|

CMA611S-COST MANAGEMENT ACCOUNTING 201-1ST OPP- JUNE 2024 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTING_AND FINANCE

QUALIFICATION:BACHELOR OF ACCOUNTING

QUALIFICATIONCODE:07BGAC LEVEL:6

COURSECODE: CMA611S

COURSENAME: COST& MANAGEMENT ACCOUNTING201

SESSION:JUNE 2024

DURATION: 3 HOURS

PAPER:THEORYAND CALCULATIONS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS Namwandi, H., Mbangula P., and Sheehama, K.G.H.

MODERATOR Ms Kangala, H.

INSTRUCTIONS

• Answer ALL the questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round off only

final answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after the start

of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF_ 4_ PAGES(excluding this front page)

0

|

2 Page 2 |

▲back to top |

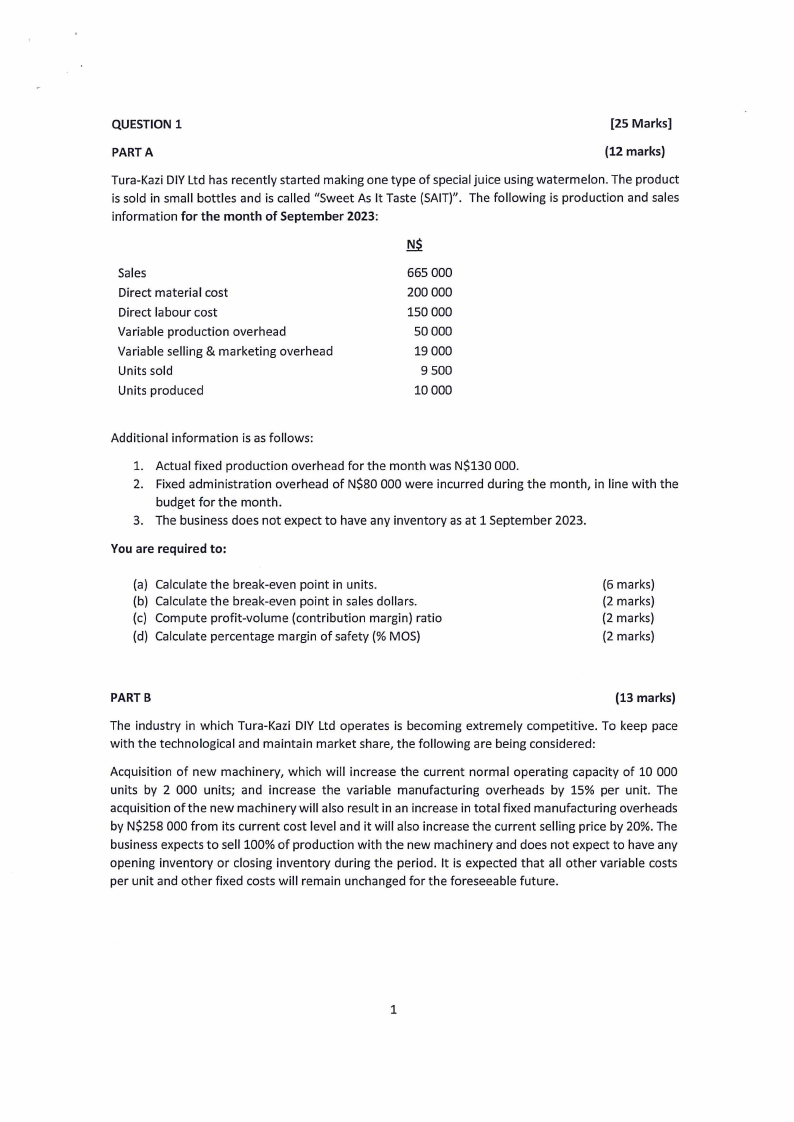

QUESTION 1

[25 Marks]

PARTA

(12 marks)

Tura-Kazi DIV Ltd has recently started making one type of special juice using watermelon. The product

is sold in small bottles and is called "Sweet As It Taste (SAIT)". The following is production and sales

information for the month of September 2023:

Sales

Direct material cost

Direct labour cost

Variable production overhead

Variable selling & marketing overhead

Units sold

Units produced

665 000

200 000

150 000

50 000

19 000

9 500

10000

Additional information is as follows:

1. Actual fixed production overhead for the month was N$130 000.

2. Fixed administration overhead of N$80 000 were incurred during the month, in line with the

budget for the month.

3. The business does not expect to have any inventory as at 1 September 2023.

You are required to:

(a) Calculate the break-even point in units.

(bl Calculate the break-even point in sales dollars.

(c) Compute profit-volume (contribution margin) ratio

(d) Calculate percentage margin of safety(% MOS)

(6 marks)

(2 marks)

(2 marks)

(2 marks)

PARTB

(13 marks)

The industry in which Tura-Kazi DIV Ltd operates is becoming extremely competitive. To keep pace

with the technological and maintain market share, the following are being considered:

Acquisition of new machinery, which will increase the current normal operating capacity of 10 000

units by 2 000 units; and increase the variable manufacturing overheads by 15% per unit. The

acquisition of the new machinery will also result in an increase in total fixed manufacturing overheads

by N$258 000 from its current cost level and it will also increase the current selling price by 20%. The

business expects to sell 100% of production with the new machinery and does not expect to have any

opening inventory or closing inventory during the period. It is expected that all other variable costs

per unit and other fixed costs will remain unchanged for the foreseeable future.

1

|

3 Page 3 |

▲back to top |

REQUIREMENT:

Advise the management of Tura Kazi DIV Ltd whether it should continue with its current operation

without the acquisition of a new machine or buy the new machine. You should show your calculations

to support your recommendations.

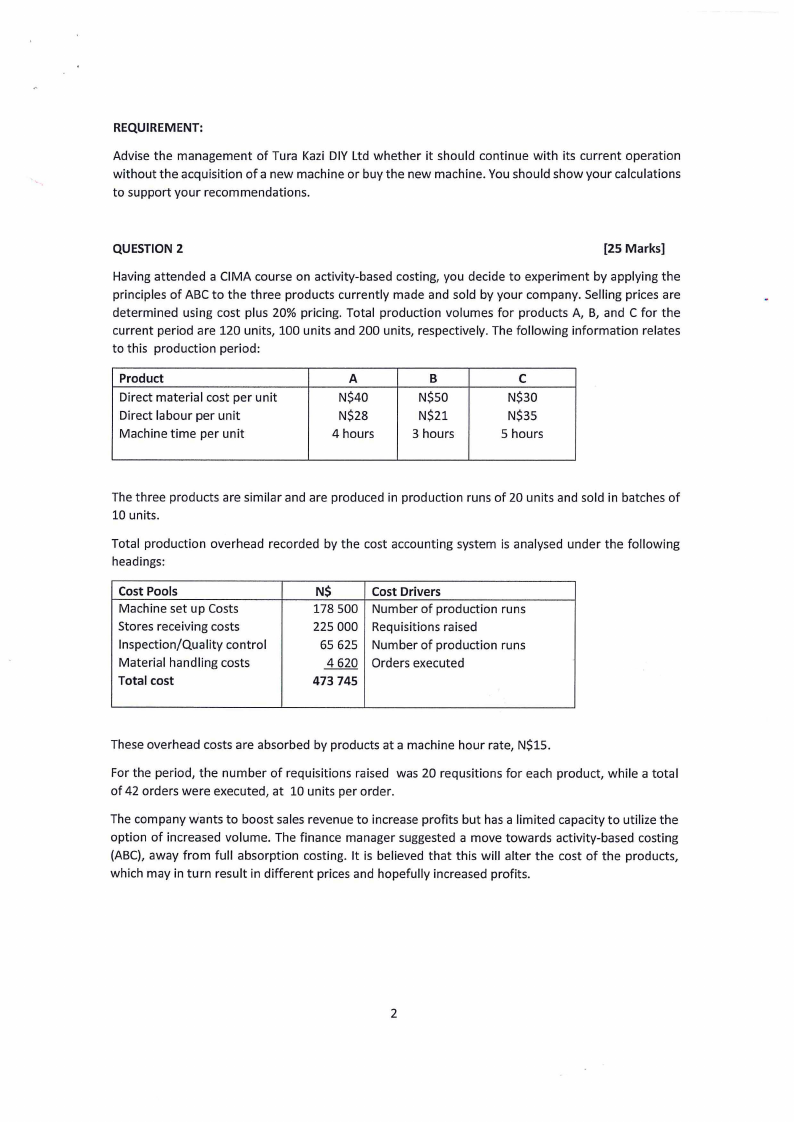

QUESTION 2

[25 Marks]

Having attended a CIMA course on activity-based costing, you decide to experiment by applying the

principles of ABC to the three products currently made and sold by your company. Selling prices are

determined using cost plus 20% pricing. Total production volumes for products A, B, and C for the

current period are 120 units, 100 units and 200 units, respectively. The following information relates

to this production period:

Product

Direct material cost per unit

Direct labour per unit

Machine time per unit

A

N$40

N$28

4 hours

B

N$50

N$21

3 hours

C

N$30

N$35

5 hours

The three products are similar and are produced in production runs of 20 units and sold in batches of

10 units.

Total production overhead recorded by the cost accounting system is analysed under the following

headings:

Cost Pools

Machine set up Costs

Stores receiving costs

Inspection/Quality control

Material handling costs

Total cost

N$

178 500

225 000

65 625

4620

473 745

Cost Drivers

Number of production runs

Requisitions raised

Number of production runs

Orders executed

These overhead costs are absorbed by products at a machine hour rate, N$15.

For the period, the number of requisitions raised was 20 requsitions for each product, while a total

of 42 orders were executed, at 10 units per order.

The company wants to boost sales revenue to increase profits but has a limited capacity to utilize the

option of increased volume. The finance manager suggested a move towards activity-based costing

(ABC), away from full absorption costing. It is believed that this will alter the cost of the products,

which may in turn result in different prices and hopefully increased profits.

2

|

4 Page 4 |

▲back to top |

You are required to:

a) Calculate sales price per unit of each product using the current method of absorption costing.

(6 marks)

b) Calculate the full production cost per unit of each product using activity-based costing. (14

marks)

c) Explain the terms" Activity-based costing", and "cost drivers" and state two examples of cost

drivers.

(5 marks)

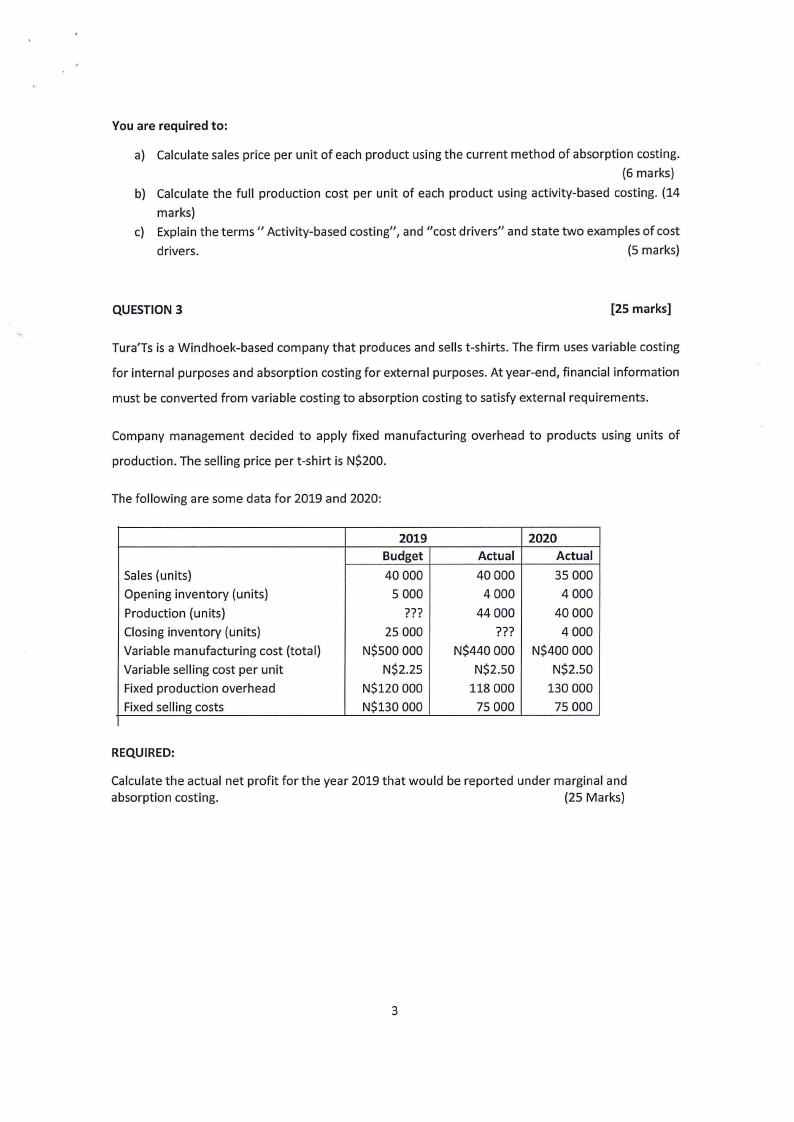

QUESTION 3

(25 marks]

Tura'Ts is a Windhoek-based company that produces and sells t-shirts. The firm uses variable costing

for internal purposes and absorption costing for external purposes. At year-end, financial information

must be converted from variable costing to absorption costing to satisfy external requirements.

Company management decided to apply fixed manufacturing overhead to products using units of

production. The selling price pert-shirt is N$200.

The following are some data for 2019 and 2020:

Sales (units)

Opening inventory (units)

Production (units)

Closing inventory (units)

Variable manufacturing cost (total)

Variable selling cost per unit

Fixed production overhead

Fixed selling costs

2019

Budget

40000

5 000

???

25 000

N$500 000

N$2.25

N$120 000

N$130 000

Actual

40000

4000

44000

???

N$440 000

N$2.50

118 000

75 000

2020

Actual

35 000

4 000

40000

4000

N$400 000

N$2.50

130000

75 000

REQUIRED:

Calculate the actual net profit for the year 2019 that would be reported under marginal and

absorption costing.

(25 Marks)

3

|

5 Page 5 |

▲back to top |

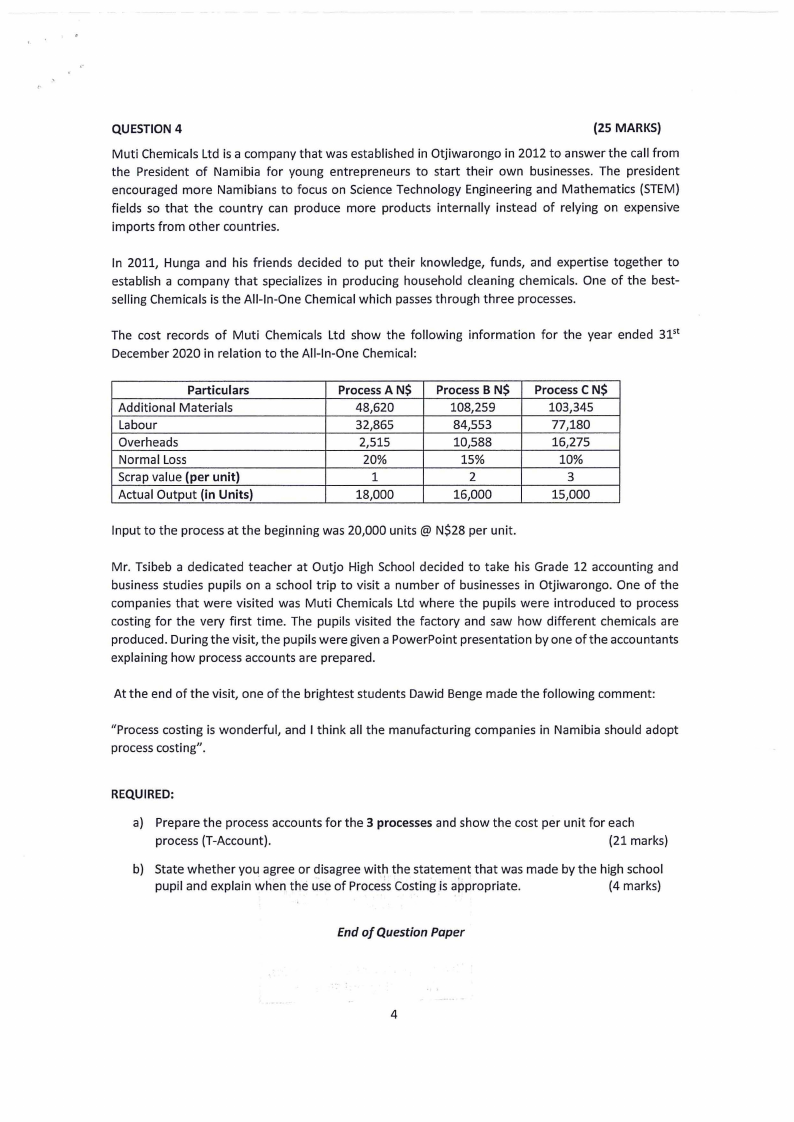

QUESTION 4

(25 MARKS)

Muti Chemicals Ltd is a company that was established in Otjiwarongo in 2012 to answer the call from

the President of Namibia for young entrepreneurs to start their own businesses. The president

encouraged more Namibians to focus on Science Technology Engineering and Mathematics (STEM)

fields so that the country can produce more products internally instead of relying on expensive

imports from other countries.

In 2011, Hunga and his friends decided to put their knowledge, funds, and expertise together to

establish a company that specializes in producing household cleaning chemicals. One of the best-

selling Chemicals is the All-In-One Chemical which passesthrough three processes.

The cost records of Muti Chemicals Ltd show the following information for the year ended 31st

December 2020 in relation to the All-In-One Chemical:

Particulars

Additional Materials

Labour

Overheads

Normal Loss

Scrap value (per unit)

Actual Output (in Units)

Process AN$

48,620

32,865

2,515

20%

1

18,000

Process B N$

108,259

84,553

10,588

15%

2

16,000

Process C N$

103,345

77,180

16,275

10%

3

15,000

Input to the process at the beginning was 20,000 units @ N$28 per unit.

Mr. Tsibeb a dedicated teacher at Outjo High School decided to take his Grade 12 accounting and

business studies pupils on a school trip to visit a number of businesses in Otjiwarongo. One of the

companies that were visited was Muti Chemicals Ltd where the pupils were introduced to process

costing for the very first time. The pupils visited the factory and saw how different chemicals are

produced. During the visit, the pupils were given a PowerPoint presentation by one of the accountants

explaining how process accounts are prepared.

At the end of the visit, one of the brightest students Dawid Benge made the following comment:

"Process costing is wonderful, and I think all the manufacturing companies in Namibia should adopt

process costing".

REQUIRED:

a) Prepare the process accounts for the 3 processes and show the cost per unit for each

process (T-Account).

(21 marks)

b) State whether you agree or disagree wit~ the statement that was made by the high school

pupil and explain when the use of ProcessCosting is appropriate.

(4 marks)

Endof QuestionPaper

4