|

BAC521C-BUSINESS ACCOUNTING 1A 2ND OPP -JUNE2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA

UnlVERSITY

OF SCIEnCEAno

TECHnOLOGY

HAROLDPUPKEWITZ

GraduateSchoool f Business

FACULTYOF COMMERCE,HUMAN SCIENCESAND EDUCATION

HAROLD PUPKEWITZGRADUATESCHOOLOF BUSINESS

QUALIFICATION: DIPLOMA IN BUSINESS PROCESSMANAGEMENT

QUALIFICATIONCODE:06DBPM LEVEL:6

COURSECODE: BAC521C

COURSENAME: BUSINESS ACCOUNTING lB

SESSION:JUNE 2024

PAPER:PAPER 1

DURATION: 3 HOURS

MARKS: 100

FIRSTOPPORTUNITYEXAMINATION QUESTIONPAPER

EXAMINER

Lameck Odada

MODERATOR Hendrina Kangala

INSTRUCTIONS

1. This question paper comprises FOUR (4) questions.

2. Answer ALLthe questions and in blue or black ink. NO pencil

3. Start each question on a new page in your answer booklet and show all workings.

4. Work with whole numbers in all your calculations and only round off only final answers

to two (2) decimal places where necessary unless otherwise stated.

5. Questions relating to this examination may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

1. Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF 5 PAGES(including this front page)

|

2 Page 2 |

▲back to top |

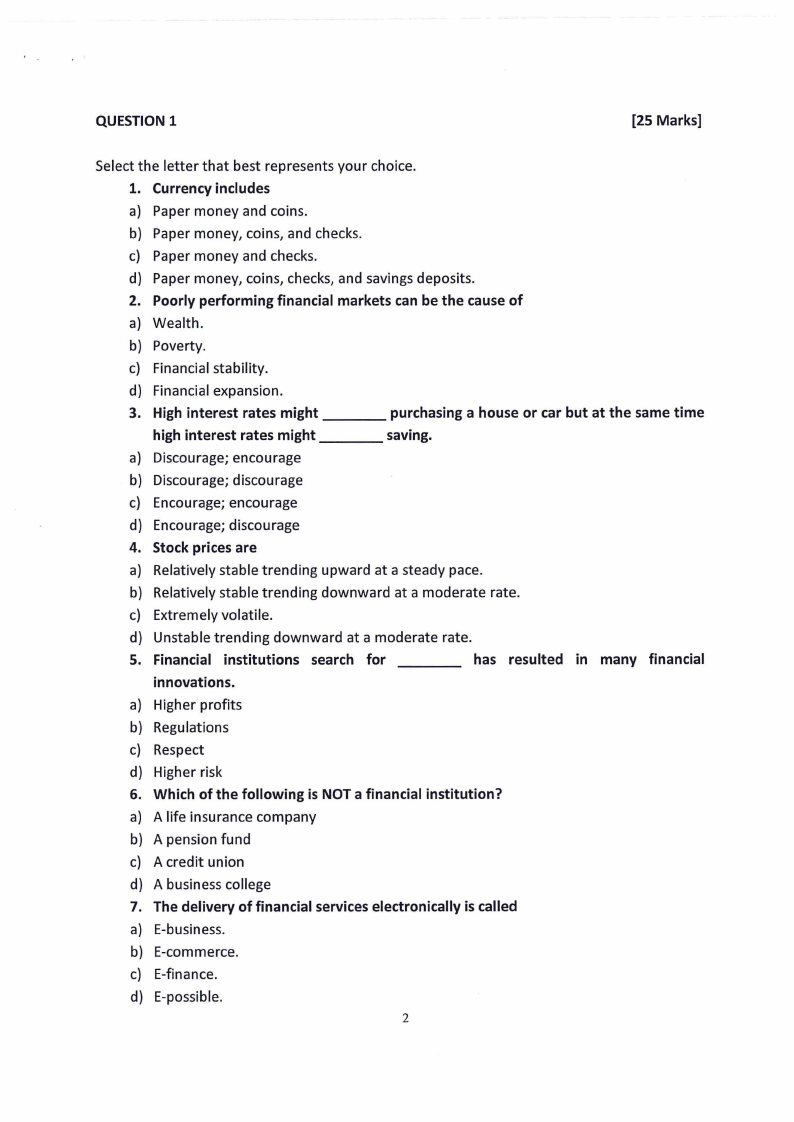

QUESTION1

[20 MARKS]

Forquestions1.1-1.10, just write the answer only (the correctletter chosen)in your answer bookand

not on the question paper. Do not copythe questionagain.

1.1 Which of the following is described as the process of determining how a particular cost behaves?

a) Cost prediction

b) Cost behaviour

c) Cost estimation

d) Cost prevention

1.2 Which of the following is a forecast of cost at a particular level of activity?

a) Cost prediction

b) Cost behaviour

c) Cost estimation

d) Cost prevention

1.3 Which of the following refers to the relationship between cost and activity?

a) Cost prediction

b) Cost behaviour

c) Cost estimation

d) Cost prevention

1.4 The cost of insurance and taxes are included in

a) Cost of ordering

b) Set up cost

c) Inventory carrying cost

d) Cost of shortages

1.5 Which of the following is true for Inventory control?

a) Economic order quantity has a minimum total cost per order

b) Inventory carrying costs increases with the quantity per order

c) Ordering cost decreases with low size

d) All of the above

1.6 The time period between placing an order and its receipt in stock is known as

a) Leadtime

b) Carrying time

c) Shortage time

1

|

3 Page 3 |

▲back to top |

d) Overtime

1.7 The best way of allocating fixed overheads between products is:

a) Equally between different products

b) As a proportion of direct cost incurred by each product

c) Basedon the number of people involved in the production of each product

d) There is no 'best' way of allocating overheads

1.8 A company absorbs overheads on machine hours which were budgeted to be 11,250 with

overheads of N$258,750. Actual results were 10,980 hours with overheads of N$254,692. Overheads

were:

a) Over-absorbed by N$2 152

b) Over-absorbed by N$4 058

c) Under-absorbed by N$4 058

d) Under-absorbed by N$2 152

Questions 1.9 and 1.10 are based on the following information:

Bushbuck Ltd supplied the following figures regarding the number of units produced during the past six

months together with the corresponding production cost:

Production units Production cost (N$)

2 000

64 500

1000

60 000

3 000

68 000

2 000

65 000

4000

72000

5 000

75 000

1.9 According to the high-low method of separating fixed and variable costs, the variable cost rate is:

a) N$1.75

b) N$4.75

c) N$2.75

d) N$3.75

1.10 According to the high-low method of separating fixed and variable costs, the fixed cost is:

a) N$56 250

b) N$42 250

c) N$37 500

d) N$47 500

2

|

4 Page 4 |

▲back to top |

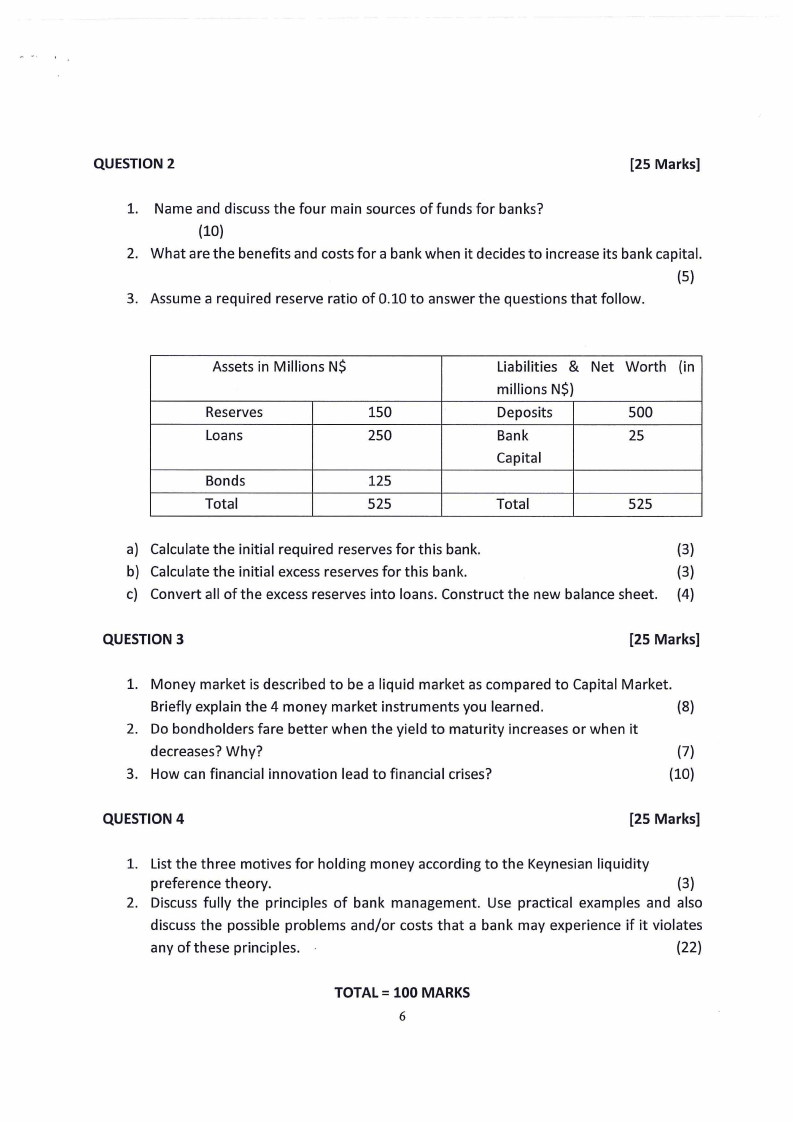

QUESTION 2

[25 MARKS]

Plastic PackagingLimited manufactures and sells plastic containers used in the pharmaceutical industry in

Namibia. The factory where production takes place is comprised oftwo production departments (Cutting

and Shaping), and two service departments -(Service A and Service B). The information provided below

has been extracted from the company's budget for the next financial year, which ends on 31 March 2025:

Allocated overhead cost

Cutting Department

Shaping Department

Service department A

Service department B

N$

140 000

160 000

35 000

28000

Other Production Overheads

Factory rent

Factory building insurance

Plant and machinery insurance

Plant and machinery depreciation

Canteen subsidy

N$

5 250 000

700 000

390 000

585 000

1500 000

The following information is also provided:

Production Departments

Cutting

Shaping

Floor area (m2)

18 000

12 000

Value of Plant and Machinery (N$)

3 000 000

500 000

Number of requisitions

1000

500

Maintenance hours

2 700

2 000

Number of employees

34

60

Machine hours

12 000

2 200

Labour hours

Additional information:

9 000

15 000

Service Departments

Service A

Service B

3 000

2 000

250 000

150 000

300

4

2

• Secondary allocation should be done on the following bases:

Service department A - number of requisitions.

Service department B - maintenance hours.

• Calculation ofthe Predetermined/Absorption rate should be done on the following bases:

Cutting department- machine hours

Shaping department - labour hours

REQUIRED: (Work with whole numbers for allocation and re-apportionment)

MARKS

Perform the primary overhead apportionment showing the allocation of each 15

a)

overhead item. Indicate the basis of apportionment for each overhead.

Using the step method, re-apportion the service department costs and calculate the 10

b)

overhead absorption rate for each production department to the nearest dollar.

3

|

5 Page 5 |

▲back to top |

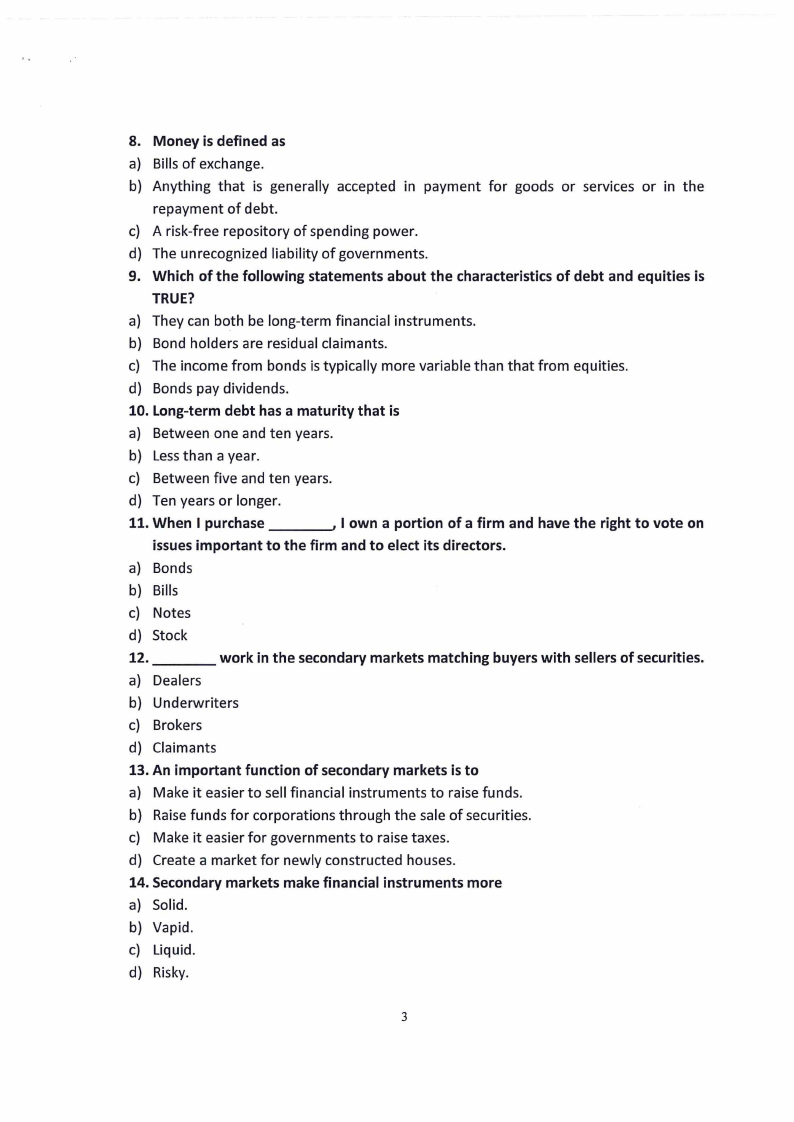

QUESTION 3

[25 MARKS]

The timesheet of employee Danielle shows that she worked 44 hours during a 40-hour workweek. The

normal overtime remuneration {1½ x normal wage) is paid. Her normal wage is N$6 per hour. Medical aid

and pension fund contributions (3% and 5% of normal wages respectively) are paid on an equal basis by

employer and employee. PAYE{12% of taxable income) is the only other deduction being made.

REQUIRED: (Work with whole numbers for all your calculations)

MARKS

a) Calculate the net earnings of employee Danielle for the week.

8

Assuming that a year consists of 52 working weeks, that Danielle gets 3 weeks of holiday leave per year,

and that the enterprise is closed for eight (8) public holidays during the year. Normal idle time is

budgeted as 7½% and a holiday bonus equal to 3 weeks' wages is paid.

b) Determine the total annual labour cost to the nearest dollar

6

c) Calculate the annual productive labour hours to the nearest whole number

7

Define the Labour Recovery Rate and determine the labour tariff per hour for

4

d)

employee Danielle to the nearest dollar.

QUESTION 4

[30 MARKS]

FG is a public sector organisation using an incremental budgeting approach and is preparing its cash

budgets for January, February, and March. Budgeted data is as follows:

November December January February March

Sales (units)

750

800

800

850

900

Production (units)

800

800

850

. 900

950

The selling price per unit is N$200. The purchase price per kg of raw material is N$25. Each unit of

finished product requires 2kgs of raw materials which are purchased on credit in the month before they

are used in production. Suppliers of raw materials are paid one month after purchase. All sales are on

credit. 80% of customers, by sales value, pay one month after sale and the remainder pay two months

after sale. The fixed overheads (N$80,000 per month) are paid in the month in which they are incurred.

Machinery costing N$100, 000 will be delivered in February and paid for in March. The opening cash

balance on 1 January is estimated to be N$15,000.

REQUIRED:

MARKS

Prepare a cash budget for each of the three months January, February, and March.

30

END OF EXAMINATION QUESTION PAPER

4

|

6 Page 6 |

▲back to top |