|

BAC621C-BUSINESS ACCOUNTING- 1ST OPP JUNE 2024 |

|

1 Page 1 |

▲back to top |

HP-GSB~

HAROLDPUPKEWITZ

GraduateSchoolof Business

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

HAROLDPUPKEWITZGRADUATESCHOOLOF BUSINESS

QUALIFICATION:DIPLOMA IN BUSINESSPROCESSMANAGEMENT

QUALIFICATIONCODE:06DBPM LEVEL:6

COURSECODE: BAC621C

COURSENAME: BUSINESSACCOUNTING2B

SESSION:JUNE 2024

PAPER:PAPER1

DURATION: 3 HOURS

MARKS: 100

EXAMINER

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Gerhardt Sheehama

MODERATOR Lameck Odada

INSTRUCTIONS

1. This question paper is made up of four (4) questions.

2. Answer ALLthe questions in blue or black ink only. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Round off only final answers to two (2) decimal places unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 8 PAGES(including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[20 MARKS]

Each of the following questions has only ONE correct answer. In your answer script, only write down the

numbers of the questions and next to each number the letter which, in your opinion, represents the correct

answer.

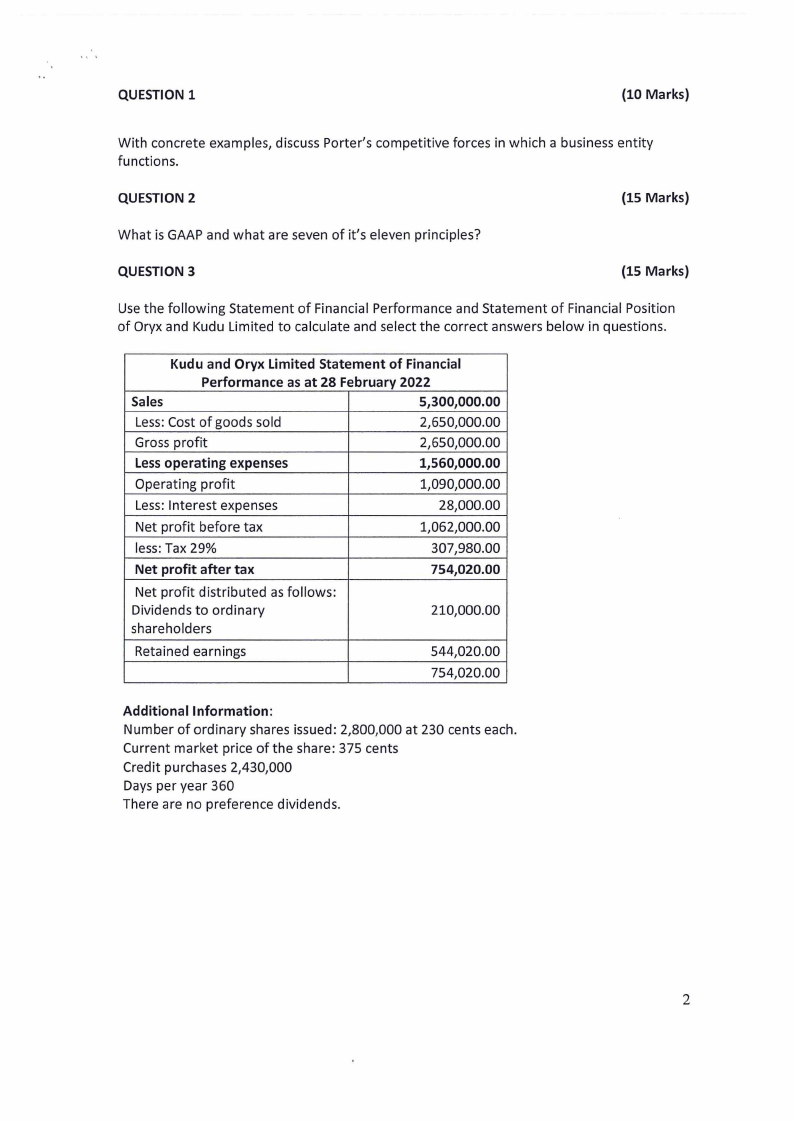

The following details refer to Questions 1.1 and 1.3:

NONA Company recorded the following direct material costs during last month:

Standard quantity material allowed

Actual quantity materials used

Materials quantity variance

Total actual direct materials cost

12 000 kg

15 000 kg

N$78 000

N$375 000

1.1 NONA's actual materials price was:

A.

N$31.25

B.

N$26.00

C.

N$32.15

D. N$25.00

1.2 NONA's standard materials price was:

A.

N$31.25

B.

N$26.00

C.

N$32.15

D. N$25.00

1.3 NONA's materials price variance was:

A.

N$15 000 adverse

B.

N$13 500 adv~rse

C.

N$15 000 favourable

D. N$13 500 favourable

1.4 The difference between the actual and standard labour rate multiplied by the

actual direct labour hours worked in production is called:

A.

Direct labour flexible budget variance

B.

Direct labour quantity variance

C.

Direct labour efficiency variance

D.

Direct labour rate variance

1.5 The following statement is NOT true with regard to standard costing:

A. The standard quantity of material represents the amount of material that

shouid have been used for the actual output.

B.

Material usage variance= (SQ-AQ) x AP

C.

If a lower quality raw material is purchased, it may result in an adverse material

usage variance.

D. Labour efficiency variance= (SH-AH) x SR

2

|

3 Page 3 |

▲back to top |

1.6 The operating leverage factor is calculated as follows:

A.

Contribution+ Fixed costs

B.

Contribution+ Variable cost

C.

Variable costs+ Fixed costs

D.

Contribution+ Net profit

1.7 The following is NOT an assumption of CVPanalysis:

A.

The variable cost per unit varies over the relevant range of activity.

B.

Selling price remains constant per unit irrespective ofthe sales volume.

C.

The total fixed cost per unit varies over the relevant range of activity.

D.

The total variable cost changes in direct proportion to changes in the level of

activity over the relevant range of activity.

1.8 An organisation manufactures and sells a single product which has a variable cost N$24 per unit and

total variable costs to sales ratio of 60%. Total monthly fixed costs are

N$720 000.

What is the monthly break-even point (in units)?

A.

18 000

B.

20 000

C. 30 000

D.

45 000

The following details refer to Questions 1.9 and 1.10:

A company manufactures a single product which it sells for N$15 per unit. The production has

total variable costs to sales ratio of 60%.

The company's weekly break-even point in sales is N$18 000.

1.9 What is the amount of fixed costs?

A.

N$7 200

B.

N$1800

C.

N$2 700

D.

N$ 4 500

1.10 What would be the profit in a week if 1500 units are sold?

A.

N$7 200

B.

N$1800

C.

N$2 700

D.

N$ 4 500

(2 marks each, 2 x 10 = 20 marks)

3

|

4 Page 4 |

▲back to top |

QUESTION 2

[28 MARKS]

A company manufactures and sells a finished product called Delta. You were recently appointed as the cost

accountant of this company and one of your duties is to assist in the preparation of the annual budget. The

following estimated figures have been gathered for 2023:

Projected sales:

Product

Units

Price per unit

Delta

6 000

N$70

Estimated inventories (units):

Product

Delta

1 January

2 000

31 December

2 500

Production schedule to manufacture one unit of Delta:

Raw material:

Mixture

4 kilograms @ N$8 per kilogram

The following is anticipated with respect to raw materials inventories:

1 January

31 December

3 200 kg

3 600 kg

Direct labour is estimated as follows:

Delta-maker

Hours per unit

2

Rate per hour

N$30

Overheads are absorbed at a rate of N$20 per direct labour hour.

REQUIRED:

Prepare the following budgets for 2017:

2.1 Sales budget (in N$)

(3)

2.2 Production budget (in units)

(4)

2.3 Raw material purchases budget for each raw material (in units and N$)

(7)

2.4 Direct labour budget (in hours and N$)

(3)

2.5 Variable overheads (in N$)

(3)

2.6 Discuss any four major benefits to be gained from budgeting

(8)

4

|

5 Page 5 |

▲back to top |

QUESTION3

[20 MARKS]

Angie Silva has recently opened The Sandal Shop in Rundu, a store that specializes in fashionable sandals. Angie

has just received a degree at NUSTand she is anxious to apply the principles she has learned. In time, she hopes

to open a chain of sandal shops. As a first step, she has prepared the following analysis for her new store:

Sales price per pair of sandals

Variable expenses per pair of sandals

Contribution margin per pair of sandals

Pairs of sandals sold

Total fixed expenses

400

160

240

300

60000

REQUIRED:

3.1

Calculate how many pairs of sandals must be sold each year to break even.

Also state what this represents in total dollar sales.

(6)

3.2

Angie has decided that she must earn at least N$31 200 the first year to justify her time

and effort.

Calculate how many pairs of sandals must be sold to reach this target profit.

(3)

3.3 Angie now has two salespersons working in the store - one full time and one part time.

It will cost her an additional fixed cost of N$75 000 per year to convert the part-time

position to a full-time position. Angie believes that the change will bring in an

additional N$120 000 in sales each year. Make a recommendation whether she should

convert the position.

(6)

3.4 Refer to the original data. During the first year, the store sold only 300 pairs of sandals and reported the

following operating results:

N$

Sales (300 pairs)

120 000

Less:variable expenses

(48 000)

Contribution margin

72 000

Less:Total fixed expenses

(60 000)

Net income

12 000

3.4.1 Calculate the store's degree of operating leverage.

(3)

3.4.2 Angie is confident that with a more intense sales effort and with a more creative

advertising program she can increase sales by 25% next year. Calculate the expected

percentage increase in net income by using the degree of operating leverage to

compute your answer.

(2)

5

|

6 Page 6 |

▲back to top |

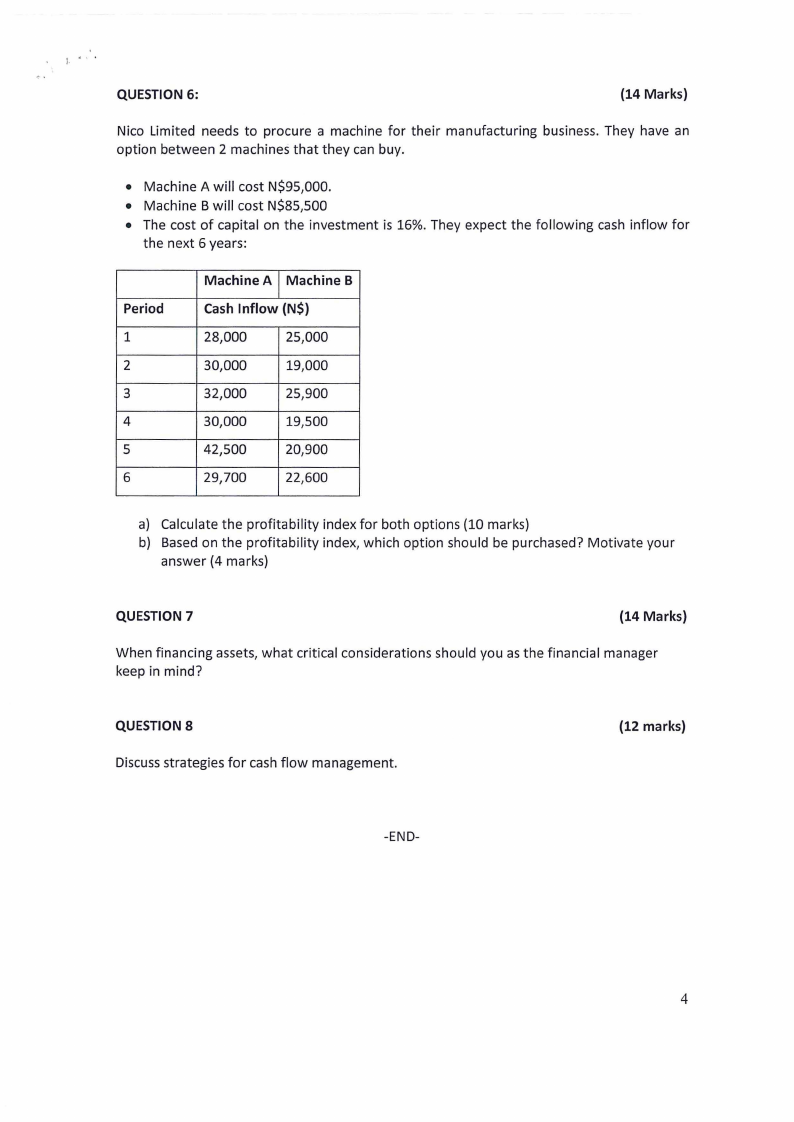

QUESTION 4

(20 MARKS)

Namtura Ltd (pty) manufactures printing paper in its Windhoek plant. The managing director has become aware

of the disadvantages of fixed budgets and asks you to prepare a flexible budget for the next accounting period.

The following for 2024 is available:

Activity level (machine hours)

Repairs and maintenance

Supplies

Water and electricity

Telephone

Rates

Energy

Salary

Total costs

Budget

N$

N$

16 000

20 000

80000

100 000

64000

80 000

152 000

160 000

48000

60000

90000

110000

60 000

70000

20 000

20 000

514 000

600 000

Actual

N$

18 000

96000

70 000

152 000

56 000

104 000

75 000

25 000

578 000

REQUIRED

Actual production required 18 machine hours during 2024. Prepare a performance report for 2024, clearly

indicate flexible budget and variances.

Note: Round off variable cost per unit to two decimal places, total costs and variances to the nearest N$.

QUESTION 5

[12 MARKS]

Haupindi CC is considering a project that would have a ten-year life and would require a N$1 000 000 investment

in equipment. It is estimated that the project will terminate at the end of ten years and that it will generate net

cashflow of N$300 000, annually. The company's required rate of return is 12%. It is further estimated that the

project will provide the following net income each year:

REQUIRED: Compute the project's net present value.

END OF EXAMINATION PAPER

6

|

7 Page 7 |

▲back to top |

APPENDIXTABLE1

Present Value Tables

Number

Interest Rate per Year

of Years 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15%

1 .990 .980 .971 .962 .952 .943 .935 .926 .917 .909 .901 .893 .885 .877 .870

2 .980 .961 .943 .925 .907 .890 .873 .857 .842 .826 .812 .797 .783 .769 .756

3 .971 .942 .915 .889 .864 .840 .816 .794 .772 .751 .731 .712 .693 .675 .658

4 .961 .924 .888 .855 .823 .792 .763 .735 .708 .683 .659 .636 .613 .592 .572

5 .951 .906 .863 .822 .784 .747 .713 .681 .650 .621 .593 .567 .543 .519 .497

6 .942 .888 .837 .790 .746 .705 .666 .630 .596 .564 .535 .507 .480 .456 .432

7 .933 .871 .813 .760 .711 .665 .623 .583 .547 .513 .482 .452 .425 .400 .376

8 .923 .853 .789 .731 .677 .627 .582 .540 .502 .467 .434 .404 .376 .351 .327

9 .914 .837 .766 .703 .645 .592 .544 .500 .460 .424 .391 .361 .333 .308 .284

10 .905 .820 .744 .676 .614 .558 .508 .463 .422 .386 .352 .322 .295 .270 .247

11 .896 .804 .722 .650 .585 .527 .475 .429 .388 .350 .317 .287 .261 .237 .215

12 .887 .788 .701 .625 .557 .497 .444 .397 .356 .319 .286 .257 .231 .208 .187

13 .879 .773 .681 .601 .530 .469 .415 .368 .326 .290 .258 .229 .204 .182 .163

14 .870 .758 .661 .577 .505 .442 .388 .340 .299 .263 .232 .205 .181 .160 .141

15 .861 .743 .642 .555 .481 .417 .362 .315 .275 .239 .209 .183 .160 .140 .123

16 .853 .728 .623 .534 .458 .394 .339 .292 .252 .218 .188 .163 .141 .123 .107

17 .844 .714 .605 .513 .436 .371 .317 .270 .231 .198 .170 .146 .125 .108 .093

18 .836 .700 .587 .494 .416 .350 .296 .250 · .212 .180 .153 .130 .111 .095 .081

19 .828 .686 .570 .475 .396 .331 .277 .232 .194 .164 .138 .116 .098 .083 .070

20 .820 .673 .554 .456 .377 .312 .258 .215 .178 .149 .124 .104 .087 .073 .061

Discountfactors:Presentvalueof $1 to be receivedaftert years= 1/(1 + r)1.

Number

Interest Rate per Year

of Years 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 26% 27% 28% 29% 30%

1 .862 .855 .847 .840 .833 .826 .820 .813 .806 .800 .794 .787 .781 .775 .769

2 .743 .731 .718 .706 .694 .683 .672 .661 .650 .640 .630 .620 .610 .601 .592

3 .641 .624 .609 .593 .579 .564 .551 .537 .524 .512 .500 .488 .477 .466 .455

4 .552 .534 .516 .499 .482 .467 .451 .437 .423 .410 .397 .384 .373 .361 .350

5 .476 .456 .437 .419 .402 .386 .370 .355 .341 .328 .315 .303 .291 .280 .269

6 .410 .390 .370 .352 .335 .319 .303 .289 .275 .262 .250 .238 .227 .217 .207

7 .354 .333 .314 .296 .279 .263 .249 .235 .222 .210 .198 .188 .178 .168 .159

8 .305 .285 .266 .249 .233 .218 .204 .191 .179 .168 .157 .148 .139 .130 .123

9 .263 .243 .225 .209 .194 .180 .167 .155 .144 .134 .125 .116 .108 .101 .094

10 .227 .208 .191 .176 .162 .149 .137 .126 .116 .107 .099 .092 .085 .078 .073

11 .195 .178 .162 .148 .135 .123 .112 .103 .094 .086 .079 .072 .066 .061 .056

12 .168 .152 .137 .124 .112 .102 .092 .083 .076 .069 .062 .057 .052 .047 .043

13 .145 .130 .116 .104 .093 .084 .075 .068 .061 .055 .050 .045 .040 .037 .033

14 .125 .111 .099 .088 .078 .069 .062 .055 .049 .044 .039 .035 .032 .028 .025

15 .108 .095 .084 .074 .065 .057 .051 .045 .040 .035 .031 .028 .025 .022 .020

16 .093 .081 .071 .062 .054 .047 .042 .036 .032 .028 .025 .022 .019 .017 .015

17 .080 .069 .060 .052 .045 .039 .034 .030 .026 .023 .020 .017 .015 .013 .012

18 .069 .059 .051 .044 .038 .032 .028 .024 .021 .018 .016 .014 .012 .010 .009

19 .060 .051 .043 .037 .031 .027 .023 .020 .017 .014 .012 .011 .009 .008 .007

20 .051 .043 .037 .031 .026 .022 .019 .016 .014 .012 .010 .008 .007 .006 .005

Note:Forexampleif, theinterestrateis 10%peryear,thepresenvtalueof $1receivedatyear5 is $.621.

7