|

GFA711S-FINANCIAL ACCOUNTING 310-2ND OPP- JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING

QUALIFICATION CODE: 07 BOAC

COURSE: FINANCIAL ACCOUNTING 310

DATE: Jul/Aug 2024

DURATION: 3 HRS

LEVEL: 7

COURSE CODE: GFA 711S

SESSION: Jun 2024

MARKS: 100

SUPPLEMENTARY ASSESSMENT - 2NDOPPORTUNITY QUESTION PAPER

EXAMINER{S} Kamotho, D.W., Dzomira, S., Ms. Garas, E., Kamana, R.,

MODERATOR: M Tondota

THIS QUESTION PAPERCONSISTSOF _6_ PAGES(Excluding this front page)

INSTRUCTIONS

1. Answer all the questions in blue or black ink

2. Start each question on a new page in your answer booklet & show all your workings

3. Questions relating to this examination may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities & any assumption made by the candidate should be clearly stated.

PERMISSIBLEMATERIALS

1. Non-programmable scientific or financial calculator

|

2 Page 2 |

▲back to top |

Question 1

25 Marks

a) Daybed Limited is a company that manufactures and retails pool loungers. Recently due to

current economic events, Daybed Limited attempted to increase sales by introducing a

profit-sharing plan for its employees. The plan read as follows:

PROFIT SHARING MEMO

To:

All sales staff

From: Executive management

Management has decided to implement the following profit-sharing plan for all sales staff:

• 25% of gross sales earned above predetermined target of N$1 500 000 will be allocated

equally among all qualifying sales staff members.

• To qualify, sales staff members must have been in the employ of the company for at

least two years as at the end of the current financial year and remain in the employ of

the company for a further year after this current year end date.

• Any a/location made to an employee who fails to meet the terms of the profit-sharing

plan is forfeited and will not be re-allocated amongst the remaining qualifying sales

staff

As the financial accountant of Daybed Limited you have to account for the profit-sharing plan.

The following information is available to you:

• The company had 50 employees during 2023, 60% of whom are sales staff. 10% of the

sales staff had been employed by the company for less than 2 years and the remaining

90% had been employed by the company for at least 2 years. It is expected that 3

employees (all of whom had been in the company's employ for 10 years) will resign

during 2024 and will be replaced by new employees.

• The gross sales achieved during the current financial year ended 31 December 2022

amounted to N$2 250 000.

Required:

i. Calculate the liability that needs to be recognised at 31 December 2022.

(8)

ii. Journalise the recognition of the liability.

(3)

iii. Provide the journal entries at 31 December 2023 to account for the payment if 5 sales

staff members actually left during 2023, all of whom had worked for Daybed Limited for

at least 2 years calculated at 31 December 2022 (the 2022 provision was considered

appropriate).

(6)

1

|

3 Page 3 |

▲back to top |

b) Matthew Limited's annual salary expense for 2023 is as follows:

• Gross salary of N$4 000 000, of which:

N$1 200 000 is employees' tax, which was withheld (payable to the tax authorities)

7% was withheld, payable, on behalf of the employee, to a defined contribution

plan.

The balance thereof was payable to the employees.

• Company contributions to the defined contribution plan: 10% of gross salaries.

Required:

Show the journals and the profit before tax note for Matthew's financial year ended 31 Dec

2023. Show the journals on an annual basis (i.e. these are normally processed monthly) (8)

[Total: 25 Marks]

2

|

4 Page 4 |

▲back to top |

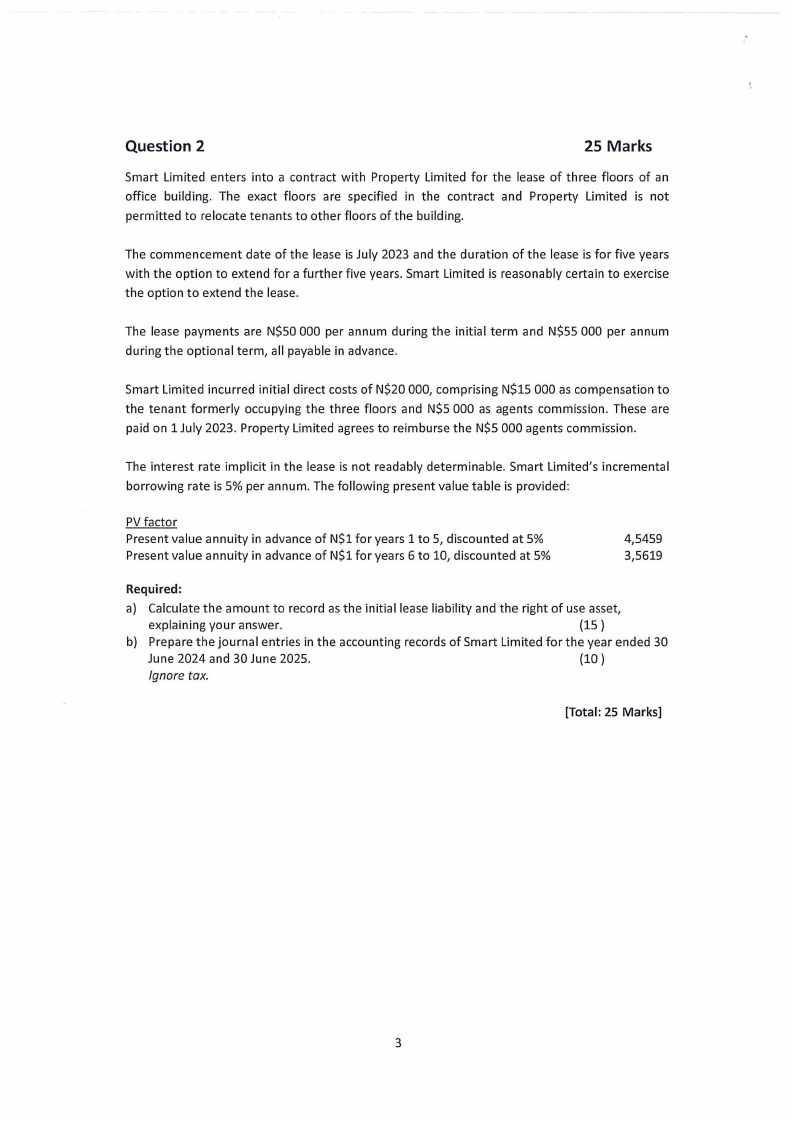

Question 2

25 Marks

Smart Limited enters into a contract with Property Limited for the lease of three floors of an

office building. The exact floors are specified in the contract and Property Limited is not

permitted to relocate tenants to other floors of the building.

The commencement date of the lease is July 2023 and the duration of the lease is for five years

with the option to extend for a further five years. Smart Limited is reasonably certain to exercise

the option to extend the lease.

The lease payments are N$50 000 per annum during the initial term and N$55 000 per annum

during the optional term, all payable in advance.

Smart Limited incurred initial direct costs of N$20 000, comprising N$15 000 as compensation to

the tenant formerly occupying the three floors and N$5 000 as agents commission. These are

paid on 1 July 2023. Property Limited agrees to reimburse the N$5 000 agents commission.

The interest rate implicit in the lease is not readably determinable. Smart Limited's incremental

borrowing rate is 5% per annum. The following present value table is provided:

PV factor

Present value annuity in advance of N$1 for years 1 to 5, discounted at 5%

Present value annuity in advance of N$1 for years 6 to 10, discounted at 5%

4,5459

3,5619

Required:

a) Calculate the amount to record as the initial lease liability and the right of use asset,

explaining your answer.

(15 )

b) Prepare the journal entries in the accounting records of Smart Limited for the year ended 30

June 2024 and 30 June 2025.

(10)

Ignore tax.

[Total: 25 Marks]

3

|

5 Page 5 |

▲back to top |

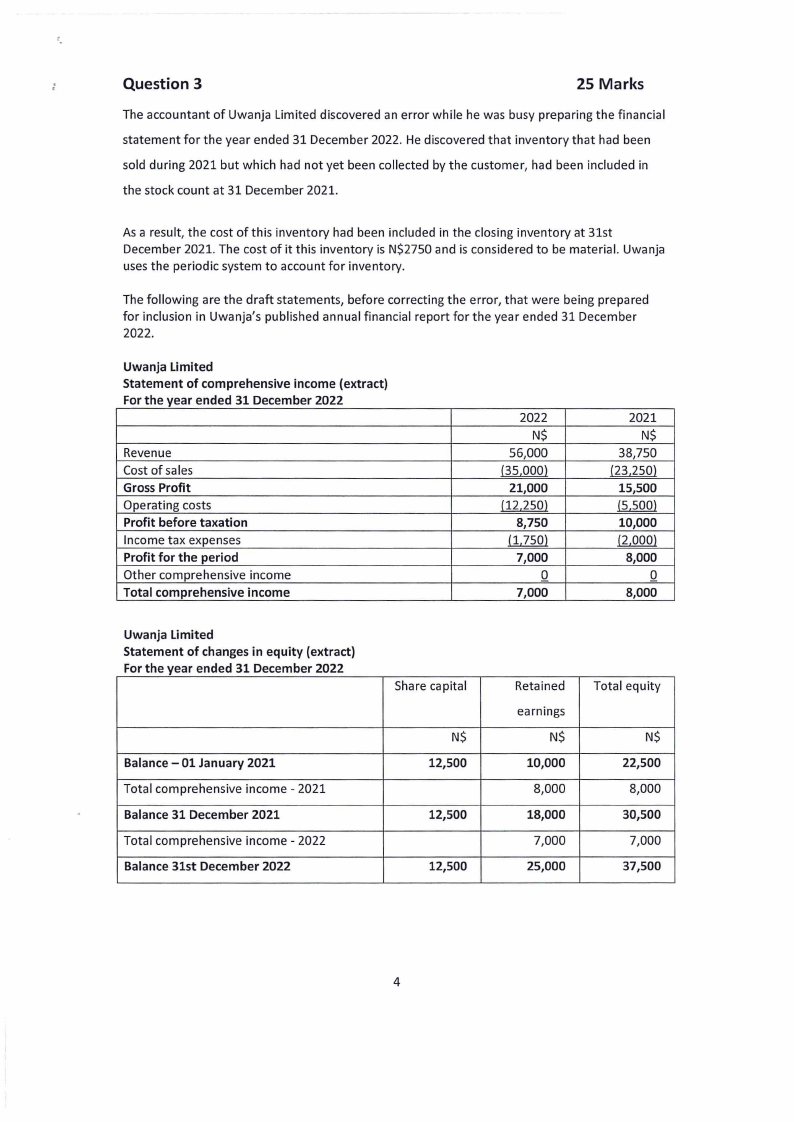

Question 3

25 Marks

The accountant of Uwanja Limited discovered an error while he was busy preparing the financial

statement for the year ended 31 December 2022. He discovered that inventory that had been

sold during 2021 but which had not yet been collected by the customer, had been included in

the stock count at 31 December 2021.

As a result, the cost of this inventory had been included in the closing inventory at 31st

December 2021. The cost of it this inventory is N$2750 and is considered to be material. Uwanja

uses the periodic system to account for inventory.

The following are the draft statements, before correcting the error, that were being prepared

for inclusion in Uwanja's published annual financial report for the year ended 31 December

2022.

Uwanja Limited

Statement of comprehensive income (extract)

For the year ended 31 December 2022

Revenue

Cost of sales

Gross Profit

Operating costs

Profit before taxation

Income tax expenses

Profit for the period

Other comprehensive income

Total comprehensive income

2022

N$

56,000

(35,000)

21,000

(12,250)

8,750

(1,750)

7,000

0

7,000

2021

N$

38,750

(23,250)

15,500

(5,500)

10,000

(2,000)

8,000

0

8,000

Uwanja Limited

Statement of changes in equity (extract)

For the year ended 31 December 2022

Share capital

Balance - 01 January 2021

Total comprehensive income - 2021

Balance 31 December 2021

Total comprehensive income - 2022

Balance 31st December 2022

N$

12,500

12,500

12,500

Retained

earnings

N$

10,000

8,000

18,000

7,000

25,000

Total equity

N$

22,500

8,000

30,500

7,000

37,500

4

|

6 Page 6 |

▲back to top |

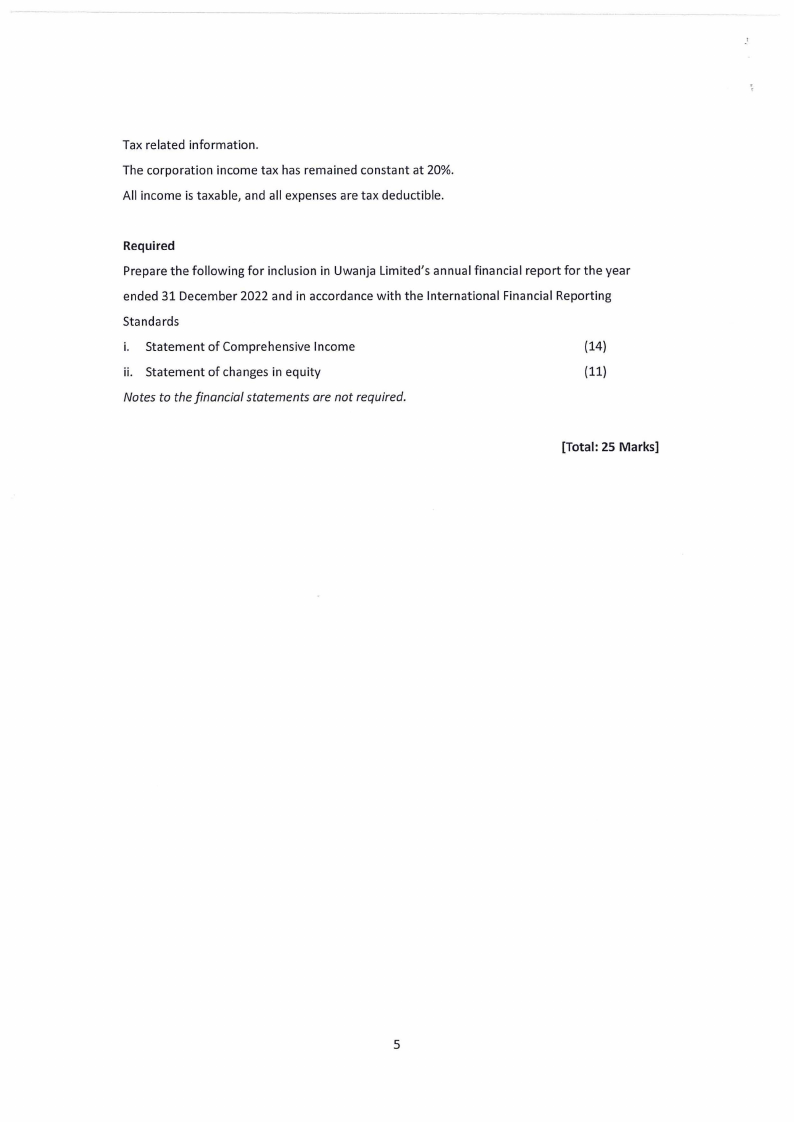

Tax related information.

The corporation income tax has remained constant at 20%.

All income is taxable, and all expenses are tax deductible.

Required

Prepare the following for inclusion in Uwanja Limited's annual financial report for the year

ended 31 December 2022 and in accordance with the International Financial Reporting

Standards

i. Statement of Comprehensive Income

(14)

ii. Statement of changes in equity

(11)

Notes to the financial statements are not required.

[Total: 25 Marks]

5

|

7 Page 7 |

▲back to top |

l

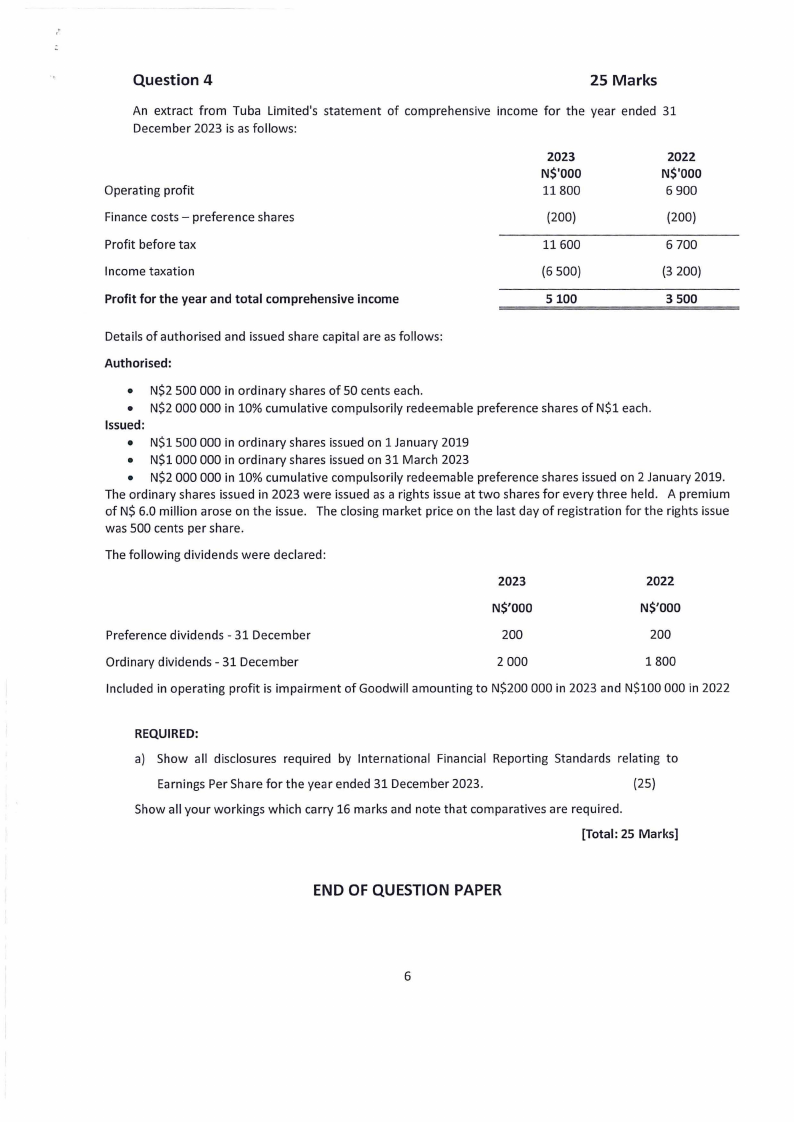

Question 4

25 Marks

An extract from Tuba Limited's statement of comprehensive income for the year ended 31

December 2023 is as follows:

Operating profit

Finance costs - preference shares

2023

N$'000

11800

(200)

2022

N$'000

6 900

(200)

Profit before tax

11600

6 700

Income taxation

(6 500)

(3 200)

Profit for the year and total comprehensive income

5100

3 500

Details of authorised and issued share capital are as follows:

Authorised:

• N$2 500 000 in ordinary shares of 50 cents each.

• N$2 000 000 in 10% cumulative compulsorily redeemable preference shares of N$1 each.

Issued:

• N$1 SOO000 in ordinary shares issued on 1 January 2019

• N$1000 000 in ordinary shares issued on 31 March 2023

• N$2 000 000 in 10% cumulative compulsorily redeemable preference shares issued on 2 January 2019.

The ordinary shares issued in 2023 were issued as a rights issue at two shares for every three held. A premium

of N$ 6.0 million arose on the issue. The closing market price on the last day of registration for the rights issue

was 500 cents per share.

The following dividends were declared:

2023

2022

N$'000

N$'000

Preference dividends - 31 December

200

200

Ordinary dividends - 31 December

2 000

1800

Included in operating profit is impairment of Goodwill amounting to N$200 000 in 2023 and N$100 000 in 2022

REQUIRED:

a) Show all disclosures required by International Financial Reporting Standards relating to

Earnings Per Share for the year ended 31 December 2023.

(25)

Show all your workings which carry 16 marks and note that comparatives are required.

[Total: 25 Marks]

END OF QUESTION PAPER

6

|

8 Page 8 |

▲back to top |