|

TAX621S- TAXATION 202- 2ND OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmlBIA

UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BOAC

LEVEL: 6

COURSE: TAXATION 202

COURSE CODE: TAX621S

DATE: JANUARY 2024

SESSION: THEORY AND CALCULATIONS

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION PAPER

EXAMINER(S): Mr. G Jansen, Ms. M Amakali and Mr. Y Elago

MODERATOR:

Mrs. Y van Wyk

THIS PAPER CONSISTS OF 6 PAGES

(Excluding this front page)

INSTRUCTIONS

1. Answer ALL the questions and in blue or black ink.

2. Write neat and clearly.

3. The names of people and businesses used throughout this test paper do not

reflect the reality and may be purely coincidental.

4. Show all workings where applicable.

s. Round off all amounts to the nearest RAND where applicable

|

2 Page 2 |

▲back to top |

QUESTION 1

(20 MARKS)

PART: A

(10 MARKS)

Indicate whether the following statements from your clients are correct according to the gross income

definition (s1 of the Income Tax Act).

If the statement is correct, indicate with a "true". If the statement is incorrect, indicate with a "false".

1. A natural person is ordinarily resident where he or she normally resides, apart from temporary and

occasional absences.

(2)

2. If farmer exchanges produce, he has grown on his farm for a plough at his local cooperative, the

value of the plough will not be included in his gross income.

(2)

3. The onus of establishing an amount to be included in gross income lies with the taxpayer.

(2)

4. Amounts received from illegal business activities will be included in gross income.

(2)

5. The concept of "accrued to" means due and payable.

(2)

PART:B

(10 MARKS)

You are the tax manager of a small auditing and accounting firm. One of the junior trainees has

approached you to help him do his assignment.

REQUIRED:

Discuss whether the income received would be included in Casper Nyovest's gross income or not. If not,

indicate which of the requirements of gross income is not met and give a short reason why the

requirement is not met.

The format of your answer shouid b '.,

5. Not included :._ca ital nat~re - ta

Casper Nyovest, a South African rap artist, held a benefit concert in aid of a specific charity in South Africa.

1 R2 000 000 was collected from ticket sales. This R2 000 000 is legally payable to the charity. (3)

2 A sponsor donated R1 000 000 directly to Casper Nyovest to help him to cover expenses in respect

of the concert.

(1)

3 Casper Nyovest sold a recording studio of him for R3 000 000, and donated the proceeds to the

charity.

(3)

4 After the show, a producer signed a recording contract with him, entitling him to a gross amount of

R10 000 000 over the term of the contract. He received R1 000 000 up front and

will receive the balance of the money as CDs are sold. The first CDs were sold in the following

year of assessment.

(3)

2

|

3 Page 3 |

▲back to top |

QUESTION 2

(15 MARKS)

An employee who is not yet 65 years of age and who is a resident of the Republic, received the following

income for the 2023 year of assessment.

Pensionable Salary R230 000

Overtime R17 000

Bonus R25 000

Interest from South African Banks R24 000

A uniform allowance of R4 000. This uniform can be distinguished from normal clothing.

He was instructed by his employer to take business customers for lunch on a regular basis and was

reimbursed after submitting the original receipts pertaining the expenditure. The total amount reimbursed

was R15 000 for the year.

Tax deducted or paid during the year of assessment is as follows: PAYE R42 177 and other tax payments

of R1 500.

REQUIRED:

Calculate the tax liability for the 2023 year of assessment. Show all your workings.

(15)

QUESTION 3

(10 MARKS)

Little Concerts Ltd ('Little Concerts') is a local events company and has the following query with regards to

the tax implications of an upcoming concert, Fireworks, to be held in Rondebosch, Cape Town by local

musicians, LocnStock. As advertised, the concert is to be held in aid of the desperate HIV/Aids situation in

South Africa, and all funds generated will be donated to the Timberland Institute for Aids Awareness. Little

Concerts expects to raise R200 000 after expenses, which it will pay to the institute once the accounting for

the event has been finalised.

REQUIRED:

Discuss only the relevant element of the gross income definition that will determine whether the proceeds

from the concert will be included in gross income of Little Concerts. Where applicable, substantiate your

answer with reference to case law.

(10)

3

|

4 Page 4 |

▲back to top |

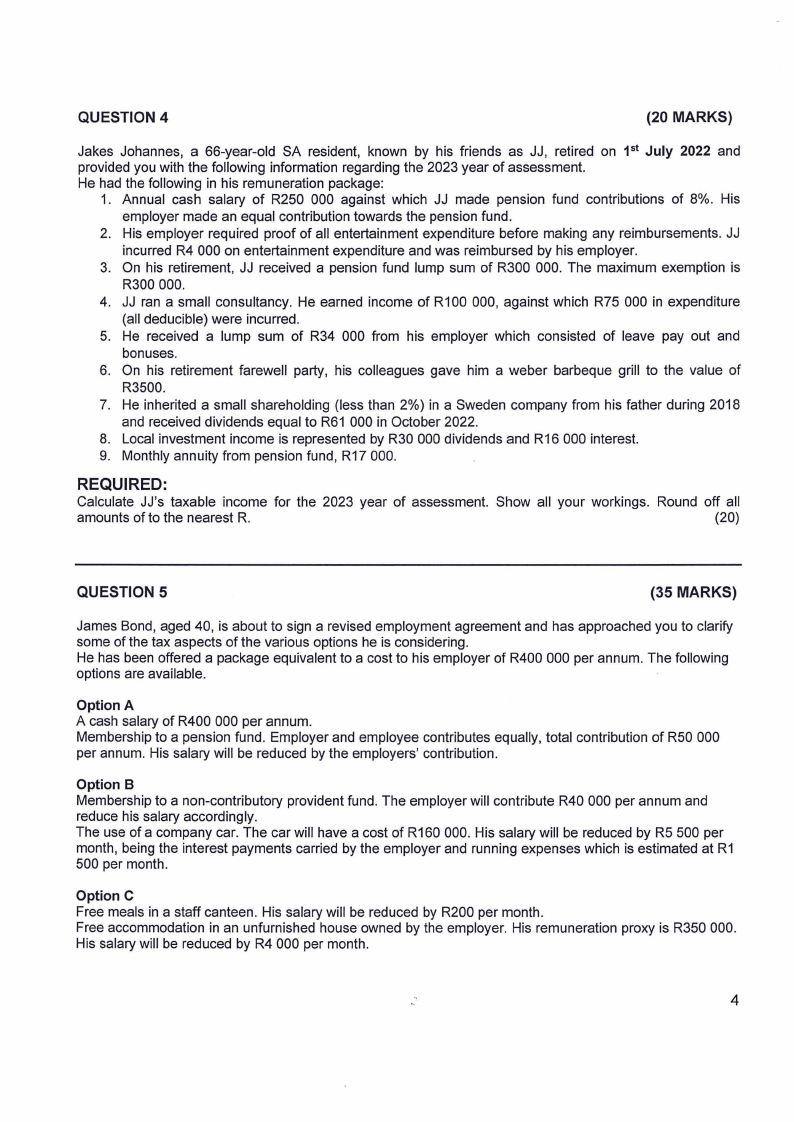

QUESTION 4

(20 MARKS)

Jakes Johannes, a 66-year-old SA resident, known by his friends as JJ, retired on 1st July 2022 and

provided you with the following information regarding the 2023 year of assessment.

He had the following in his remuneration package:

1. Annual cash salary of R250 000 against which JJ made pension fund contributions of 8%. His

employer made an equal contribution towards the pension fund.

2. His employer required proof of all entertainment expenditure before making any reimbursements. JJ

incurred R4 000 on entertainment expenditure and was reimbursed by his employer.

3. On his retirement, JJ received a pension fund lump sum of R300 000. The maximum exemption is

R300 000.

4. JJ ran a small consultancy. He earned income of R100 000, against which R75 000 in expenditure

(all deducible) were incurred.

5. He received a lump sum of R34 000 from his employer which consisted of leave pay out and

bonuses.

6. On his retirement farewell party, his colleagues gave him a weber barbeque grill to the value of

R3500.

7. He inherited a small shareholding (less than 2%) in a Sweden company from his father during 2018

and received dividends equal to R61 000 in October 2022.

8. Local investment income is represented by R30 000 dividends and R16 000 interest.

9. Monthly annuity from pension fund, R17 000.

REQUIRED:

Calculate JJ's taxable income for the 2023 year of assessment. Show all your workings. Round off all

amounts of to the nearest R.

(20)

QUESTION 5

(35 MARKS)

James Bond, aged 40, is about to sign a revised employment agreement and has approached you to clarify

some of the tax aspects of the various options he is considering.

He has been offered a package equivalent to a cost to his employer of R400 000 per annum. The following

options are available.

Option A

A cash salary of R400 000 per annum.

Membership to a pension fund. Employer and employee contributes equally, total contribution of R50 000

per annum. His salary will be reduced by the employers' contribution.

Option B

Membership to a non-contributory provident fund. The employer will contribute R40 000 per annum and

reduce his salary accordingly.

The use of a company car. The car will have a cost of R160 000. His salary will be reduced by R5 500 per

month, being the interest payments carried by the employer and running expenses which is estimated at R1

500 per month.

Option C

Free meals in a staff canteen. His salary will be reduced by R200 per month.

Free accommodation in an unfurnished house owned by the employer. His remuneration proxy is R350 000.

His salary will be reduced by R4 000 per month.

4

|

5 Page 5 |

▲back to top |

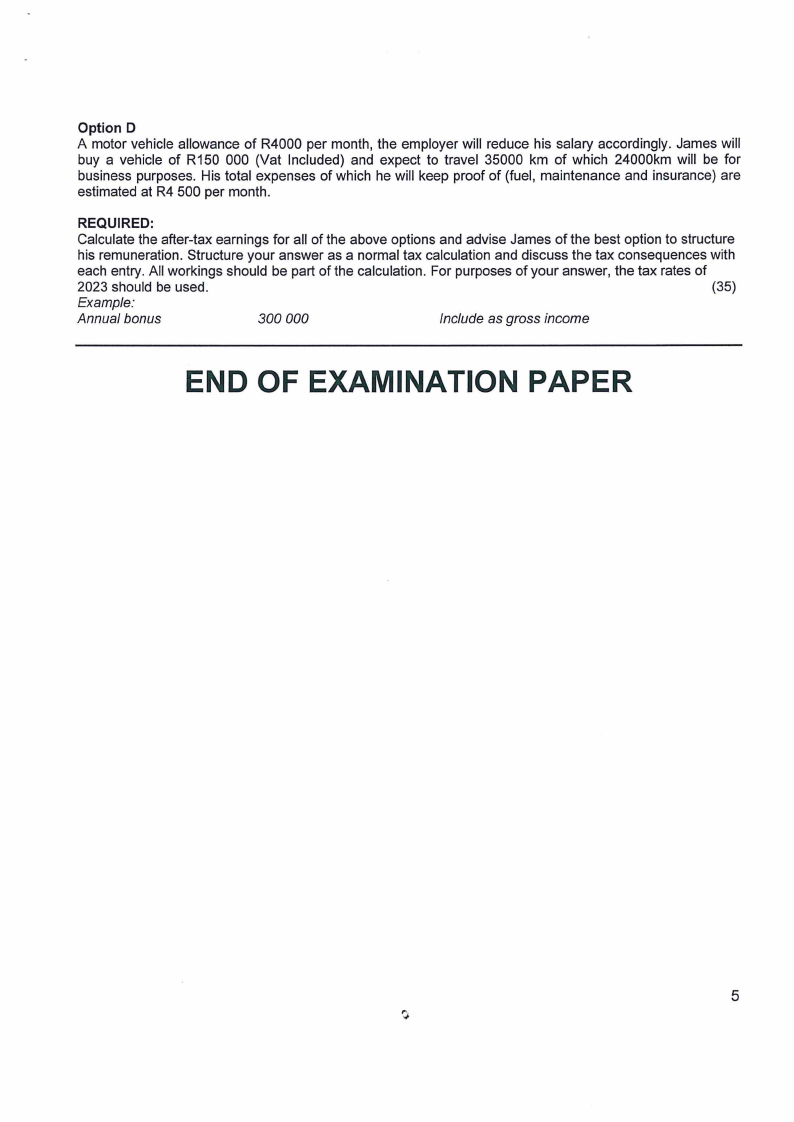

Option D

A motor vehicle allowance of R4000 per month, the employer will reduce his salary accordingly. James will

buy a vehicle of R150 000 (Vat Included) and expect to travel 35000 km of which 24000km will be for

business purposes. His total expenses of which he will keep proof of (fuel, maintenance and insurance) are

estimated at R4 500 per month.

REQUIRED:

Calculate the after-tax earnings for all of the above options and advise James of the best option to structure

his remuneration. Structure your answer as a normal tax calculation and discuss the tax consequences with

each entry. All workings should be part of the calculation. For purposes of your answer, the tax rates of

2023 should be used.

(35)

Example:

Annual bonus

300 000

Include as gross income

END OF EXAMINATION PAPER

5

|

6 Page 6 |

▲back to top |

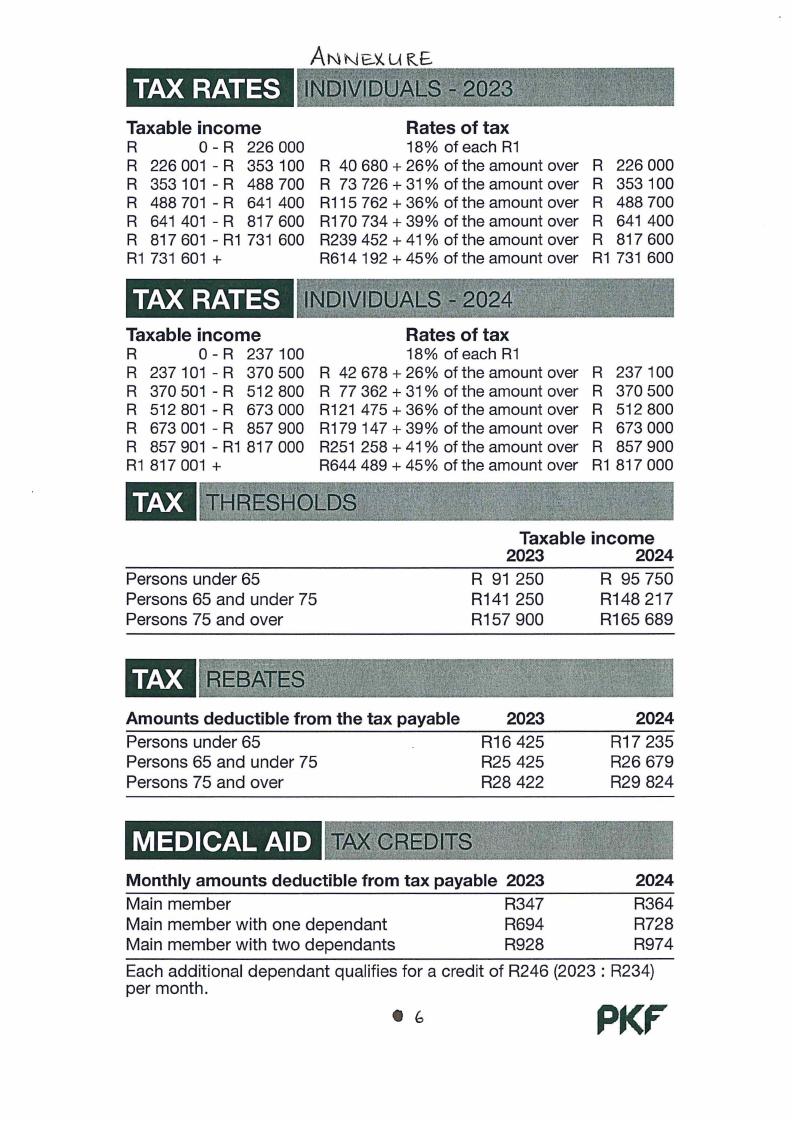

TAX RATES

Taxable income

R

0 - R 226 000

R 226 001 - R 353 100

R 353 101 - R 488 700

R 488 701 - R 641 400

R 641 401 - R 817 600

R 817 601 - R1 731 600

R1 731 601 +

Rates of tax

18% of each R1

R 40 680 + 26% of the amount over

R 73 726 + 31 % of the amount over

R115 762 + 36% of the amount over

R170 734 + 39% of the amount over

R239 452 + 41 % of the amount over

R614 192 + 45% of the amount over

R 226 000

R 353 100

R 488 700

R 641 400

R 817 600

R1 731 600

TAX RATES

Taxable income

R

0 - R 237 100

R 237 101 - R 370 500

R 370 501 - R 512 800

R 512 801 - R 673 000

R 673 001 - R 857 900

R 857 901 - R1 817 000

R1817001 +

Rates of tax

18% of each R1

R 42 678 + 26% of the amount over

R 77 362 + 31 % of the amount over

R121 475 + 36% of the amount over

R179 147 + 39% of the amount over

R251 258 + 41 % of the amount over

R644 489 + 45% of the amount over

R 237 100

R 370 500

R 512 800

R 673 000

R 857 900

R1 817 000

Persons under 65

Persons 65 and under 75

Persons 75 and over

Taxable income

2023

2024

R 91 250

R 95 750

R141 250

R148217

R157900

R165 689

Amounts deductible from the tax payable

Persons under 65

Persons 65 and under 75

Persons 75 and over

2023

R16 425

R25 425

R28 422

2024

R17 235

R26 679

R29 824

MEDICAL AID

Monthly amounts deductible from tax payable 2023

Main member

R34 7

Main member with one dependant

R694

Main member with two dependants

R928

2024

R364

R728

R974

Each additional dependant qualifies for a credit of R246 (2023 : R234)

per month.

eb

PKF

|

7 Page 7 |

▲back to top |

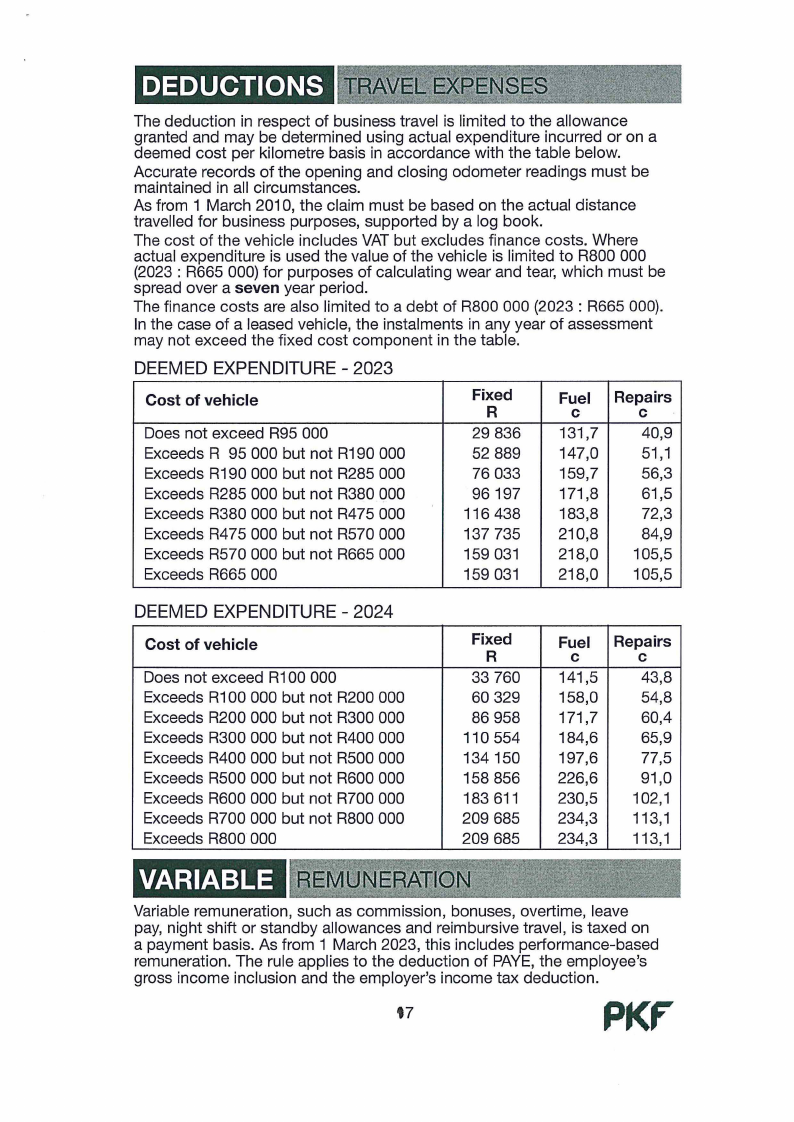

DEDUCTIONS

The deduction in respect of business travel is limited to the allowance

granted and may be determined using actual expenditure incurred or on a

deemed cost per kilometre basis in accordance with the table below.

Accurate records of the opening and closing odometer readings must be

maintained in all circumstances.

As from 1 March 2010, the claim must be based on the actual distance

travelled for business purposes, supported by a log book.

The cost of the vehicle includes VAT but excludes finance costs. Where

actual expenditure is used the value of the vehicle is limited to R800 000

(2023: R665 000) for purposes of calculating wear and tear, which must be

spread over a seven year period.

The finance costs are also limited to a debt of R800 000 (2023 : R665 000).

In the case of a leased vehicle, the instalments in any year of assessment

may not exceed the fixed cost component in the table.

DEEMED EXPENDITURE - 2023

Cost of vehicle

Does not exceed R95 000

Exceeds R 95 000 but not R190 000

Exceeds R190 000 but not R285 000

Exceeds R285 000 but not R380 000

Exceeds R380 000 but not R475 000

Exceeds R475 000 but not R570 000

Exceeds R570 000 but not R665 000

Exceeds R665 000

Fixed

R

29 836

52 889

76 033

96197

116 438

137 735

159 031

159 031

Fuel

C

131,7

147,0

159,7

171,8

183,8

210,8

218,0

218,0

Repairs

C

40,9

51,1

56,3

61,5

72,3

84,9

105,5

105,5

DEEMED EXPENDITURE - 2024

Cost of vehicle

Does not exceed R100 000

Exceeds R100 000 but not R200 000

Exceeds R200 000 but not R300 000

Exceeds R300 000 but not R400 000

Exceeds R400 000 but not R500 000

Exceeds R500 000 but not R600 000

Exceeds R600 000 but not R700 000

Exceeds R700 000 but not R800 000

Exceeds R800 000

Fixed

R

33 760

60 329

86 958

110 554

134 150

158 856

183 611

209 685

209 685

Fuel

C

141,5

158,0

171,7

184,6

197,6

226,6

230,5

234,3

234,3

Repairs

C

43,8

54,8

60,4

65,9

77,5

91,0

102,1

113, 1

113, 1

VARIABLE

Variable remuneration, such as commission, bonuses, overtime, leave

pay, night shift or standby allowances and reimbursive travel, is taxed on

a payment basis. As from 1 March 2023, this includes performance-based

remuneration. The rule applies to the deduction of PAYE,the employee's

gross income inclusion and the employer's income tax deduction.

t7

PKr

|

8 Page 8 |

▲back to top |