|

CMA611S-COST AND MANAGEMENT ACCOUNTING 201-2ND OPP JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmI BIA un IVERS ITY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTINGAND FINANCE

QUALIFICATION:BACHELOR OF ACCOUNTING

QUALIFICATIONCODE:07BGAC LEVEL:6

COURSECODE: CMA611S

COURSENAME: COST & MANAGEMENT ACCOUNTING 201

SESSION:JULY 2024

DURATION: 3 HOURS

PAPER:THEORY AND CALCULATIONS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS Namwandi, H., Mbangula P., and Sheehama, K.G.H.

MODERATOR Kangala, H.

INSTRUCTIONS

• Answer ALL the questions in blue or black ink only. NO PENCIL.

• Start each question on a new page, number the answers correctly and clearly.

• Write clearly, and neatly showing all your workings/assumptions.

• Work with at least four (4) decimal places in all your calculations and only round off final

answers to two (2) decimal places.

• Questions relating to this examination may be raised in the initial 30 minutes after the

start of the examination. Thereafter, candidates must use their initiative to deal with any

perceived errors or ambiguities and any assumptions made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

• Silent, non-programmable calculators

THIS QUESTION PAPERCONSISTSOF_ 4_ PAGES(excluding this front page)

0

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 Marks]

North-region Corporation makes a single product called OMBIKE/KASHIPEMBEwhich is sold for

N$300. It is based upon the organization's current normal operating capacity of 3 000 units per period.

Currently, the organization can sell all that it produces, and it has no inventory of any kind (raw

materials, work-in-progress or finished goods) on hand.

At this level of production, the costs per unit are:

Direct material

Direct labour (5 hours per unit)

Manufacturing overheads

Production/Manufacturing cost

Administration and selling

Total costs

N$

150 000

75 000

270 000

495 000

135000

550 000

Manufacturing overheads have been shown to have the following cost-volume relationship:

Direct labour hours per period

Manufacturing overheads

5 000

N$375 000

6 250

N$393 750

7 500

N$412 500

The administration and selling cost comprises a sales commission, which is calculated at 5% of the

selling price and is incurred for each unit sold. The balance of the administration and selling costs is

fixed in nature. All fixed production overhead costs are budgeted on the basis of 20 000 direct labour

hours per year.

Actual fixed production overheads of N$300 000 for the period were in line with the budget for that

period.

The industry in which North-region Corporation operates is becoming extremely competitive. North-

region Corporation is considering changing its method of inventory valuation from absorption costing

to direct costing. It is expected that all other variable costs per unit and other fixed costs will remain

unchanged or the foreseeable future. The managing director has asked you to undertake various

financial analyses as shown in the requirements below, to assessthe impact of the proposed changes.

In all cases,you are informed that the Corporation had actual production of 2 800 units and had sold

2 500 units. The business did not have any inventory at the beginning of the period.

You are required to:

a) Calculate the predetermined overhead rate (POR)or overheads absorption rate. (2 marks)

b) Calculate the contribution margin per unit.

(5 marks)

c) Compute total fixed costs

(2 marks)

d) Prepare a statement of profit or loss for the period using Absorption costing system. (9

marks)

e) Determine the net income/net profit using direct costing system without preparing

statement of profit or loss.

(3 maks)

f) Explain the reasons for any difference in the reported profit under the two costing systems.

1

|

3 Page 3 |

▲back to top |

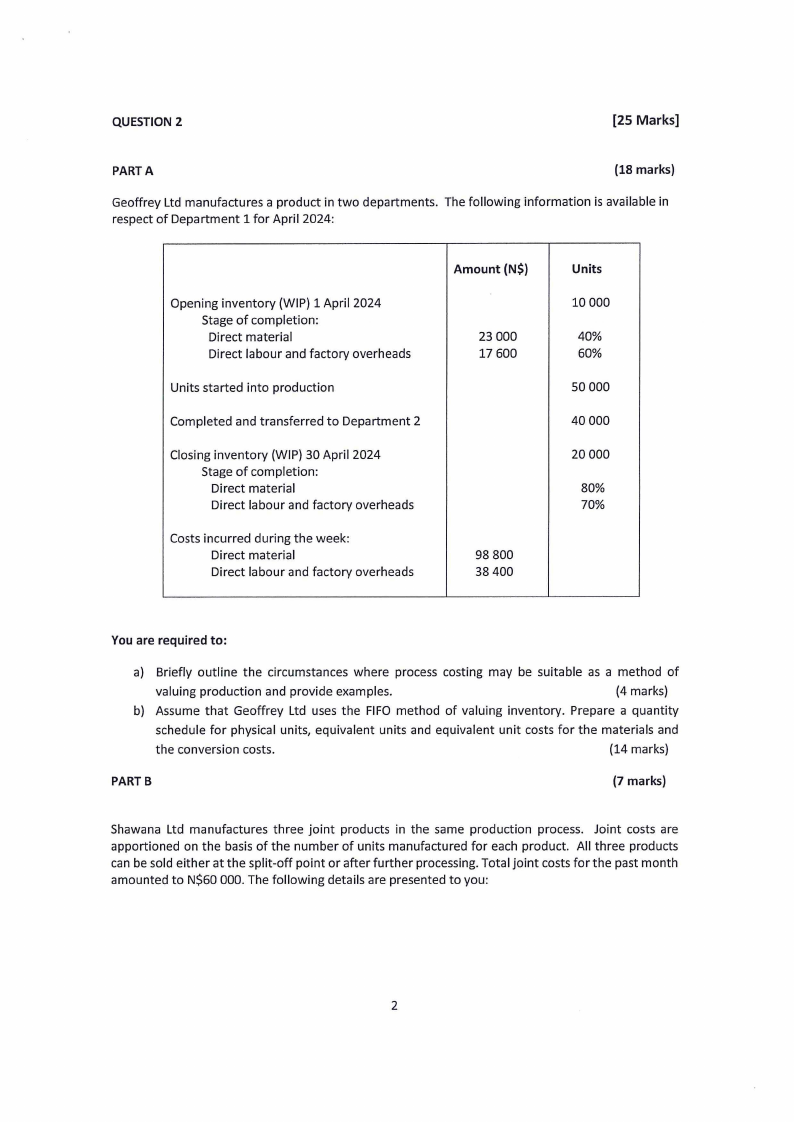

QUESTION 2

[25 Marks]

PART A

(18 marks)

Geoffrey Ltd manufactures a product in two departments. The following information is available in

respect of Department 1 for April 2024:

Opening inventory (WIP) 1 April 2024

Stage of completion:

Direct material

Direct labour and factory overheads

Units started into production

Completed and transferred to Department 2

Closing inventory (WIP) 30 April 2024

Stage of completion:

Direct material

Direct labour and factory overheads

Costs incurred during the week:

Direct material

Direct labour and factory overheads

Amount (N$)

23 000

17 600

98 800

38400

Units

10000

40%

60%

50000

40000

20000

80%

70%

You are required to:

a) Briefly outline the circumstances where process costing may be suitable as a method of

valuing production and provide examples.

(4 marks)

b) Assume that Geoffrey Ltd uses the FIFO method of valuing inventory. Prepare a quantity

schedule for physical units, equivalent units and equivalent unit costs for the materials and

the conversion costs.

(14 marks)

PARTB

(7 marks)

Shawana Ltd manufactures three joint products in the same production process. Joint costs are

apportioned on the basis of the number of units manufactured for each product. All three products

can be sold either at the split-off point or after further processing. Total joint costs for the past month

amounted to N$60 000. The following details are presented to you:

2

|

4 Page 4 |

▲back to top |

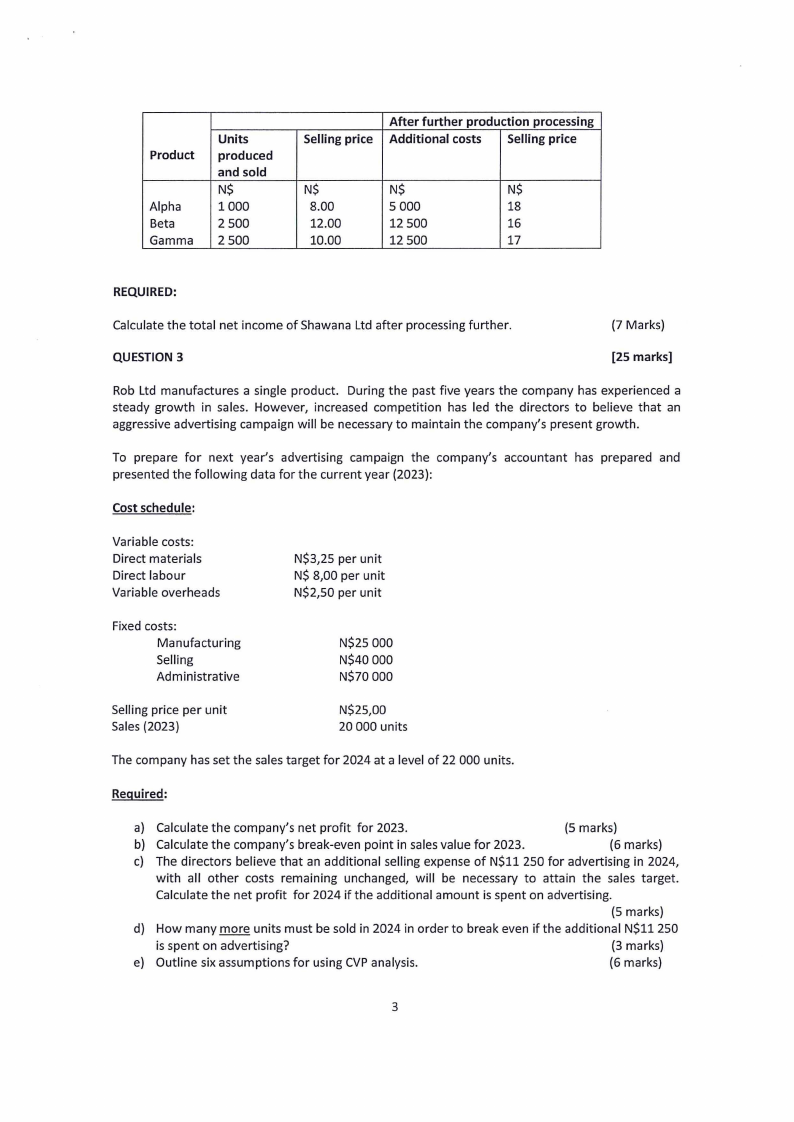

Product

Alpha

Beta

Gamma

Units

produced

and sold

N$

1000

2 500

2 500

After further production processing

Selling price Additional costs Selling price

N$

N$

N$

8.00

5 000

18

12.00

12 500

16

10.00

12 500

17

REQUIRED:

Calculate the total net income of Shawana Ltd after processing further.

(7 Marks)

QUESTION 3

[25 marks]

Rob Ltd manufactures a single product. During the past five years the company has experienced a

steady growth in sales. However, increased competition has led the directors to believe that an

aggressive advertising campaign will be necessary to maintain the company's present growth.

To prepare for next year's advertising campaign the company's accountant has prepared and

presented the following data for the current year (2023):

Cost schedule:

Variable costs:

Direct materials

Direct labour

Variable overheads

N$3,25 per unit

N$ 8,00 per unit

N$2,50 per unit

Fixed costs:

Manufacturing

Selling

Administrative

N$25 000

N$40 000

N$70 000

Selling price per unit

Sales (2023)

N$25,00

20 000 units

The company has set the sales target for 2024 at a level of 22 000 units.

Required:

a) Calculate the company's net profit for 2023.

(5 marks)

b) Calculate the company's break-even point in sales value for 2023.

(6 marks)

c) The directors believe that an additional selling expense of N$11 250 for advertising in 2024,

with all other costs remaining unchanged, will be necessary to attain the sales target.

Calculate the net profit for 2024 if the additional amount is spent on advertising.

(5 marks)

d) How many more units must be sold in 2024 in order to break even if the additional N$11 250

is spent on advertising?

(3 marks)

e) Outline six assumptions for using CVPanalysis.

(6 marks)

3

|

5 Page 5 |

▲back to top |

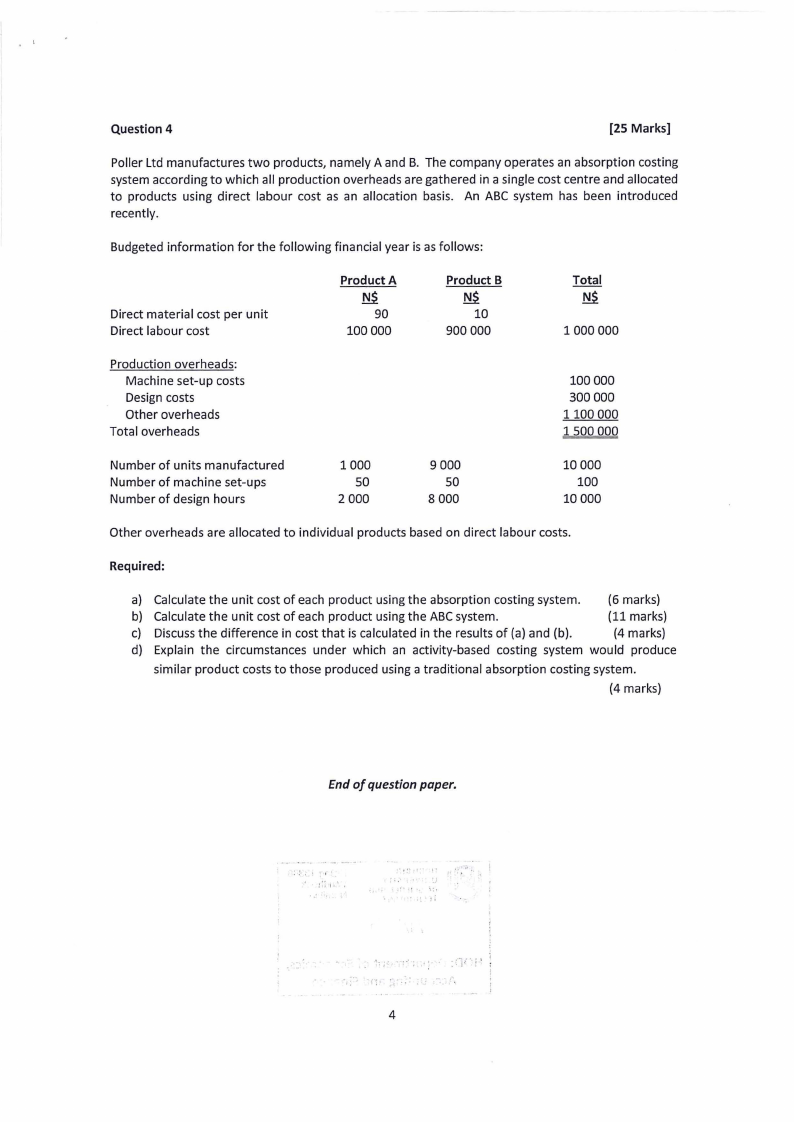

Question 4

[25 Marks]

Poller Ltd manufactures two products, namely A and B. The company operates an absorption costing

system according to which all production overheads are gathered in a single cost centre and allocated

to products using direct labour cost as an allocation basis. An ABC system has been introduced

recently.

Budgeted information for the following financial year is as follows:

Product A

Product B

Direct material cost per unit

Direct labour cost

90

100 000

10

900 000

1000 000

Production overheads:

Machine set-up costs

Design costs

Other overheads

Total overheads

100 000

300 000

1100 000

1500 000

Number of units manufactured

Number of machine set-ups

Number of design hours

1000

50

2 000

9000

50

8 000

10000

100

10 000

Other overheads are allocated to individual products based on direct labour costs.

Required:

a) Calculate the unit cost of each product using the absorption costing system. (6 marks)

b) Calculate the unit cost of each product using the ABCsystem.

(11 marks)

c) Discuss the difference in cost that is calculated in the results of (a) and (b).

(4 marks)

d) Explain the circumstances under which an activity-based costing system would produce

similar product costs to those produced using a traditional absorption costing system.

(4 marks)

End of question paper.

•·'. .'. . .:ii ..;'

4