|

PMV611S - PRINCIPLES AND METHODS OF VALUATION - 2ND OPP - JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF ENGINEERINGAND THE BUILTENVIRONMENT

DEPARTMENT OF LAND AND SPATIALSCIENCES

QUALIFICATION(S): BACHELOROF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION(S)CODE: 08BOPS

06DIPS

NQF LEVEL:6

COURSECODE: PMV611S

COURSENAME: PRINCIPLESAND METHODS OF

VALUATION

EXAMS SESSION:JULY 2024

PAPER:

THEORY

DURATION: 3 HOURS

MARKS:

100

SECONDOPPORTUNITY/SUPPLEMENTARYEXAMINATION QUESTION PAPER

EXAMINER(S) AMIN ISSA

MODERATOR: SAMUEL ATO K HAYFORD

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. Please STARTEACHQUESTION ON A FRESHPAGE.

4. The question paper contains a total of 4 questions.

5. You must answer ALLQUESTIONS.

6. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLEMATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPERCONSISTSOF 6 PAGES(Including this front page)

|

2 Page 2 |

▲back to top |

Principles and Methods of Valuation

PMV611S

Question 1

For each of the following statements indicate whether it is true or false. Each correct answer carries 1 (one)

mark.

(24)

a) The Residual Method is used to find the value of special purpose properties and the land on which

they are built.

b) The main challenge in the residual method is in estimating the amounts of the many variables that go

into the valuation.

c) The residual method is used for the purpose of finding the residual value of land only and if the land is

bought then it is also used to find the value of the developments on the land.

d) The expected profit in the residual method is calculated from the Cost of Development (CoD).

e) If the land is already owned by the developer, the profit margin and cost of development can then be

easily calculated.

f) Gross development value is the value of the development intended by the developer and is realised by

either sale of the developed properties or the renting out of rooms in an estate or even income

generated by the hotel.

g) The contingencies that are part of the cost of development include, amongst others, industrial action

by the construction workers, floods, sudden increase in construction materials.

h) In the Profits method of valuation the value of the property will be related to the profits which can be

made from their use in as far as the value is derived from the income generated by the business.

i) Both rental and capital values tend to be directly influenced by the potential for profit and in these

circumstances a valuation having regard to the profits achieved is more likely to produce a realistic

valuation than any application of comparison methods.

Second Opportunity Examination Paper

Page2 of 6

July 2024

|

3 Page 3 |

▲back to top |

Principles and Methods of Valuation

PMV611S

j) A prospective purchaser may hold the view that current profits could be improved substantially by

better management, improved financial controls, the incorporation of other sales lines or

improvements to the premises. This is called business acumen.

k) Pump prices and income margins available to both dealer and oil company are prescribed and also the

availability of sites for the construction of petrol stations are restricted and these influence the way

valuations are carried out.

I) When the market is weak and few market transactions are available, the applicability of the sales

comparison approach may not be limited.

m) When undertaking valuation assignments, whether to estimate market value or some other defined

non-market value, the valuer is sometimes required to apply one or more valuation methods or

approaches.

n) The cost approach is based upon the premise that the informed purchaser will not pay more for a

property than the cost of constructing an equally desirable substitute less appreciable depreciation.

o) The suitability of the investment method of valuation depends upon a variety of factors, including the

use of realistic yield, an accurate allowance for outgoings and, in the case of leasehold interests, an

appropriate tax rate.

p) If all sales are comparable to the subject, averaging is done if sales are similar in time or we select the

most recent sale and the one most comparable to the subject to place the most weight on.

q) The comparative analysis of properties and transactions focuses on similarities and differences that

affect value but there are variations found in these similarities and differences.

r) Functional obsolescence is caused by the presence of currently desirable layout, design or other

features, or presence of currently desirable features.

s) The basis of valuation for sale/purchase purposes is the Replacement cost/value while the basis of

valuation for mortgage purpose is the full insurable value.

Second Opportunity Examination Paper

Page3 of 6

July 2024

|

4 Page 4 |

▲back to top |

Principles and Methods of Valuation

PMV611S

t) The cost approach is based upon the premise that the informed purchaser will pay more for a

property than the cost of constructing an equally desirable substitute less appreciable depreciation.

u) Under the Principle of Substitution of the Comparison method of Valuation, a buyer is willing to pay no

more for a property than the cost of acquiring a similar substitute property.

v) In the Income approach, the Capitalization Rate.reflects the market's expected return on investment

for the property type and risk level.

w) The Residual Method is used to find the value of special purpose properties and the land on which

they are built.

x) Both rental and capital values tend to be directly influenced by the potential for profit and in these

circumstances a valuation having regard to the profits achieved is more likely to produce a realistic

valuation than any application of comparison methods.

(24]

Question 2

a) Explain the two (2) principles relating to the investment method of valuation.

(S)

i) Anticipation and change

ii) Supply and Demand

b) Explain the three (3) main purposes for undertaking a residual valuation.

(6)

c) Outline the eight (8) potential sources of data that you would look for when using the comparative

method of valuation.

(4)

d) Under what circumstances would a valuer use the Cost Method of valuation?

(4)

e) Enumerate the steps involved in the The Discounted Cash Flow Technique

(3)

f) Explain the use of the Profits method of valuation.

(4)

(26]

Second Opportunity Examination Paper

Page4of6

July 2024

|

5 Page 5 |

▲back to top |

Principles and Methods of Valuation

PMV611S

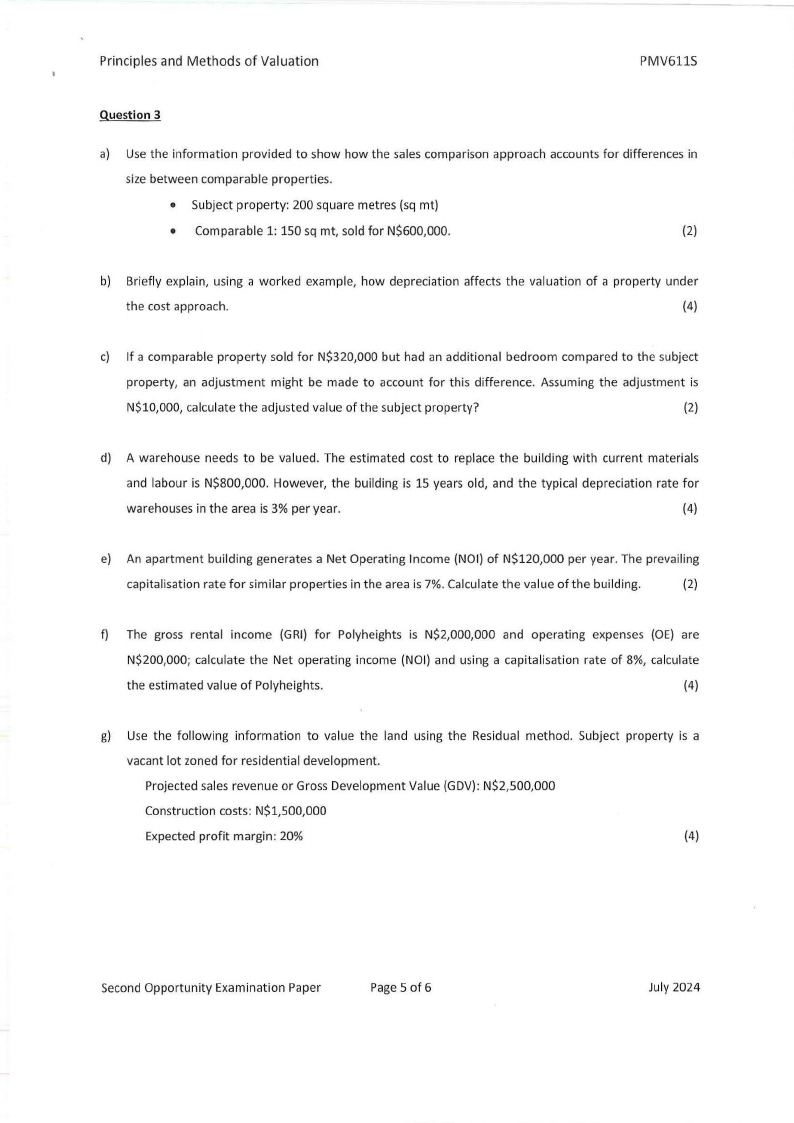

Question 3

a) Use the information provided to show how the sales comparison approach accounts for differences in

size between comparable properties.

• Subject property: 200 square metres (sq mt)

• Comparable 1: 150 sq mt, sold for N$600,000.

(2)

b) Briefly explain, using a worked example, how depreciation affects the valuation of a property under

the cost approach.

(4)

c) If a comparable property sold for N$320,000 but had an additional bedroom compared to the subject

property, an adjustment might be made to account for this difference. Assuming the adjustment is

N$10,000, calculate the adjusted value of the subject property?

(2)

d) A warehouse needs to be valued. The estimated cost to replace the building with current materials

and labour is N$800,000. However, the building is 15 years old, and the typical depreciation rate for

warehouses in the area is 3% per year.

(4)

e) An apartment building generates a Net Operating Income (NOi) of N$120,000 per year. The prevailing

capitalisation rate for similar properties in the area is 7%. Calculate the value of the building.

(2)

f) The gross rental income (GRI) for Polyheights is N$2,000,000 and operating expenses (OE) are

N$200,000; calculate the Net operating income (NOi) and using a capitalisation rate of 8%, calculate

the estimated value of Polyheights.

(4)

g) Use the following information to value the land using the Residual method. Subject property is a

vacant lot zoned for residential development.

Projected sales revenue or Gross Development Value (GOV): N$2,500,000

Construction costs: N$1,500,000

Expected profit margin: 20%

(4)

Second Opportunity Examination Paper

Page5 of 6

July 2024

|

6 Page 6 |

▲back to top |

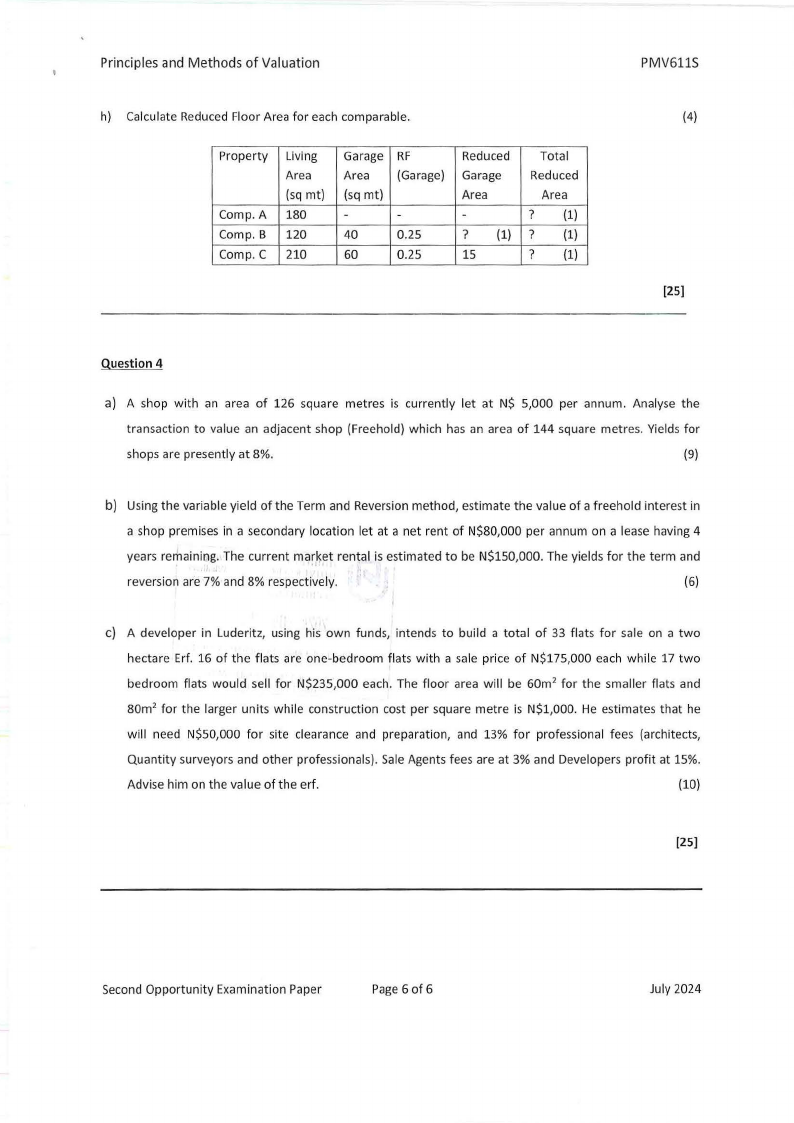

Principles and Methods of Valuation

h) Calculate Reduced Floor Area for each comparable.

Property

Comp. A

Comp. B

Comp. C

Living

Area

(sq mt)

180

120

210

Garage

Area

(sq mt)

-

40

60

RF

(Garage)

-

0.25

0.25

Reduced

Garage

Area

-

? (1)

15

Total

Reduced

Area

? (1)

? (1)

? (1)

PMV611S

(4)

[25]

Question 4

a) A shop with an area of 126 square metres is currently let at N$ 5,000 per annum. Analyse the

transaction to value an adjacent shop (Freehold) which has an area of 144 square metres. Yields for

shops are presently at 8%.

(9)

b) Using the variable yield of the Term and Reversion method, estimate the value of a freehold interest in

a shop premises in a secondary location let at a net rent of N$80,000 per annum on a lease having 4

years remaining. The current ma~_ketrental is estimated to be N$150,000. The yields for the term and

reversion are 7% and 8% respectively.

(6)

c) A developer in Luderitz, using his own funds, intends to build a total of 33 flats for sale on a two

hectare Erf. 16 of the flats are one-bedroom flats with a sale price of N$175,000 each while 17 two

bedroom flats would sell for N$235,000 each. The floor area will be 60m2 for the smaller flats and

80m2 for the larger units while construction cost per square metre is N$1,000. He estimates that he

will need N$50,000 for site clearance and preparation, and 13% for professional fees (architects,

Quantity surveyors and other professionals). Sale Agents fees are at 3% and Developers profit at 15%.

Advise him on the value of the erf.

(10)

[25]

Second Opportunity Examination Paper

Page 6 of 6

July 2024