|

FAC612S - FINANCIAL ACCOUNTING 202 - 2ND OPP - JAN 2020 |

|

1 Page 1 |

▲back to top |

“a

NAMIBIA UNIVERSITY

OF SCIENCE AND TECHNOLOGY

Faculty of Management Sciences

Department of Accounting, Economics and Finance

QUALIFICATION : BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07BACC

COURSE: FINANCIAL ACCOUNTING 202

LEVEL: 7

COURSE CODE: FAC612S

SESSION: JANUARY/FEBRUARY 2020

PAPER: THEORETICAL FRAMEWORK

DURATION: 3 HOURS

MARKS: 100

SECOND OPPORTUNITY EXAMINATION QUESTIONS

EXAMINER(S)

W. GERTZE, A. SIMASIKU, C. SIMASIKU AND DR JO AKANDE

MODERATOR:

D. KAMOTHO

INSTRUCTIONS

1. This examination paper is made up of four (4) questions

2. Answer ALL questions in blue or black ink

3. Start each question on a new page in your answer sheet & show all your

workings

4. Questions relating to this test may be raised in the initial 30 minutes after the

start of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should

be clearly stated.

PERMISSIBLE MATERIALS

1. Non-programmable calculator may be used

2. The examination scripts must be handed over to the invigilators before

leaving the examination hall.

THIS QUESTION PAPER CONSIST OF 6 PAGES (excluding this front page)

|

2 Page 2 |

▲back to top |

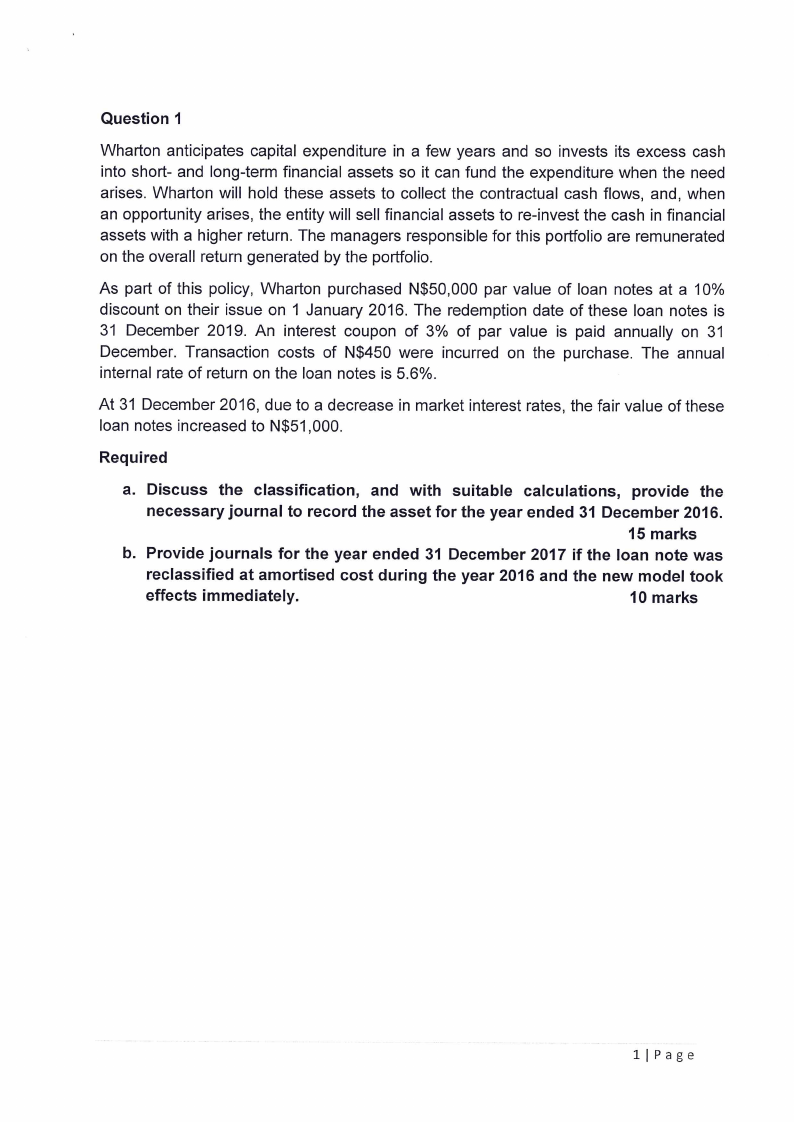

Question 1

Wharton anticipates capital expenditure in a few years and so invests its excess cash

into short- and long-term financial assets so it can fund the expenditure when the need

arises. Wharton will hold these assets to collect the contractual cash flows, and, when

an opportunity arises, the entity will sell financial assets to re-invest the cash in financial

assets with a higher return. The managers responsible for this portfolio are remunerated

on the overall return generated by the portfolio.

As part of this policy, Wharton purchased N$50,000 par value of loan notes at a 10%

discount on their issue on 1 January 2016. The redemption date of these loan notes is

31 December 2019. An interest coupon of 3% of par value is paid annually on 31

December. Transaction costs of N$450 were incurred on the purchase. The annual

internal rate of return on the loan notes is 5.6%.

At 31 December 2016, due to a decrease in market interest rates, the fair value of these

loan notes increased to N$51,000.

Required

a. Discuss the classification, and with suitable calculations, provide the

necessary journal to record the asset for the year ended 31 December 2016.

15 marks

b. Provide journals for the year ended 31 December 2017 if the loan note was

reclassified at amortised cost during the year 2016 and the new model took

effects immediately.

10 marks

1|Page

|

3 Page 3 |

▲back to top |

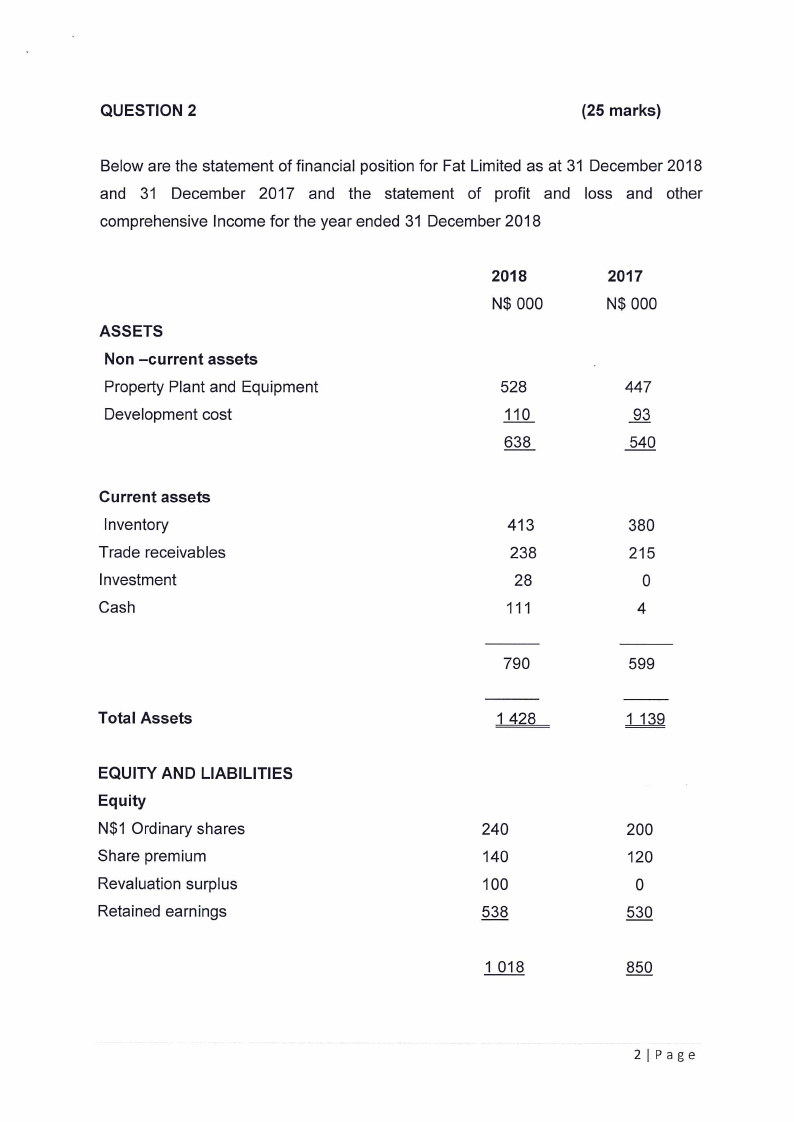

QUESTION 2

(25 marks)

Below are the statement of financial position for Fat Limited as at 31 December 2018

and 31 December 2017 and the statement of profit and loss and other

comprehensive Income for the year ended 31 December 2018

ASSETS

Non —current assets

Property Plant and Equipment

Development cost

2018

N$ 000

528

2017

NS 000

447

Current assets

Inventory

Trade receivables

Investment

Cash

Total Assets

EQUITY AND LIABILITIES

Equity

N$1 Ordinary shares

Share premium

Revaluation surplus

Retained earnings

413

238

28

111

790

599

240

140

100

938

2|Page

|

4 Page 4 |

▲back to top |

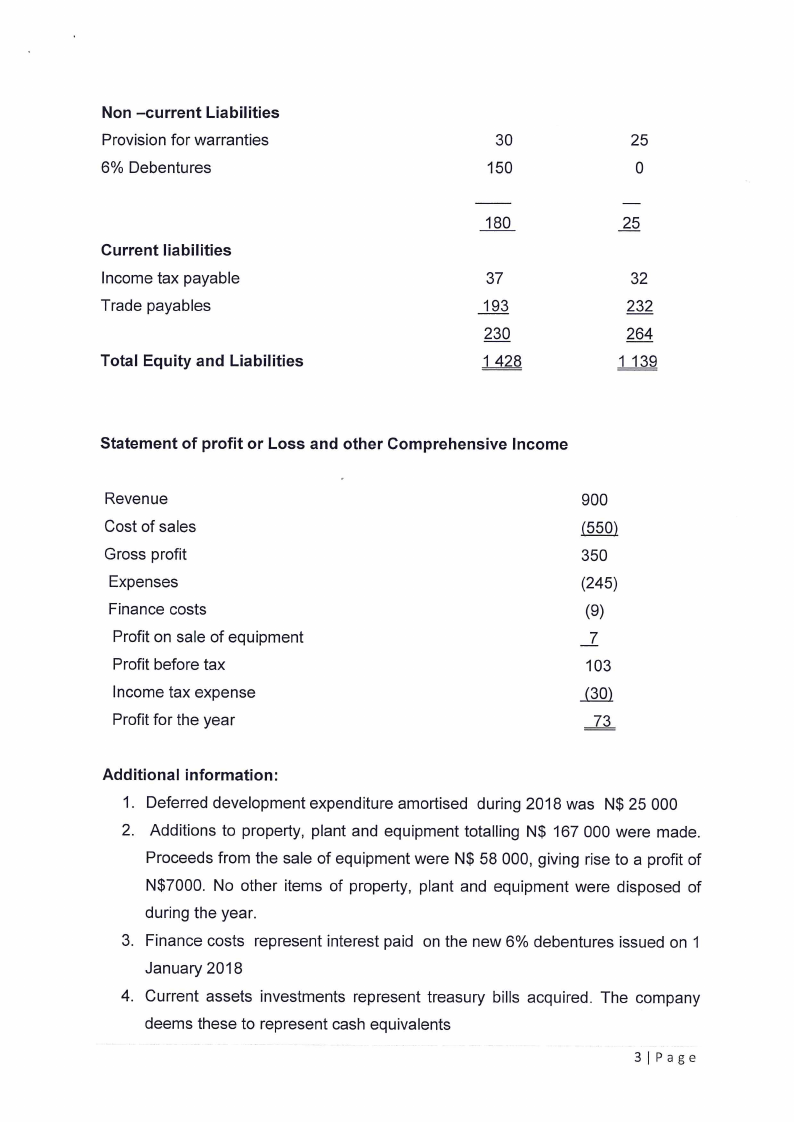

Non —current Liabilities

Provision for warranties

6% Debentures

Current liabilities

Income tax payable

Trade payables

Total Equity and Liabilities

30

25

150

0

180_

25

af

193

230

1428

32

232

264

1139

Statement of profit or Loss and other Comprehensive Income

Revenue

Cost of sales

Gross profit

Expenses

Finance costs

Profit on sale of equipment

Profit before tax

Income tax expense

Profit for the year

900

550

350

(245)

(9)

Tf

103

(30)

_f3.

Additional information:

1. Deferred development expenditure amortised during 2018 was N$ 25 000

2. Additions to property, plant and equipment totalling N$ 167 000 were made.

Proceeds from the sale of equipment were N$ 58 000, giving rise to a profit of

N$7000. No other items of property, plant and equipment were disposed of

during the year.

3. Finance costs represent interest paid on the new 6% debentures issued on 1

January 2018

4. Current assets investments represent treasury bills acquired. The company

deems these to represent cash equivalents

3|Page

|

5 Page 5 |

▲back to top |

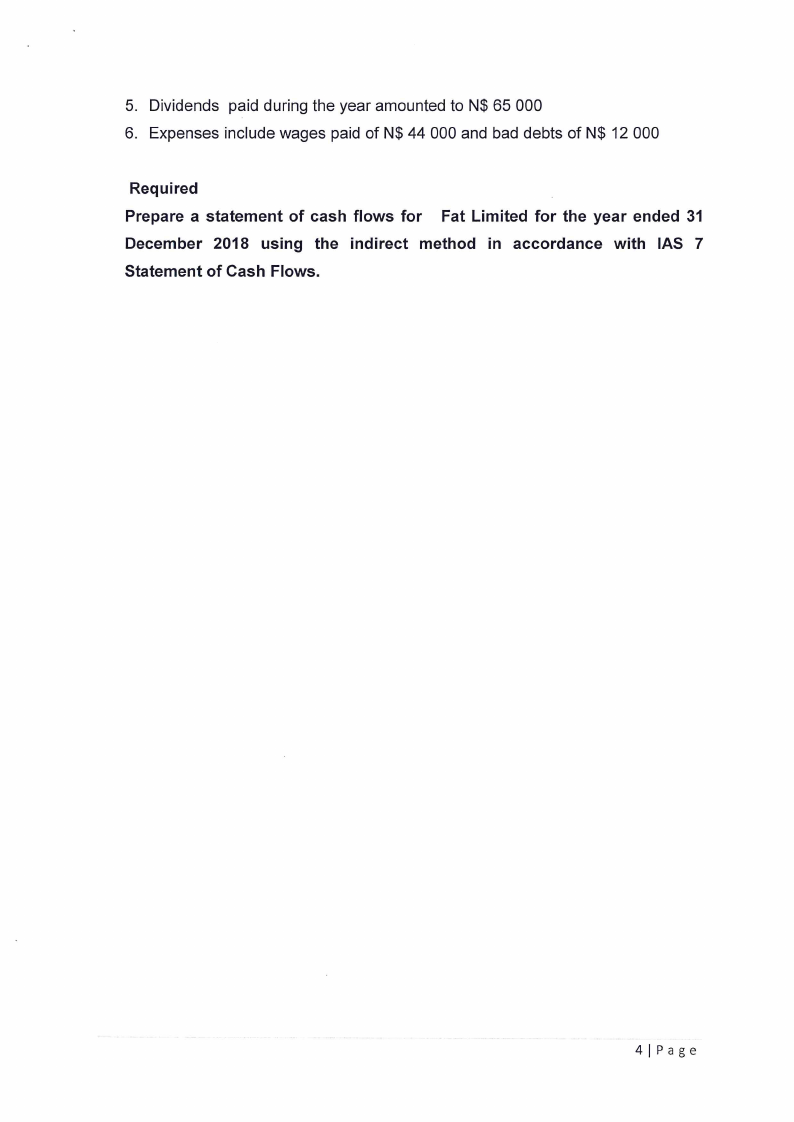

5. Dividends paid during the year amounted to N$ 65 000

6. Expenses include wages paid of N$ 44 000 and bad debts of N$ 12 000

Required

Prepare a statement of cash flows for Fat Limited for the year ended 31

December 2018 using the indirect method in accordance with IAS 7

Statement of Cash Flows.

4|Page

|

6 Page 6 |

▲back to top |

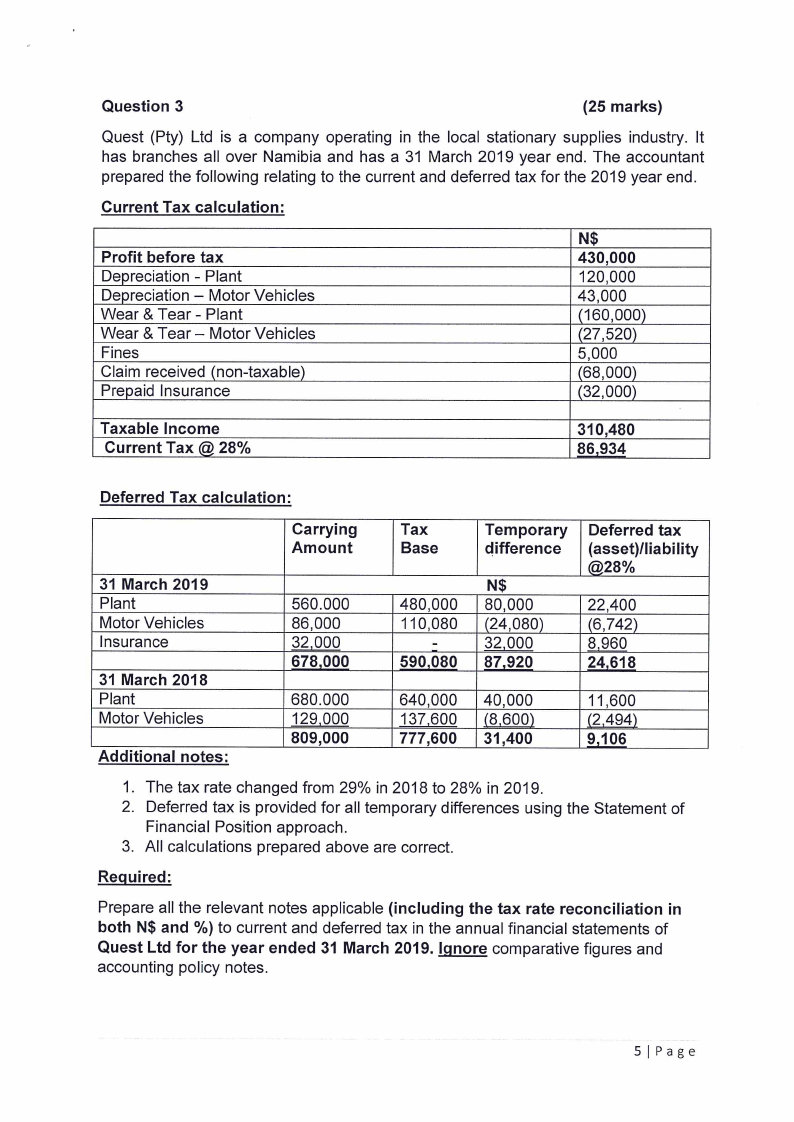

Question 3

(25 marks)

Quest (Pty) Ltd is a company operating in the local stationary supplies industry. It

has branches all over Namibia and has a 31 March 2019 year end. The accountant

prepared the following relating to the current and deferred tax for the 2019 year end.

Current Tax calculation:

Profit before tax

Depreciation - Plant

Depreciation — Motor Vehicles

Wear & Tear - Plant

Wear & Tear — Motor Vehicles

Fines

Claim received (non-taxable)

Prepaid Insurance

N$

430,000

120,000

43,000

(160,000)

(27,520)

5,000

(68,000)

(32,000)

Taxable Income

Current Tax @ 28%

310,480

86,934

Deferred Tax calculation:

31 March 2019

Plant

Motor Vehicles

Insurance

31 March 2018

Plant

Motor Vehicles

Additional notes:

Carrying

Amount

560.000

86,000

32,000

678,000

680.000

129.000

809,000

Tax

Base

480,000

110,080

-

590,080

Temporary | Deferred tax

difference | (asset)/liability

@28%

N$

| 80,000

22,400

| (24,080)

(6,742)

32,000

8,960

| 87,920

24,618

640,000 | 40,000

137,600 | (8,600)

777,600 | 31,400

11,600

(2,494)

9,106

1. The tax rate changed from 29% in 2018 to 28% in 2019.

2. Deferred tax is provided for all temporary differences using the Statement of

Financial Position approach.

3. All calculations prepared above are correct.

Required:

Prepare all the relevant notes applicable (including the tax rate reconciliation in

both N$ and %) to current and deferred tax in the annual financial statements of

Quest Ltd for the year ended 31 March 2019. Ignore comparative figures and

accounting policy notes.

5|Page

|

7 Page 7 |

▲back to top |

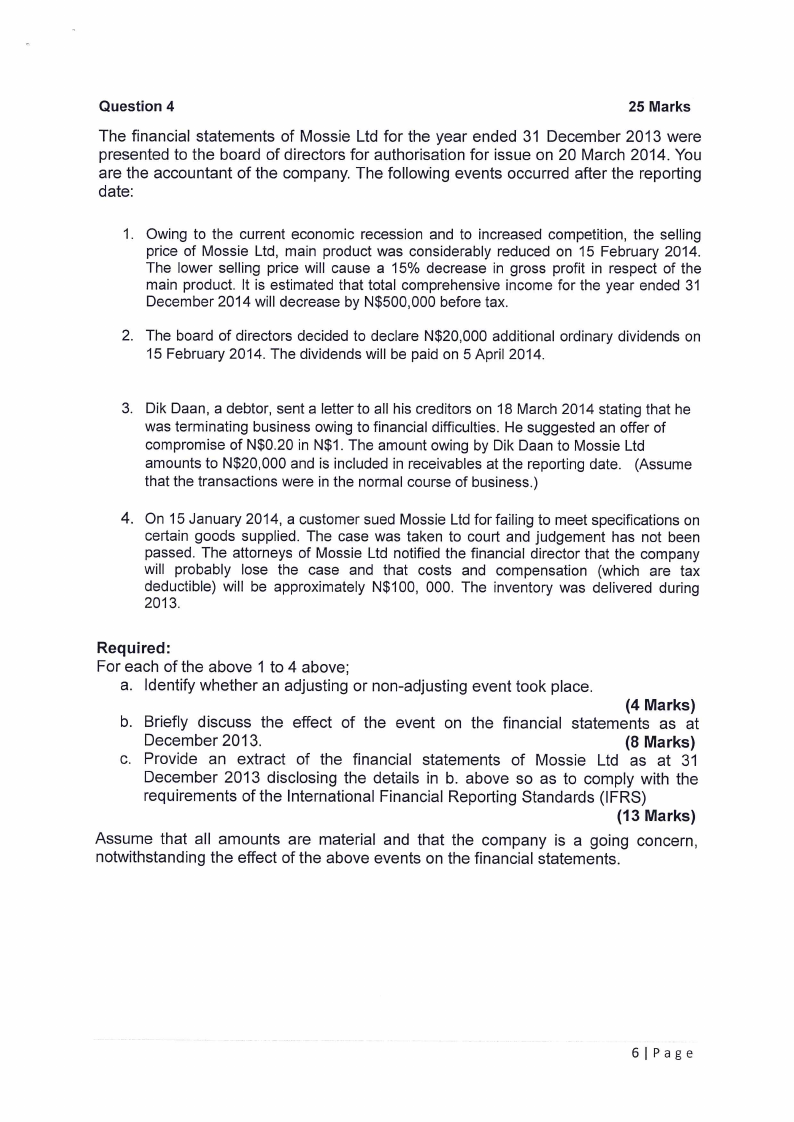

Question 4

25 Marks

The financial statements of Mossie Ltd for the year ended 31 December 2013 were

presented to the board of directors for authorisation for issue on 20 March 2014. You

are the accountant of the company. The following events occurred after the reporting

date:

1. Owing to the current economic recession and to increased competition, the selling

price of Mossie Ltd, main product was considerably reduced on 15 February 2014.

The lower selling price will cause a 15% decrease in gross profit in respect of the

main product. It is estimated that total comprehensive income for the year ended 31

December 2014 will decrease by N$500,000 before tax.

2. The board of directors decided to declare N$20,000 additional ordinary dividends on

15 February 2014. The dividends will be paid on 5 April 2014.

3. Dik Daan, a debtor, sent a letter to all his creditors on 18 March 2014 stating that he

was terminating business owing to financial difficulties. He suggested an offer of

compromise of N$0.20 in N$1. The amount owing by Dik Daan to Mossie Ltd

amounts to N$20,000 and is included in receivables at the reporting date. (Assume

that the transactions were in the normal course of business.)

4. On 15 January 2014, a customer sued Mossie Ltd for failing to meet specifications on

certain goods supplied. The case was taken to court and judgement has not been

passed. The attorneys of Mossie Ltd notified the financial director that the company

will probably lose the case and that costs and compensation (which are tax

deductible) will be approximately N$100, 000. The inventory was delivered during

2013.

Required:

For each of the above 1 to 4 above;

a. Identify whether an adjusting or non-adjusting event took place.

(4 Marks)

b. Briefly discuss the effect of the event on the financial statements as at

December 2013.

(8 Marks)

c. Provide an extract of the financial statements of Mossie Ltd as at 31

December 2013 disclosing the details in b. above so as to comply with the

requirements of the International Financial Reporting Standards (IFRS)

(13 Marks)

Assume that all amounts are material and that the company is a going concern,

notwithstanding the effect of the above events on the financial statements.

6|Page