|

FAC511S FINANCILA ACCOUNTING 101-1ST OPP- JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAmI BI A unIVER sITY

OF SCIEnCE TECHnOLOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING AND BACHELOROF LOGISTICSAND SUPPLY

CHAIN MANAGEMENT

QUALIFICATION CODE: 07BGAC AND

07BLSC

LEVEL: 5

COURSE: FINANCIAL ACCOUNTING 101

COURSE CODE: FAC511S

SESSION: JUNE 2024

DURATION: 3 Hours

PAPER: THEORY & CALCULATIONS

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINERS:

Ms. H Kangala, Mr. H Namwandi, J Chikambi, Ms Y. Odio & Mr P

Mbangula,

MODERATOR:

Mr C Mahindi

INSTRUCTIONS TO CANDIDATES

1. Answer all questions in blue or blackink.

2. Round off all amounts to the nearest Namibian Dollar, where applicable.

3. A non-programmable calculator is permissible.

4. Show all your workings (where applicable).

This Question paper is made up of 5 Pages (Excluding the front page)

0

|

2 Page 2 |

▲back to top |

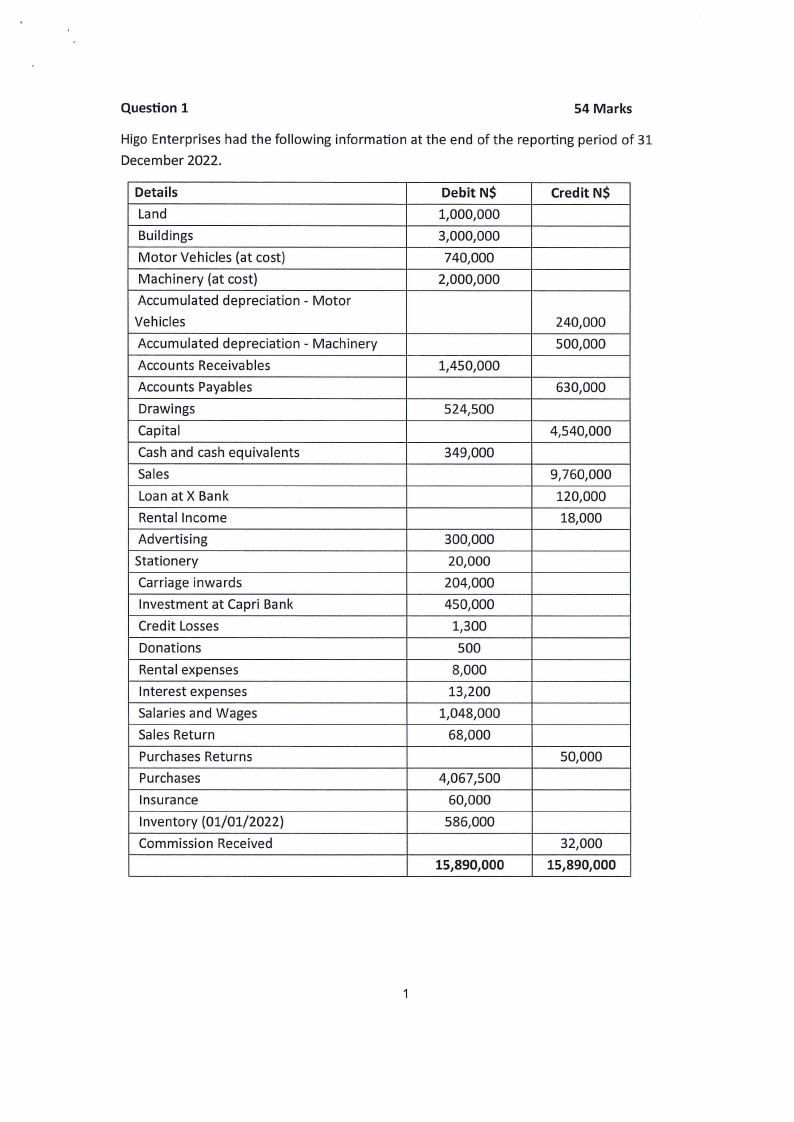

Question 1

54 Marks

Higo Enterprises had the following information at the end of the reporting period of 31

December 2022.

Details

Land

Buildings

Motor Vehicles (at cost)

Machinery (at cost)

Accumulated depreciation - Motor

Vehicles

Accumulated depreciation - Machinery

Accounts Receivables

Accounts Payables

Drawings

Capital

Cash and cash equivalents

Sales

Loan at X Bank

Rental Income

Advertising

Stationery

Carriage inwards

Investment at Capri Bank

Credit Losses

Donations

Rental expenses

Interest expenses

Salaries and Wages

Sales Return

Purchases Returns

Purchases

Insurance

Inventory {01/01/2022)

Commission Received

Debit N$

1,000,000

3,000,000

740,000

2,000,000

1,450,000

524,500

349,000

300,000

20,000

204,000

450,000

1,300

500

8,000

13,200

1,048,000

68,000

4,067,500

60,000

586,000

15,890,000

Credit N$

240,000

500,000

630,000

4,540,000

9,760,000

120,000

18,000

50,000

32,000

15,890,000

|

3 Page 3 |

▲back to top |

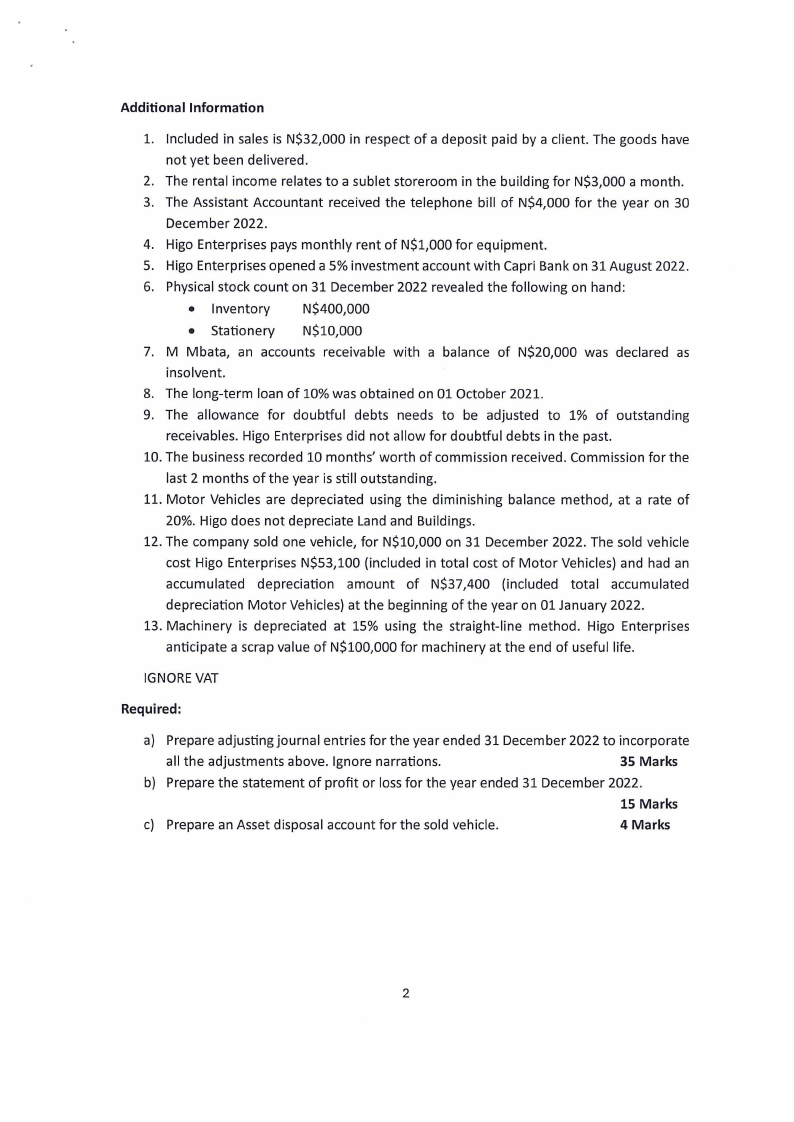

Additional Information

l. Included in sales is N$32,000 in respect of a deposit paid by a client. The goods have

not yet been delivered.

2. The rental income relates to a sublet storeroom in the building for N$3,000 a month.

3. The Assistant Accountant received the telephone bill of N$4,000 for the year on 30

December 2022.

4. Higo Enterprises pays monthly rent of N$1,000 for equipment.

5. Higo Enterprises opened a 5% investment account with Capri Bank on 31 August 2022.

6. Physical stock count on 31 December 2022 revealed the following on hand:

• Inventory

N$400,000

• Stationery N$10,000

7. M Mbata, an accounts receivable with a balance of N$20,000 was declared as

insolvent.

8. The long-term loan of 10% was obtained on 01 October 2021.

9. The allowance for doubtful debts needs to be adjusted to 1% of outstanding

receivables. Higo Enterprises did not allow for doubtful debts in the past.

10. The business recorded 10 months' worth of commission received. Commission for the

last 2 months of the year is still outstanding.

11. Motor Vehicles are depreciated using the diminishing balance method, at a rate of

20%. Higo does not depreciate Land and Buildings.

12. The company sold one vehicle, for N$10,000 on 31 December 2022. The sold vehicle

cost Higo Enterprises N$53,100 (included in total cost of Motor Vehicles) and had an

accumulated depreciation amount of N$37,400 (included total accumulated

depreciation Motor Vehicles) at the beginning of the year on 01 January 2022.

13. Machinery is depreciated at 15% using the straight-line method. Higo Enterprises

anticipate a scrap value of N$100,000 for machinery at the end of useful life.

IGNOREVAT

Required:

a) Prepare adjusting journal entries for the year ended 31 December 2022 to incorporate

all the adjustments above. Ignore narrations.

35 Marks

b) Prepare the statement of profit or loss for the year ended 31 December 2022.

15 Marks

c) Prepare an Asset disposal account for the sold vehicle.

4 Marks

2

|

4 Page 4 |

▲back to top |

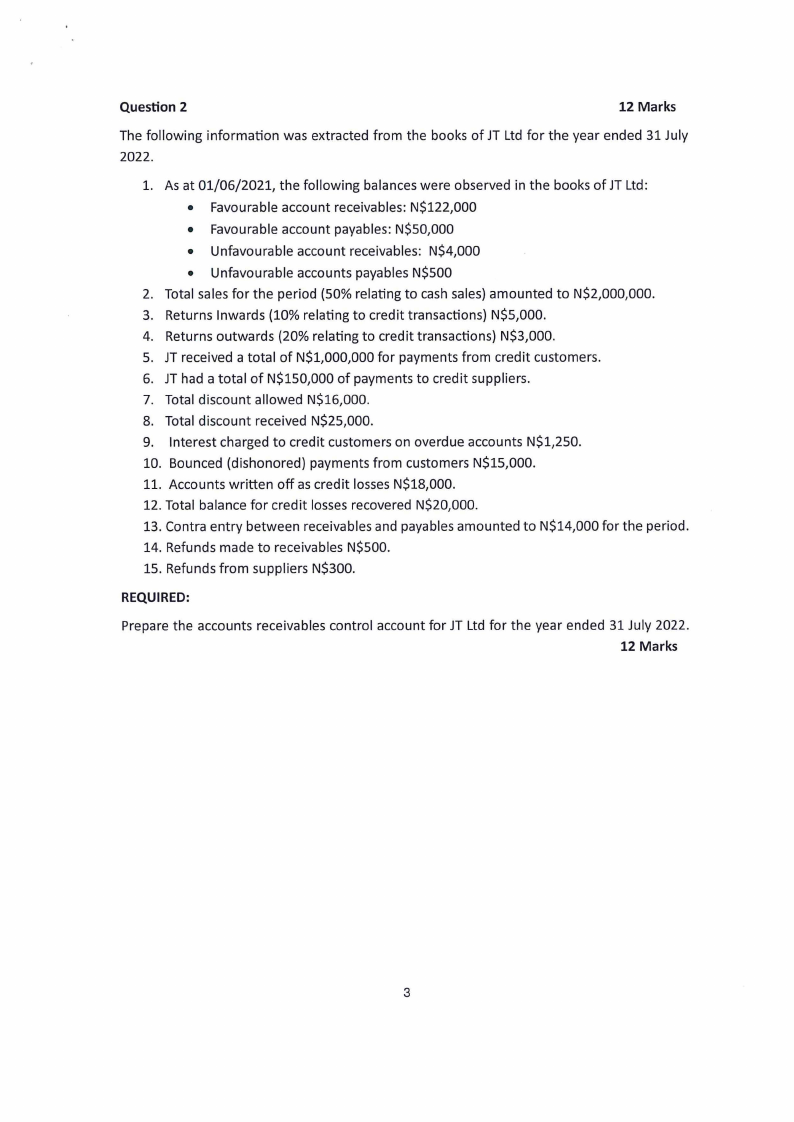

Question 2

12 Marks

The following information was extracted from the books of JT Ltd for the year ended 31 July

2022.

1. As at 01/06/2021, the following balances were observed in the books of JT Ltd:

• Favourable account receivables: N$122,000

• Favourable account payables: N$50,000

• Unfavourable account receivables: N$4,000

• Unfavourable accounts payables N$500

2. Total sales for the period (50% relating to cash sales) amounted to N$2,000,000.

3. Returns Inwards (10% relating to credit transactions) N$5,000.

4. Returns outwards (20% relating to credit transactions) N$3,000.

5. JT received a total of N$1,000,000 for payments from credit customers.

6. JT had a total of N$150,000 of payments to credit suppliers.

7. Total discount allowed N$16,000.

8. Total discount received N$25,000.

9. Interest charged to credit customers on overdue accounts N$1,250.

10. Bounced (dishonored) payments from customers N$15,000.

11. Accounts written off as credit losses N$18,000.

12. Total balance for credit losses recovered N$20,000.

13. Contra entry between receivables and payables amounted to N$14,000 for the period.

14. Refunds made to receivables N$500.

15. Refunds from suppliers N$300.

REQUIRED:

Prepare the accounts receivables control account for JT Ltd for the year ended 31 July 2022.

12 Marks

3

|

5 Page 5 |

▲back to top |

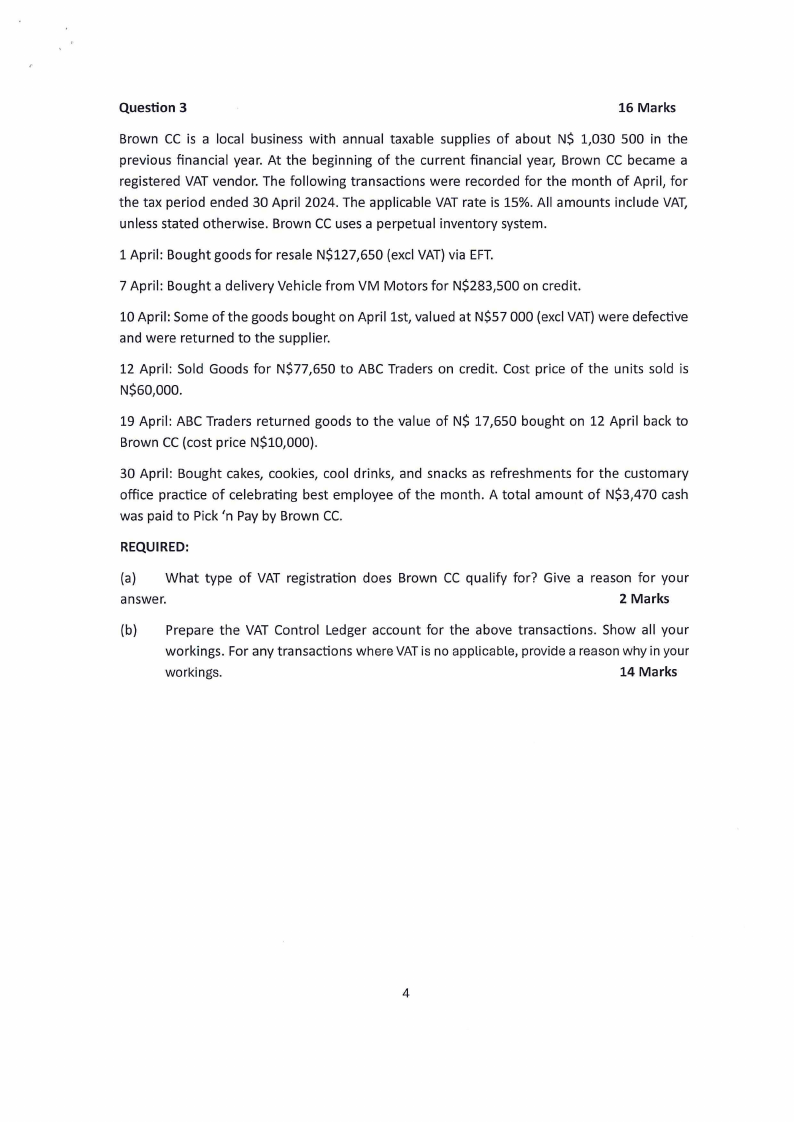

Question 3

16 Marks

Brown CC is a local business with annual taxable supplies of about N$ 1,030 500 in the

previous financial year. At the beginning of the current financial year, Brown CC became a

registered VAT vendor. The following transactions were recorded for the month of April, for

the tax period ended 30 April 2024. The applicable VAT rate is 15%. All amounts include VAT,

unless stated otherwise. Brown CC uses a perpetual inventory system.

1 April: Bought goods for resale N$127,650 (excl VAT) via EFT.

7 April: Bought a delivery Vehicle from VM Motors for N$283,500 on credit.

10 April: Some of the goods bought on April 1st, valued at N$57 000 (excl VAT)were defective

and were returned to the supplier.

12 April: Sold Goods for N$77,650 to ABC Traders on credit. Cost price of the units sold is

N$60,000.

19 April: ABC Traders returned goods to the value of N$ 17,650 bought on 12 April back to

Brown CC(cost price N$10,000).

30 April: Bought cakes, cookies, cool drinks, and snacks as refreshments for the customary

office practice of celebrating best employee of the month. A total amount of N$3,470 cash

was paid to Pick 'n Pay by Brown CC.

REQUIRED:

(a) What type of VAT registration does Brown CC qualify for? Give a reason for your

answer.

2 Marks

(b) Prepare the VAT Control Ledger account for the above transactions. Show all your

workings. For any transactions where VATis no applicable, provide a reason why in your

workings.

14 Marks

4

|

6 Page 6 |

▲back to top |

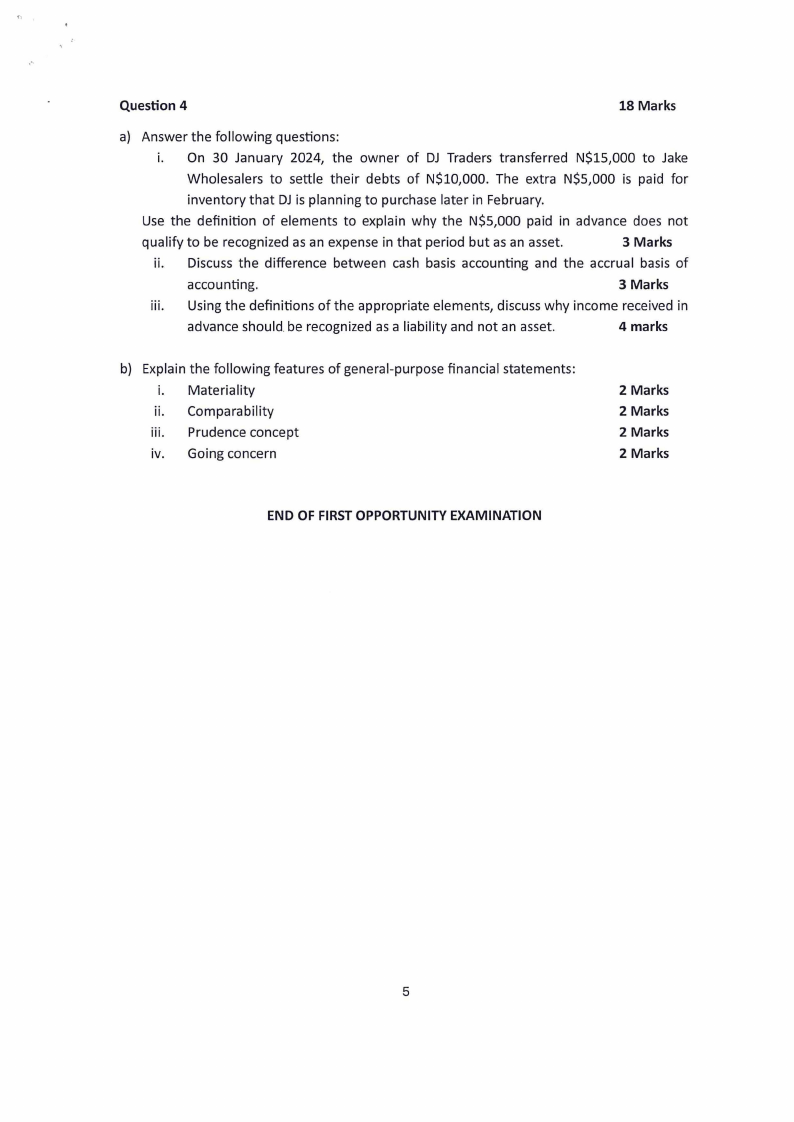

Question 4

18 Marks

a) Answer the following questions:

i. On 30 January 2024, the owner of DJ Traders transferred N$15,000 to Jake

Wholesalers to settle their debts of N$10,000. The extra N$5,000 is paid for

inventory that DJ is planning to purchase later in February.

Use the definition of elements to explain why the N$5,000 paid in advance does not

qualify to be recognized as an expense in that period but as an asset.

3 Marks

ii. Discuss the difference between cash basis accounting and the accrual basis of

accounting.

3 Marks

iii. Using the definitions of the appropriate elements, discuss why income received in

advance should be recognized as a liability and not an asset.

4 marks

b) Explain the following features of general-purpose financial statements:

i. Materiality

ii. Comparability

iii. Prudence concept

iv. Going concern

2 Marks

2 Marks

2 Marks

2 Marks

END OF FIRST OPPORTUNITY EXAMINATION

5