|

BAC1100-BUSINESS ACCOUNTING-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAm I BIA un IVERS ITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ACCOUNTING, ECONOMICSAND FINANCE

QUALIFICATION:VARIOUS PROGRAMMES

QUALIFICATION CODE: VARIOUS

LEVEL:5

COURSECODE: BACll00

COURSENAME: BUSINESSACCOUNTING 1A

SESSION:JULY 2022

DURATION: 3 HOURS

PAPER:THEORYAND CALCULATIONS

MARKS: 100

SECONDOPPORTUNITYEXAMINATION QUESTIONPAPER

EXAMINERS

Kangala, H., Neliwa, N., Hainghumbi, H., Sheehama, K.G.H., Namwandi, H.

and Odada, L.

MODERATOR Andrew, Y

INSTRUCTIONS

• Answer ALLthe questions in blue or black ink only. STRICTLYNO PENCIL

• Start each question on a new page, number the answers correctly and clearly.

• Show all your workings/calculations and round off only final answers to two decimal

places

• Questions relating to this examination may be raised in the initial 30 minutes after

the start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLEMATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF _6_ PAGES{Excluding this front page)

|

2 Page 2 |

▲back to top |

1

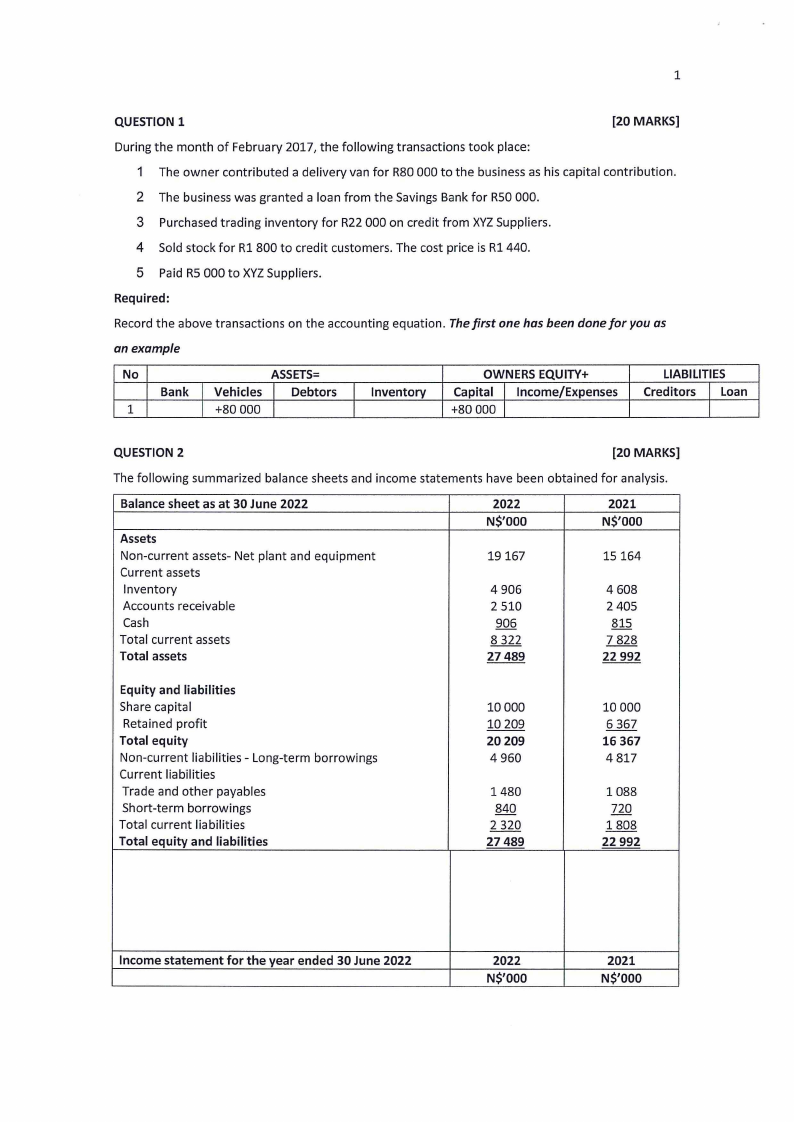

QUESTION 1

[20 MARKS]

During the month of February 2017, the following transactions took place:

1 The owner contributed a delivery van for R80 000 to the business as his capital contribution.

2 The business was granted a loan from the Savings Bank for R50 000.

3 Purchased trading inventory for R22 000 on credit from XYZSuppliers.

4 Sold stock for R1 800 to credit customers. The cost price is R1 440.

5 Paid RS000 to XYZSuppliers.

Required:

Record the above transactions on the accounting equation. Thefirst one has been done for you as

an example

No

ASSETS=

I I I Bank Vehicles

Debtors

Inventory

1

I +80 000 I

I

OWNERS EQUITY+

I Capital Income/Expenses

+80 oooI

LIABILITIES

I Creditors Loan

I

QUESTION 2

[20 MARKS]

The following summarized balance sheets and income statements have been obtained for analysis.

Balance sheet as at 30 June 2022

Assets

Non-current assets- Net plant and equipment

Current assets

Inventory

Accounts receivable

Cash

Total current assets

Total assets

2022

N$'000

19167

4 906

2 510

906

8 322

27489

2021

N$'000

15164

4 608

2 405

815

7 828

22 992

Equity and liabilities

Share capital

Retained profit

Total equity

Non-current liabilities - Long-term borrowings

Current liabilities

Trade and other payables

Short-term borrowings

Total current liabilities

Total equity and liabilities

10000

10 209

20209

4960

1480

840

2 320

27489

10000

6 367

16 367

4 817

1088

720

1808

22 992

Income statement for the year ended 30 June 2022

2022

N$'000

2021

N$'000

|

3 Page 3 |

▲back to top |

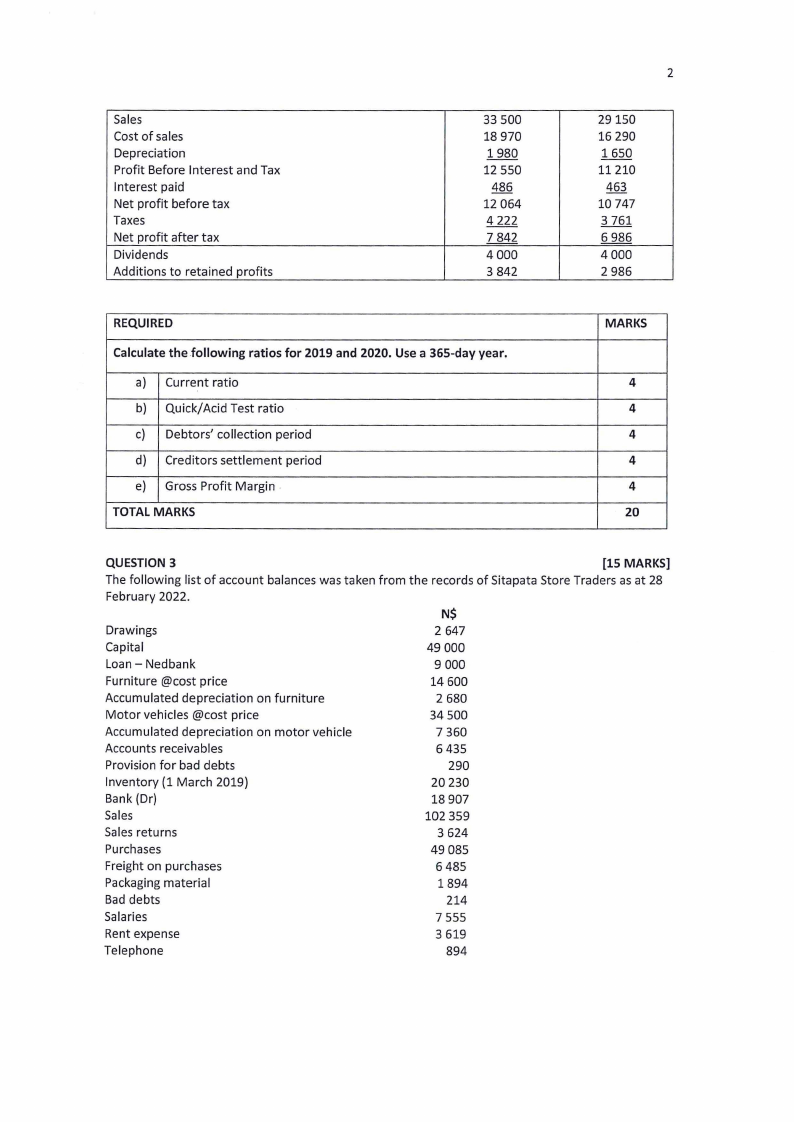

Sales

Cost of sales

Depreciation

Profit Before Interest and Tax

Interest paid

Net profit before tax

Taxes

Net profit after tax

Dividends

Additions to retained profits

33 500

18 970

1980

12 550

486

12 064

4 222

7 842

4000

3 842

2

29150

16 290

1650

11210

463

10 747

3 761

6 986

4000

2 986

REQUIRED

Calculate the following ratios for 2019 and 2020. Use a 365-day year.

a) Current ratio

b) Quick/Acid Test ratio

c) Debtors' collection period

d) Creditors settlement period

e) Gross Profit Margin

TOTAL MARKS

MARKS

4

4

4

4

4

20

QUESTION 3

[15 MARKS]

The following list of account balances was taken from the records of Sitapata Store Traders as at 28

February 2022.

N$

Drawings

2 647

Capital

49 000

Loan- Nedbank

9 000

Furniture @cost price

14600

Accumulated depreciation on furniture

2 680

Motor vehicles @cost price

34500

Accumulated depreciation on motor vehicle

7 360

Accounts receivables

6435

Provision for bad debts

290

Inventory (1 March 2019)

20 230

Bank (Dr)

18907

Sales

102 359

Sales returns

3 624

Purchases

49 085

Freight on purchases

6485

Packaging material

1894

Bad debts

214

Salaries

7 555

Rent expense

3 619

Telephone

894

|

4 Page 4 |

▲back to top |

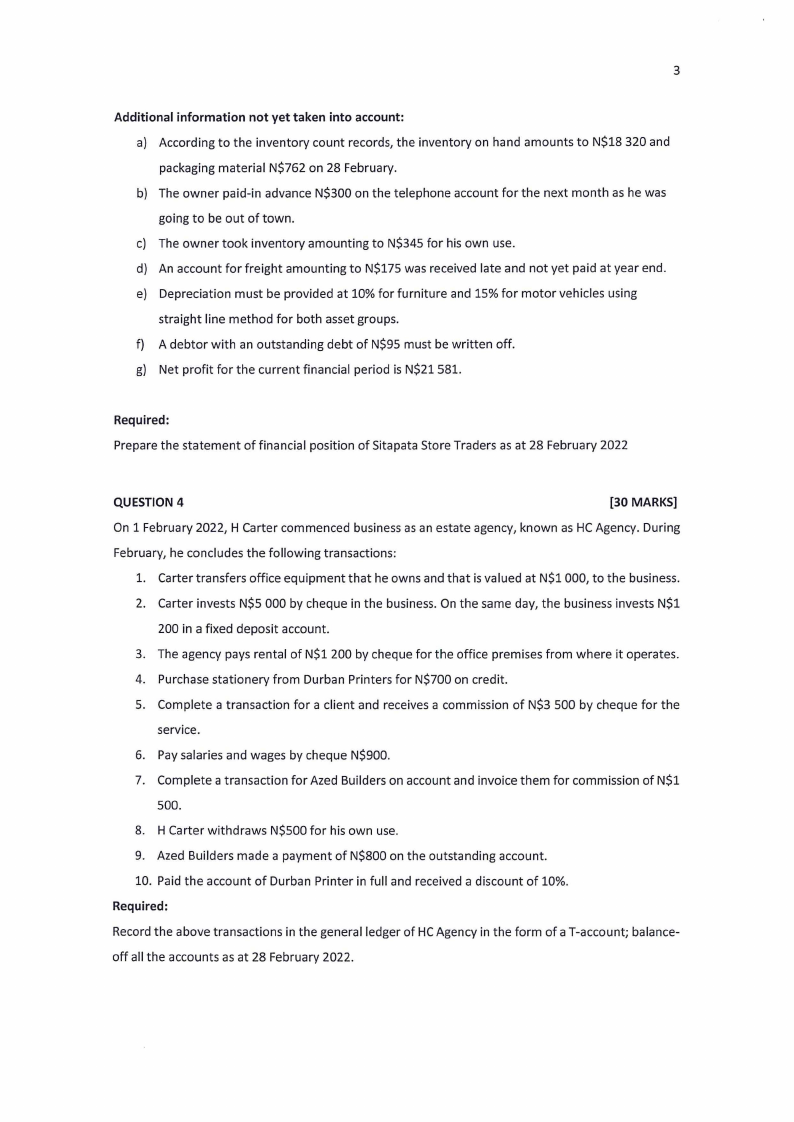

3

Additional information not yet taken into account:

a) According to the inventory count records, the inventory on hand amounts to N$18 320 and

packaging material N$762 on 28 February.

b) The owner paid-in advance N$300 on the telephone account for the next month as he was

going to be out of town.

c) The owner took inventory amounting to N$345 for his own use.

d) An account for freight amounting to N$175 was received late and not yet paid at year end.

e) Depreciation must be provided at 10% for furniture and 15% for motor vehicles using

straight line method for both asset groups.

f) A debtor with an outstanding debt of N$95 must be written off.

g) Net profit for the current financial period is N$21 581.

Required:

Prepare the statement of financial position of Sitapata Store Traders as at 28 February 2022

QUESTION4

[30 MARKS]

On 1 February 2022, H Carter commenced business as an estate agency, known as HCAgency. During

February, he concludes the following transactions:

1. Carter transfers office equipment that he owns and that is valued at N$1 000, to the business.

2. Carter invests N$5 000 by cheque in the business. On the same day, the business invests N$1

200 in a fixed deposit account.

3. The agency pays rental of N$1 200 by cheque for the office premises from where it operates.

4. Purchase stationery from Durban Printers for N$700 on credit.

5. Complete a transaction for a client and receives a commission of N$3 500 by cheque for the

service.

6. Pay salaries and wages by cheque N$900.

7. Complete a transaction for Azed Builders on account and invoice them for commission of N$1

500.

8. H Carter withdraws N$S00 for his own use.

9. Azed Builders made a payment of N$800 on the outstanding account.

10. Paid the account of Durban Printer in full and received a discount of 10%.

Required:

Recordthe above transactions in the general ledger of HCAgency in the form of a T-account; balance-

off all the accounts as at 28 February 2022.

|

5 Page 5 |

▲back to top |

4

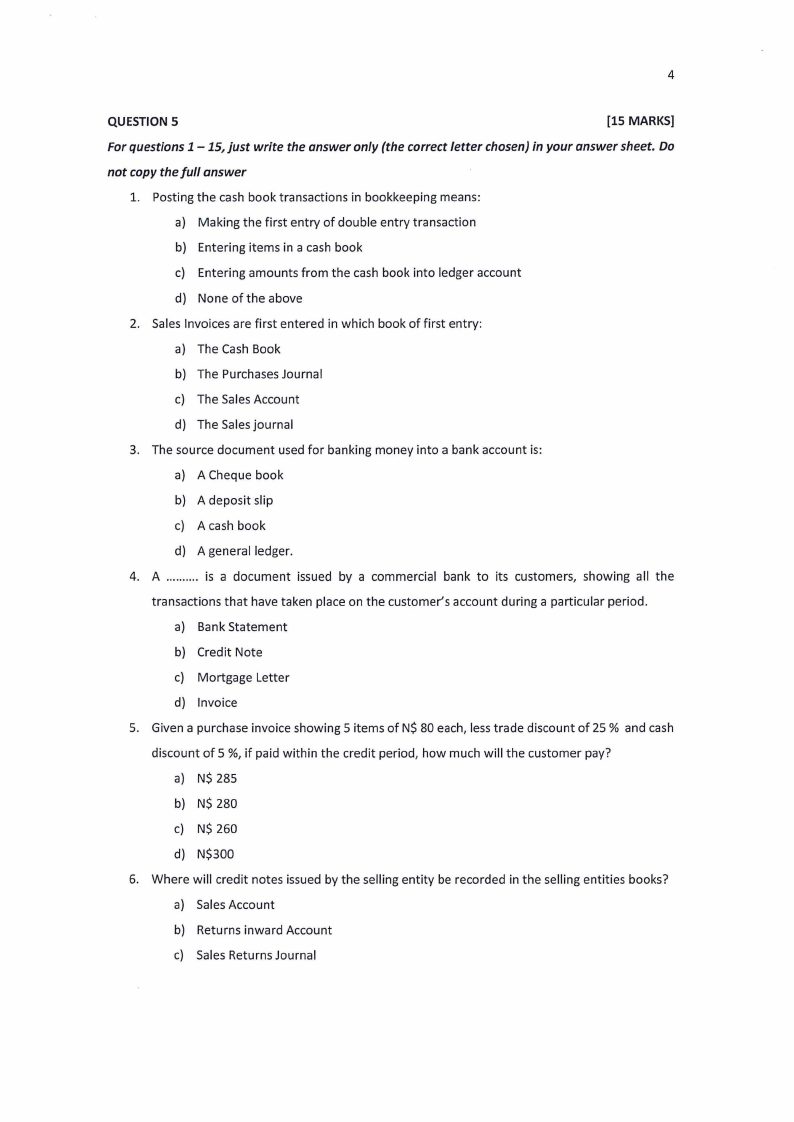

QUESTION 5

[15 MARKS]

Forquestions 1 -15, just write the answer only (the correct letter chosen) in your answer sheet. Do

not copy the full answer

1. Posting the cash book transactions in bookkeeping means:

a) Making the first entry of double entry transaction

b) Entering items in a cash book

c) Entering amounts from the cash book into ledger account

d) None of the above

2. Sales Invoices are first entered in which book of first entry:

a) The Cash Book

b) The Purchases Journal

c) The Sales Account

d) The Salesjournal

3. The source document used for banking money into a bank account is:

a) A Cheque book

b) A deposit slip

c) A cash book

d) A general ledger.

4. A .......... is a document issued by a commercial bank to its customers, showing all the

transactions that have taken place on the customer's account during a particular period.

a) Bank Statement

b) Credit Note

c) Mortgage Letter

d) Invoice

5. Given a purchase invoice showing 5 items of N$ 80 each, less trade discount of 25 % and cash

discount of 5 %, if paid within the credit period, how much will the customer pay?

a) N$ 285

b) N$ 280

c) N$ 260

d) N$300

6. Where will credit notes issued by the selling entity be recorded in the selling entities books?

a) Sales Account

b) Returns inward Account

c) Sales Returns Journal

|

6 Page 6 |

▲back to top |

5

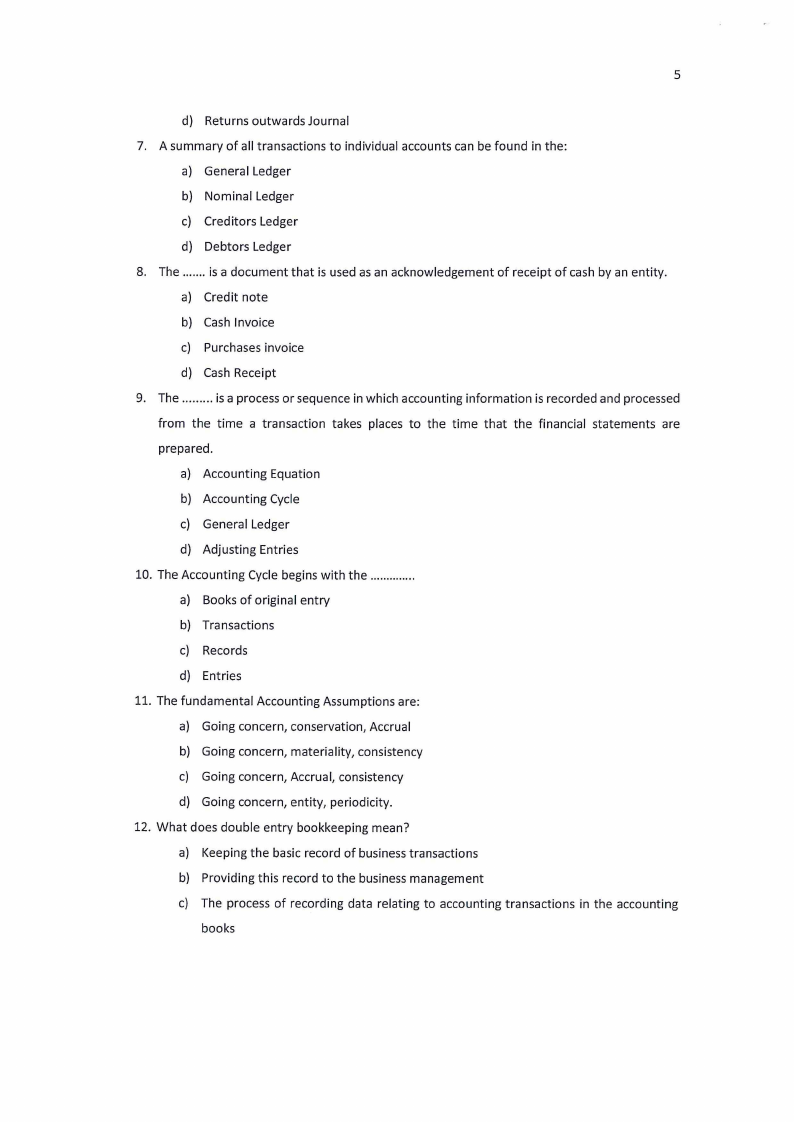

d) Returns outwards Journal

7. A summary of all transactions to individual accounts can be found in the:

a) General Ledger

b) Nominal Ledger

c) Creditors Ledger

d) Debtors Ledger

8. The ....... is a document that is used as an acknowledgement of receipt of cash by an entity.

a) Credit note

b) Cash Invoice

c) Purchases invoice

d) Cash Receipt

9. The ......... is a process or sequence in which accounting information is recorded and processed

from the time a transaction takes places to the time that the financial statements are

prepared.

a) Accounting Equation

b) Accounting Cycle

c) General Ledger

d) Adjusting Entries

10. The Accounting Cycle begins with the .............

a) Books of original entry

b) Transactions

c) Records

d) Entries

11. The fundamental Accounting Assumptions are:

a) Going concern, conservation, Accrual

b) Going concern, materiality, consistency

c) Going concern, Accrual, consistency

d) Going concern, entity, periodicity.

12. What does double entry bookkeeping mean?

a) Keeping the basic record of business transactions

b) Providing this record to the business management

c) The process of recording data relating to accounting transactions in the accounting

books

|

7 Page 7 |

▲back to top |

6

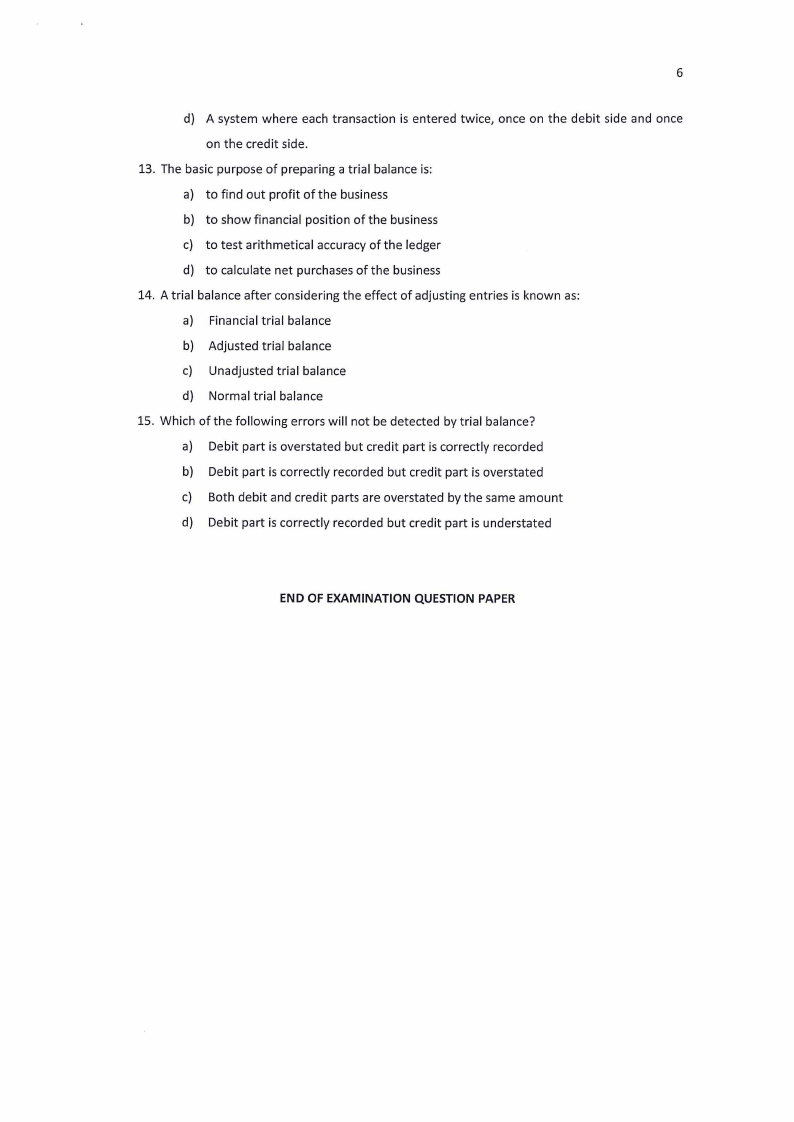

d) A system where each transaction is entered twice, once on the debit side and once

on the credit side.

13. The basic purpose of preparing a trial balance is:

a) to find out profit of the business

b) to show financial position of the business

c) to test arithmetical accuracy of the ledger

d) to calculate net purchases of the business

14. A trial balance after considering the effect of adjusting entries is known as:

a) Financial trial balance

b) Adjusted trial balance

c) Unadjusted trial balance

d) Normal trial balance

15. Which of the following errors will not be detected by trial balance?

a) Debit part is overstated but credit part is correctly recorded

b) Debit part is correctly recorded but credit part is overstated

c) Both debit and credit parts are overstated by the same amount

d) Debit part is correctly recorded but credit part is understated

END OF EXAMINATION QUESTION PAPER

|

8 Page 8 |

▲back to top |