|

AEM810S-APPLIED ECONOMETRICS-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCES AND EDUCATION

DEPARTMENTOF ACCOUNTING, ECONOMICSAND FINANCE

QUALIFICATION:BACHELOROF ECONOMICSHONOURS DEGREE

QUALIFICATIONCODE: 08HECO

LEVEL:

8

COURSECODE:

AEM810S

COURSENAME: APPLIEDECONOMETRICS

SESSION:

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

SECONDOPPORTUNITYQUESTIONPAPER

EXAMINER(S) Prof. Tafirenyika Sunde

MODERATOR: Dr. Reinhold Kamati

INSTRUCTIONS

1. Answer all questions.

2. Write clearly and neatly.

3. Number the answers.

PERMISSIBLEMATERIALS

1. Ruler

2. calculator

THISQUESTIONPAPERCONSISTSOF6 PAGES

1

|

2 Page 2 |

▲back to top |

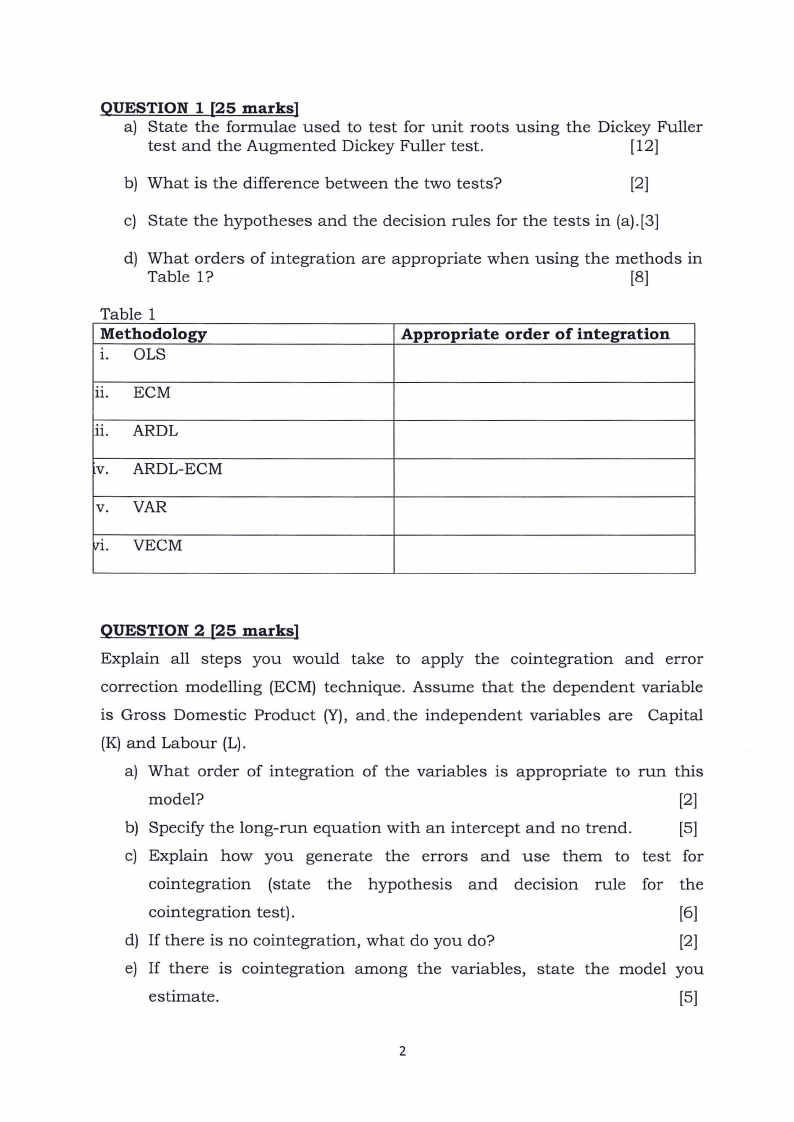

QUESTION 1 [25 marks]

a) State the formulae used to test for unit roots using the Dickey Fuller

test and the Augmented Dickey Fuller test.

[12]

b) What is the difference between the two tests?

[2]

c) State the hypotheses and the decision rules for the tests in (a).[3]

d) What orders of integration are appropriate when using the methods in

Table 1?

[8]

Table 1

Methodology

1. OLS

Appropriate order of integration

11. ECM

11. ARDL

V. ARDL-ECM

V. VAR

vi. VECM

QUESTION 2 [25 marks]

Explain all steps you would take to apply the cointegration and error

correction modelling (ECM) technique. Assume that the dependent variable

is Gross Domestic Product (Y), and. the independent variables are Capital

(K) and Labour (L).

a) What order of integration of the variables is appropriate to run this

model?

[2]

b) Specify the long-run equation with an intercept and no trend.

[5]

c) Explain how you generate the errors and use them to test for

cointegration (state the hypothesis and decision rule for the

cointegration test).

[6]

d) If there is no cointegration, what do you do?

[2]

e) If there is cointegration among the variables, state the model you

estimate.

[5]

2

|

3 Page 3 |

▲back to top |

f) Which parameters in your model are short-run and which parameters

are long-run?

[5]

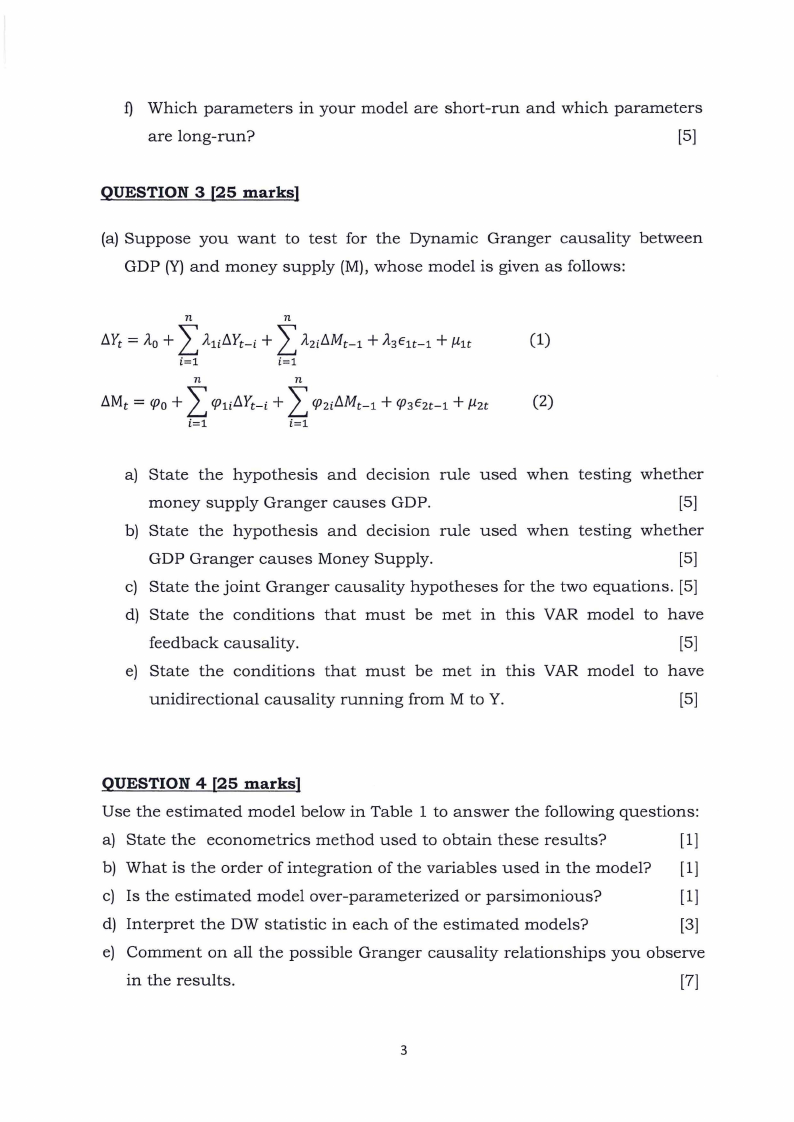

QUESTION 3 [25 marks]

(a) Suppose you want to test for the Dynamic Granger causality between

GDP (Y) and money supply (M), whose model is given as follows:

L L n

n

.t.Yt =Ao+

A1i.t.Yt-i +

+ + Azi.t.Mt-1

A3E1t-1 µlt

(1)

i=l

i=l

L L n

n

= .t.Mt <fJo+ <fJ1i.t.Yt-+i + + <fJ2i.t.Mt-1 <{J3Eu-1 µu

(2)

i=l

i=l

a) State the hypothesis and decision rule used when testing whether

money supply Granger causes GDP.

[5]

b) State the hypothesis and decision rule used when testing whether

GDP Granger causes Money Supply.

[5]

c) State the joint Granger causality hypotheses for the two equations. [5]

d) State the conditions that must be met in this VAR model to have

feedback causality.

[5]

e) State the conditions that must be met in this VAR model to have

unidirectional causality running from M to Y.

[5]

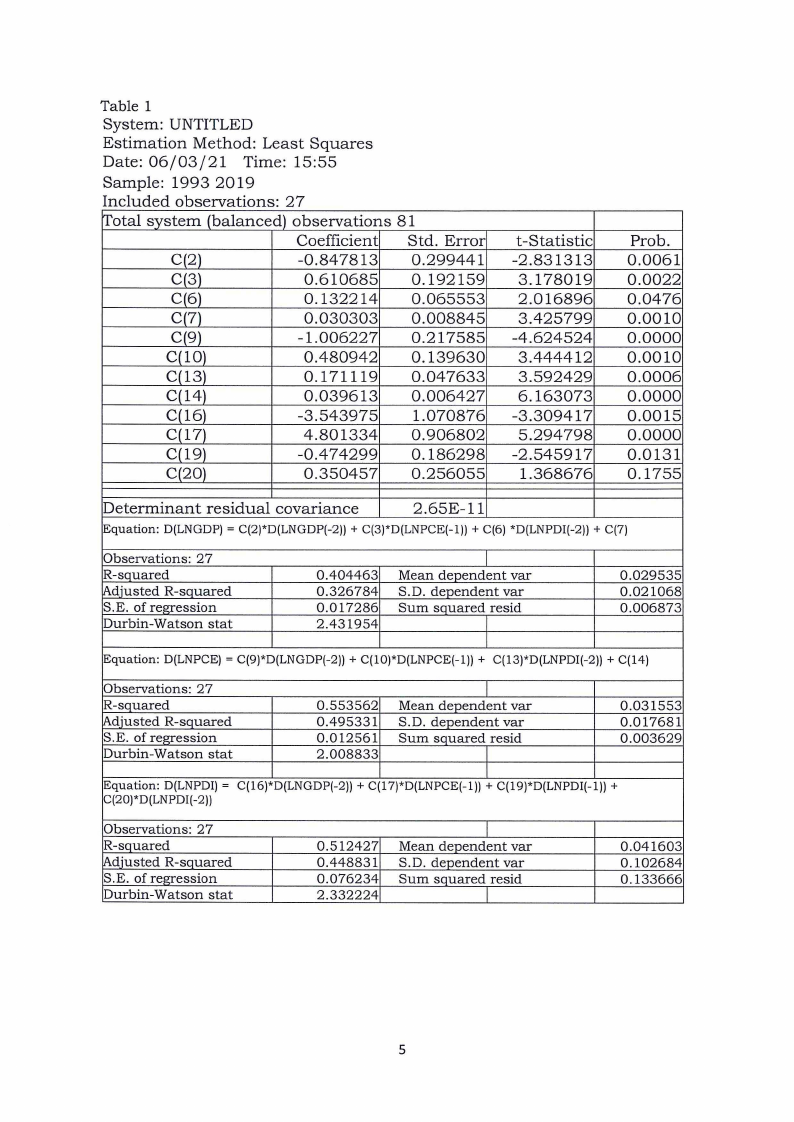

QUESTION 4 [25 marks]

Use the estimated model below in Table 1 to answer the following questions:

a) State the econometrics method used to obtain these results?

[1]

b) What is the order of integration of the variables used in the model? [1]

c) Is the estimated model over-parameterized or parsimonious?

[ 1]

d) Interpret the DW statistic in each of the estimated models?

[3]

e) Comment on all the possible Granger causality relationships you observe

in the results.

[7]

3

|

4 Page 4 |

▲back to top |

Table 1

System: UNTITLED

Estimation Method: Least Squares

Date: 06/03/21 Time: 15:55

Sample: 1993 2019

Included observations: 27

rrotal system (balanced) observations

Coefficient

C(2)

-0.847813

C(3)

0.610685

C(6)

0.132214

C(7)

0.030303

C(9)

-1.006227

C(l0)

0.480942

C(13)

0.171119

C(14)

0.039613

C(16)

-3.543975

C(17)

4.801334

C(19)

-0.474299

C(20)

0.350457

81

Std. Error

0.299441

0.192159

0.065553

0.008845

0.217585

0.139630

0.047633

0.006427

1.070876

0.906802

0.186298

0.256055

t-Statistic

-2.831313

3.178019

2.016896

3.425799

-4.624524

3.444412

3.592429

6.163073

-3.309417

5.294798

-2.545917

1.368676

Prob.

0.0061

0.0022

0.0476

0.0010

0.0000

0.0010

0.0006

0.0000

0.0015

0.0000

0.0131

0.1755

Determinant residual covariance

2.65E-11

Equation: D(LNGDP) = C(2)*D(LNGDP(-2)) + C(3)*D(LNPCE(-l)) + C(6) *D(LNPDI(-2)) + C(7)

Observations: 27

R-squared

!Adjusted R-squared

S.E. of regression

Durbin-Watson stat

0.404463

0.326784

0.017286

2.431954

Mean dependent var

S.D. dependent var

Sum squared resid

0.029535

0.021068

0.006873

Equation: D(LNPCE) = C(9)*D(LNGDP(-2)) + C(l0)*D(LNPCE(-1)) + C(l3)*D(LNPDI(-2)) + C(l4)

Observations: 27

R-squared

Adjusted R-squared

S.E. of regression

Durbin-Watson stat

0.553562

0.495331

0.012561

2.008833

Mean dependent var

S.D. dependent var

Sum squared resid

0.031553

0.017681

0.003629

Equation: D(LNPDI) = C(l6)*D(LNGDP(-2)) + C(l 7)*D(LNPCE(-l)) + C(l9)*D(LNPDI(-l)) +

C(20)*D(LNPDI(-2))

Observations: 27

R-squared

Adiusted R-squared

S.E. of regression

Durbin-Watson stat

0.512427

0.448831

0.076234

2.332224

Mean dependent var

S.D. dependent var

Sum squared resid

0.041603

0.102684

0.133666

5

|

5 Page 5 |

▲back to top |

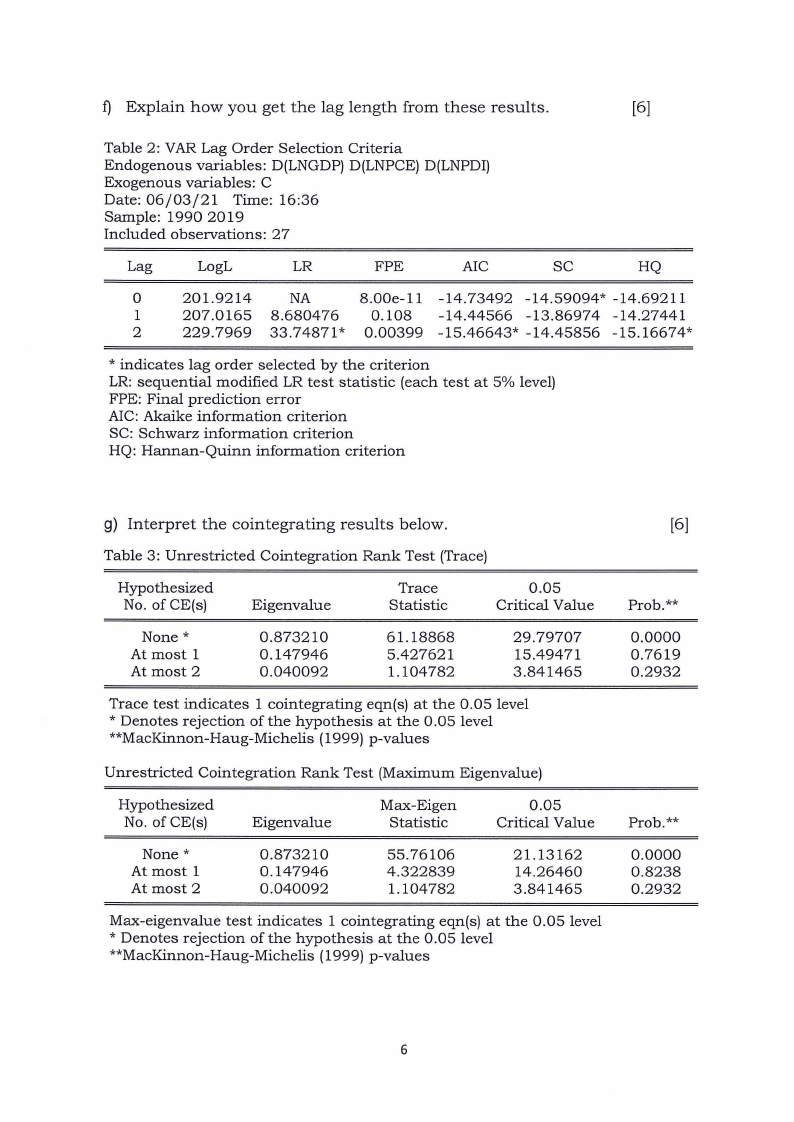

f) Explain how you get the lag length from these results.

[6]

Table 2: VAR Lag Order Selection Criteria

Endogenous variables: D(LNGDP) D(LNPCE) D(LNPDI)

Exogenous variables: C

Date: 06/03/21 Time: 16:36

Sample: 1990 2019

Included observations: 27

Lag

LogL

LR

FPE

AIC

SC

HQ

0

201.9214

NA

8.00e-11 -14.73492 -14.59094* -14.69211

1

207.0165 8.680476

0.108 -14.44566 -13.86974 -14.27441

2

229.7969 33.74871 * 0.00399 -15.46643* -14.45856 -15.16674*

* indicates lag order selected by the criterion

LR: sequential modified LR test statistic (each test at 5% level)

FPE: Final prediction error

AIC: Akaike information criterion

SC: Schwarz information criterion

HQ: Hannan-Quinn information criterion

g) Interpret the cointegrating results below.

Table 3: Unrestricted Cointegration Rank Test (Trace)

Hypothesized

No. of CE(s)

Eigenvalue

Trace

Statistic

0.05

Critical Value

None*

At most 1

At most 2

0.873210

0.147946

0.040092

61.18868

5.427621

1.104782

29.79707

15.49471

3.841465

Trace test indicates 1 cointegrating eqn(s) at the 0.05 level

* Denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

Hypothesized

No. of CE(s)

Eigenvalue

Max-Eigen

Statistic

0.05

Critical Value

None*

At most 1

At most 2

0.873210

0.147946

0.040092

55.76106

4.322839

1.104782

21.13162

14.26460

3.841465

Max-eigenvalue test indicates 1 cointegrating eqn(s) at the 0.05 level

* Denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

[6]

Prob.**

0.0000

0.7619

0.2932

Prob.**

0.0000

0.8238

0.2932

6