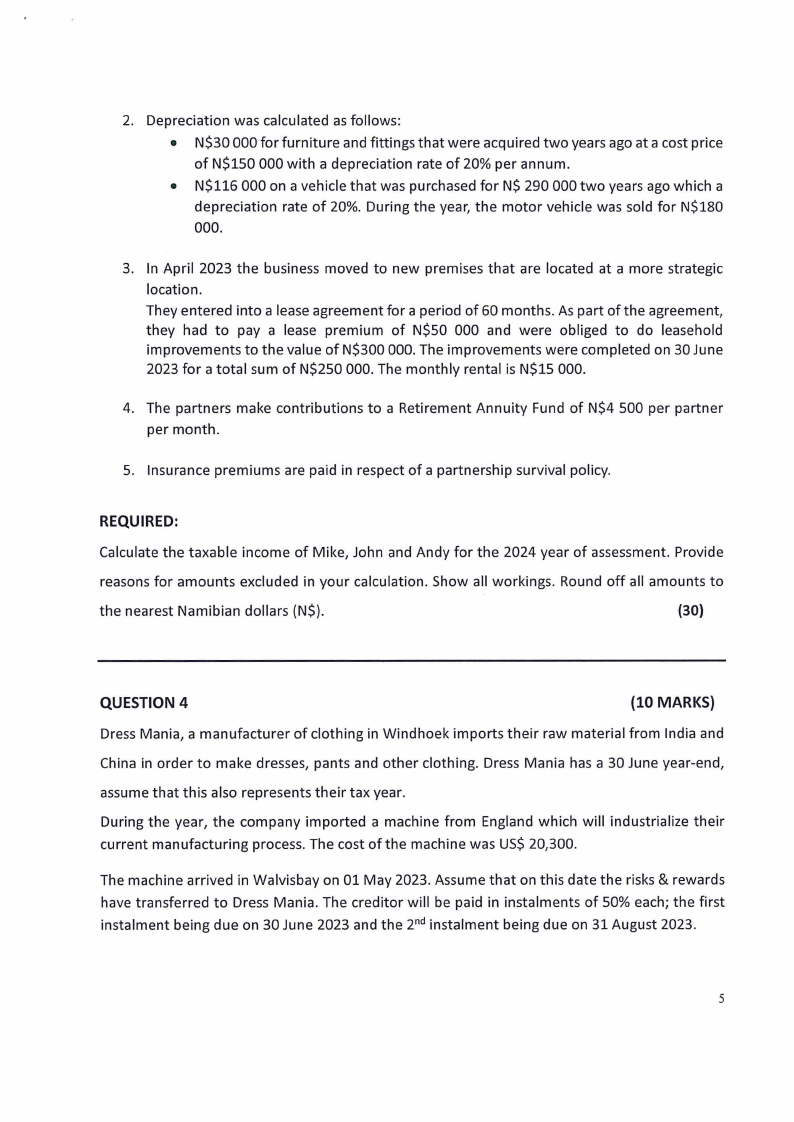

QUESTION 3

{30 MARKS)

A few years ago, while on vacation, Mike, John and Andy decided to start a partnership called

MJA Stationers. They sell stationery and are located in Windhoek. The partners share profits and

losses in a ratio of 4:2:3.

An extract from the Statement of Profit and Lossfor the 2024 year of assessment follows:

Revenue

Other Income (Note 1)

Profit on disposal of assets

987 500

54 000

6 000

Expenses

Salaries

Mike

John

Andy

263 000

187 000

202 000

Depreciation (Note 2)

Bad debts

Rent paid (Note 3)

146 000

11000

165 000

Interest on capital

Mike

John

Andy

7 000

5 000

6 000

Retirement annuity fund contribution (Note 4)

Insurance policy (Note 5)

162 000

20000

Notes:

1. Included in other income is an amount of N$5 000 interest received from First National

Bank of Namibia in favour of John. There is also an amount of N$8 500 received from a

debtor who was previously written off as a bad debt. The rest of the other income relates

to printing services that MJA Stationers provides at an ad hoc basis.

4

|

6 Page 6 |

▲back to top |

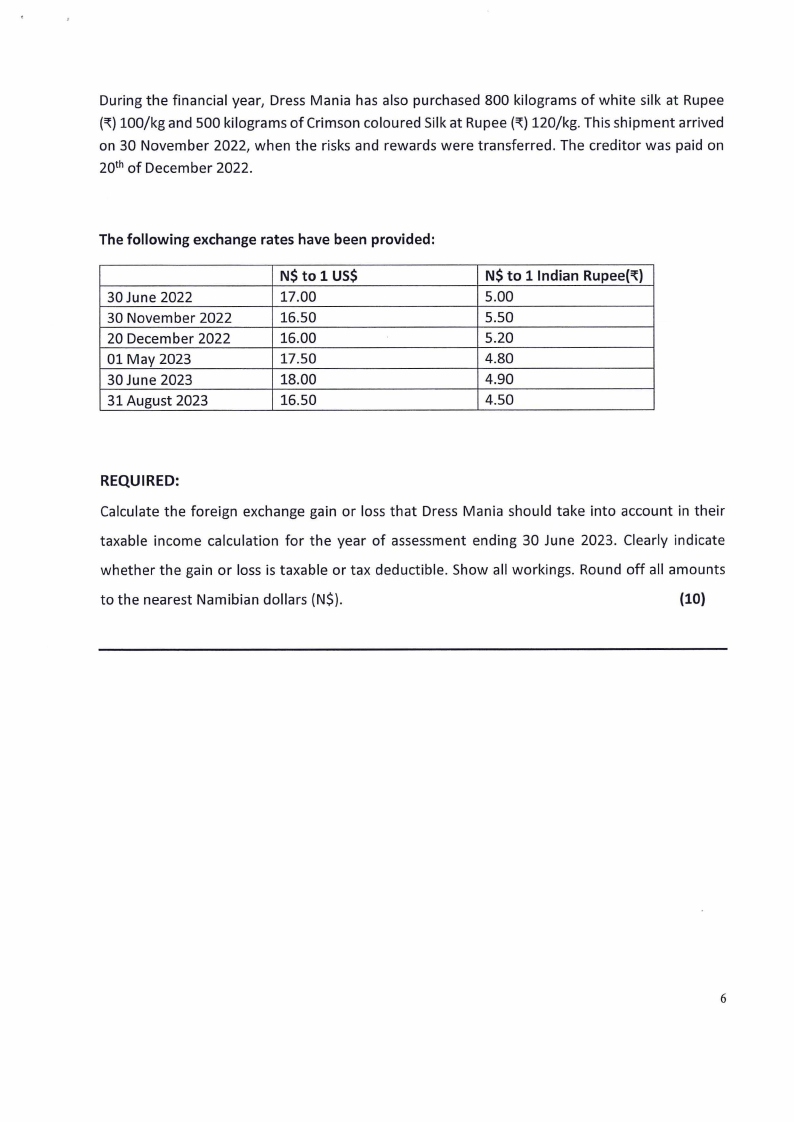

2. Depreciation was calculated as follows:

• N$30 000 for furniture and fittings that were acquired two years ago at a cost price

of N$150 000 with a depreciation rate of 20% per annum.

• N$116 000 on a vehicle that was purchased for N$ 290 000 two years ago which a

depreciation rate of 20%. During the year, the motor vehicle was sold for N$180

000.

3. In April 2023 the business moved to new premises that are located at a more strategic

location.

They entered into a lease agreement for a period of 60 months. As part of the agreement,

they had to pay a lease premium of N$50 000 and were obliged to do leasehold

improvements to the value of N$300 000. The improvements were completed on 30 June

2023 for a total sum of N$250 000. The monthly rental is N$15 000.

4. The partners make contributions to a Retirement Annuity Fund of N$4 500 per partner

per month.

5. Insurance premiums are paid in respect of a partnership survival policy.

REQUIRED:

Calculate the taxable income of Mike, John and Andy for the 2024 year of assessment. Provide

reasons for amounts excluded in your calculation. Show all workings. Round off all amounts to

the nearest Namibian dollars (N$).

(30)

QUESTION 4

(10 MARKS)

Dress Mania, a manufacturer of clothing in Windhoek imports their raw material from India and

China in order to make dresses, pants and other clothing. Dress Mania has a 30 June year-end,

assume that this also represents their tax year.

During the year, the company imported a machine from England which will industrialize their

current manufacturing process. The cost of the machine was US$ 20,300.

The machine arrived in Walvisbay on 01 May 2023. Assume that on this date the risks & rewards

have transferred to Dress Mania. The creditor will be paid in instalments of 50% each; the first

instalment being due on 30 June 2023 and the 2nd instalment being due on 31 August 2023.

5

|

7 Page 7 |

▲back to top |

During the financial year, Dress Mania has also purchased 800 kilograms of white silk at Rupee

(~) 100/kg and 500 kilograms of Crimson coloured Silk at Rupee (~) 120/kg. This shipment arrived

on 30 November 2022, when the risks and rewards were transferred. The creditor was paid on

20th of December 2022.

The following exchange rates have been provided:

30 June 2022

30 November 2022

20 December 2022

01 May 2023

30 June 2023

31 August 2023

N$ to 1 US$

17.00

16.50

16.00

17.50

18.00

16.50

N$ to 1 Indian Rupee(~)

5.00

5.50

5.20

4.80

4.90

4.50

REQUIRED:

Calculate the foreign exchange gain or loss that Dress Mania should take into account in their

taxable income calculation for the year of assessment ending 30 June 2023. Clearly indicate

whether the gain or loss is taxable or tax deductible. Show all workings. Round off all amounts

to the nearest Namibian dollars (N$}.

(10)

6

|

8 Page 8 |

▲back to top |

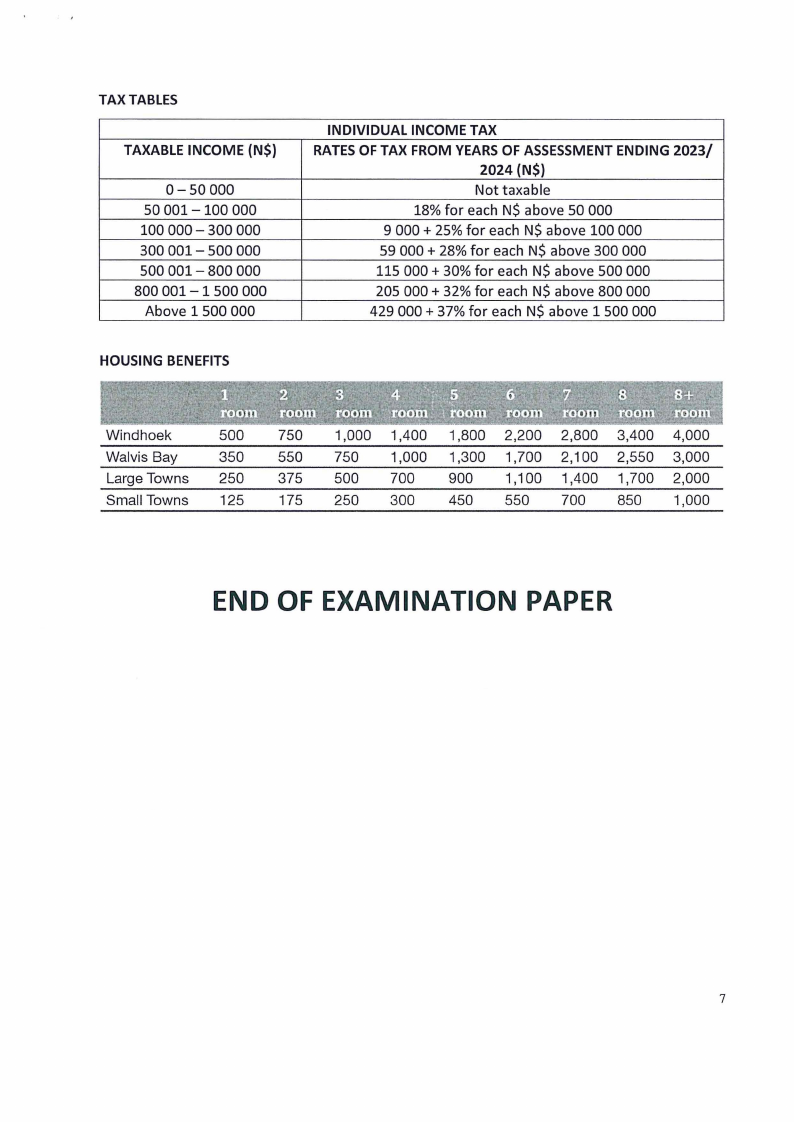

TAX TABLES

TAXABLE INCOME (N$)

0-50000

50 001- 100 000

100 000 - 300 000

300 001- 500 000

500 001- 800 000

800 001-1500000

Above 1 500 000

INDIVIDUAL INCOME TAX

RATES OF TAX FROM YEARS OF ASSESSMENT ENDING 2023/

2024 (N$)

Not taxable

18% for each N$ above 50 000

9 000 + 25% for each N$ above 100 000

59 000 + 28% for each N$ above 300 000

115 000 + 30% for each N$ above 500 000

205 000 + 32% for each N$ above 800 000

429 000 + 37% for each N$ above 1 500 000

HOUSING BENEFITS

Windhoek

500

750

1,000 1,400 1,800 2,200 2,800 3,400 4,000

Walvis Bay

350

550

750

1,000 1,300 1,700 2,100 2,550 3,000

Large Towns 250

375

500

700

900

1,100 1,400 1,700 2,000

Small Towns

125

175 250

300

450

550

700

850

1,000

END OF EXAMINATION PAPER

7