|

FAR811S-ADVANCED FINANCIAL ACC AND REPORTING-1ST OPP-JUNE 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA un1VERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING HONOURS

QUALIFICATION CODE: 08 BOAH

COURSE CODE: FAR811S

SESSION: June 2022

LEVEL: 8

COURSE NAME: ADVANCEDFINANCIALACCOUNTING

AND REPORTING

PAPER: THEORYAND CALCULATIONS

DURATION: 3 hours

MARKS: 100

EXAMINER(S)

FINAL ASSESSMENT-1 st Opportunity

D W Kamotho

MODERATOR: Dr E Mashiri

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only.

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. No programmable calculators are allowed.

5. Questions relating to the paper may be raised in the initial 30

minutes after the start of the paper. Thereafter, candidates must use

their initiative to deal with any perceived error or ambiguities & any

assumption made by the candidate should be clearly stated.

6. Any resemblance to any people, places, organisations or anything is

purely coincidental.

THIS QUESTION PAPER CONSISTS OF 8 PAGES (Including the front page)

1

|

2 Page 2 |

▲back to top |

QUESTION 1

(15 marks)

Shimo Ltd is a wholly owned subsidiary of Litho Ltd. Shimo Ltd commenced with the

construction of a qualifying asset on 1 July 2021 and on this date obtained a loan of N$ 1 500

000 at 15% interest per annum from Citizen Bank, specifically for constructing the qualifying

asset.

Litho Ltd finances capital expenditure with a general-purpose loan of N$2 0000 000 from

County Bank at 14% per annum. Rhyne Ltd lends money to its subsidiaries for capital

expenditure in excess of original loans granted, at a rate of 16% per annum.

The average accumulated expenditure incurred on the qualifying asset for the six-month

period ended 31 December 2021 amounted to N$1 900 000. Construction activities are

expected to be completed during the 2023 financial year.

Ignore taxation.

YOU ARE REQUIRED TO:

MARKS

a

Calculate and journalise the amount of borrowing costs to be capitalized by

Shimo Ltd for the year ended 31 December 2021, in accordance with

7

International Financial Reporting Standards {IFRS)

b

Calculate the amount of borrowing costs to be capitalized in the consolidated

financial statements of the Litho Ltd Group for the year ended 31 December

2021 and prepare the Consolidation journal entries in respect of borrowing

8

costs of the Litho Ltd Group on 31 December 2021. your answer must comply

with International Financial Reporting Standards (IFRS).

TOTAL MARKS: QUESTION 1

(15)

2

|

3 Page 3 |

▲back to top |

QUESTION 2

(40 Marks)

(a)

IFRS15 Revenue from Contracts with Customers provides detailed and consistent guidance

regarding revenue recognition. IFRS15 sets out a five-step model, which applies to revenue

earned from a contract with a customer with limited exceptions, regardless of the type of

revenue transaction or the industry. Step one in the five-step model requires the

identification of the contract with the customer and is critical for the purpose of applying the

Standard. The remaining four steps in the Standard's revenue recognition model are

irrelevant if the contract does not fall within the scope of IFRS15.

Required

(a) (i) Discuss the criteria which must be met for a contract with a customer to fall within the

scope of IFRS15. (10 marks)

(ii) Discussthe four remaining steps which lead to revenue recognition after a contract has

been identified as falling within the scope of IFRS15. (10 marks)

(b)

(i) Tang enters into a contract with a customer to sell an existing printing machine such that

control of the printing machine vests with the customer in two years' time. The contract has

two payment options. The customer can pay N$240,000 when the contract is signed or

N$300,000 in two years' time when the customer gains control of the printing machine. The

interest rate implicit in the contract is 11.8% in order to adjust for the risk involved in the

delay in payment. However, Tang's incremental borrowing rate is 5%. The customer paid

N$240,000 on 1 December 2020 when the contract was signed. (7 marks)

(ii) Tang enters into a contract on 1 December 2020 to construct a printing machine on a

customer's premises for a promised consideration of N$1,500,000 with a bonus of N$100,000

ifthe machine is completed within 24 months. At the inception ofthe contract, Tang correctly

accounts for the promised bundle of goods and services as a single performance obligation in

accordance with IFRS 15. At the inception of the contract, Tang expects the costs to be

N$800,000 and concludes that it is highly probable that a significant reversal in the amount

of cumulative revenue recognised will occur. Completion of the printing machine is highly

susceptible to factors outside of Tang's influence, mainly issues with the supply of

components.

At 30 November 2021, Tang has satisfied 65% of its performance obligation on the basis of

costs incurred to date and concludes that the variable consideration is still constrained in

accordance with IFRS15. However, on 4 December 2021, the contract is modified with the

result that the fixed consideration and expected costs increase by N$110,000 and N$60,000

respectively. The time allowable for achieving the bonus is extended by six months with the

result that Tang concludes that it is highly probable that the bonus will be achieved and that

the contract still remains a single performance obligation. Tang has an accounting year end

of 30 November. (13 marks)

3

|

4 Page 4 |

▲back to top |

YOU ARE REQUIRED TO:

MARKS

a. (i) Discuss the criteria which must be met for a contract with a customer to

10

fall within the scope of IFRS15.

(ii) Discuss the four remaining steps which lead to revenue recognition after

a contract has been identified as falling within the scope of IFRS15.

10

b. Discusshow the above two contracts should be accounted for under IFRS15.

{In the case of (b)(i), the discussion should include the accounting treatment

20

up to 30 November 2022 and in the case of (b)(ii), the accounting treatment

up to 4 December 2021.)

Note. The mark allocation is shown against each of the items above.

TOTAL MARKS: QUESTION 2

(40}

4

|

5 Page 5 |

▲back to top |

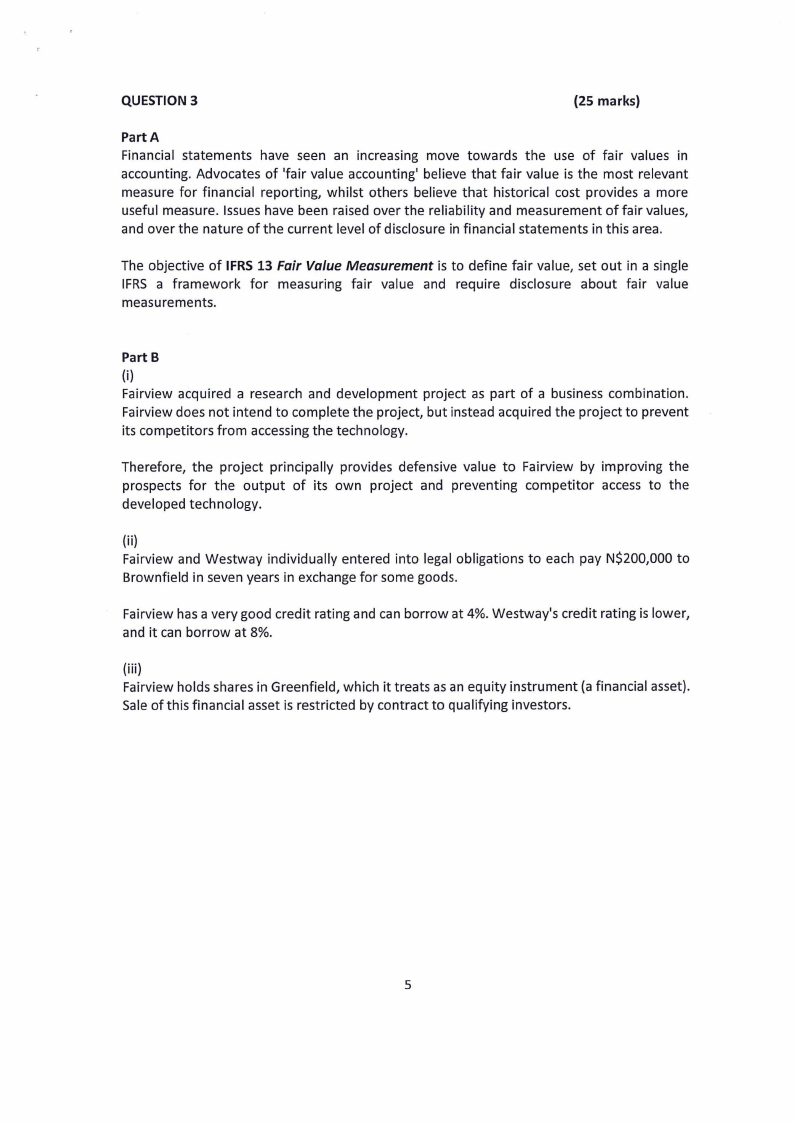

QUESTION 3

(25 marks)

Part A

Financial statements have seen an increasing move towards the use of fair values in

accounting. Advocates of 'fair value accounting' believe that fair value is the most relevant

measure for financial reporting, whilst others believe that historical cost provides a more

useful measure. Issues have been raised over the reliability and measurement of fair values,

and over the nature of the current level of disclosure in financial statements in this area.

The objective of IFRS 13 Fair Value Measurement is to define fair value, set out in a single

IFRS a framework for measuring fair value and require disclosure about fair value

measurements.

Part B

(i)

Fairview acquired a research and development project as part of a business combination.

Fairview does not intend to complete the project, but instead acquired the project to prevent

its competitors from accessing the technology.

Therefore, the project principally provides defensive value to Fairview by improving the

prospects for the output of its own project and preventing competitor access to the

developed technology.

(ii)

Fairview and Westway individually entered into legal obligations to each pay N$200,000 to

Brownfield in seven years in exchange for some goods.

Fairview has a very good credit rating and can borrow at 4%. Westway's credit rating is lower,

and it can borrow at 8%.

(iii)

Fairview holds shares in Greenfield, which it treats as an equity instrument (a financial asset).

Sale of this financial asset is restricted by contract to qualifying investors.

5

|

6 Page 6 |

▲back to top |

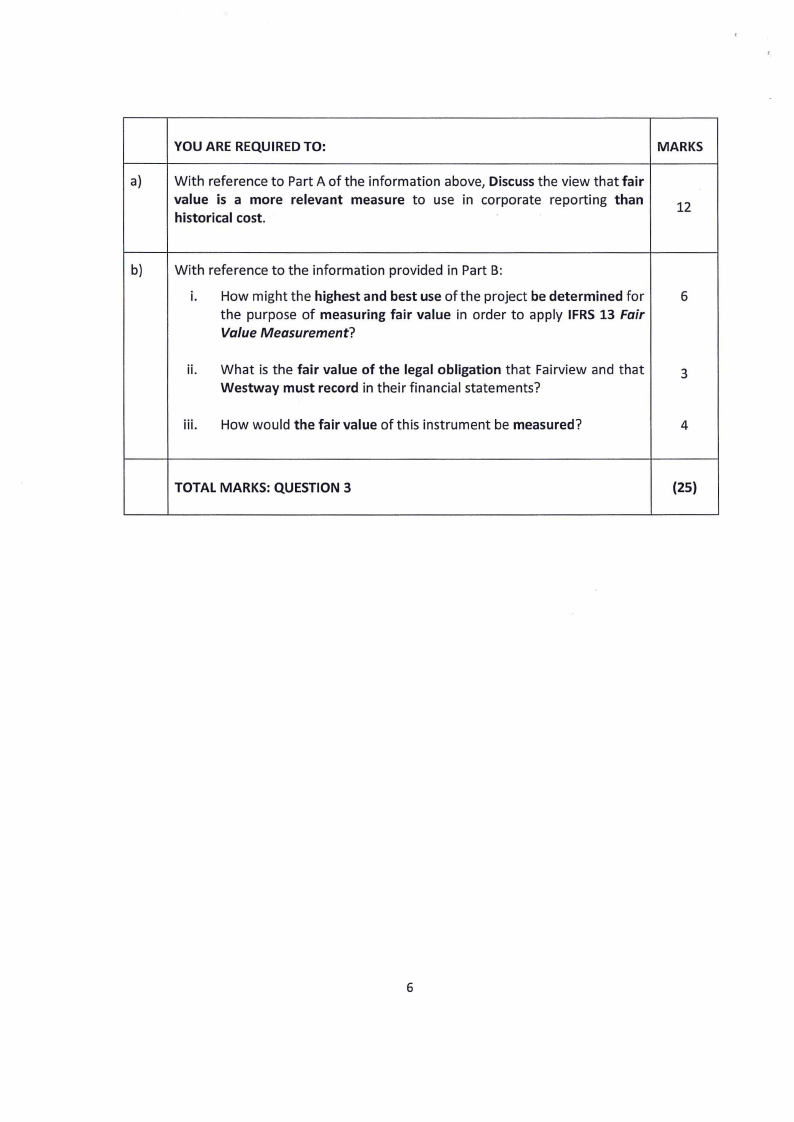

YOU ARE REQUIRED TO:

MARKS

a) With reference to Part A of the information above, Discussthe view that fair

value is a more relevant measure to use in corporate reporting than

12

historical cost.

b) With reference to the information provided in Part B:

i. How might the highest and best use of the project be determined for

6

the purpose of measuring fair value in order to apply IFRS 13 Fair

Value Measurement?

ii. What is the fair value of the legal obligation that Fairview and that

3

Westway must record in their financial statements?

iii. How would the fair value of this instrument be measured?

4

TOTAL MARKS: QUESTION 3

(25)

6

|

7 Page 7 |

▲back to top |

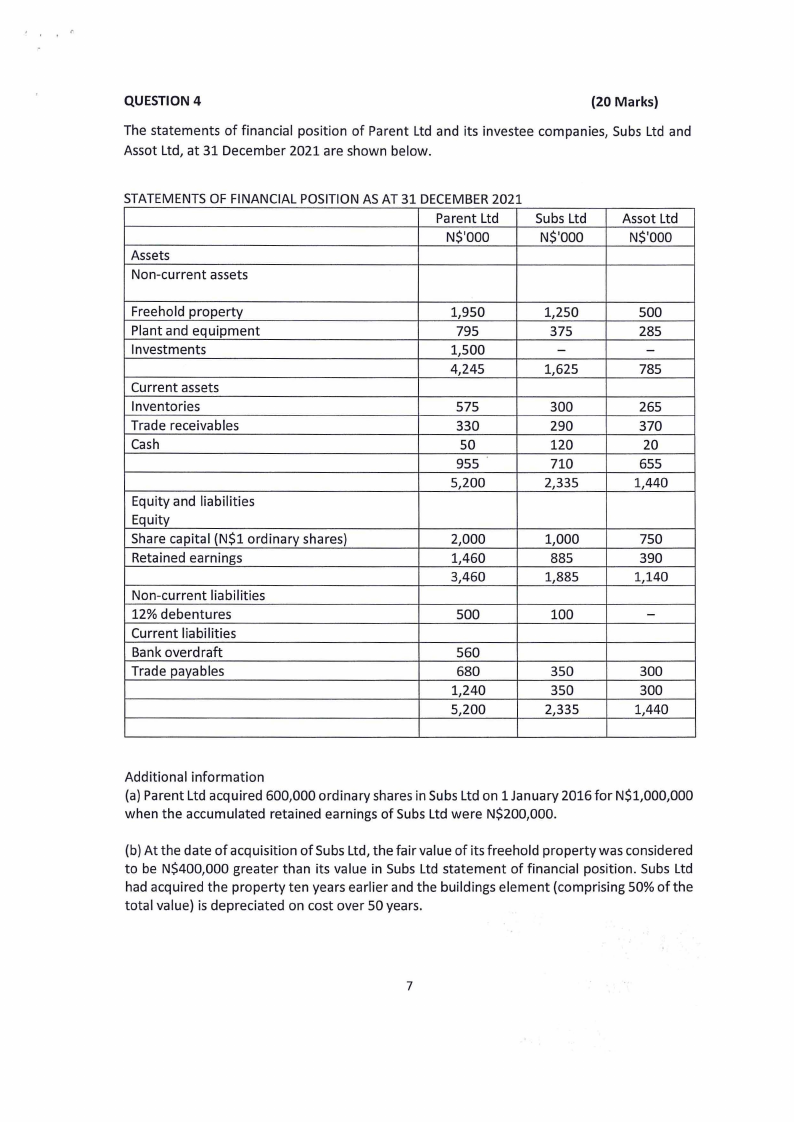

QUESTION 4

(20 Marks)

The statements of financial position of Parent Ltd and its investee companies, Subs Ltd and

Assot Ltd, at 31 December 2021 are shown below.

STATEMENTSOF FINANCIALPOSITIONASAT 31 DECEMBER2021

Parent Ltd

N$'000

Assets

Non-current assets

Subs Ltd

N$'000

Freehold property

Plant and equipment

Investments

Current assets

Inventories

Trade receivables

Cash

Equity and liabilities

Equity

Share capital (N$1 ordinary shares)

Retained earnings

Non-current liabilities

12% debentures

Current liabilities

Bank overdraft

Trade payables

1,950

795

1,500

4,245

575

330

so

955

5,200

2,000

1,460

3,460

500

560

680

1,240

5,200

1,250

375

-

1,625

300

290

120

710

2,335

1,000

885

1,885

100

350

350

2,335

Assot Ltd

N$'000

500

285

-

785

265

370

20

655

1,440

750

390

1,140

-

300

300

1,440

Additional information

(a) Parent Ltd acquired 600,000 ordinary shares in Subs Ltd on 1 January 2016 for N$1,000,000

when the accumulated retained earnings of Subs Ltd were N$200,000.

(b) At the date of acquisition of Subs Ltd, the fair value of its freehold property was considered

to be N$400,000 greater than its value in Subs Ltd statement of financial position. Subs Ltd

had acquired the property ten years earlier and the buildings element (comprising 50% of the

total value) is depreciated on cost over 50 years.

7

|

8 Page 8 |

▲back to top |

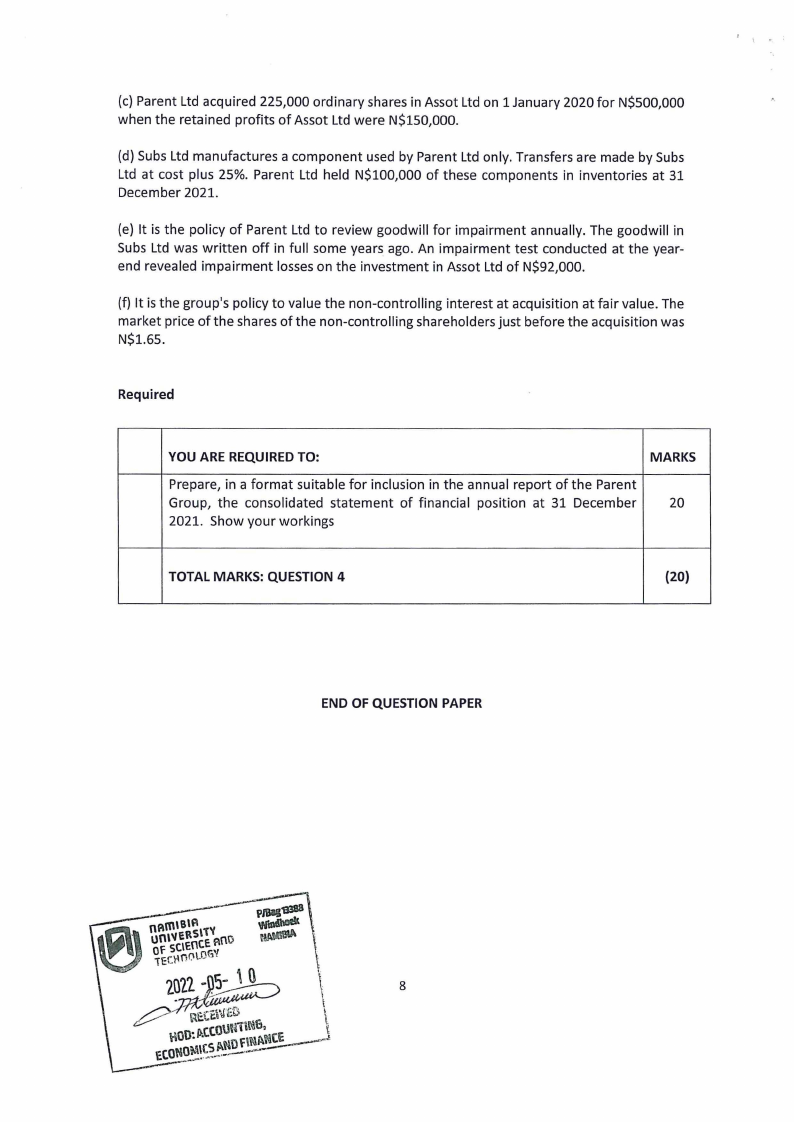

(c} Parent Ltd acquired 225,000 ordinary shares in Assot Ltd on 1 January 2020 for N$S00,000

when the retained profits of Assot Ltd were N$150,000.

(d} Subs Ltd manufactures a component used by Parent Ltd only. Transfers are made by Subs

Ltd at cost plus 25%. Parent Ltd held N$100,000 of these components in inventories at 31

December 2021.

(e} It is the policy of Parent Ltd to review goodwill for impairment annually. The goodwill in

Subs Ltd was written off in full some years ago. An impairment test conducted at the year-

end revealed impairment losses on the investment in Assot Ltd of N$92,000.

(f} It is the group's policy to value the non-controlling interest at acquisition at fair value. The

market price of the shares of the non-controlling shareholders just before the acquisition was

N$1.65.

Required

YOU ARE REQUIRED TO:

MARKS

Prepare, in a format suitable for inclusion in the annual report of the Parent

Group, the consolidated statement of financial position at 31 December

20

2021. Show your workings

TOTAL MARKS: QUESTION 4

{20)

END OF QUESTION PAPER

8