|

CAC710S-COMPUTERISED ACCOUNTING 301-1ST OPP-NOV 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA unlVERSITY

OF SCIEnCE Ano TECHnDLOGY

FACULTYOF COMMERCE, HUMAN SCIENCEAND EDUCATION

DEPARTMENTOF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOR OF ACCOUNTING/BACHELOR OF ACCOUNTING (CA)

QUALIFICATION CODE: 07BOAC/07BACC

COURSE CODE: CAC710S

LEVEL: 7

COURSE NAME: COMPUTERISED

ACCOUNTING 301

SESSION: NOVEMBER 2024

PAPER: PRACTICAL

DURATION: 3 HOURS (Including printing and set

up)

MARKS: 100

EXAMINERS:

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

H Namwandi, Y Elago and E Kangootui

MODERATOR: E Milijala

INSTRUCTIONS

• This question paper comprises one (1) question, split into three parts.

o Ensure your student number appears on all reports (Generated through the system,

not handwritten).

• It's your responsibility to see that all reports are printed and submitted.

.. Ensure that all worl< done during the assessment is your own.

" The use of the internet on any electronic device is prohibited during the assessment.

" Questions relating to this paper may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities and any assumption made by the candidate should be

clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 7 PAGES (Including this front page)

1

|

2 Page 2 |

▲back to top |

QUESTION 1

100 Marks

Background of the organisation.

Ntate Vuma established a Hotel a few years back when he saw an opportunity in the market

to help residents in the Oshikoto-Omuthiya region who require a good hospitality seNice within

their area to enjoy with their families. He named the hotel "Etotha Hotel Pty". The hotel has

been doing well over the past financial years due to the excellent customer seNice offered,

and in future, he would like to expand the business in other Northern parts of the country.

Since its inception, Etotha Hotel's accounting records have been recorded on the Quick Books

program, and the owner wants all the records to be migrated to the new Patel S50, a program

that he recently bought. The business is registered for Tax (VAT Vendor). You are supplied

with a list of hotel account balances to help the accountant who is on a month-long vacation

leave.

You are required to create a company on the "C" drive using the following

information.

Company Name:

Financial Year:

Date Format

Processing Method

Bankers

Printing

Supplier Processing

Student Number

1st September 2023 - 31 August 2024

01/09/2023

Balance Forward

Bank Windhoek

Plain Paper

No GRN, Purchase Orders and No inventory creation

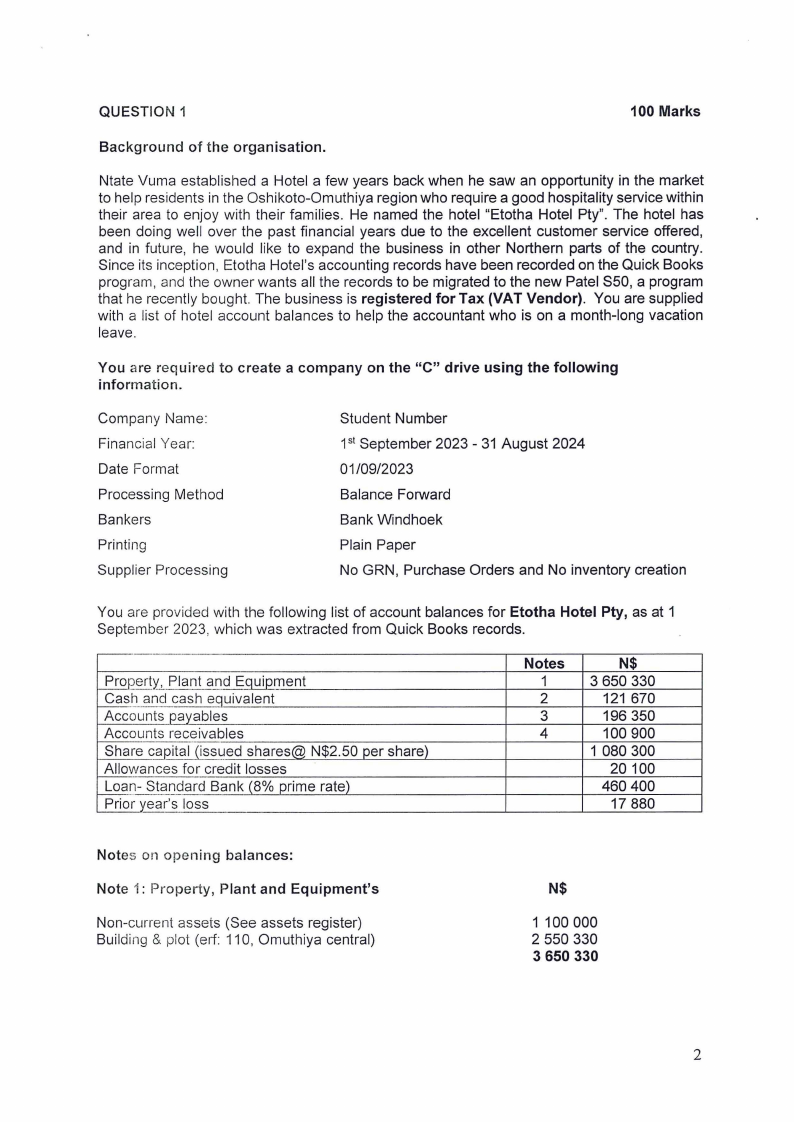

You are provided with the following list of account balances for Etotha Hotel Pty, as at 1

September 2023, which was extracted from Quick Books records.

~ertt,

Plant and Egui12ment

Cash and cash equivalent

Accounts payables

Accounts receivables

Share capital (issued shares@ N$2.50 per share)

Allowances for credit losses

Loan- Standard Bank (8% prime rate)

Prior year's loss

Notes

1

2

3

4

N$

3 650 330

121 670

196 350

100 900

1 080 300

20100

460 400

17 880

Notes on opening balances:

Note i: Property, Plant and Equipment's

Non-current assets (See assets register)

Building & plot (erf: 110, Omuthiya central)

N$

1 100 000

2 550 330

3 650 330

2

|

3 Page 3 |

▲back to top |

Assets Register:

Asset

number

Description

Acquisition

date

PPE001

PPE002

PPE002

-

PPE003

PPE004

PPE005

PPE006

PPE009

Master chef-pots,

pans, spoons,

knives & forks

Egyptian cotton

blankets & Bed

Sheets

Lenovo Photocopy &

printer machine

Office chairs, desks

& filing cabinets

lveco Mini-Bus

Samsunq Laptops

Hisense Sound bar

& TV

Floor mats and

curtains

01/11/2021

01/11/2021

01/03/2021

01/03/2022

01/11/2022

28/02/2022

28/02/2022

28/02/2022

Cost price

(N$)

55 000

Residual

value

(N$)

-

41 500

-

25 000

-

125 000

-

645 000

-

20 000

-

150 000

-

38 500

-

1 100 000

Life

span

5

5

5

10

10

5

5

-

Property, Plant and Equipment's depreciation policy:

Property, plant and Equipment owned by the hotel are depreciated using the following policy:

0 All property, plants and equipment owned by Etotha Hotel Pty are depreciated using

the fixed instalment method at a rate of 10%.

" Depreciation is calculated on assets in existence at the end of each year, using the

basis of one month's ownership.

" No depreciation is to be charged on assets in the year of disposal.

e The building, plot, TV, soundbar, floor mats and curtains are not depreciated.

Note 2: Cash and cash equivalent

Bank Windhoek investment

Bank Windhoek current account (balance as per cash book)

Petty cash

Note 3: Accounts payable

Pick n Pay (PP001)

Metro Liquor Store (ML002)

Readi Bites Butchery (RB003)

Notes 4: Accounts receivable

Ministry of Defence (MD001)

UNAfVI (UN002)

Chili Agent Ltd (CA003)

N$

65150

56 520 Dr

121 670

N$

81 340

100 010

15 000

196 350

N$

27 500

68 200

5 200

100 900

3

|

4 Page 4 |

▲back to top |

Required:

You are required to capture the opening balances of Etotha Hotel Pty accounts, including the

accumulated depreciation for all non-current assets as at 1 September 2023 (Period one).

UPDATE YOUR TRANSACTIONS BEFORE PROCEEDING TO THE NEXT QUESTION.

NB: No report is required to be printed at this stage.

Part B: Period One Transactions

In this section, you are required to process supplier and customer transactions. All

transactions rnust be processed in the general ledger (GL) only.

NB: Since all transactions will be processed under the general ledger (GL), you are required

to calculate the total costs for customer and supplier transactions separately. Once you are

done, you may enter the final amount into the system.

NB: No inventory items to be processed or created.

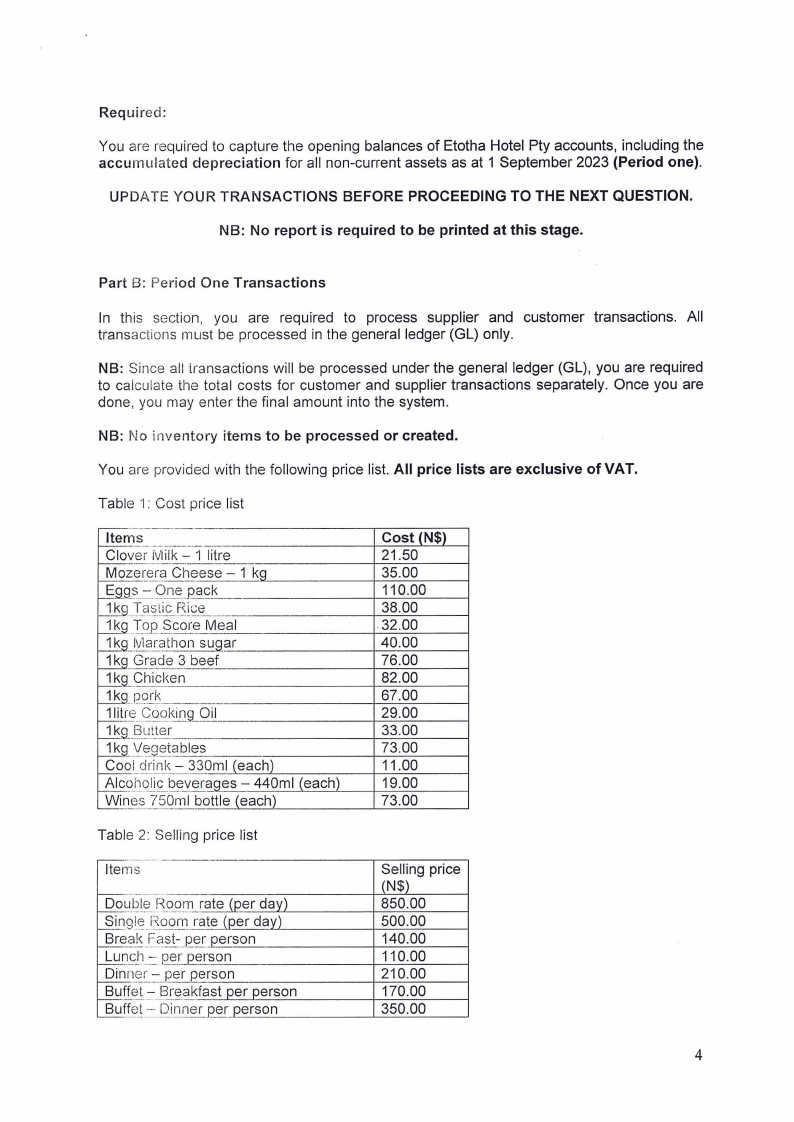

You are provided with the following price list. All price lists are exclusive of VAT.

Table 1: Cost price list

~- Items

Clover Milk - 1 litre

~-

Mozerera Cheese - 1 kq

~99.~-=-9n~pack

.J!.g_ Tastic F~ice __

-1£9-I.<?12Score Meal

.J!_g_Marathon suqar

1kq Grade 3 beef

1kg Chicken

L1!~1fL2ork

~e Co_okingOil

.J_tg Butter

.JJs._g__'{_~getables

Cool drink - 330ml (each)

Alcoholic beveraqes - 440ml (each)

Wines 750ml bottle (each)

Cost (N$)

21.50

35.00

110.00

38.00

32.00

40.00

76.00

82.00

67.00

29.00

33.00

73.00

11.00

19.00

73.00

Table 2: Selling price list

Items

Double Room rate

Sing~ _F_3,oomrate

Break Fast- per__.__e_r_s___o___n_

Luncl1_=:per erson

Dinner- er erson

Buffet - Breakfast er erson

Buf~_\\_::D:: inner 12er_._______

Selling price

N$

850.00

500.00

---1-_1_4O__0_O.

110.00

210.00

170.00

.,___3_50__._0_0

4

|

5 Page 5 |

▲back to top |

Cool drink - 330ml (each)

Alcoholic beverages - 440ml (each)

--Wines bottle (each)

20.00

30.00

105.00

The following transactions (purchases and sales) took place during the period of 1

September 2023. All transactions were on account.

Supplier

Invoice

number

Pick n Pay

----~- ----··---

~--

-···--·----------

Metro Liquor store

PP541

MR245

--------

Readi Bites Butchery

RB369

·------

Customer

Invoice

number

Ministry of Defence

NI001

Items bought

50 litres of Clover milk

3 pack of eggs

15 kq of Mozerera cheese

4kQ of Tastic Rice

6kg of Marathon Sugar

13 bottles of 750ml wine

96 Cool drinks- 330ml

144 Alcoholic beverages - 440ml

25kQ of Grade 3 beef

56kg of Pork

?0kq of Chicken

Service/goods sold

Served 24 buffet breakfasts each day for 10

days

Served 24 dinners each day for 10 days

Served 24 lunches each day for 10 days

Served 72 cool drinks each day for 10 days

Single room booked for 24 people for 10 days

UNAfVI

NI002

Served 12 lunches each day for 5 for days

Served 12 dinners each day for 5 days

Served 6 cool drinks each day for 5 days

Served 6 alcoholic beverages each day for 5

days

Part C: Year-end adjustments

Ntate Vuma provided you with the following year-end adjustments and cash book transactions,

which have not yet been recorded in the hotel's books. All year-end adjustments should be

processed in period 2.

Q One of Etotha Hotel Pty customers, Chilli Agent Ltd was declared insolvent by the high

court. Ntate Vuma decided to write off the whole balance.

e The directors of Etotha Hotel declared a dividend of N$0.75 per share on all issued

share capital, which will be paid in the next financial year.

5

|

6 Page 6 |

▲back to top |

'11 The auditor discovered that the Samsung laptop value was overstated by N$ 2,000 as

on the acquisition date and recommended that an adjustment be made accordingly.

" Interest on loan for the current period has not yet been paid but must be accounted for

in the books.

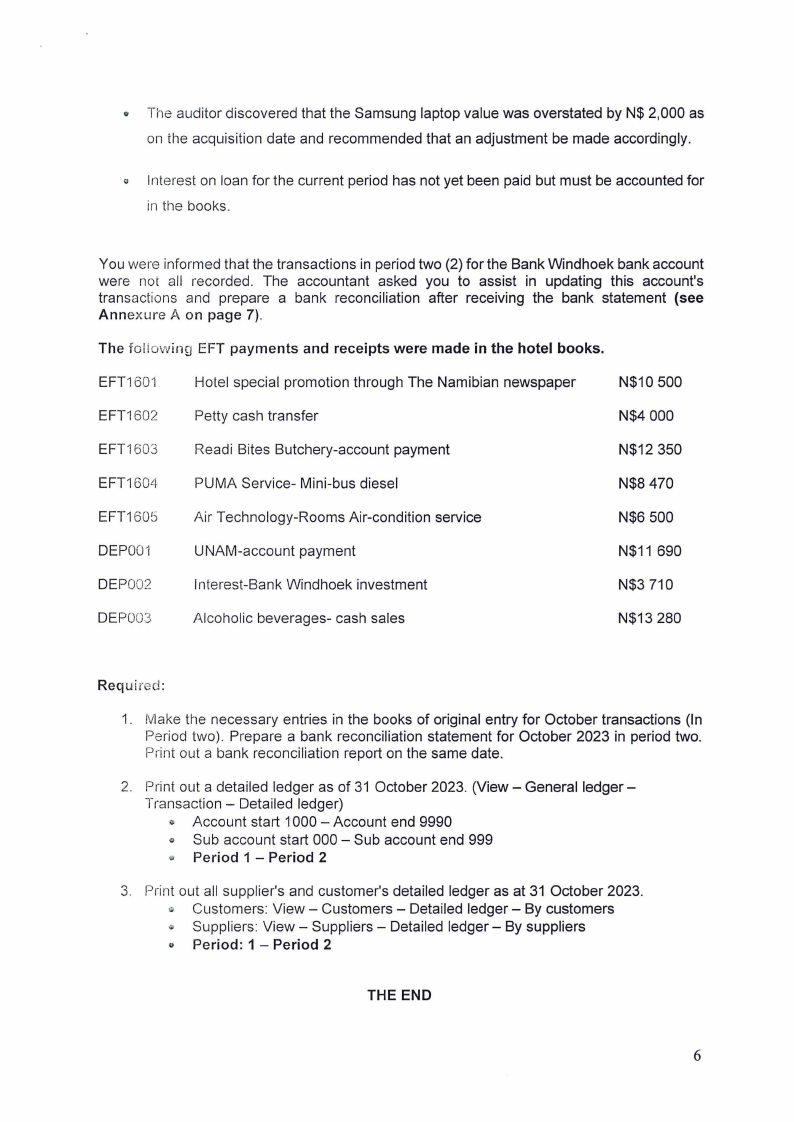

You were informed that the transactions in period two (2) for the Bank Windhoek bank account

were not all recorded. The accountant asked you to assist in updating this account's

transactions and prepare a bank reconciliation after receiving the bank statement (see

Annexure A on page 7).

The following EFT payments and receipts were made in the hotel books.

EFT1601

Hotel special promotion through The Namibian newspaper

N$10 500

EFT1602

Petty cash transfer

N$4 000

EFT1603

Readi Bites Butchery-account payment

N$12 350

EFT1604

PUMA Service- Mini-bus diesel

N$8 470

EFT1605

Air Technology-Rooms Air-condition service

N$6 500

DEP001

UNAM-account payment

N$11 690

DEP002

Interest-Bank Windhoek investment

N$3 710

DEP003

Alcoholic beverages- cash sales

N$13 280

Required:

1. Make the necessary entries in the books of original entry for October transactions (In

Period two). Prepare a bank reconciliation statement for October 2023 in period two.

Print out a bank reconciliation report on the same date.

2. Print out a detailed ledger as of 31 October 2023. (View - General ledger-

Transaction - Detailed ledger)

e Account start 1000 - Account end 9990

0 Sub account start 000 - Sub account end 999

Period 1 - Period 2

3. Print out all supplier's and customer's detailed ledger as at 31 October 2023.

,;; Customers: View - Customers - Detailed ledger - By customers

"' Suppliers: View - Suppliers - Detailed ledger - By suppliers

" Period: 1 - Period 2

THE END

6

|

7 Page 7 |

▲back to top |

ANNEXURE A

Bank Windhoek

Bank Statement- Etotha Hotel Pty: October/November 2023

-

Date

Details

Dr/Cr (N$)

1 Oct 23 Balance b/f

-

1 Oct 23

--

2 Oct 23

----

3 Oct 23

KPMG - internal audit fees

Petty cash-Transfer

Omuthiya Town council- Rates & Taxes

(11 450)

(4 000)

(2 680)

9 Oct 23

--------·

10 Oct 23

--·--

12 Oct 23

Investment interest-Investment

/\\milema Village- Grocery donation

-

Readi Bites Butchery-payment

3 710

(10 980)

(12 350

15 Oct 23

15 Oct 23

------

17 Ocl 23

-------

17 Oct 23

1-------------

20 Oct 23

1-------

21 Oct 23

Windhoek Flower cc- Rooms decoration

--

Rent a Drum Cleaner- service fees

OHL-fees

Kadhila Amoomo Lawyers- attorney charges

rvtinistry of Defence-payment

--·-

Waltons Namibia-office accessories

(6 185)

(5 000)

(1 680)

(3 570)

14 000

(1 490)

24 Oct 23 Pick n Pay-payment

(15 660)

25 Oct 23 Staff remunerations

----------

27 Oct 23 I Bank Windhoek- account service fees

--

---· ----- -·

28 Ocl 23 fv1etro Liquor Store-payment

--

28 Oct 23 NUST Hotel School-Culinarily Classes fees

-------

30 Oct 23 TN Mobile- Service charges

>--------

1 Nov 23

Cash sales-Alcoholic beverages

-··-••·••·--

3 Nov 23

PUMA Service-Diesel

~---·-----

(34 580)

(860)

(20 940)

(10 080)

(2 540)

13 280

(8 470)

.._______ __---------

Balance (N$)

56 520

45 070

41 070

38 390

42 100

31 120

18 770

12 585

7 585

5 905

2 335

16 335

14 845

(815)

(35 395)

(36 255)

(57 195)

(67 275)

(69 815)

(56 535)

(65 005)

7