FSL811S- FINANCIAL STRATEGIES FOR LOGISTICS AND SUPPLY CHAIN OPTIMISATION- 2ND OPP- MAY 2024

|

FSL811S- FINANCIAL STRATEGIES FOR LOGISTICS AND SUPPLY CHAIN OPTIMISATION- 2ND OPP- MAY 2024 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVE RSITY

OFSCIEnCEAno TECHno LOGY

FACULTYOF COMMERCE,HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF MARKETING,LOGISTICSAND SPORTMANAGEMENT

QUALIFICATION: BACHELOR OF LOGISTICS & SUPPLY CHAIN MANAGEMENT HONOURS

QUALIFICATION CODE: 08BSLH

COURSE CODE: FSL811 S

SESSION: MAY 2024

LEVEL: 8

COURSE NAME: FINANCIAL STRATEGIES FOR

LOGISTICS AND & SUPPLY CHAIN OPTIMISATION

PAPER: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY FINAL ASSESSMENT QUESTION PAPER

EXAMINER

MR. LAMECK ODADA

MODERATOR MR. JOHANNES NDJULUWA

INSTRUCTIONS

1. This question paper consists of FOUR (4) questions.

2. Answer ALL FOUR (4) questions in blue or black ink only. NO PENCIL.

3. Start each question on a new page, number the answers correctly and clearly.

4. Write clearly, neatly and show all your workings/calculations/assumptions.

5. Unless otherwise stated, work with four (4) decimal places in all your calculations and

only round off final answers to two (2) decimal places.

6. Questions relating to this assessment may be raised in the initial 30 minutes after the

start of the examination. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

• Silent, non-programmable calculators

THISASSESSMENTCONSISTSOF_9_ PAGES(including this cover page, but not tables)

|

2 Page 2 |

▲back to top |

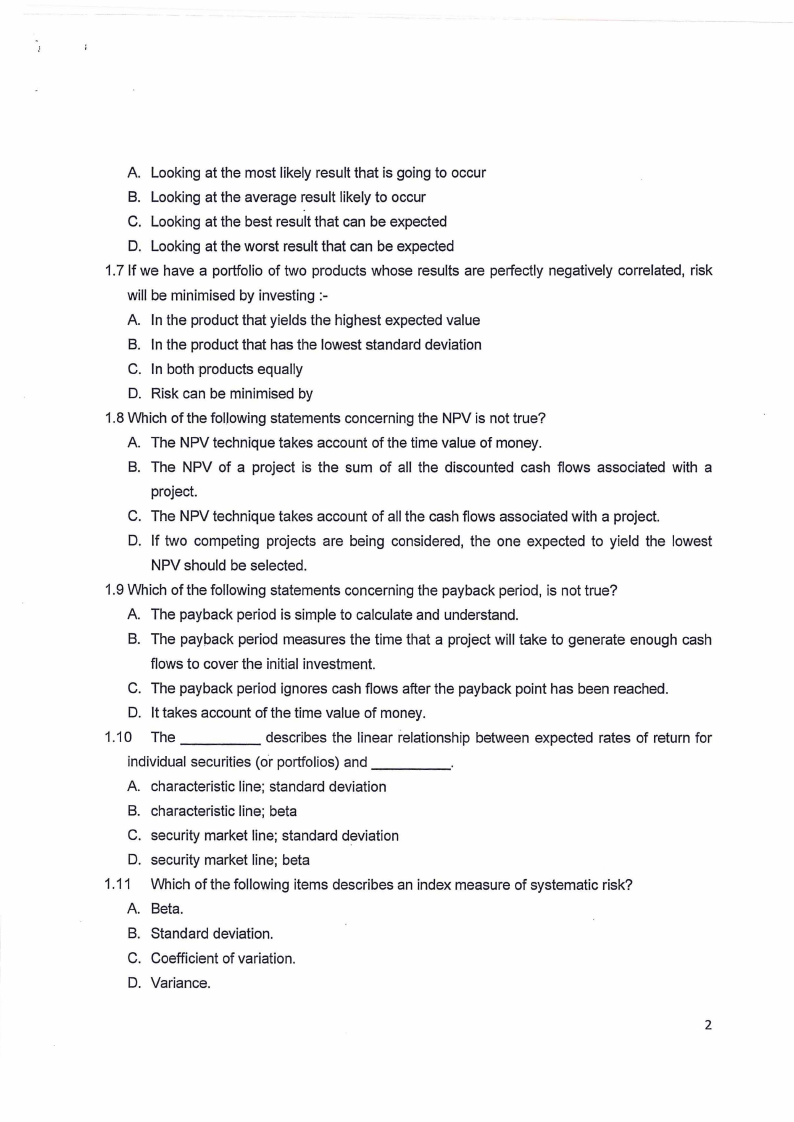

A Looking at the most likely result that is going to occur

8. Looking at the average result likely to occur

C. Looking at the best result that can be expected

D. Looking at the worst result that can be expected

1.7 If we have a portfolio of two products whose results are perfectly negatively correlated, risk

will be minimised by investing :-

A In the product that yields the highest expected value

8. In the product that has the lowest standard deviation

C. In both products equally

D. Risk can be minimised by

1.8 Which of the following statements concerning the NPV is not true?

A The NPV technique takes account of the time value of money.

8. The NPV of a project is the sum of all the discounted cash flows associated with a

project.

C. The NPV technique takes account of all the cash flows associated with a project.

D. If two competing projects are being considered, the one expected to yield the lowest

NPV should be selected.

1.9 Which of the following statements concerning the payback period, is not true?

A The payback period is simple to calculate and understand.

8. The paypack period measures the time that a project will take to generate enough cash

flows to cover the initial investment.

C. The payback period ignores cash flows after the payback point has been reached.

D. It takes account of the time value of money.

1.1O The _____

describes the linear relationship between expected rates of return for

individual securities (or portfolios) and ____

_

A characteristic line; standard deviation

8. characteristic line; beta

C. security market line; standard deviation

D. security market line; beta

1.11 Which of the following items describes an index measure of systematic risk?

A Beta.

B. Standard deviation.

C. Coefficient of variation.

D. Variance.

2

|

3 Page 3 |

▲back to top |

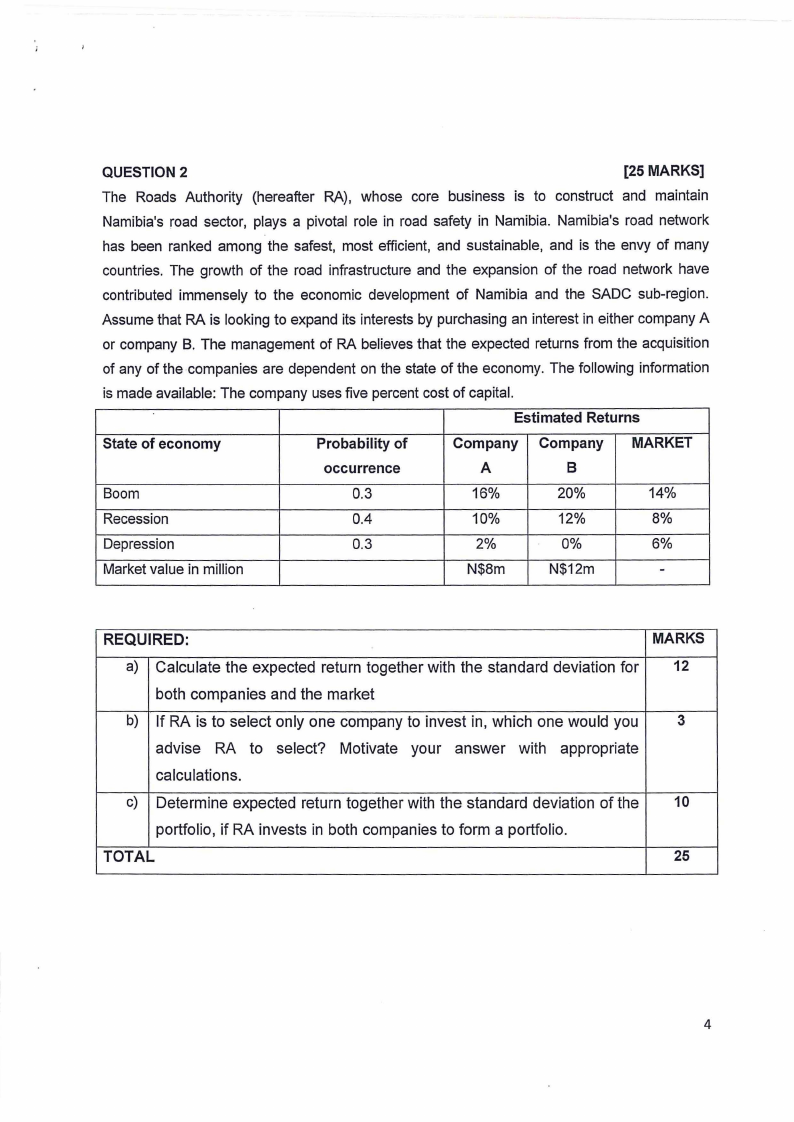

QUESTION 2

[25 MARKS]

The Roads Authority (hereafter RA), whose core business is to construct and maintain

Namibia's road sector, plays a pivotal role in road safety in Namibia. Namibia's road network

has been ranked among the safest, most efficient, and sustainable, and is the envy of many

countries. The growth of the road infrastructure and the expansion of the road network have

contributed immensely to the economic development of Namibia and the SADC sub-region.

Assume that RA is looking to expand its interests by purchasing an interest in either company A

or company B. The management of RA believes that the expected returns from the acquisition

of any of the companies are dependent on the state of the economy. The following information

is made available: The company uses five percent cost of capital.

Estimated Returns

State of economy

Probability of

Company Company MARKET

occurrence

A

8

Boom

0.3

16%

20%

14%

Recession

0.4

10%

12%

8%

Depression

0.3

2%

0%

6%

Market value in million

N$8m

N$12m

-

REQUIRED:

MARKS

a) Calculate the expected return together with the standard deviation for 12

both companies and the market

b) If RA is to select only one company to invest in, which one would you

3

advise RA to select? Motivate your answer with appropriate

calculations.

c) Determine expected return together with the standard deviation of the 10

portfolio, if RA invests in both companies to form a portfolio.

TOTAL

25

4

|

4 Page 4 |

▲back to top |

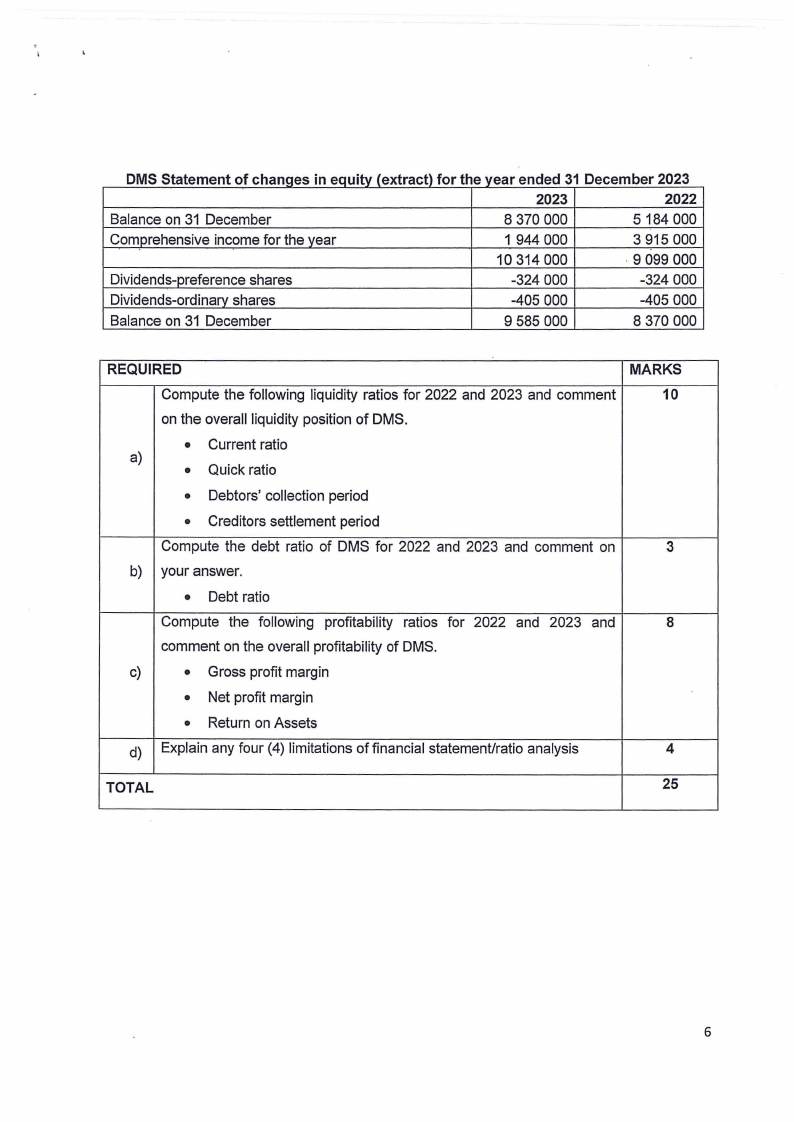

OMS Statement of changes in equity (extract) for the year ended 31 December 2023

2023

2022

Balance on 31 December

8 370 000

5 184 000

Comprehensive income for the year

1 944 000

3 915 000

10 314 000

· 9 099 000

Dividends-preference shares

-324 000

-324 000

Dividends-ordinary shares

-405 000

-405 000

Balance on 31 December

9 585 000

8 370 000

REQUIRED

MARKS

Compute the following liquidity ratios for 2022 and 2023 and comment

10

on the overall liquidity position of OMS.

• Current ratio

a)

• Quick ratio

• Debtors' collection period

• Creditors settlement period

Compute the debt ratio of OMS for 2022 and 2023 and comment on

3

b) your answer.

• Debt ratio

Compute the following profitability ratios for 2022 and 2023 and

8

comment on the overall profitability of OMS.

c)

• Gross profit margin

• Net profit margin

• Return on Assets

d) Explain any four (4) limitations of financial statement/ratio analysis

4

TOTAL

25

6

|

5 Page 5 |

▲back to top |

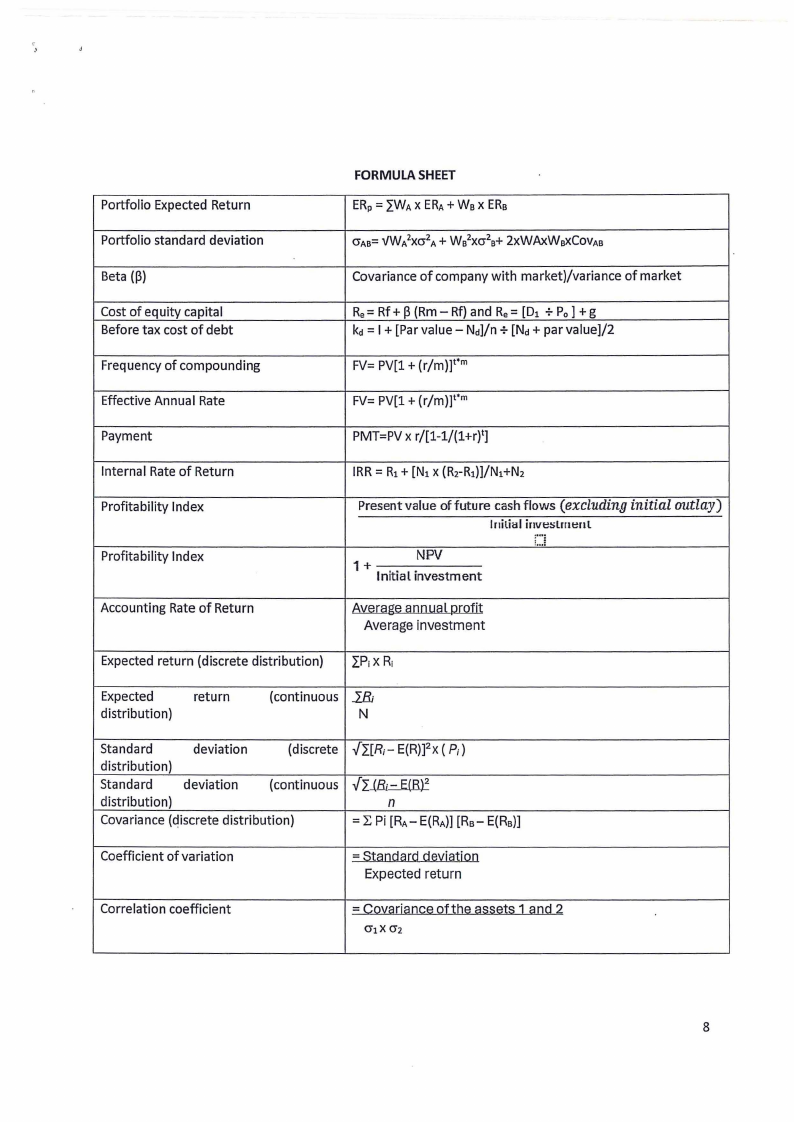

Portfolio Expected Return

Portfolio standard deviation

FORMULASHEET

ERp= "'j_WAX ERA+Ws X ERs

O"As=vW/xcr 2A+ Ws2Xcr2s+ 2xWAx.WsXCOVAB

Beta (~)

Covariance of company with market)/variance of market

Cost of equity capital

Before tax cost of debt

Re= Rf+~ (Rm - Rf) and Re= [D1 + Po] + g

kd =I+ [Par value- Nd]/n +[Nd+ par value]/2

Frequency of compounding

FV= PV[l + (r/m)] 1*m

Effective Annual Rate

FV= PV[l + (r/m)] 1*m

Payment

PMT=PV x r/[1-1/(1+r) 1]

Internal Rate of Return

Profitability Index

Profitability Index

Accounting Rate of Return

IRR= R1+ [N1 x (R2-R1)]/N1+N2

Present value of future cash flows (excluding initial outlay)

lr1ilial inve:;lmtml

1•••:

NPV

1+

Initial investment

Average investment

Expected return (discrete distribution)

"'i..PiXRi

Expected

distribution)

return

(continuous .lli

N

Standard

deviation

(discrete

distribution)

Standard

deviation

(continuous

distribution)

Covariance (discrete distribution)

../"i.[R;- E(R)]2x ( P;)

../"i.J&::~E.(B.).:

n

= L Pi [RA- E(RA)][Rs- E(Rs)]

Coefficient of variation

=

Expected return

Correlation coefficient

=

oHbe assets 1 2

0"1X 0"2

8

|

6 Page 6 |

▲back to top |