|

PDM611S - PROPERTY DEVELOPMENT AND MARKETING - 2ND OPP - JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTYOF ENGINEERINGAND THE BUILT ENVIRONMENT

DEPARTMENT OF LANDAND SPATIALSCIENCES

QUALIFICATION(S): BACHELOR OF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION(S)CODE: 08BOPS

06DIPS

NQF LEVEL:6

COURSECODE: PDM611S

COURSENAME: PROPERTYDEVELOPMENT AND

MARKETING

EXAMS SESSION:JULY 2024

PAPER:

THEORY

DURATION: 3 HOURS

MARKS:

100

SECONDOPPORTUNITY/SUPPLEMENTARYEXAMINATION QUESTION PAPER

EXAMINER(S) SAMUEL ATO K. HAYFORD

MODERATOR: UAURIKA KAHIREKE

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. Please STARTEACHQUESTION ON A FRESHPAGE.

4. The question paper contains a total of 4 questions.

5. You must answer ALLQUESTIONS.

6. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLEMATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPERCONSISTSOF 5 PAGES(Including this front page)

|

2 Page 2 |

▲back to top |

Property Development and Marketing

PDM611S

Question 1

For each of the following statements indicate whether it is 'TRUE' or 'FALSE'. Each correct answer carries 1

mark.

(18)

a) For a specific property development project, market research is important in getting to know the

relevant clientele in a specific real estate sub-market and respond to their needs with a suitable

product offering.

b) It is the responsibility of the agent or salesperson to advise and assist, the seller has extremely limited

right in determining the listing price of the property for sale.

c) The real estate market is not a single market but consists rather of a series of submarkets with

different needs and desires that can change independently of one another.

d) One of the attributes of a perfect investment is that it produces an income which compensates for

the eroding effects of inflation.

e) The local authority is one of the members of the property development team in the development of

private estates such as town houses.

f) The real property market is an omnibus term that covers all transactions in real property. However, it

is possible to distinguish sub-markets according to the characteristics of each.

g) Overtime, amongst other things, demand for land resources is brought about by changes in size and

composition of the population.

h) Any new development, or change in use, in urban areas under local authority jurisdiction usually do

not require planning consent.

i) The three primary reasons for owning landed property are as an investment, showing off (prestige)

and charity purposes.

j) The two main legal interests in land are sub-leasehold and servitude.

Second Opportunity Examination Paper

Page 2 of 5

July 2024

|

3 Page 3 |

▲back to top |

Property Development and Marketing

PDM611S

k) Rental growth does not depend upon a tenant's performance but upon supply and demand for

property for occupation by tenants.

I) When the supply of a certain type of real estate is short, rents and prices may be high, but only

temporarily. New competition will add to the supply and drive prices further up.

m) Real estate market analysis has the potential to identify some features lacking in the existing supply of

properties, which if included in the proposed project, will offer a competitive advantage.

n) Market areas that boast of better highway network capacity usually tend to have competitive

advantage that enhances their ability to command rent.

o) The more stable the market, the less the need for market research for data collection and analysis.

p) Financial analysis is crucial and should be conducted in real estate investment decisions to ensure

what is being planned is actually feasible.

q) Rental revenues can be estimated by looking at comparable properties in the market and

benchmarking existing rental rates. Leasing brokers are the best sources for this type of information.

r) Tenants sometimes receive rent concessions or special inducements from property owners. This is

normally related to periods where vacancies are particularly high.

(18]

Question 2

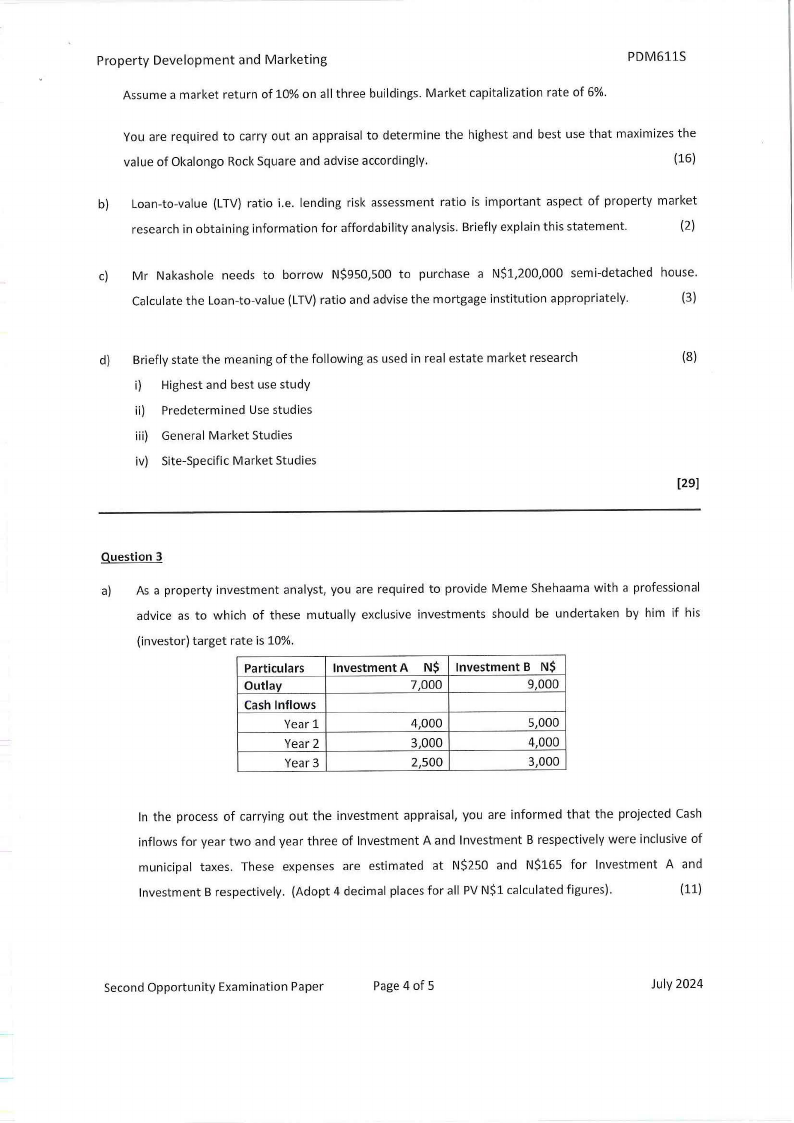

a) Okalongo Rock Square could reasonably be expected to be used to develop for residential, an office

or a commercial facility. Recent market survey conducted revealed the detail construction and

marketing information on the respective uses below;

Types of Use

Residential

Office

Commercial

Area for

Construction

(sq. m)

455

358

285

Cost of

construction

(sq.min N$)

750

850

610

Rental

(N$ sq. m)

55

68

75

Vacancy

rate(%)

3

2

3

Operating

expenses

(N$)

12,500

8,400

6,200

Second Opportunity Examination Paper

Page 3 of 5

July 2024

|

4 Page 4 |

▲back to top |

Property Development and Marketing

PDM611S

Assume a market return of 10% on all three buildings. Market capitalization rate of 6%.

You are required to carry out an appraisal to determine the highest and best use that maximizes the

value of Okalongo Rock Square and advise accordingly.

(16)

b) Loan-to-value (LTV) ratio i.e. lending risk assessment ratio is important aspect of property market

research in obtaining information for affordability analysis. Briefly explain this statement.

(2)

c) Mr Nakashole needs to borrow N$950,500 to purchase a N$1,200,000 semi-detached house.

Calculate the Loan-to-value (LTV) ratio and advise the mortgage institution appropriately.

(3)

d) Briefly state the meaning of the following as used in real estate market research

(8)

i) Highest and best use study

ii) Predetermined Use studies

iii) General Market Studies

iv) Site-Specific Market Studies

[29]

Question 3

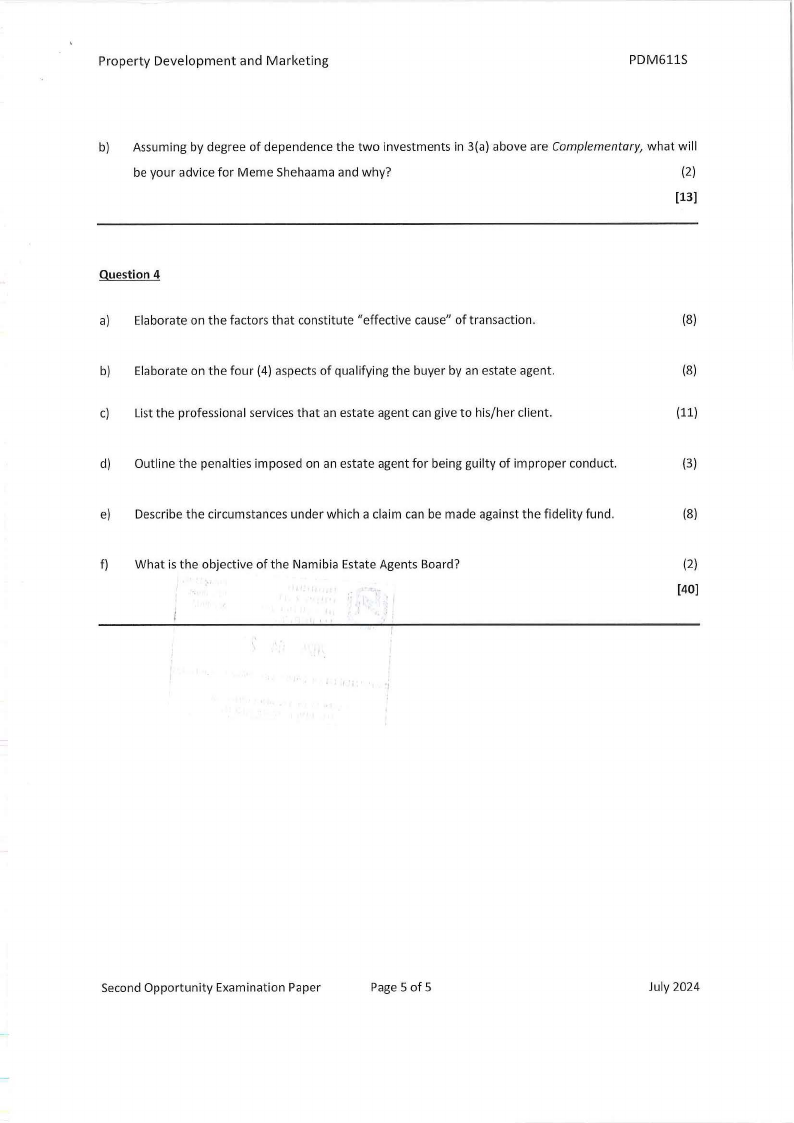

a) As a property investment analyst, you are required to provide Meme Shehaama with a professional

advice as to which of these mutually exclusive investments should be undertaken by him if his

(investor) target rate is 10%.

Particulars

Outlay

Cash Inflows

Year 1

Year 2

Year 3

Investment A N$

7,000

4,000

3,000

2,500

Investment B N$

9,000

5,000

4,000

3,000

In the process of carrying out the investment appraisal, you are informed that the projected Cash

inflows for year two and year three of Investment A and Investment B respectively were inclusive of

municipal taxes. These expenses are estimated at N$250 and N$165 for Investment A and

Investment B respectively. (Adopt 4 decimal places for all PV N$1 calculated figures).

(11)

Second Opportunity Examination Paper

Page 4 of 5

July 2024

|

5 Page 5 |

▲back to top |

Property Development and Marketing

PDM611S

b) Assuming by degree of dependence the two investments in 3(a) above are Complementary, what will

be your advice for Meme Shehaama and why?

(2)

[13]

Question 4

a) Elaborate on the factors that constitute "effective cause" of transaction.

(8)

b) Elaborate on the four (4) aspects of qualifying the buyer by an estate agent.

(8)

c) List the professional services that an estate agent can give to his/her client.

(11)

d) Outline the penalties imposed on an estate agent for being guilty of improper conduct.

(3)

e) Describe the circumstances under which a claim can be made against the fidelity fund.

(8)

f) What is the objective of the Namibia Estate Agents Board?

(2)

[40]

Second Opportunity Examination Paper

Page 5 of 5

July 2024