QUESTION 4 (60 MARKS}

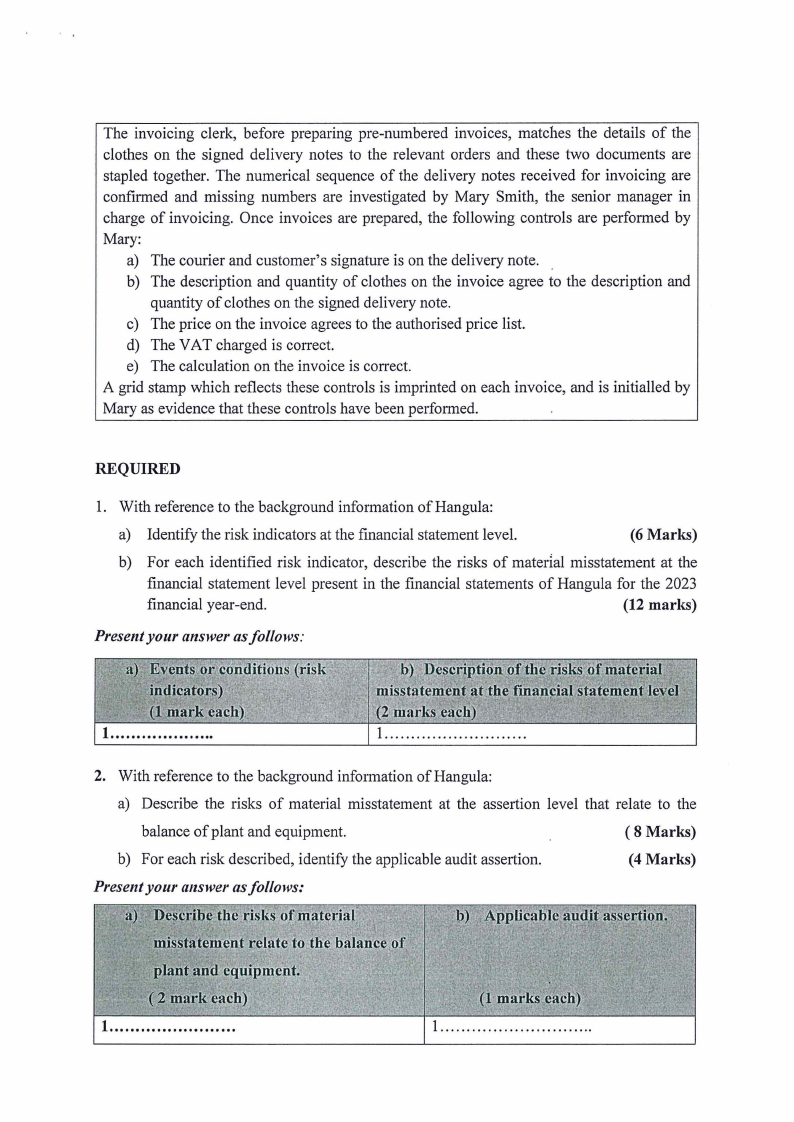

You are a member of the audit team perfo1ming the 30 September 2023 year-end audit of

Hangula Limited (Hangula). The following information relating to the company is available to

you:

BACKGROUND INFORMATION

Hangula is listed on the Namibia Stock Exchange (NSX). Hangula manufactures clothing

mostly for Mr Clothes stores in Namibia. The company imports all its material and

manufacturing equipment from foreign countries. Hangula manufactures clothing at its

premises based in Oshakati.

The company recently decided to expand its portfolio and now intends to submit a tender for

manufacturing the clothing for all Xedgars stores. As part of the tender application, Hangula is

required to include the audited financial statements for the year ended 30 September 2023. One

of the criteria which Hangula must comply with to qualify for the tender is to have a current

ratio of 2: 1. The deadline for the submission of tender applications is 20 October 2023. This

places the auditors under extreme pressure to complete the audit before the tender deadline.

The Chief Financial Officer (CFO) indicated that if the tender is successful, the management

ofHangula will receive bonuses based on profits for the year ended 30 September 2023.

During July and August 2023 Hangula factory wage workers went on strike demanding a wage

increase from N$ 70 per hour to N$ 140 per hour. The strikes were often violent and in one

incident factory wage workers burnt down one of Hangula's plants containing expensive

manufacturing equipment. Soon thereafter, the strike was suspended as Hangula and the wage

workers agreed to a wage rate ofN$ 130 per hour, almost being double.the original wage rate.

Hangula's insurance company is still in the process of investigating the arson of plant and

equipment during the strike and indicated that the insurance payout might be substantially

lower than expected as Hangula is underinsured. In the meanwhile Hangula decided to lease

manufacturing equipment in order to continue with the manufacturing of clothing. In preparing

the financial statements for the 2023 year end, the CFO decided that all damaged manufacturing

equipment should be written off. However, upon investigation the CFO determined that in the

past the company's equipment was not depreciated correctly according to its useful life. The

CFO decided to appoint an expe11to determine the correct carrying value of equipment that is

still in a working condition and to decide which equipment should be written off.