|

MAB611S-MONEY AND BANKING-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: O7BEC0

LEVEL: 7

COURSE CODE: MAB611S

COURSE NAME: MONEY AND BANKING

SESSION: JULY2022

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

SECONDOPPORTUNITYEXAMINATION QUESTION PAPER

EXAMINER(S) Mr Eslon Ngeendepi

Mr Makaisapi Tjiumbirua

MODERATOR: Mr Eden Shipanga

INSTRUCTIONS

1. Answer ALL the questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLEMATERIALS

1. Pens/pencils/ erasers

2. Calculator

3. Ruler

THIS QUESTION PAPER CONSISTS OF 6 PAGES {Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 Marks]

Select the letter that best represents your choice.

1. Currency includes

a) Paper money and coins.

b) Paper money, coins, and checks.

c) Paper money and checks.

d) Paper money, coins, checks, and savings deposits.

2. Poorly performing financial markets can be the cause of

a) Wealth.

b) Poverty.

c) Financial stability.

d) Financial expansion.

3. High interest rates might ____

purchasing a house or car but at the same time

high interest rates might ____

saving.

a) Discourage; encourage

b) Discourage; discourage

c) Encourage; encourage

d) Encourage; discourage

4. Stock prices are

a) Relatively stable trending upward at a steady pace.

b) Relatively stable trending downward at a moderate rate.

c) Extremely volatile.

d) Unstable trending downward at a moderate rate.

5. Financial institutions search for ____

has resulted in many financial

innovations.

a) Higher profits

b) Regulations

c) Respect

d) Higher risk

6. Which of the following is NOT a financial institution?

a) A life insurance company

b) A pension fund

c) A credit union

d) A business college

7. The delivery of financial services electronically is called

a) E-business.

b) E-commerce.

c) E-finance.

d) E-possible.

2

|

3 Page 3 |

▲back to top |

8. Money is defined as

a) Bills of exchange.

b) Anything that is generally accepted in payment for goods or services or in the

repayment of debt.

c) A risk-free repository of spending power.

d) The unrecognized liability of governments.

9. Which of the following statements about the characteristics of debt and equities is

TRUE?

a) They can both be long-term financial instruments.

b) Bond holders are residual claimants.

c) The income from bonds is typically more variable than that from equities.

d) Bonds pay dividends.

10. Long-term debt has a maturity that is

a) Between one and ten years.

b) Lessthan a year.

c) Between five and ten years.

d) Ten years or longer.

11. When I purchase ___

_, I own a portion of a firm and have the right to vote on

issuesimportant to the firm and to elect its directors.

a) Bonds

b) Bills

c) Notes

d) Stock

12. ____

work in the secondary markets matching buyers with sellers of securities.

a) Dealers

b) Underwriters

c) Brokers

d) Claimants

13. An important function of secondary markets is to

a) Make it easier to sell financial instruments to raise funds.

b) Raisefunds for corporations through the sale of securities.

c) Make it easier for governments to raise taxes.

d) Create a market for newly constructed houses.

14. Secondary markets make financial instruments more

a) Solid.

b) Vapid.

c) Liquid.

d) Risky.

3

|

4 Page 4 |

▲back to top |

15. A financial market in which only short-term debt instruments are traded is called the

----

a) Bond

market.

b) Money

c) Capital

d) Stock

16. Equity and debt instruments with maturities greater than one year are called

----

market instruments.

a) Capital

b) Money

c) Federal

d) Benchmark

17. If bad credit risks are the ones who most actively seek loans and, therefore, receive

them from financial intermediaries, then financial intermediaries face the problem

of

a) Moral hazard.

b) Adverse selection.

c) Free-riding.

d) Costly state verification.

18. An example of the problem of ____

is when a corporation uses the funds raised

from selling bonds to fund corporate expansion to pay for Caribbean cruises for all

of its employees and their families.

a) Adverse selection

b) Moral hazard

c) Risk sharing

d) Credit risk

19. Financial intermediaries have developed expertise in monitoring the parties they

lend to, thus reducing losses due to

a) Moral hazard.

b) Adverse selection.

c) Free-riding.

d) Economies of scope.

20. What is the present value of $500.00 to be paid in two years if the interest rate is 5

percent?

a) $453.51

b) $500.00

c) $476.25

d) $550.00

4

|

5 Page 5 |

▲back to top |

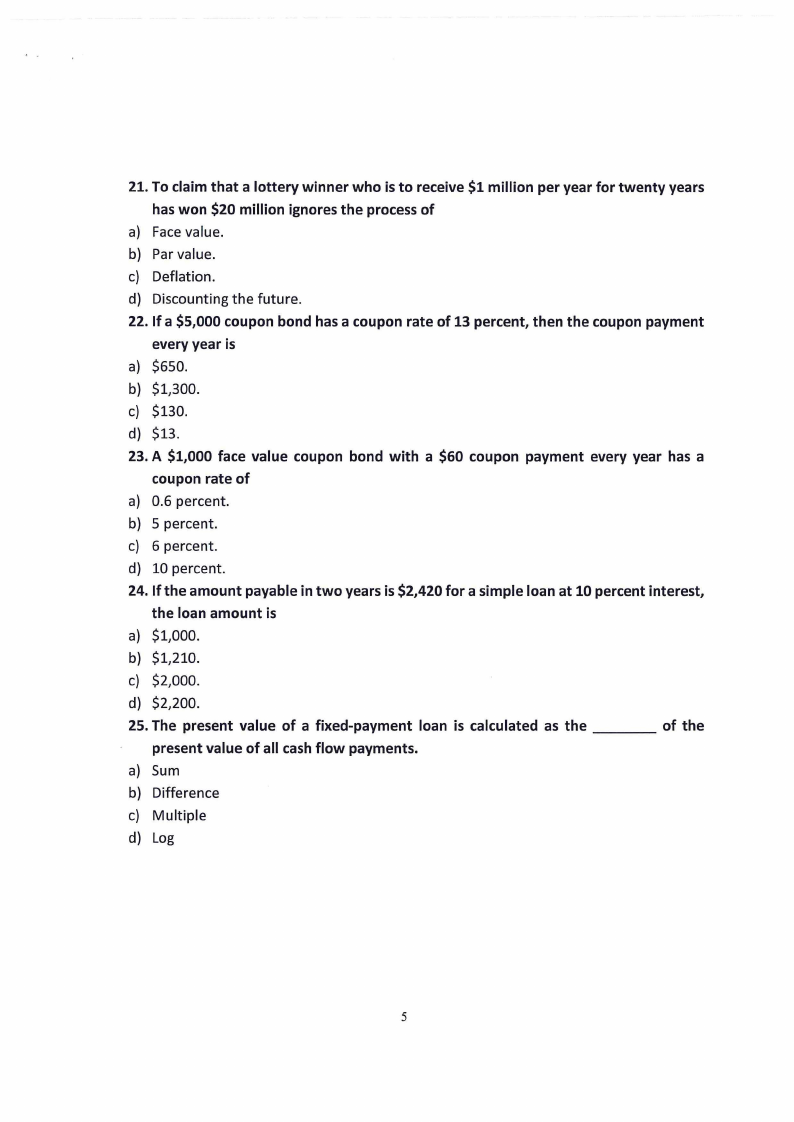

21. To claim that a lottery winner who is to receive $1 million per year for twenty years

has won $20 million ignores the process of

a} Face value.

b} Par value.

c} Deflation.

d} Discounting the future.

22. If a $5,000 coupon bond has a coupon rate of 13 percent, then the coupon payment

every year is

a} $650.

b} $1,300.

c} $130.

d} $13.

23. A $1,000 face value coupon bond with a $60 coupon payment every year has a

coupon rate of

a} 0.6 percent.

b} 5 percent.

c} 6 percent.

d} 10 percent.

24. If the amount payable in two years is $2,420 for a simple loan at 10 percent interest,

the loan amount is

a} $1,000.

b} $1,210.

c} $2,000.

d} $2,200.

25. The present value of a fixed-payment loan is calculated as the ____

of the

present value of all cash flow payments.

a} Sum

b} Difference

c} Multiple

d} Log

5

|

6 Page 6 |

▲back to top |

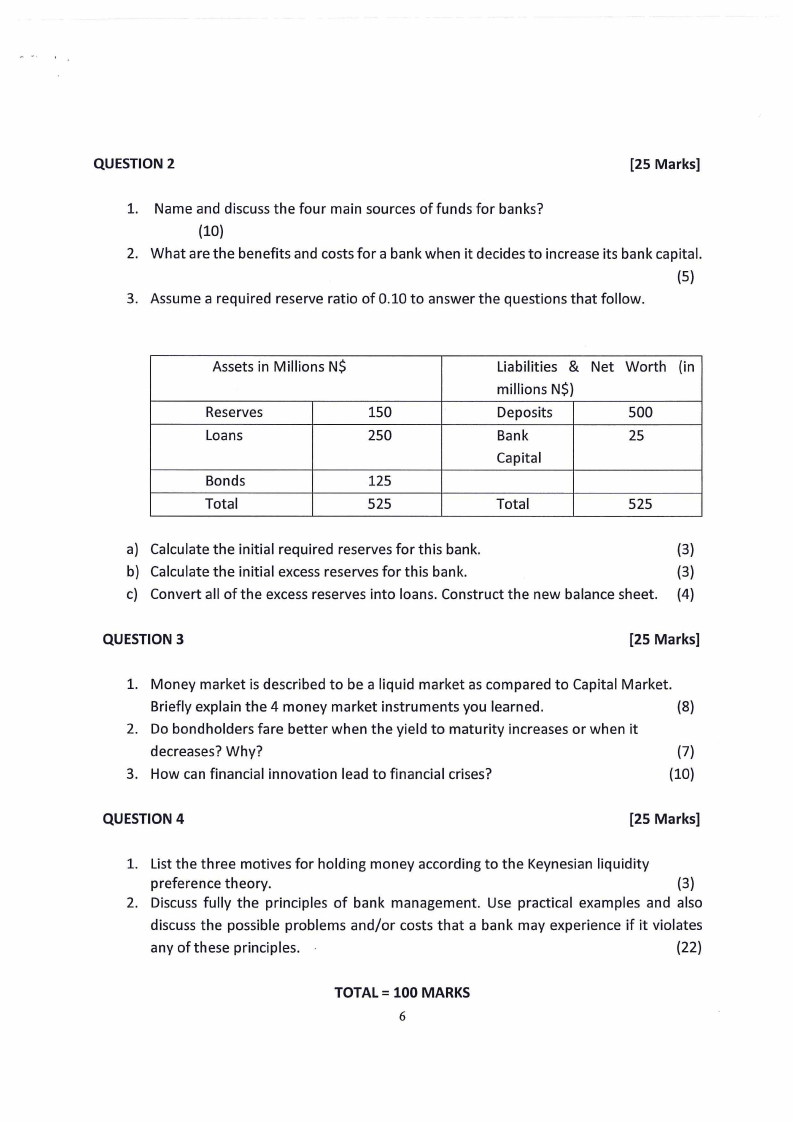

QUESTION 2

[25 Marks]

1. Name and discuss the four main sources of funds for banks?

{10}

2. What are the benefits and costs for a bank when it decides to increase its bank capital.

{5}

3. Assume a required reserve ratio of 0.10 to answer the questions that follow.

Assets in Millions N$

Reserves

150

Loans

250

Bonds

125

Total

525

Liabilities & Net Worth (in

millions N$}

Deposits

500

Bank

25

Capital

Total

525

a} Calculate the initial required reserves for this bank.

{3}

b} Calculate the initial excess reserves for this bank.

{3}

c} Convert all of the excess reserves into loans. Construct the new balance sheet. (4)

QUESTION 3

[25 Marks]

1. Money market is described to be a liquid market as compared to Capital Market.

Briefly explain the 4 money market instruments you learned.

{8}

2. Do bondholders fare better when the yield to maturity increases or when it

decreases? Why?

(7)

3. How can financial innovation lead to financial crises?

(10}

QUESTION 4

[25 Marks]

1. List the three motives for holding money according to the Keynesian liquidity

preference theory.

{3}

2. Discuss fully the principles of bank management. Use practical examples and also

discuss the possible problems and/or costs that a bank may experience if it violates

any of these principles.

{22}

TOTAL= 100 MARKS

6