|

ATX812S- ADVANCED TAXATION- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVE Rs ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING (HONOURS)

QUALIFICATION CODE: 08BOAH

LEVEL: 8

COURSE: ADVANCED TAXATION

COURSE CODE: ATX812S

DATE: NOVEMBER 2023

SESSION: THEORY & CALCULATIONS

DURATION: 4 HOURS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION - QUESTION PAPER

EXAMINER:

Ms Y Andrew

MODERATOR:

Ms M Amakali

INSTRUCTIONS TO CANDIDATES

1. This paper consists of 7 pages (excluding cover page).

2. Answer all the questions using either blue or black ink.

3. Write neat and clear.

4. A non-programmable calculator is permissible.

5. The Namibian Income Tax Act no.24 of 1981 is permissible.

6. The Namibian Value-added Tax Act no.10 of 2000 is permissible.

7. Round off all amounts to the nearest Namibian Dollar (N$).

8. Cleary state (any) assumptions made (where applicable).

9. Show all your workings.

|

2 Page 2 |

▲back to top |

QUESTION 1

20 marks (48 min)

Coastal Wholesales Limited is a manufacturer and wholesaler of goods in Walvis Bay. The

company is a registered VAT vendor and has a 30 November year end. A new bookkeeper joined

the company on 1 September 2023. An extract from the VAT ledger account for the two-month

VAT period ending on 30 November 2023 follows:

DR

2023

Oct 7 Entertainment (note 3)

15 NAMRA oavment

31 Motor vehicle (note 4)

Nov 30 Purchases (note 5)

30 Rental (note 6)

30 Sundry expenses (note 7)

30 Computer (note 8)

VAT account

CR

N$ 2023

N$

706 Oct 1 Balance b/d

18 349

14 689 Nov 30 Sales (note 1)

49 761

24 737

30 Bad debt recovered (note 2) 1 726

14 625

3142

1 911

1 575

Notes:

All amounts include VAT, unless stated otherwise.

1. This represents the tax fraction in respect of the following:

N$

Local sales

Export Sales

264 500

117 000

381 500

No VAT had been charged to export customers but the bookkeeper believes the company

should account for VAT otherwise the input tax deductions cannot be claimed.

2. This represents the tax fraction in respect of a bad debt recovered. The bad debt was

written off on 1 October 2020.

3. Entertainment expenses include the following:

Hotel costs of sales manager while away on business (incl VAT)

Teas, coffee and other staff refreshments (incl VAT)

Restaurant bill of managing director on business lunch (incl VAT)

N$

3 886

988

536

.5..A1.Q

4. A new VW T-cross was acquired on 31 October 2023 for the exclusive free use of the

financial manager. The cash cost of the motor car was N$437 000 (including VAT). The

free use of the car was made available from 1 November 2023. The previous vehicle,

which the financial manager had been using since 1 March 2020, a VW pick-up, was stolen

on 1 October 2022. The company's insurance company paid out N$33 000 in full and final

settlement of the insurance claim on 15 November 2023.

The VW pick-up (not double cab) had been originally acquired by Coastal Wholesales

Limited on 1 December 2022 at a cost of N$58 650 (including VAT) and had been used

1

|

3 Page 3 |

▲back to top |

for business purposes from this date. Wear and tear on this vehicle is allowed by NAM RA

in terms of section 17(1)(e).

5. This represents the tax fraction of the purchases for the two-month VAT period. All

purchases were from VAT vendors and Coastal Wholesales Limited was in possession of

all relevant tax invoices.

6. This represents the VAT content in respect of rental of the company's administration

offices.

7. The total sundry expenses for the two-month VAT period are made up as follows:

Expenses incurred in respect of transactions with VAT vendors

Expenses incurred in respect of transactions with non-vendors

(but not second-hand goods)

Fuel expense incurred from the local Puma service station

N$

14 375

1 824

976

17 175

8. This computer, which is second-hand, was acquired from a non-vendor for N$12 075. The

non-vendor was paid on 15 December 2023.

REQUIRED

MARKS

(a) Calculate the correct VAT payable/ receivable to/from NAM RA in respect of the

12

VAT period ending 30 November 2023.

(b) Indicate when the VAT liability, if any, should be paid to NAMRA in respect of

2

the VAT period ending 30 November 2023.

(c) Calculate the income tax effects in respect of the payout of N$33 000 received

6

from the insurance company for the year of assessment ending 30 November

2023.

QUESTION 2

30 marks (72 min)

Mr Joseph, a Namibian resident, is employed by First Rand Namibia as a short-term insurance

broker. He has been working for the company for the past 21 years.

The following information relates to his 2023 year of assessment:

Salary

Long service award

Housing allowance (per month)

Travel allowance (per month)

Staff loan

Employer contribution to pension fund

Cellphone allowance (per month)

Laptop acquired from employer

Note

1

2

3

4

5

6

7

N$

774 000

4424

12 000

6 200

35 000

?

700

5 000

2

|

4 Page 4 |

▲back to top |

Notes

1. Mr Joseph received a digital camera to the value of N$4 424 as a long service award.

2. First Rand Namibia has an approved housing scheme registered with the Receiver of

Revenue.

3. Mr Joseph is obligated in terms of his employment agreement to visit clients in order to

prepare insurance schedules that meet the clients' specific needs. He receives a travel

allowance in order to carry out his duties. He uses his own motor vehicle, which he

acquired during the 2021 year of assessment, which cost him N$460 000 (including VAT

and excluding finance charges). First Rand Namibia reimburses Mr Joseph for all his

actual fuel expenses for business. He kept accurate records of his fuel expenses during

the year which amounted to N$14 540. The maintenance cost amounted N$5 400

(including VAT), and license fees were N$805 in respect of his motor vehicle for the current

year of assessment. His logbook reflected his total kilometers travelled for the year as 36

000, of which 27 000 related to business travel.

4. Mr Joseph applied for a staff loan which the company acceded to on 1 November. The

company charged Mr Joseph interest of 6.25% on the loan. The loan is repayable in 12

months.

5. The employer contributes 8.5% per month of his basic salary to a pension fund. In addition

Mr Joseph contributes N$1 250 per month to a Retirement Annuity fund.

6. Mr Joseph kept accurate records of all his business calls during the year which amounted

to N$5 600.

7. Mr Joseph purchased an old laptop from his employer. The market value of the laptop is

N$6 200.

8. He earned local interest and dividends of N$8 200 and N$10 000, respectively during the

year on investments he holds.

9. Employees tax of N$223 480 was deducted by First Rand Namibia, in respect of Mr

Joseph's 2023 year of assessment.

REQUIRED:

MARKS

Calculate Mr Joseph's tax liability for his 2023 year of assessment. Show all 30

calculations and indicate if an amount is not included in or deducted/exempt from

taxable income.

3

|

5 Page 5 |

▲back to top |

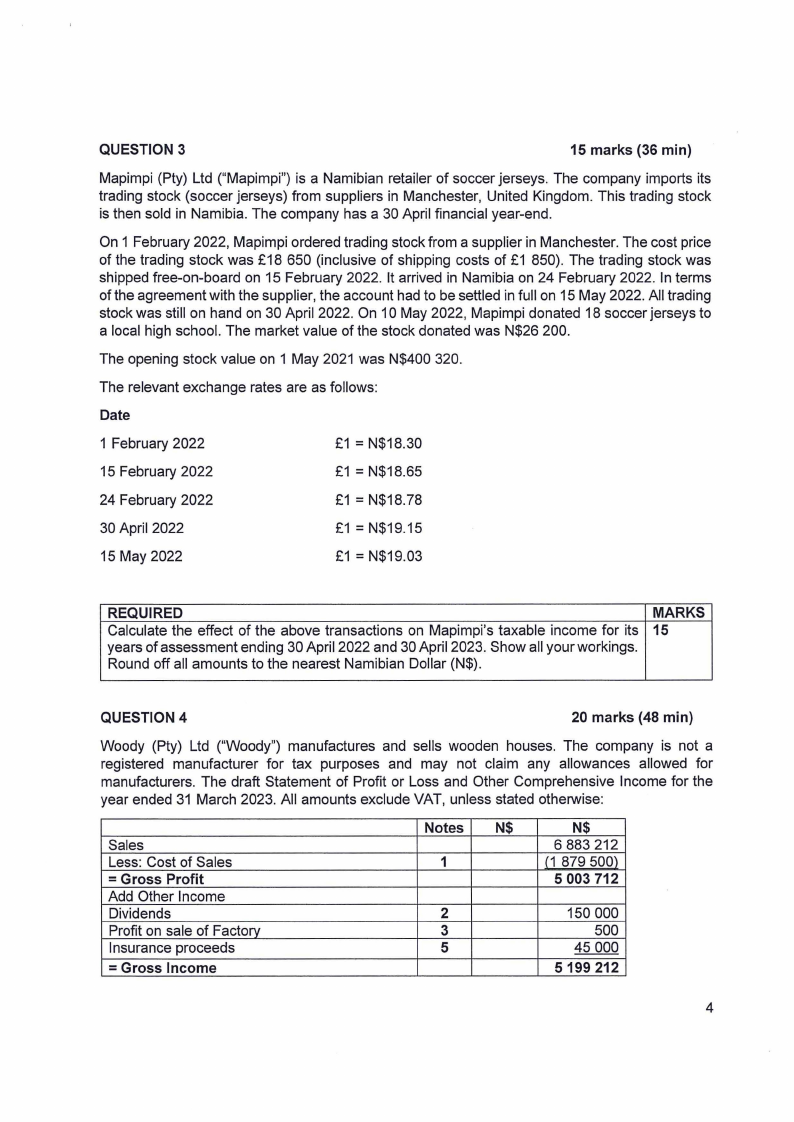

QUESTION 3

15 marks (36 min)

Mapimpi (Pty) ltd ("Mapimpi") is a Namibian retailer of soccer jerseys. The company imports its

trading stock (soccer jerseys) from suppliers in Manchester, United Kingdom. This trading stock

is then sold in Namibia. The company has a 30 April financial year-end.

On 1 February 2022, Mapimpi ordered trading stock from a supplier in Manchester. The cost price

of the trading stock was £18 650 (inclusive of shipping costs of £1 850). The trading stock was

shipped free-on-board on 15 February 2022. It arrived in Namibia on 24 February 2022. In terms

of the agreement with the supplier, the account had to be settled in full on 15 May 2022. All trading

stock was still on hand on 30 April 2022. On 10 May 2022, Mapimpi donated 18 soccer jerseys to

a local high school. The market value of the stock donated was N$26 200.

The opening stock value on 1 May 2021 was N$400 320.

The relevant exchange rates are as follows:

Date

1 February 2022

£1 = N$18.30

15 February 2022

£1 = N$18.65

24 February 2022

£1 = N$18.78

30 April 2022

£1 =N$19.15

15 May 2022

£1 = N$19.03

REQUIRED

Calculate the effect of the above transactions on Mapimpi's taxable income for its

years of assessment ending 30 April 2022 and 30 April 2023. Show all your workings.

Round off all amounts to the nearest Namibian Dollar (N$).

MARKS

15

QUESTION 4

20 marks (48 min)

Woody (Pty) ltd ("Woody") manufactures and sells wooden houses. The company is not a

registered manufacturer for tax purposes and may not claim any allowances allowed for

manufacturers. The draft Statement of Profit or Loss and Other Comprehensive Income for the

year ended 31 March 2023. All amounts exclude VAT, unless stated otherwise:

Sales

Less: Cost of Sales

= Gross Profit

Add Other Income

Dividends

Profit on sale of Factory

Insurance proceeds

= Gross Income

Notes N$

N$

6 883 212

1

(1 879 500)

5 003 712

2

150 000

3

500

5

45 000

5 199 212

4

|

6 Page 6 |

▲back to top |

Less: Expenses

Lease premium and payment

4 480 000

Depreciation

6 148 878

Finance charges on lease of machine

12 020

Interest paid

60 000

Other expenses (all deductible for tax purposes

473 698 (1 174 596}

= Net Profit before tax

4 024 616

Notes

1. Purchases amounted to N$1 973 000, opening stock and closing stock were N$202 500

and N$296 000, respectively. The market value of stock has never been below its cost.

2. "Local" dividends of N$150 000 accruing during the 2023 year of assessment.

3. During its 2017 year of assessment, the company purchased a factory (industrial building)

at a cost of N$1 000 000. The seller was entitled to a building allowance in terms of s

17(1)(f) from 2010 (year brought into use) to the 2016 year of assessment. As a result of

rapid developments, this factory became too small to meet the company's needs and it

was sold on 31 October 2022 for N$1 000 000.

4. After the old factory was sold, and as from 1 November 2022, the company leased a new

factory building for a period of 20 years. In terms of the lease agreement, a once off lease

premium of N$80 000 had to be paid and rental of N$80 000 per month was payable as

well. The new factory was occupied from 1 November 2022. In terms of the lease

agreement, Woody was obliged to make improvements to the factory at a cost of N$ 1

500 000. The improvements were completed on 1 March 2023, but their actual cost

amounted to N$2 100 000.

5. In the early morning hours of 1 April 2022, a fire destroyed Machine A The following

amounts (net of the relevant output tax) were received from the insurer:

N$

Loss of profits due to fire:

28 000

Loss of Machine A:

17 000

45 000

The cost price of Machine A was N$50 000 and its tax value on 1 April 2022 was N$20

000 (refer to note 6 for details of Machine B which replaced Machine A).

6. Depreciation was calculated as follows on the following assets:

Asset

Machine B

Leased Machine C

Acquisition

date

2 November

2022

N/a

Brought

into use

2 November

2022

N/a

Cost (excl Market

VAT)N$

Value N$

100 000 N/a

N/a

24 000

5

|

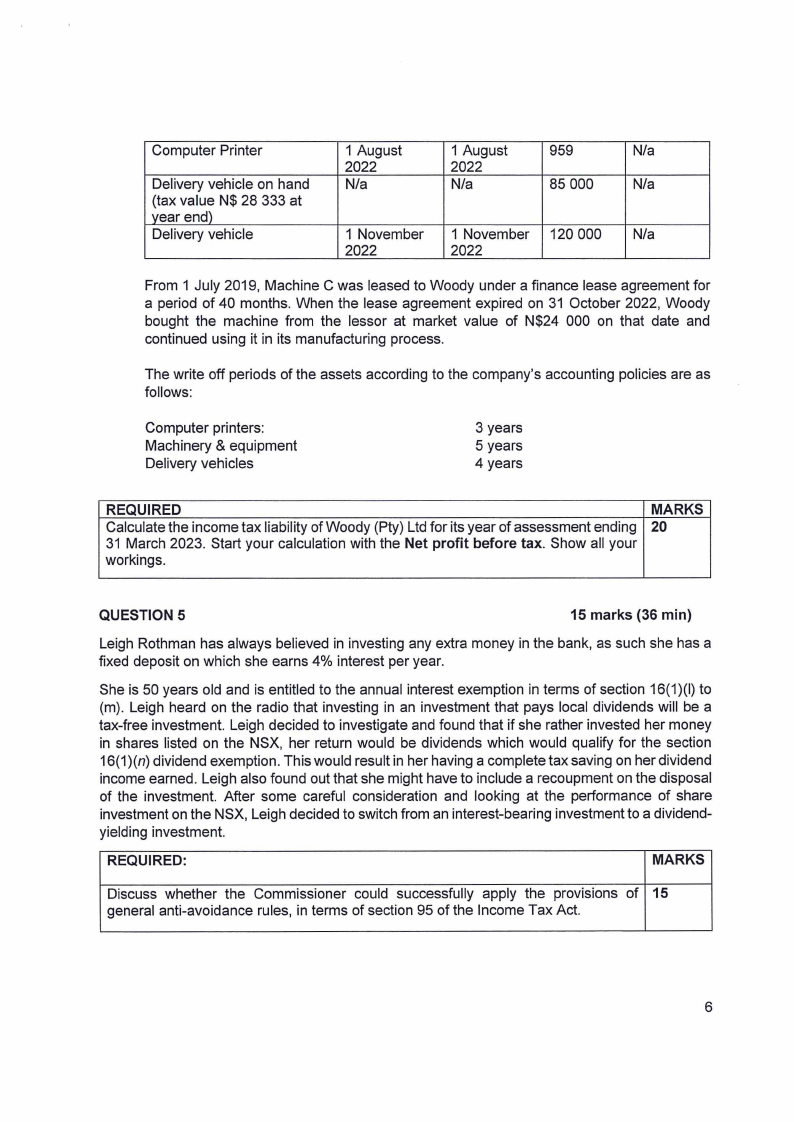

7 Page 7 |

▲back to top |

Computer Printer

Delivery vehicle on hand

(tax value N$ 28 333 at

vear end)

Delivery vehicle

1 August

2022

N/a

1 August

2022

N/a

959

N/a

85 000

N/a

1 November 1 November 120 000 N/a

2022

2022

From 1 July 2019, Machine C was leased to Woody under a finance lease agreement for

a period of 40 months. When the lease agreement expired on 31 October 2022, Woody

bought the machine from the lessor at market value of N$24 000 on that date and

continued using it in its manufacturing process.

The write off periods of the assets according to the company's accounting policies are as

follows:

Computer printers:

Machinery & equipment

Delivery vehicles

3 years

5 years

4 years

REQUIRED

Calculate the income tax liability of Woody (Pty) Ltd for its year of assessment ending

31 March 2023. Start your calculation with the Net profit before tax. Show all your

workings.

MARKS

20

QUESTION 5

15 marks (36 min)

Leigh Rothman has always believed in investing any extra money in the bank, as such she has a

fixed deposit on which she earns 4% interest per year.

She is 50 years old and is entitled to the annual interest exemption in terms of section 16(1)(I) to

(m). Leigh heard on the radio that investing in an investment that pays local dividends will be a

tax-free investment. Leigh decided to investigate and found that if she rather invested her money

in shares listed on the NSX, her return would be dividends which would qualify for the section

16(1)(n) dividend exemption. This would result in her having a complete tax saving on her dividend

income earned. Leigh also found out that she might have to include a recoupment on the disposal

of the investment. After some careful consideration and looking at the performance of share

investment on the NSX, Leigh decided to switch from an interest-bearing investment to a dividend-

yielding investment.

REQUIRED:

MARKS

Discuss whether the Commissioner could successfully apply the provisions of 15

general anti-avoidance rules, in terms of section 95 of the Income Tax Act.

6

|

8 Page 8 |

▲back to top |

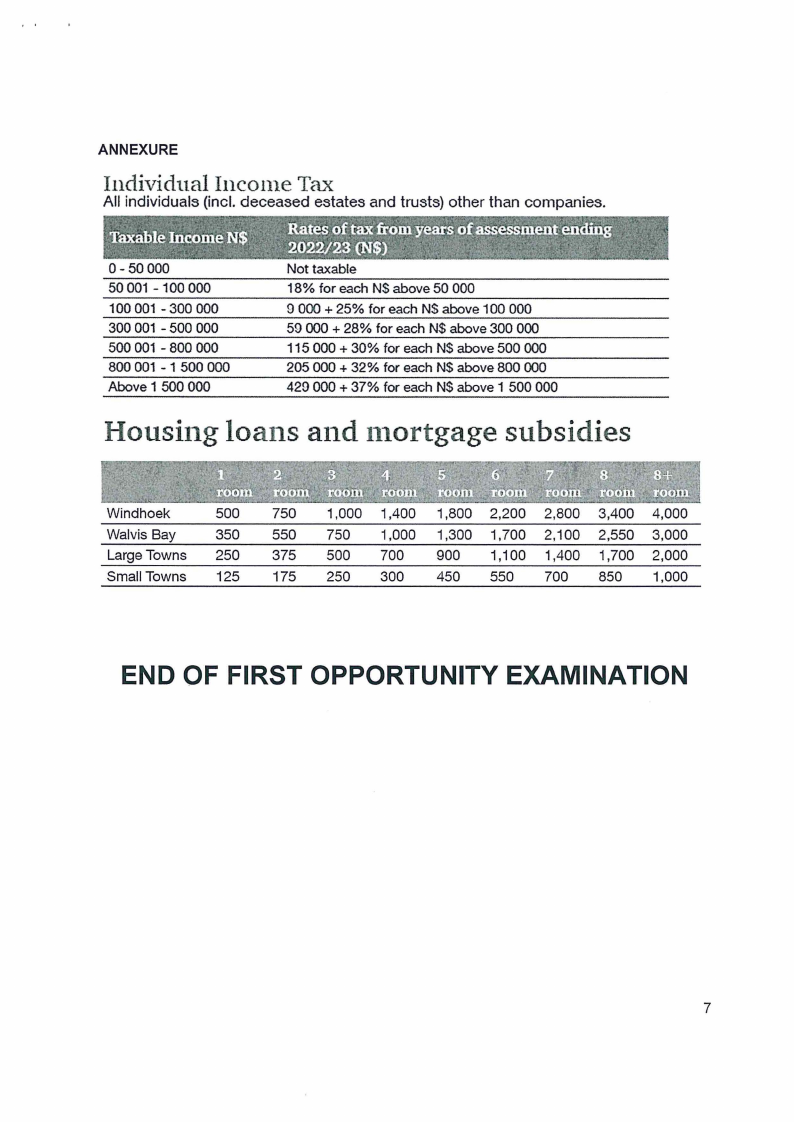

ANNEXURE

Individual Inco1ne Tax

All individuals (incl. deceased estates and trusts) other than companies.

0-50000

50 001 - 100 000

100 001 - 300 000

300 001 - 500 000

500 001 - 800 000

800 001 - 1 500 000

Above 1 500 000

Not taxable

18% for each NS above 50 000

9 000 + 25% for each NS above 100 000

59 000 + 28% for each N$ above 300 000

115 000 + 30% for each N$ above 500 000

205 000 + 32% for each N$ above 800 000

420 000 + 37% for each N$ above 1 500 000

Hottsing loa11s a11d111ortgage sttbsidies

Windhoek

500 750 1,000 1,400 1,800 2,200 2,800 3,400 4,000

Walvis Bay

350 550 750 1,000 1,300 1,100 2, mo 2,550 3,ooo

LargeTowns 250 375 500 700 900 1,100 1,400 1,700 2,000

Small Towns 125 175 250 300 450 550 700 850 1,000

END OF FIRST OPPORTUNITY EXAMINATION

7