|

FAC611S-FINANCIAL ACCOUNTING 310-1ST OPP- JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEn CE RnD TECHn

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTINGAND FINANCE

QUALIFICATION:BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

LEVEL: 6

COURSECODE: FAC611S

COURSENAME: FINANCIALACCOUNTING201

DATE:JUNE 2024

DURATION:3 HOURS

PAPER:THEORYAND CALCULATIONS

MARKS: 100

FIRSTOPPORTUNITYEXAMINATION PAPER

EXAMINER(S) Ms. P. Erkie, Ms. G. Kafula, Mr. C. Mahindi, Mr. C Simasiku and Ms. L Dala

MODERATOR: Dr. D. Kamotho

INSTRUCTIONS

1. Capture your full name, student number and assessment number on the first page.

2. Answer ALL the questions and manage your time properly.

3. Number each page correctly

4. Write clearly and neatly.

5. Do not write in pencil and do not use tip-ex, as this will not be marked.

6. The names of people and businesses used throughout this assessment do not reflect the

reality and may be purely coincidental.

7. SHOW ALLWORKINGS!

THIS QUESTION PAPERCONSISTSOF 5 PAGES(excluding this front page)

|

2 Page 2 |

▲back to top |

Question1

{10 Marks)

New EraConstruction Limited ("New Era") is a company operating in the construction industry in

Windhoek. It deals with the production, sale and trade of buildings in the ordinary course of

business.The information below relatesto one of their buildings.

The fair value of a building in the Windhoek CBD(it has alwaysbeen leasedto tenants) has never

been determinable. The building was completed on 1 May 2022 at a cost of N$5,000,000. Its total

estimated useful life is 10 years. Fairvalues are now considered possible, and the accountant is

adamant that the asset should either be measured under the fair value model forthwith or that

the depreciation on the building should be measured using an estimated residual value of

N$1,000,000 (previously the residual value was nil). The estimated useful life has remained

unchanged.The fair value on 30 April 2024 was N$6,800,000.

New Era construction limited elects to uses the fair value model to measure investment

property.

Required:

Discuss how the above property should be classified and recognised in the records of New

Era Construction Limited. Your discussion should include, the appropriate definition, initial

recognition and subsequent measurement.

(10).

Question2

{70 Marks)

This question consists of two interrelated parts.

PARTA

{35 Marks)

Namrose (Pty) Ltd "Namrose" is a company incorporated in Namibia during 2022 for the

purpose of manufacturing flower vases. The founder, Ms. August was very fond of flowers

but could never quite find the perfect vases for her flowers. The company has a 31

December year-end.

You have recently been appointed as an Assistant Accountant responsible for the non-

current assets of the company. The following are details of the non-current assets owned

by the company.

Land

On 01 January 2022, the company purchased a plot of land to start the construction of the

factory building. Namrose paid N$2 000 000 as settlement of the purchase price to the

previous owner of the land, and an additional fee of N$200 000 as legal fees to have the

title deed changed into its name. The fair value of the land was N$2 500 000 on 31

December 2022 and at N$2 000 000 on 31 December 2023.

1

|

3 Page 3 |

▲back to top |

Factory Building

Namrose commenced construction of a factory building on 1 January 2022. The

construction was completed on 30 November 2022, Namrose at a cost of N$4 500 000.

Namrose financed the construction of this factory building via bank loan from FNBthat was

obtained on 1 January 2022. Finance costs incurred on the loan up to 30 November 2022

amounted to N$500,000. These finance costs meet the criteria of qualifying borrowing

costs. The factory building was available for use on 1 December 2022, on which date, it was

put into use. An inauguration function was held on 1 December 2022 to officially open the

factory building at a cost of N$50 000. The useful life of the building is 10 years a with a nil

residual value.

Machinery

The company also purchased machinery at a cost of N$800 000 on 1 December 2022. The

machinery's useful life was estimated to be 5 years, with a nil residual value.

On 31 December of 2023, the employee responsible for servicing the machine used the

incorrect oil, causing serious damage to the machine. On this date, the fair value less cost

to sell the machine was estimated to be N$450 000,

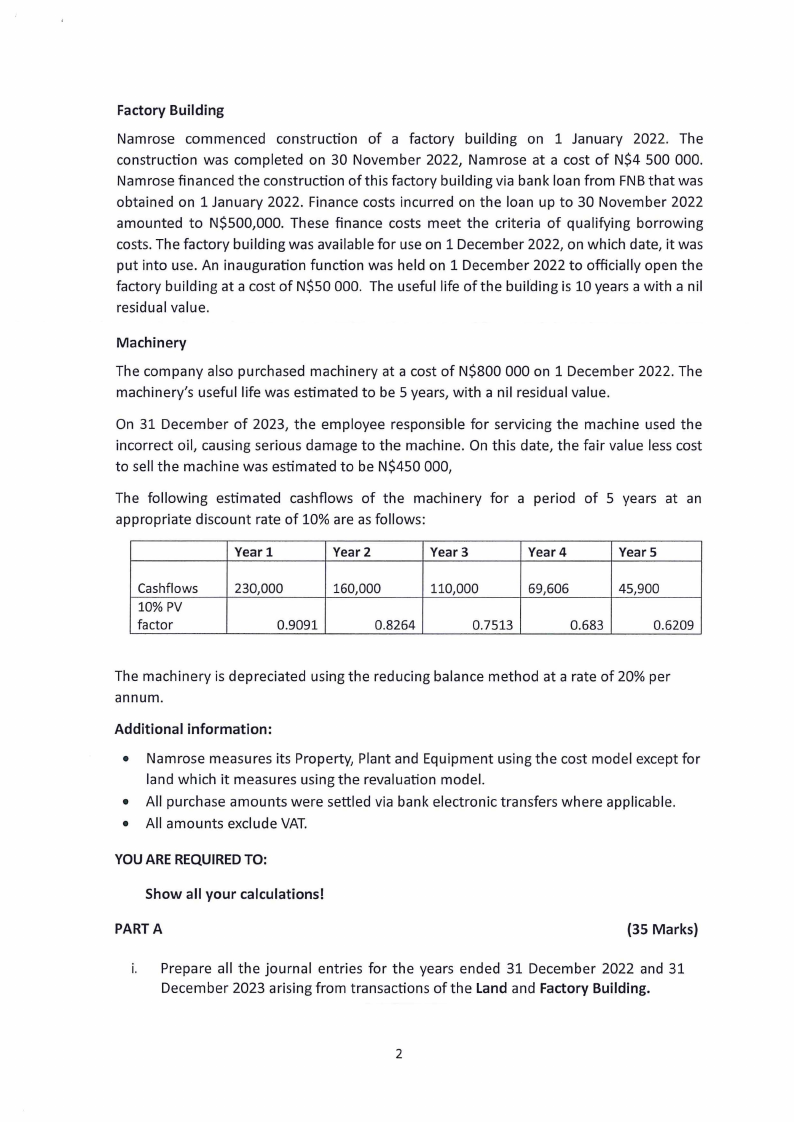

The following estimated cashflows of the machinery for a period of 5 years at an

appropriate discount rate of 10% are as follows:

Year 1

Year 2

Vear 3

Year4

Year 5

Cashflows

10% PV

factor

230,000

160,000

110,000

69,606

45,900

0.9091

0.8264

0.7513

0.683

0.6209

The machinery is depreciated using the reducing balance method at a rate of 20% per

annum.

Additional information:

• Nam rose measures its Property, Plant and Equipment using the cost model except for

land which it measures using the revaluation model.

• All purchase amounts were settled via bank electronic transfers where applicable.

• All amounts exclude VAT.

YOU AREREQUIREDTO:

Show all your calculations!

PART A

(35 Marks)

i. Prepare all the journal entries for the years ended 31 December 2022 and 31

December 2023 arising from transactions of the Land and Factory Building.

2

|

4 Page 4 |

▲back to top |

• Present the journals for each non-current asset separately.

• Indicate the date of the transaction, the statement being affected {SPL,SFP

etc)

• Journal narrations are required.

Mark Allocation:

• Land

• Factory Building

(10)

(15)

ii. Discuss whether the Machinery should be impaired as at 31 December 2023.

Support your answer with relevant calculations

{10}

PARTB

(35 Marks)

Equipment

On 01 January 2023, equipment with a cost of N$500 000 was purchased by Namrose. At

the date of purchase, the estimated useful life of this equipment was 4 years. On the date

of purchase no separate components were identified. However, on 30 June 2023, a

component of the equipment suddenly stopped functioning. On that same day, the

company purchased a replacement component for N$50 000 and estimated it to have a

remaining useful life of 2 years. It also estimated that the original component cost when

purchased as part of the equipment amounted to N$20,000.

Sale of Equipment

You have been provided with the following internal memorandum by Ms. August.

MEMORANDUM

TO: All Staff Members

FROM: Management,

DATE:31 December 2023

SUBJECTS: aleof Equipment and Future Investment Plan

Dear Team,

We would like to inform you about a significant decision made by the management of

Namrose Limited. On December 31, 2023, it was decided to sell one of our pieces of

equipment 'voetstoots' (as is).

To ensure a swift sale, we have engaged a reputable advertising agency which has been

tasked with marketing the equipment at a price that aligns with current market values. This

strategic pricing is expected to expedite the sale process. Our aim is to complete the sale by

March 2024. The funds generated from this sale will be used to acquire other equipment.

Best Regards,

Management

3

|

5 Page 5 |

▲back to top |

Additional information:

• Nam rose measures its Property, Plant and Equipment using the cost model except for

land which it measures using the revaluation model.

• All purchase amounts were settled via bank electronic transfers where applicable.

• All amounts exclude VAT.

YOU AREREQUIREDTO:

Show all your calculations!

PART B

(35 Marks)

i. Prepare all the general journal entries to account for the Equipment Components

for the reporting period ended 31 December 2023.

(13}

ii. With regard to the sale of Equipment, discuss whether the equipment meets the

criteria to be classified as held for sale in accordance with IFRS5 Non-currentassets

heldfor sale and discontinued operations.

(15}

Clarity of discussion

(1)

iii. Assuming the equipment met the IFRS5 classification criteria, present the non-

current assets held for sale as it would appear in the Statement of financial position

of Nam rose Limited as at 31 December 2023 assuming the fair value less cost to sell

of the equipment amounted to N$400,000. Provide reasons as to the value you

used. Show all calculations!

(6)

Question 3

(20 Marks)

Farmcor Limited is a manufacturer of insecticides that is situated in Karibib. The company has

a 28 February year end. The following details are available regarding the assets of the

company:

Purchased - PestAway patent

On 1 May 2021 Farmcor Limited acquired an insecticide patent, called PestAway, for

N$795,000. This innovative patent positioned the company at the forefront of the insecticide

market worldwide. On 1 May 2021 the patent's useful life was determined to be 10 years, and

no residual value was allocated to the patent. The patent was available for use, as intended

by management, on the acquisition date.

Over the past two years, the company decided to focus more on organic markets and on 30

November 2022, management decided to sell the PestAway patent. The sale is expected to

be completed by 31 May 2023 for cash. All the criteria as set out in IFRS5 for classifying an

asset as held for sale were met on 30 November 2022.

4

|

6 Page 6 |

▲back to top |

Internally generated intangible asset - Organopest patent

On 1 March 2022 the company commenced with research on a new patent for organic

insecticides as part of its latest business strategy to enter the organic market. The research

phase was completed on 30 September 2022. On this date the chief financial officer of

Farmcor Limited determined that all the criteria for the recognition of an internally generated

intangible asset were satisfied. The development of the Organopest patent commenced on 1

October 2022 and was still in progress at year end.

The following costs were evenly incurred during the research and development phases of the

Organopest patent:

• The total salaries for the developers who were involved full time in both the research

phase and the development phase amounted to N$ 76 000 per month.

• Water and electricity directly attributable to patent research and development for the

2023 financial year amounted to N$387 000.

Farmcor Limited used an insecticide manufacturing machine that was purchased for

N$438,550 during the 2021 financial year in the development phase of the Organopest patent

for the period 1 November 2022 until 31 January 2023. The useful life of the machine was

estimated to be 15 years, with a residual value of N$25 000.

Additional information

1. It is the accounting policy of the company to account for intangible assets according to

the cost model and to provide amortisation on intangible assets according to the

straight-line method over the estimated useful lives of the assets.

REQUIRED:

a) Disclose the Intangible assets notes to the annual financial statements of Farmcor Limited

for the year ended 28 February 2023. {A total column is not required).

(20 marks)

r -~. END OF EXAMINATION QUESTION PAPER

. ··:: ''.

..'

.'

. ·,...

'.

- ' ..

5