|

PMV611S - PRINCIPLES AND METHODS OF VALUATION - 1ST OPP - JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAm I BlA un IVE RSITY

OF SCIEnCE Ano TECHn OLOGY

FACULTYOF ENGINEERINGAND THE BUILT ENVIRONMENT

DEPARTMENT OF LAND AND SPATIALSCIENCES

QUALIFICATION(S): BACHELOROF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION(S)CODE: 08BOPS

06DIPS

NQF LEVEL:6

COURSECODE: PMV611S

COURSENAME: PRINCIPLESAND METHODS OF

VALUATION

EXAMSSESSION:JUNE 2024

PAPER:

THEORY

DURATION: 3 HOURS

MARKS:

100

EXAMINER($)

FIRSTOPPORTUNITY EXAMINATION QUESTION PAPER

AMIN ISSA

MODERATOR: SAMUEL ATO K. HAYFORD

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. Please STARTEACHQUESTION ON A FRESHPAGE.

4. The question paper contains a total of 4 questions.

5. You must answer ALLQUESTIONS.

6. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLEMATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPERCONSISTSOF 8 PAGES(Including this front page)

|

2 Page 2 |

▲back to top |

Principles and Methods of Valuation

PMV611S

Question 1

a) For each of the following statements indicate whether it is true or false. Eachcorrect answer carries 1

(one) mark.

(25)

i) The Cost Approach method is heavily reliant on the current market conditions and demand for

similar properties.

ii) In the Comparable Sales Method, adjustments are made to the sale prices of comparable properties

to account for differences from the subject property.

iii) In the Comparable Sales Method, the term "comparable" refers to properties that are identical in

every aspect to the subject property.

iv) The Cost Approach method considers the reproduction cost of the property minus depreciation to

estimate its value.

v) The Income Capitalisation Method is primarily used for residential properties and not applicable to

commercial properties.

vi) The Cost Approach method typically produces the most accurate valuation for income-generating

properties.

vii) In the Income Capitalisation Method, the Net Operating Income (NOi) is divided by the

capitalisation rate to determine the property value.

viii) The Comparable Sales Method is less suitable for valuing unique properties or those with special

characteristics.

ix) A commercial property with a stable income stream may be better valued using the Cost Method,

which directly considers its earning potential.

x) In the Comparable Sales Method, adjustments are made to the sale prices of comparable properties

to make them more comparable to the subject property.

First Opportunity Examination Paper

Page 2 of 8

June 2024

|

3 Page 3 |

▲back to top |

Principles and Methods of Valuation

PMV611S

xi) The Income Capitalization Method ignores the property's operating expenses when calculating its

value.

xii) The Cost Approach method tends to be more accurate when valuing new construction properties

compared to older ones.

xiii) In the Comparable Sales Method, the sales price of a comparable property is adjusted downward if

it has features superior to the subject property.

xiv) The Income Capitalisation Method relies solely on the property's gross rental income to determine

its value.

xv) The profits method of valuation focuses on the income generated by the business operating within

the property, making it ideal for properties like restaurants or petrol stations.

xvi) The Discounted Cash Flow (DCF)methodology relies on the construction of an explicit cash flow

reflecting all real receipts and payments associated with property ownership as well as the

valuer's understanding of market perceptions of growth and risk.

xvii) If a building layout or style fails to meet market tastes or standards due to changes in design and

technological advances, the building suffers from economic obsolescence.

xviii) The difference between a building's economic life and its remaining economic life is the actual

age.

xix) If a comparable property sold for $400,000 but had a swimming pool, while the subject property

does not, a downward adjustment would be made to reflect the difference in value.

xx) The age of a property based on the amount of wear and tear it has sustained is referred to as the

effective age.

xxi) The Internal Rate of Return {IRR) is the actual return provided by an investment which equates the

present value of the future cash flow with the initial outlay.

First Opportunity Examination Paper

Page 3 of8

June 2024

|

4 Page 4 |

▲back to top |

Principles and Methods of Valuation

PMV611S

xxii) When the market is weak and few market transactions are available, the applicability of the sales

comparison approach may not be limited.

xxiii) If a property generates a net operating income of N$80,000 per year and the prevailing

capitalisation rate is 6%, the resulting value is approximately $1,333,333.

xxiv) If the total value using the income approach is N$1,000,000 and the Land value (using market

data) is N$200,000 then the building value is N$1,200,000

xxv) The residual method of valuation is used to find the value of special purpose properties and the

land on which they are built.

b) Multiple choice questions. Each answer carries 1 (one) mark.

(10)

i) Which formula is applicable in establishing the value of a property by the cost approach?

a) Cost of site+ cost of building - obsolescence - depreciation = value of the property

b) Cost of site+ cost of building+ obsolescence - depreciation= value of the property

c) Cost of materials+ cost of building - expenses = value of the property

d) Cost of money+ cost of building - obsolescence - depreciation = value of the property.

ii) Which method is best suited for the valuation of hotels, lodges and cinemas?

a) Cost approach

b) Accounts method

c) Residual method

d) Hospitality comparable method

iii) A property valuer is undertaking the valuation of NUSTin August 2018, which property type should

he/she considers in establishing the rate of land per square metre?

a) The NUSTland rates

b) The rate being applied on public universities in Windhoek

c) The rate being applied on properties within Windhoek West

d) All of the above.

First Opportunity Examination Paper

Page4of8

June 2024

|

5 Page 5 |

▲back to top |

Principles and Methods of Valuation

PMV611S

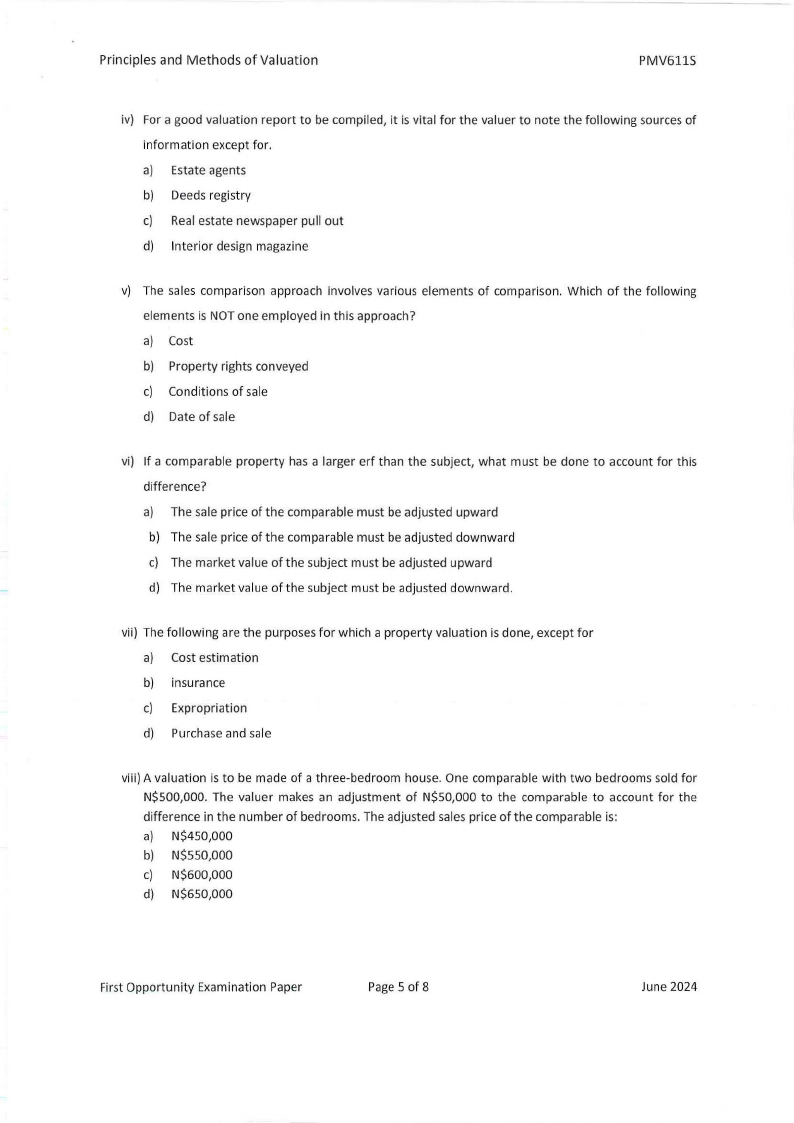

iv) For a good valuation report to be compiled, it is vital for the valuer to note the following sources of

information except for.

a) Estate agents

b) Deeds registry

c) Real estate newspaper pull out

d) Interior design magazine

v) The sales comparison approach involves various elements of comparison. Which of the following

elements is NOT one employed in this approach?

a) Cost

b) Property rights conveyed

c) Conditions of sale

d) Date of sale

vi) If a comparable property has a larger erf than the subject, what must be done to account for this

difference?

a) The sale price of the comparable must be adjusted upward

b) The sale price of the comparable must be adjusted downward

c) The market value of the subject must be adjusted upward

d) The market value of the subject must be adjusted downward.

vii) The following are the purposes for which a property valuation is done, except for

a) Cost estimation

b) insurance

c) Expropriation

d) Purchase and sale

viii) A valuation is to be made of a three-bedroom house. One comparable with two bedrooms sold for

N$500,000. The valuer makes an adjustment of N$50,000 to the comparable to account for the

difference in the number of bedrooms. The adjusted sales price of the comparable is:

a) N$450,000

b) N$SSO,000

c) N$600,000

d) N$650,000

First Opportunity Examination Paper

Page5 of 8

June 2024

|

6 Page 6 |

▲back to top |

Principles and Methods of Valuation

PMV611S

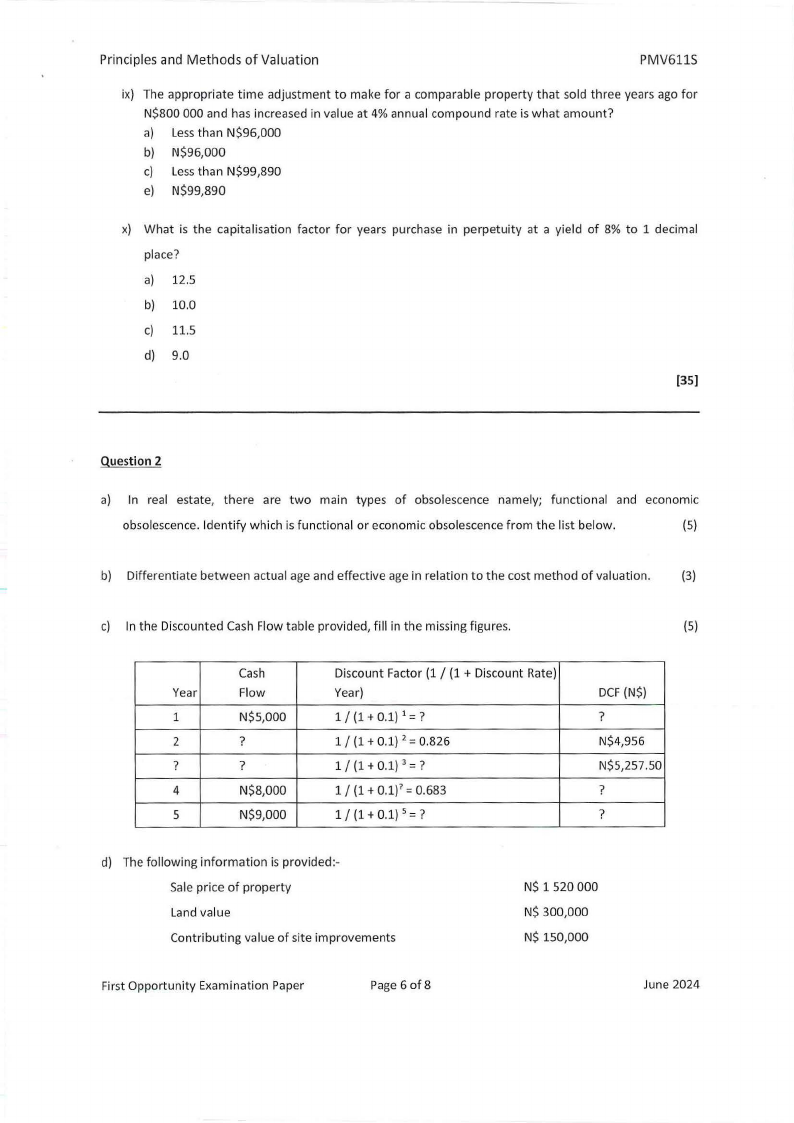

ix) The appropriate time adjustment to make for a comparable property that sold three years ago for

N$800 000 and has increased in value at 4% annual compound rate is what amount?

a) Lessthan N$96,000

b) N$96,000

c) Lessthan N$99,890

e) N$99,890

x) What is the capitalisation factor for years purchase in perpetuity at a yield of 8% to 1 decimal

place?

a) 12.5

b) 10.0

c) 11.5

d) 9.0

(35]

Question 2

a) In real estate, there are two main types of obsolescence namely; functional and economic

obsolescence. Identify which is functional or economic obsolescence from the list below.

(5)

b) Differentiate between actual age and effective age in relation to the cost method of valuation.

(3)

c) In the Discounted Cash Flow table provided, fill in the missing figures.

(5)

Year

1

2

?

4

5

Cash

Flow

N$5,000

?

?

N$8,000

N$9,000

Discount Factor (1 / (1 + Discount Rate)

Year)

1 / (1 + 0.1) 1 = ?

1 / (1 + 0.1) 2 = 0.826

1 / (1 + 0.1) 3 = ?

1 / (1 + 0.1)7 = 0.683

1 / (1 + 0.1) 5 =?

DCF(N$)

?

N$4,956

N$5,257.50

?

?

d) The following information is provided:-

Sale price of property

Land value

Contributing value of site improvements

N$ 1520 000

N$ 300,000

N$ 150,000

First Opportunity Examination Paper

Page6of8

June 2024

|

7 Page 7 |

▲back to top |

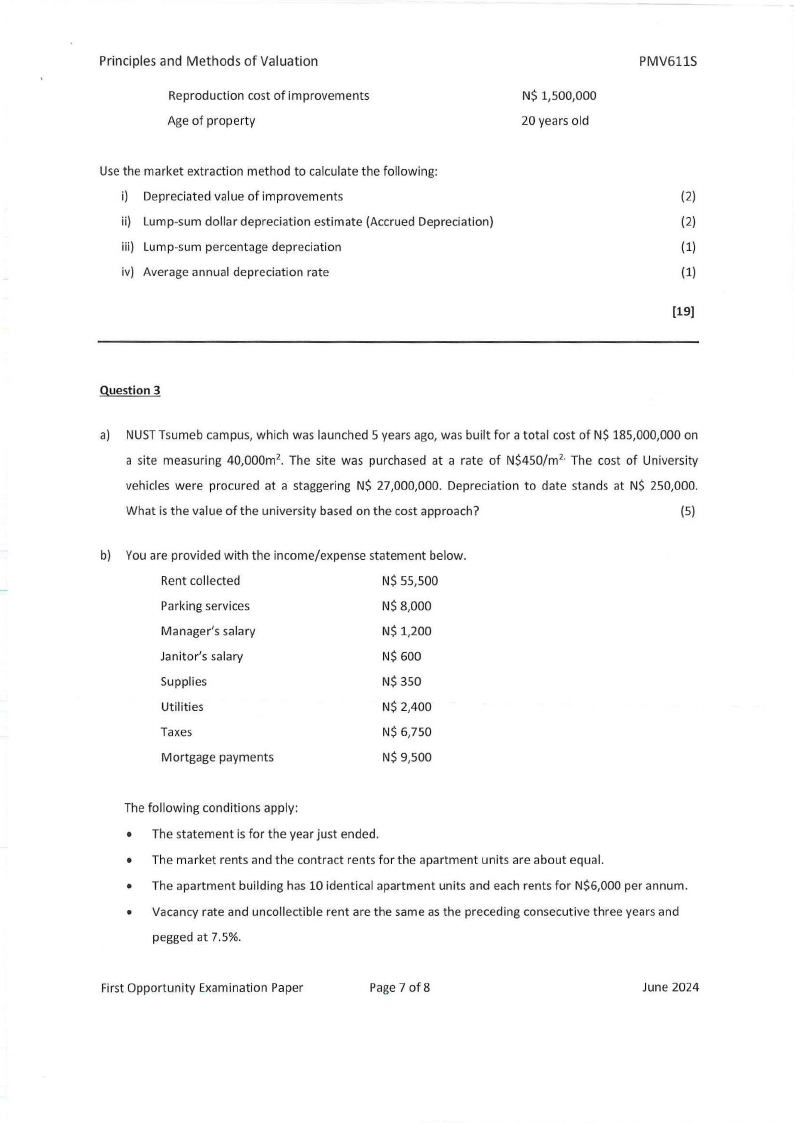

Principles and Methods of Valuation

Reproduction cost of improvements

Age of property

N$ 1,500,000

20 years old

Use the market extraction method to calculate the following:

i) Depreciated value of improvements

ii) Lump-sum dollar depreciation estimate (Accrued Depreciation)

iii) Lump-sum percentage depreciation

iv) Average annual depreciation rate

PMV611S

(2)

(2)

(1)

(1)

[19)

Question 3

a) NUSTTsumeb campus, which was launched 5 years ago, was built for a total cost of N$ 185,000,000 on

a site measuring 40,000m 2• The site was purchased at a rate of N$450/m 2· The cost of University

vehicles were procured at a staggering N$ 27,000,000. Depreciation to date stands at N$ 250,000.

What is the value of the university based on the cost approach?

(5)

b) You are provided with the income/expense statement below.

Rent collected

N$ 55,500

Parking services

N$ 8,000

Manager's salary

N$ 1,200

Janitor's salary

N$ 600

Supplies

N$ 350

Utilities

N$ 2,400

Taxes

N$ 6,750

Mortgage payments

N$ 9,500

The following conditions apply:

• The statement is for the year just ended.

• The market rents and the contract rents for the apartment units are about equal.

• The apartment building has 10 identical apartment units and each rents for N$6,000 per annum.

• Vacancy rate and uncollectible rent are the same as the preceding consecutive three years and

pegged at 7.5%.

First Opportunity Examination Paper

Page7of8

June 2024

|

8 Page 8 |

▲back to top |

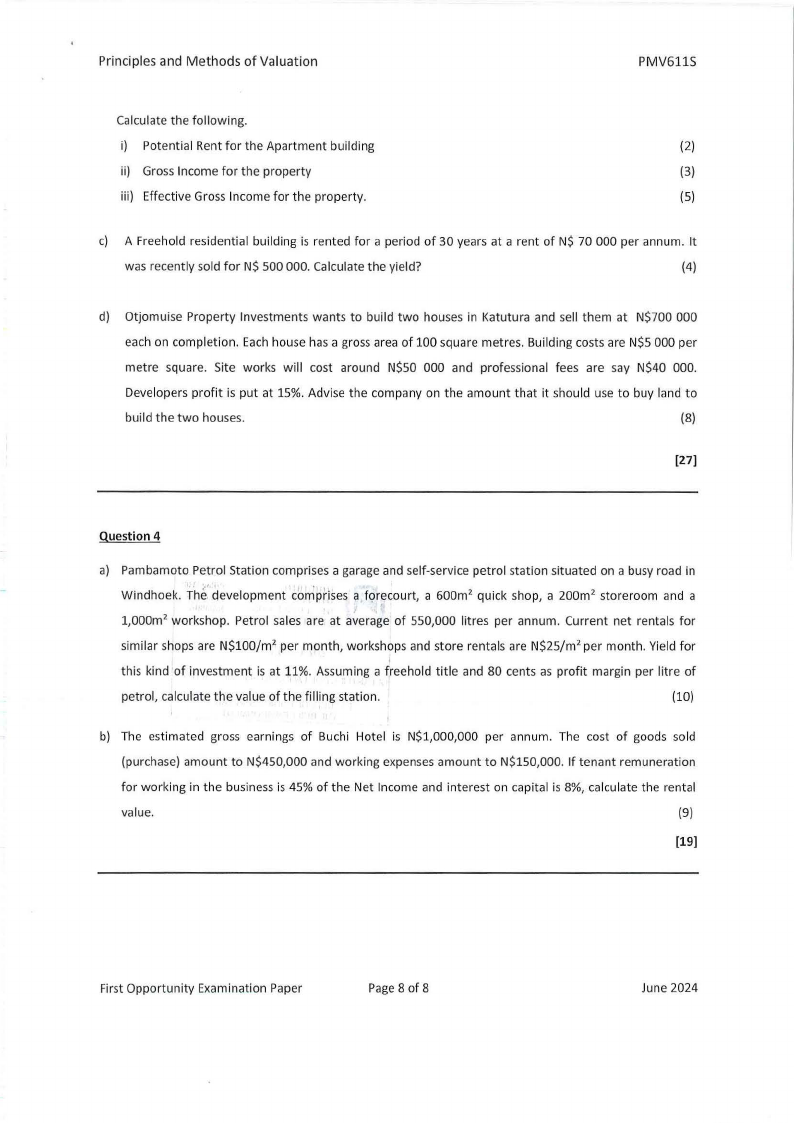

Principles and Methods of Valuation

PMV611S

Calculate the following.

i) Potential Rent for the Apartment building

(2)

ii) Gross Income for the property

{3}

iii) Effective Gross Income for the property.

(5)

c) A Freehold residential building is rented for a period of 30 years at a rent of N$ 70 000 per annum. It

was recently sold for N$ 500 000. Calculate the yield?

(4)

d) Otjomuise Property Investments wants to build two houses in Katutura and sell them at N$700 000

each on completion. Each house has a gross area of 100 square metres. Building costs are N$5 000 per

metre square. Site works will cost around N$50 000 and professional fees are say N$40 000.

Developers profit is put at 15%. Advise the company on the amount that it should use to buy land to

build the two houses.

(8)

(27]

Question 4

a) Pambamoto Petrol Station comprises a garage and self-service petrol station situated on a busy road in

Windhoek. The' development comprises a f9recourt 1 a 600m 2 quick shop, a 200m 2 storeroom and a

1,000m2 workshop. Petrol sales are at average of 550,000 litres per annum. Current net rentals for

similar shops are N$100/m 2 per month, workshops and store rentals are N$25/m 2 per month. Yield for

this kind of investment is at 11%. Assuming a freehold title and 80 cents as profit margin per litre of

petrol, calculate the value of the filling station.

{10)

b) The estimated gross earnings of Buchi Hotel is N$1,000,000 per annum. The cost of goods sold

(purchase) amount to N$450,000 and working expenses amount to N$150,000. If tenant remuneration

for working in the business is 45% of the Net Income and interest on capital is 8%, calculate the rental

value.

(9)

[19]

First Opportunity Examination Paper

Page8 of 8

June 2024