|

CMA512S- COST AND MANAGEMENT ACCOUNTING 102- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

lUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATION CODE: 07BOAC LEVEL:5

COURSE CODE: CMA512S

SESSION: NOVEMBER 2023

COURSE NAME: COST& MANAGEMENT ACCOUNTING 102

PAPER: THEORYAND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS

Jessy Angula; Gerhardt Sheehama and Lameck Odada

MODERATOR Helmut Namwandi

INSTRUCTIONS

1. This question paper consists of FOUR (4) questions

2. Answer ALL questions in blue or black ink only. NO PENCIL.

3. Start each question on a new page, and number the answers correctly and clearly.

4. Write clearly, and neatly showing all your formulas and workings.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the examination. Thereafter, candidates must use their initiative to deal with

any perceived errors or ambiguities and any assumptions made by the candidate should

be clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS EXAMINATION QUESTION PAPER CONSISTS OF _7 _ PAGES (including this cover page)

|

2 Page 2 |

▲back to top |

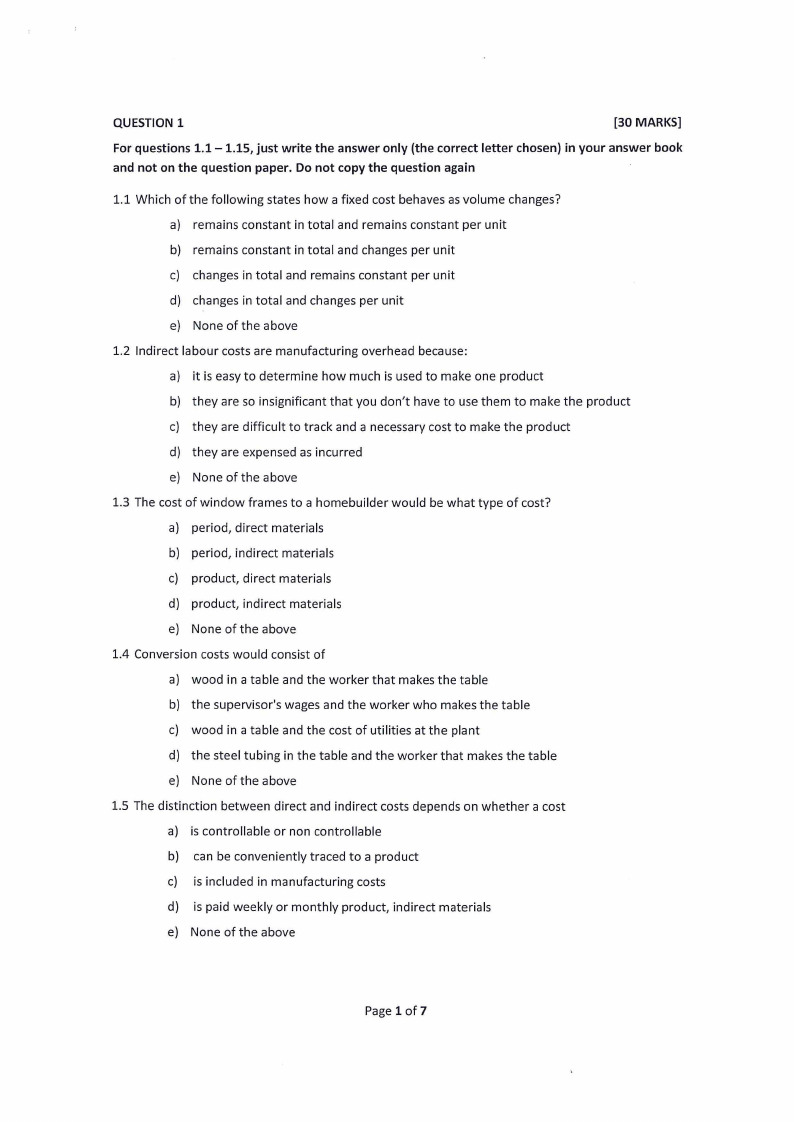

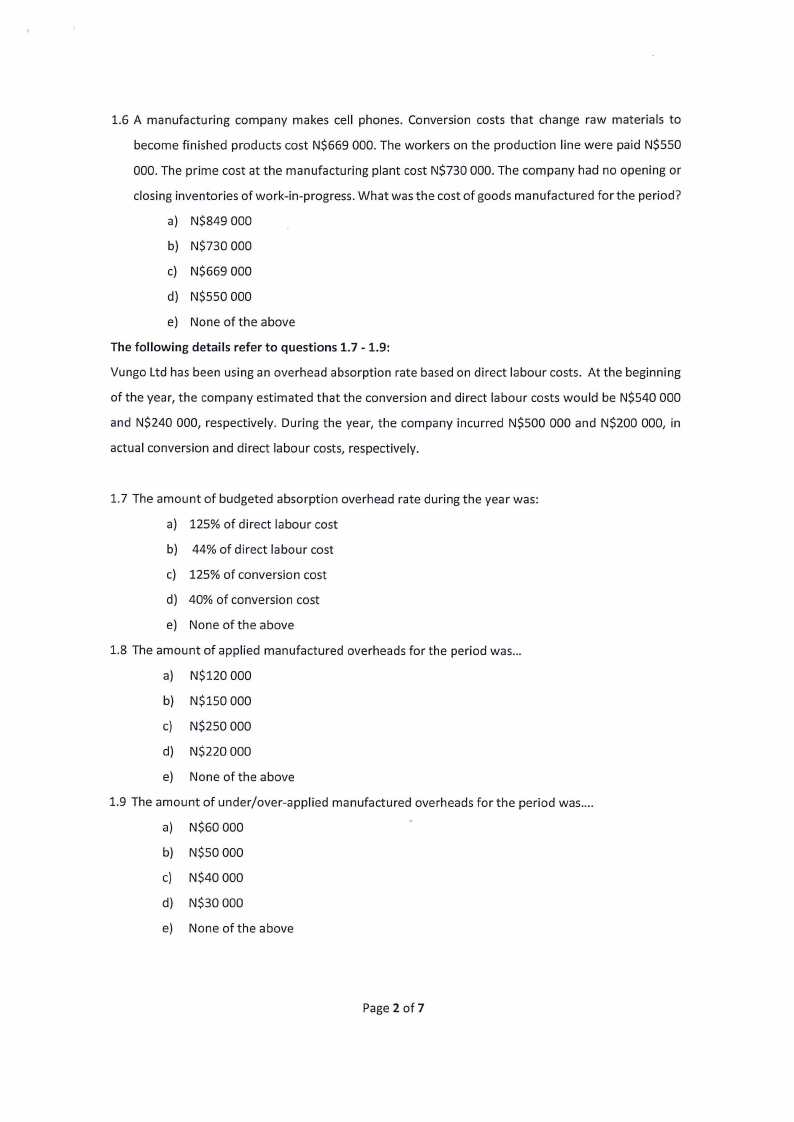

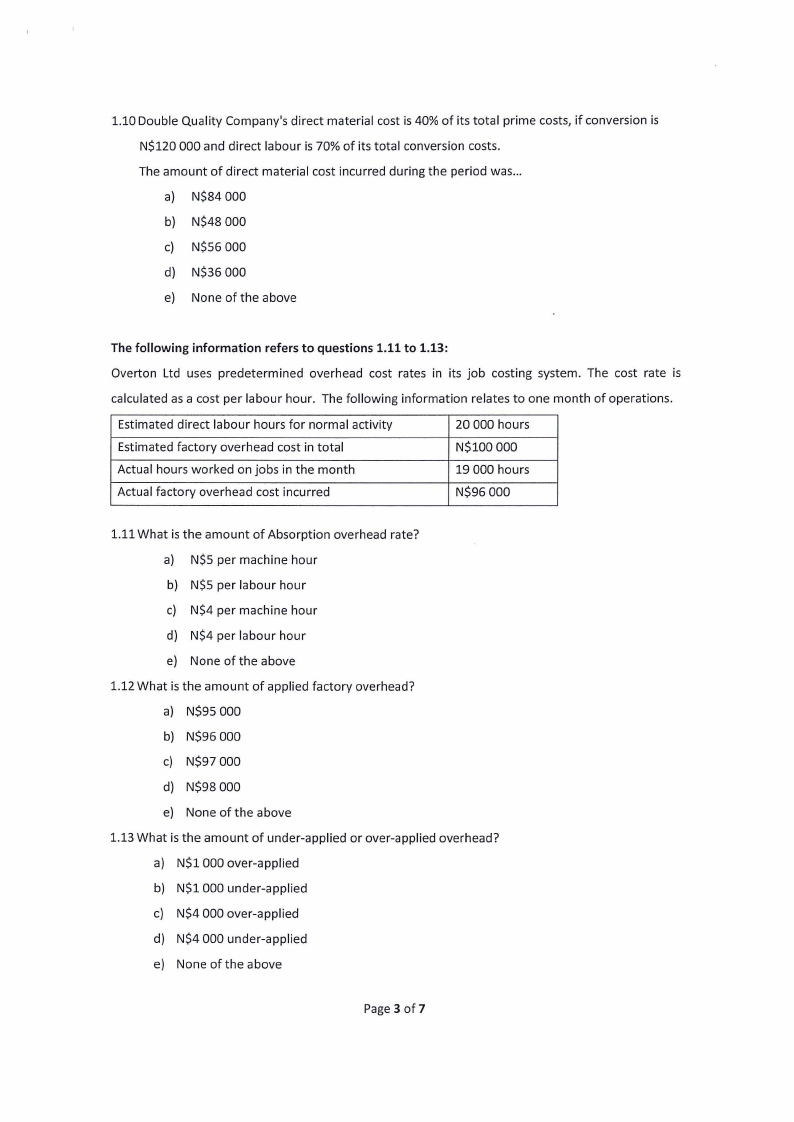

QUESTION 1

[30 MARKS]

For questions 1.1 - 1.15, just write the answer only (the correct letter chosen) in your answer book

and not on the question paper. Do not copy the question again

1.1 If actual output is lower than budgeted output, which of the following costs would you expect to

be lower than the original budget?

a) Total fixed costs

b) Total variable costs

c) Fixed costs per unit

d) Variable costs per unit

e) None of the above

1.2 Management accounting has the following functions:

a) Providing information to external parties

b) Estimating costs of products and services

c) Providing information for internal use

d) a and c

e) band c

1.3 In the code of ethics followed by management accountants, integrity is:

a) Being honest, standing for what is right

b) Being just and unbiased

c) Being courteous and decent

d) Not revealing or disclosing privileged or private information

e) Accepting the consequences of actions and decisions

1.4 In the code of ethics followed by management accountants, confidentiality is:

a) Being honest, standing for what is right

b) Being just and unbiased

c) Being courteous and decent

d) Not revealing or disclosing privileged or private information

e) Accepting the consequences of actions and decisions

1.5 In the code of ethics followed by management accountants, accountability is:

a) Being honest, standing for what is right

b) Being just and unbiased

c) Being courteous and decent

d) Not revealing or disclosing privileged or private information

e) Accepting the consequences of actions and decisions

Page 1 of 6

|

3 Page 3 |

▲back to top |

1.6 Fixed cost per unit:

a) Increases as activity volume decreases

b) Remains constant with volume of activity

c) Increases as activity volume increases

d} Decreases as activity volume increases

e) band c

1.7 A cost that will change in the future due to a decision being made is known as:

a) An opportunity cost

b) A sunk cost

c) A changing cost

d) An incremental cost

e) A relevant cost

1.8 Conversion costs include:

a) Direct labour

b) Direct material

c) Direct material and manufacturing overheads

d) Direct labour and direct materials

e) Direct labour and manufacturing overheads

1.9 Cost unaffected by a choice between alternatives and have been included in the past is:

a) A sunk cost

b) A period cost

c) A product cost

d) A direct cost

e) An indirect cost

1.10 Variable cost per unit:

a) Increases as activity volume decreases

b) Remains constant with volume of activity

c) Decreases as activity volume increases

d} a and b

e) band c

1.11 A firm's water and electricity account would normally be classified into the following category:

a) Fixed cost

b) Variable cost

c) Stepped fixed cost

Page 2 of 6

|

4 Page 4 |

▲back to top |

d) Semi-variable/mixed cost

e) None of the above

1.12 The following statement is NOT true:

a) Selling expense is an example of a non-manufacturing cost.

b) Prime cost consists of direct material plus direct labour

c) If production increases, total fixed costs will remain constant but will decrease per unit.

d) If production increases, total fixed costs will remain constant but will increase per unit.

e) None of the above

Questions 1.13 and 1.14 are based on the following information:

Bushbuck Ltd supplied the following figures regarding the number of units produced during the past

six months together with the corresponding production cost:

Production units Production cost (N$)

2 000

64 500

1000

60000

3 000

68 000

2 000

65 000

4 000

72 000

5 000

75 000

1.13 According to the high-low method of separating fixed and variable costs, the variable cost

rate is:

a) N$1.75

b) N$4.75

c) N$2.75

d) N$3.75

e) None of the above

1.14 According to the high-low method of separating fixed and variable costs, the fixed cost is:

a) N$56 250

b) N$42 250

c) N$37 500

d) N$47 500

e) None of the above

1.15 A company absorbs overheads on machine hours which were budgeted to be 11 250 with

overheads of N$258 750. Actual results were 10 980 hours with overheads of N$254 692.

Overheads were:

a) Over-absorbed by N$2 152

b) Over-absorbed by N$4 058

c) Under-absorbed by N$4 058

Page 3 of 6

|

5 Page 5 |

▲back to top |

d) Under-absorbed by N$2 152

e) None of the above

QUESTION 2

(25 MARKS]

Plastic Packaging Limited manufactures and sells plastic containers used in the pharmaceutical

industry in Namibia. The factory where production takes place is comprised of two production

departments {Cutting and Shaping), and two service departments -(Service 1 and Service 2). The

information provided below has been extracted from the company's budget for the next financial year,

which ends on 31 March 2024:

Other Production Overheads

Factory rent

Factory building insurance

Plant and machinery insurance

Plant and machinery depreciation

Canteen subsidy

N$

5 250 000

700 000

390 000

585 000

1500 000

Allocated overhead cost

Cutting Department

Shaping Department

Service 1

Service 2

N$

140 000

160 000

35 000

28 000

The following information is also provided:

Floor area (m 2)

Value of Plant and Machinery (N$)

Number of requisitions

Maintenance hours

Number of employees

Machine hours

Labour hours

Production Departments

Cutting

Shaping

18 000

12 000

3 000 000

500 000

1000

500

2 700

2 000

34

60

12 000

2 200

9 000

15 000

Service Departments

Service 1 Service 2

3 000

2 000

250 000

150 000

300

4

2

Additional information:

• Secondary allocation should be done on the following bases:

Service 1 - number of requisitions

Service 2 - maintenance hours

• Calculation of the Predetermined/ Absorption rate should be done on the following bases:

Cutting department - machine hours

Shaping department - labour hours

Page 4 of 6

|

6 Page 6 |

▲back to top |

REQUIRED: (Hint: work with whole numbers for allocation and re-apportionment)

MARKS

Perform the primary overhead apportionment showing the allocation of each 15

a)

overhead item. Indicate the basis of apportionment for each overhead.

Using the step method, re-apportion the service department costs and calculate

10

b) the overhead absorption rate for each production department to two decimal

places.

QUESTION 3

[25 MARKS]

The timesheet of employee Stevens shows that he worked 44 hours during a 40- hour workweek.

The normal overtime remuneration (1½ x normal wage) is paid. His normal wage is N$6 per hour.

Medical aid and pension fund contributions (3% and 5% of normal wages respectively) are paid on an

equal basis by employer and employee. PAYE(12% of taxable income) is the only other deduction

being made.

REQUIRED: (Hint: work with whole numbers for all your calculations)

MARKS

a) Calculate the net earnings of employee Stevens for the week

8

Assuming that a year consists of 52 working weeks, that Stevens gets 3 weeks of holiday leave per

year, and that the enterprise is closed for eight (8) public holidays during the year. Normal idle time

is budgeted as 7½% and a holiday bonus equal to 3 weeks' wages is paid.

b) Determine the total annual labour cost to the nearest dollar

6

c) Calculate the annual productive labour hours to the nearest whole number

7

Define the Labour Recovery Rate and determine the labour tariff per hour for

4

d)

employee Stevens to the nearest dollar

Page 5 of 6

|

7 Page 7 |

▲back to top |

QUESTION 4

(20 MARKS]

The Patio is a manufacturer of garden furniture that has consistently used weighted average costing

(AVCO) in valuing inventory. The management of the Patio is now interested in knowing the effect of

using FIFO in valuing inventory instead of using AVCO. The following transactions for the Patio were

recorded for the period:

2 August Opening inventory

100 units @N$50.00 per unit

5 August Received

120 units @N$57.50 per unit

6 August Issued/sales

200 units

7 August Received

180 units @N$60.00 per unit

8 August Issued/sales

150 units

9 August Return to supplier units purchased on 7 August 20 units

REQUIRED:

MARKS

Prepare an inventory ledger card of the Patio for the month of August using

14

a) four columns showing the date, receiving, issuing, and balancing columns. Each

column contains quantity, unit price and the total amount

Calculate the gross profit of the Patio. Assume that the selling price is N$300

6

b)

per unit.

END OF EXAMINATION QUESTION PAPER

Page 6 of 6

|

8 Page 8 |

▲back to top |