|

IHA520S - INTRODUCTION TO HOSP AND TOURISM ACCOUNTING - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING. ECONOMICS & FINANCE

QUALIFICATIONS: BACHELOR OF HOSPITALITY, BACHELOR OF TOURISM AND

BACHELOR OF NATURE

QUALIFICATION CODE: 07BOH

LEVEL: 5

COURSE: INTRODUCTION TO HOSPITALITY AND COURSE CODE: IHA520S

TOURISM ACCOUNTING

DATE: JANUARY 2020

SESSION: THEORY + APPLICATION

DURATION: 3 HOURS

MARKS: 100

EXAMINER

2ND OPPORTUNITY EXAMINATION QUESTION PAPER

Kuhepa Tjondu

MODERATOR:

Mr. E. Mushonga

INSTRUCTIONS

_ Answer ALL questions in blue or black ink only

. Write clearly and neatly.

. Start each question on a new page and number the answers

clearly.

No programmable calculators are allowed.

Questions relating to the paper may be raised in the initial 30

minutes after the start of the paper. Thereafter, candidates must

use their initiative to deal with any perceived error or ambiguities

& any assumption made by the candidate should be clearly

stated.

_ The names of people and businesses used throughout this exam

paper do not reflect reality and are purely coincidental.

. Show all workings!

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Excluding the front page)

|

2 Page 2 |

▲back to top |

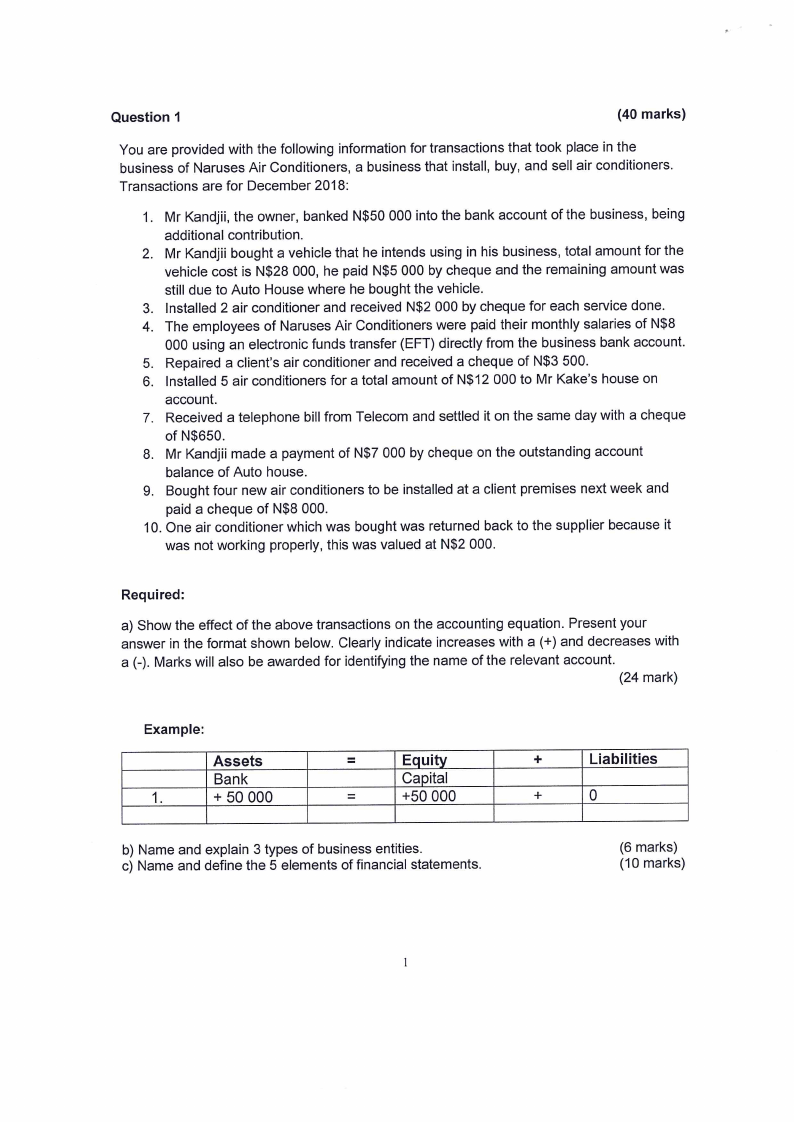

Question 1

(40 marks)

You are provided with the following information for transactions that took place in the

business of Naruses Air Conditioners, a business that install, buy, and sell air conditioners.

Transactions are for December 2018:

1. Mr Kandjii, the owner, banked N$50 000 into the bank account of the business, being

additional contribution.

2. Mr Kandjii bought a vehicle that he intends using in his business, total amount for the

vehicle cost is N$28 000, he paid N$5 000 by cheque and the remaining amount was

still due to Auto House where he bought the vehicle.

3. Installed 2 air conditioner and received N$2 000 by cheque for each service done.

4. The employees of Naruses Air Conditioners were paid their monthly salaries of N$8

000 using an electronic funds transfer (EFT) directly from the business bank account.

5. Repaired a client's air conditioner and received a cheque of N$3 500.

6. Installed 5 air conditioners for a total amount of N$12 000 to Mr Kake’s house on

account.

7. Received a telephone bill from Telecom and settled it on the same day with a cheque

of N$650.

8. Mr Kandjii made a payment of N$7 000 by cheque on the outstanding account

balance of Auto house.

9. Bought four new air conditioners to be installed at a client premises next week and

paid a cheque of N$8 000.

10. One air conditioner which was bought was returned back to the supplier because it

was not working properly, this was valued at N$2 000.

Required:

a) Show the effect of the above transactions on the accounting equation. Present your

answer in the format shown below. Clearly indicate increases with a (+) and decreases with

a (-). Marks will also be awarded for identifying the name of the relevant account.

(24 mark)

Example:

Assets

Bank

1.

+ 50 000

=

Equity

Capital

=

+50 000

+

Liabilities

+

0

b) Name and explain 3 types of business entities.

c) Name and define the 5 elements of financial statements.

(6 marks)

(10 marks)

|

3 Page 3 |

▲back to top |

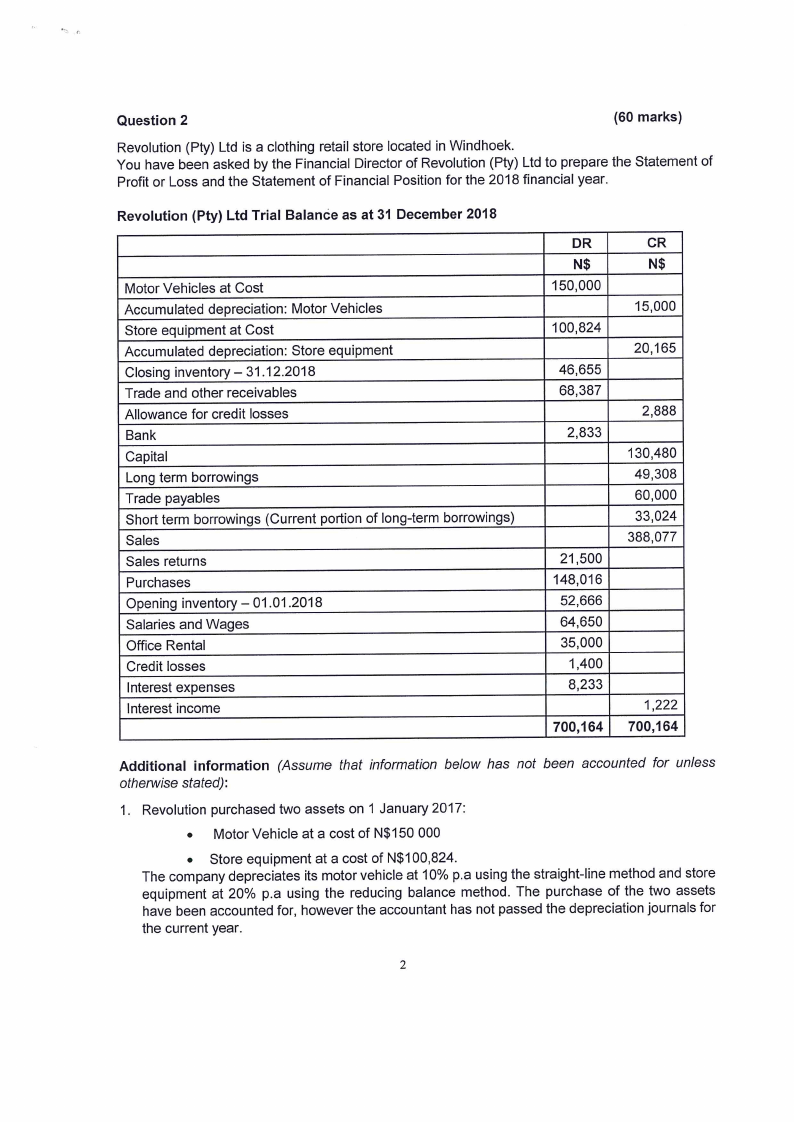

Question 2

(60 marks)

Revolution (Pty) Ltd is a clothing retail store located in Windhoek.

You have been asked by the Financial Director of Revolution (Pty) Ltd to prepare the Statement of

Profit or Loss and the Statement of Financial Position for the 2018 financial year.

Revolution (Pty) Ltd Trial Balance as at 31 December 2018

Motor Vehicles at Cost

Accumulated depreciation: Motor Vehicles

Store equipment at Cost

Accumulated depreciation: Store equipment

Closing inventory— 31.12.2018

Trade and other receivables

Allowance for credit losses

Bank

Capital

Long term borrowings

Trade payables

Short term borrowings (Current portion of long-term borrowings)

Sales

Sales returns

Purchases

Opening inventory — 01.01.2018

Salaries and Wages

Office Rental

Credit losses

Interest expenses

Interest income

DR

N$

150,000

100,824

46,655

68,387

2,833

21,500

148,016

52,666

64,650

35,000

1,400

8,233

700,164}

CR

N$

15,000

20,165

2,888

130,480

49,308

60,000

33,024

388,077

1,222

700,164

Additional information (Assume that information below has not been accounted for unless

otherwise stated):

1. Revolution purchased two assets on 1 January 2017:

e Motor Vehicle at a cost of N$150 000

e Store equipment at a cost of N$100,824.

The company depreciates its motor vehicle at 10% p.a using the straight-line method and store

equipment at 20% p.a using the reducing balance method. The purchase of the two assets

have been accounted for, however the accountant has not passed the depreciation journals for

the current year.

|

4 Page 4 |

▲back to top |

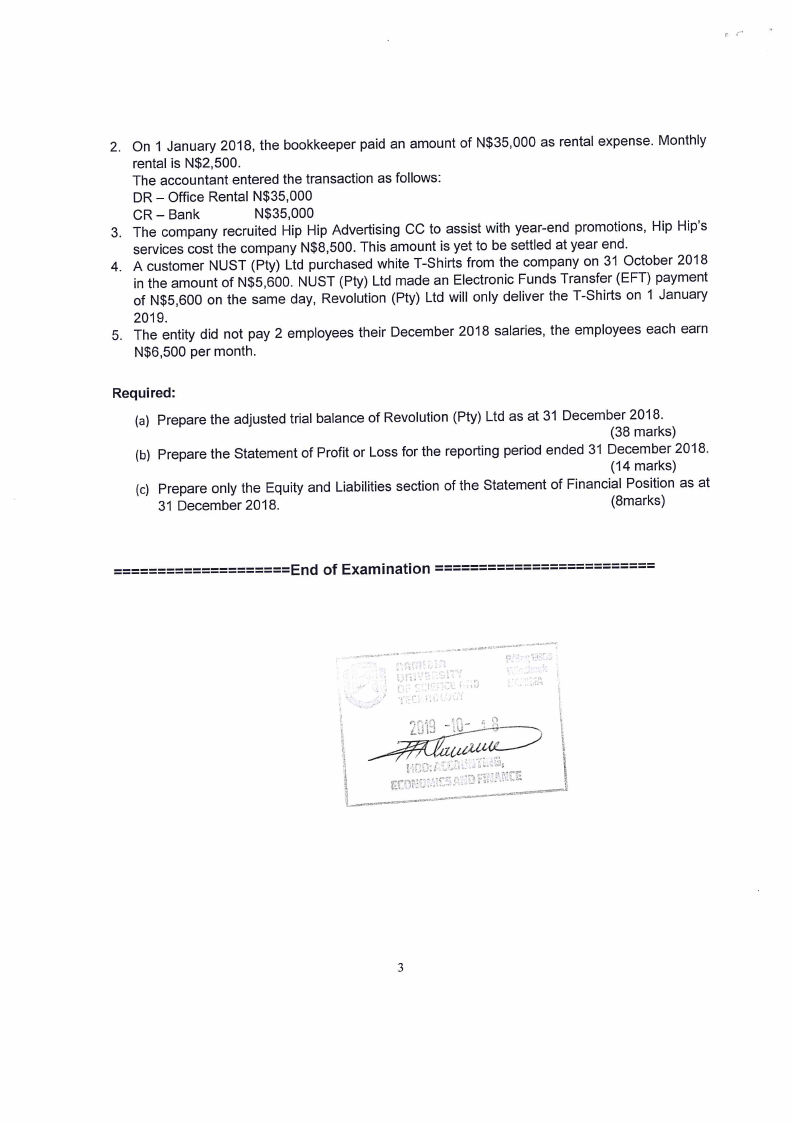

2. On1 January 2018, the bookkeeper paid an amount of N$35,000 as rental expense. Monthly

rental is N$2,500.

The accountant entered the transaction as follows:

DR —- Office Rental N$35,000

CR — Bank

N$35,000

3. The company recruited Hip Hip Advertising CC to assist with year-end promotions, Hip Hip’s

services cost the company N$8,500. This amount is yet to be settled at year end.

4. Acustomer NUST (Pty) Ltd purchased white T-Shirts from the company on 31 October 2018

in the amount of N$5,600. NUST (Pty) Ltd made an Electronic Funds Transfer (EFT) payment

of N$5,600 on the same day, Revolution (Pty) Ltd will only deliver the T-Shirts on 1 January

2019.

5. The entity did not pay 2 employees their December 2018 salaries, the employees each earn

N$6,500 per month.

Required:

(a) Prepare the adjusted trial balance of Revolution (Pty) Ltd as at 31 December 2018.

(38 marks)

(b) Prepare the Statement of Profit or Loss for the reporting period ended 31 December 2018.

(14 marks)

(c) Prepare only the Equity and Liabilities section of the Statement of Financial Position as at

31 December 2018.

(8marks)