|

FAC611S-FINANCIAL ACCOUNTING 310-1ST OPP- JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEn CE Ano TECHn OLOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTINGAND FINANCE

QUALIFICATION:BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

LEVEL: 6

COURSECODE: FAC611S

COURSENAME: FINANCIALACCOUNTING201

DATE:JULY2024

DURATION:3 HOURS

PAPER:THEORYAND CALCULATIONS

MARKS: 100

SECONDOPPORTUNITYEXAMINATION PAPER

EXAMINER(S) Ms. P.Erkie, Ms. G. Kafula, Mr. C. Mahindi, Mr. C Simasiku and Ms. L Dala

MODERATOR: Dr. D. Kamotho

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page.

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

7. SHOW ALLWORKINGS!

THIS QUESTION PAPERCONSISTSOF 5 PAGES(excluding this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

(6 Marks)

1. Wayne Enterprises purchased investment property on 1 January 2021 for N$600 000. It

incurs the following costs upon purchase:

• Transfer duty of N$60 000

• Start up costs of N$20 000, which were necessary to bring the property to the

condition necessary for it to be used to earn rental income

• Improvements to building totalling N$80 000

• Repairs to damage caused by builders who were doing the improvements, of

N$40,000.

The amount at which the building is initially measured is:

a) N$ 660 000

b) N$ 760 000

c) N$ 670 000

d) N$ 800 000

e) None of the options (a - d) are correct

2. Consider the following statements in the context of IAS 40 Investment Property and

identify the correct option:

a) If a portion of a property meets the definition of investment property and the

remaining portion is owner-occupied, the entire property is accounted for as

investment property.

b) If a portion of a property meets the definition of investment property and the

remaining portion is owner-occupied, the entire property is accounted for as

property, plant & equipment.

c) If a portion of a property meets the definition of investment property and the

remaining portion is owner-occupied, the portion that meets the definition of

investment property is accounted for as investment property and the remaining

portion of the property is accounted for as property, plant & equipment.

d) If a portion of a property meets the definition of investment property and the

remaining portion is owner-occupied, the entire property is accounted for as

investment property on condition that the owner-occupied portion is insignificant.

e) None of the statements are correct.

3. Consider the following statements in the context of IAS 40 Investment Property:

Gotham Limited is the parent of DC Limited. Gotham Limited leases a property under an

operating lease to DC Limited. DC Limited uses the property as its head-office. Gotham

Limited will account for this property as investment property but DC Limited and the

Gotham and DC Group would account for it as property, plant & equipment.

a) This statement is correct.

b) This statement is incorrect.

Required:

Select the correct answer for each of the three scenarios above.

{6)

1

|

3 Page 3 |

▲back to top |

Question2

(37 Marks)

Wellness Limited, a company with a 31 December year end, produces a thick, foul-smelling

medicine that has been found to be excellent in warding off Hester in Wonderland

Syndrome (HIWS}, or micropsia, which is a disorienting neurological condition which affects

human visual perception. Patients with this disease perceive humans, parts of humans,

animals, and inanimate objects as substantially smaller than in reality.

Wellness Limited's factory operated from a building that it owned, situated in Mandume

Street in Windhoek. On 30 June 2023, however, the factory building was swallowed by a

giant sinkhole caused by a tropical storm.

This factory building had been purchased on 1 January 2023 for N$2 000 000 and was

thought to have a total useful life of 20 years and a residual value of nil.

Thankfully this happened at night while the building was empty. Wellness Limited was also

fortunate in that it owned another property three roads away in Independence Avenue. This

other property was, at the time, leased to Eduardo Ronalda under an operating lease.

Eduardo was generally late in paying his lease rentals, and this natural disaster gave

Wellness Limited a perfect opportunity to evict him with immediate effect so that they

could move their factory into the undamaged building:

• Was purchased on 1 January 2023 for N$300 000

• Had a fair value of N$550000 on 30 June 2023 and NSl 000 000 on 31 December 2023;

• Had a total estimated useful life of 6 years, estimated from the date of purchase;

• Had an estimated residual value of nil.

Wellness Limited measures:

• Its property, plant and equipment using the cost model; and

• Its investment properties on the fair value model.

YOU AREREQUIREDTO:

a) Journalise the above transactions in Wellness Limited's general journal on30 June

2023.

(16 marks)

b) Define fair value and explain how it is calculated.

(4 marks)

c) Prepare the property, Plant and Equipment note of Wellness Limited for the

reporting period ended 31 December 2023.

(12 marks)

d) Disclose the Investment Property note of wellness Limited for the reporting ended 31

December 2023.

(5 marks)

2

|

4 Page 4 |

▲back to top |

Question 3

(20 Marks)

Simply Foods Ltd is a food processing company situated in Opuwo, Namibia. The company has

a 31 December year-end.

Internally generated intangible asset - Recipe

The directors of Simply Foods Ltd decided during the 2022 financial year to develop their own

secret recipe for a range of pasta sauces.

On 1 September 2022, research of this recipe commenced and research expenses of N$ 30

500 were incurred for the year ended 31 December 2022. On 28 February 2023, management

was presented with sufficient information to indicate that all the criteria for recognition as an

intangible asset were met. The development phase commenced on 1 March 2023 and was

completed on 31 July 2023. Production of the pasta sauces commenced immediately

thereafter.

The following directly attributable costs were incurred evenly for the period 1 January 2023

to 31 July 2023:

N$

General overhead expenses

Salary costs

Staff training costs

Water & electricity

42 500

150 000

55 000

70 000

Depreciation of a machine used in the development phase amounted to N$33 000.

At completion date, the recipe has a residual value of nil and an estimated useful life of 6

years.

Additional information:

1. It is the accounting policy of the company to account for intangible assets according to

the cost model.

2. It is the accounting policy of the company to provide for amortisation according to the

straight-line method over the assets' estimated useful lives.

You are required to:

a) Discuss how the costs incurred in respect of the research and development of the recipe

should be accounted for in the annual financial statements of Simply Foods Ltd for the

year ended 31 December 2023 in accordance with IAS 38, Intangible Assets. (Include

calculations in your discussion).

(15 marks)

3

|

5 Page 5 |

▲back to top |

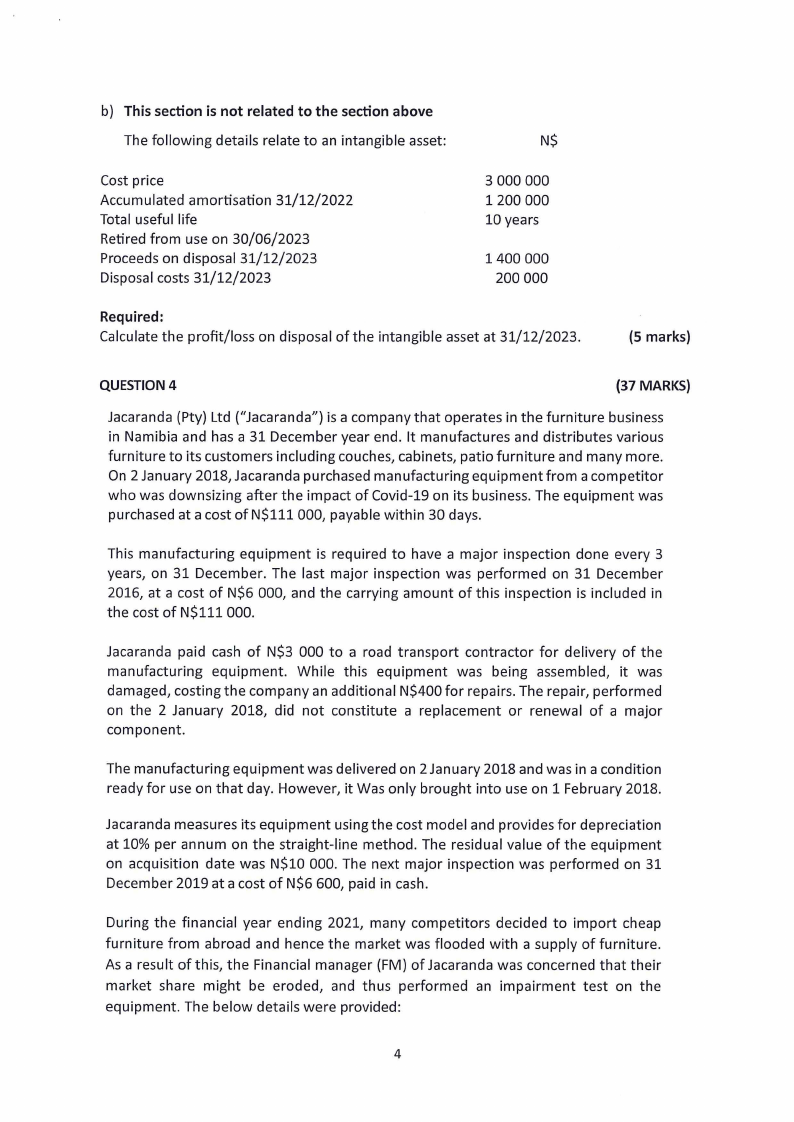

b) This section is not related to the section above

The following details relate to an intangible asset:

N$

Cost price

Accumulated amortisation 31/12/2022

Total useful life

Retired from use on 30/06/2023

Proceeds on disposal 31/12/2023

Disposal costs 31/12/2023

3 000 000

1200 000

10 years

1400 000

200 000

Required:

Calculate the profit/loss on disposal of the intangible asset at 31/12/2023.

(5 marks)

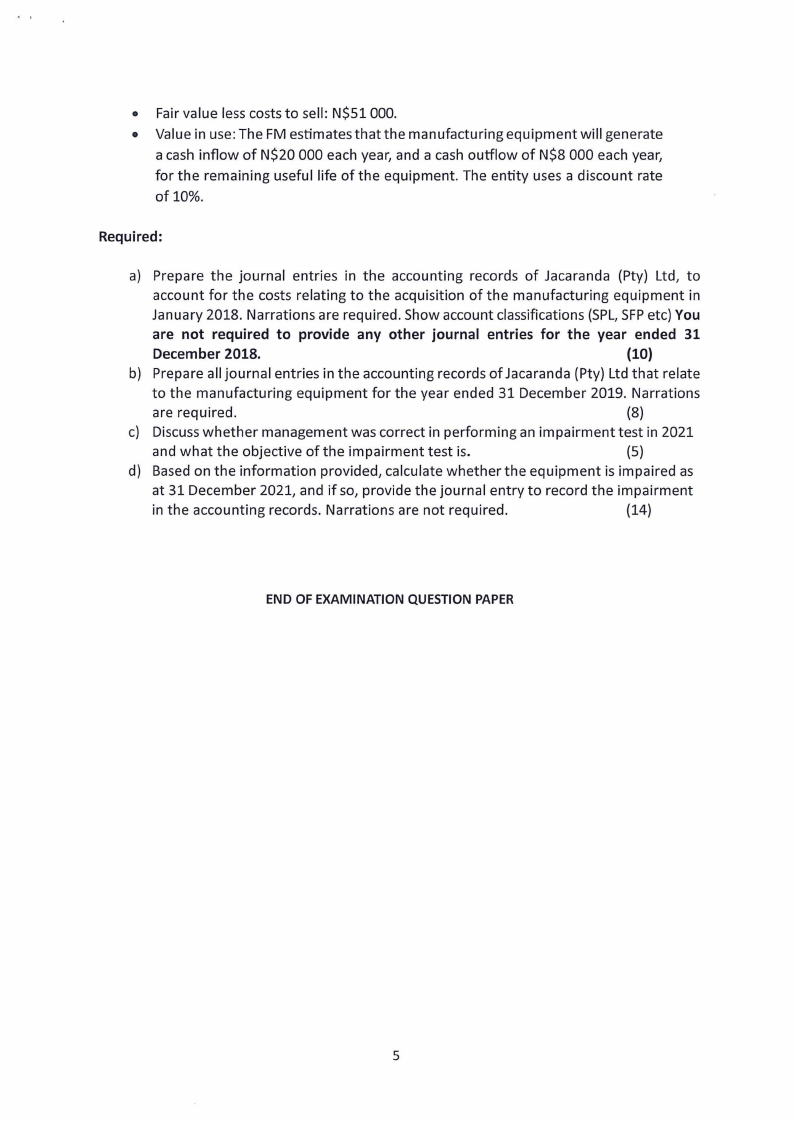

QUESTION4

(37 MARKS)

Jacaranda (Pty) Ltd ("Jacaranda") is a company that operates in the furniture business

in Namibia and has a 31 December year end. It manufactures and distributes various

furniture to its customers including couches, cabinets, patio furniture and many more.

On 2 January 2018, Jacaranda purchased manufacturing equipment from a competitor

who was downsizing after the impact of Covid-19 on its business. The equipment was

purchased at a cost of N$111 000, payable within 30 days.

This manufacturing equipment is required to have a major inspection done every 3

years, on 31 December. The last major inspection was performed on 31 December

2016, at a cost of N$6 000, and the carrying amount of this inspection is included in

the cost of N$111 000.

Jacaranda paid cash of N$3 000 to a road transport contractor for delivery of the

manufacturing equipment. While this equipment was being assembled, it was

damaged, costing the company an additional N$400 for repairs. The repair, performed

on the 2 January 2018, did not constitute a replacement or renewal of a major

component.

The manufacturing equipment was delivered on 2 January 2018 and was in a condition

ready for use on that day. However, it Was only brought into use on 1 February 2018.

Jacaranda measures its equipment using the cost model and provides for depreciation

at 10% per annum on the straight-line method. The residual value of the equipment

on acquisition date was N$10 000. The next major inspection was performed on 31

December 2019 at a cost of N$6 600, paid in cash.

During the financial year ending 2021, many competitors decided to import cheap

furniture from abroad and hence the market was flooded with a supply of furniture.

As a result of this, the Financial manager (FM} of Jacaranda was concerned that their

market share might be eroded, and thus performed an impairment test on the

equipment. The below details were provided:

4

|

6 Page 6 |

▲back to top |

• Fair value less costs to sell: N$51 000.

• Value in use: The FM estimates that the manufacturing equipment will generate

a cash inflow of N$20 000 each year, and a cash outflow of N$8 000 each year,

for the remaining useful life of the equipment. The entity uses a discount rate

of 10%.

Required:

a) Prepare the journal entries in the accounting records of Jacaranda (Pty) Ltd, to

account for the costs relating to the acquisition of the manufacturing equipment in

January 2018. Narrations are required. Show account classifications (SPL,SFPetc) You

are not required to provide any other journal entries for the year ended 31

December 2018.

(10)

b) Prepare all journal entries in the accounting records of Jacaranda (Pty) Ltd that relate

to the manufacturing equipment for the year ended 31 December 2019. Narrations

are required.

(8)

c) Discuss whether management was correct in performing an impairment test in 2021

and what the objective of the impairment test is.

(5)

d) Based on the information provided, calculate whether the equipment is impaired as

at 31 December 2021, and if so, provide the journal entry to record the impairment

in the accounting records. Narrations are not required.

(14}

END OF EXAMINATION QUESTIONPAPER

5