|

FEO810S-FINANCIAL ECONOMICS-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

Pl nAmlBIA UnlVERSITY

OFSCIEnCEAno TECHnOLOGY

---

FACULTY OF MANAGEMENT SCIENCES

DEPARTMENT OF ACCOUNTING, ECONOMICS AND FINANCE

BACHELOR OF ECONOMICS HONOURS (08BECH}

DATE:

DURATION:

MARKS:

June 2022

3 Hours

100

FINANCIAL ECONOMICS (FEO810S}

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER

Prof. T. KAULIHOWA

MODERATOR

Dr. R. KAMATI

INSTRUCTIONS

I

1. This paper is made up of three {3) questions

2. Answer ALL questions

3. Show all your workings & round off only final answers to 2 decimal places

4. Financial/Scientific calculators are allowed

REQUIREMENTS: Scientific or Financial calculator

This paper consists of 5 pages excluding this cover page and appendices

|

2 Page 2 |

▲back to top |

SECTION A: Answer all questions

1. Increased uncertainty resulting from the coronavirus pandemic ____

investment in equity.

A) raised

B) lowered

C) had no impact on

D) decreased

[40 MARKS)

the required return on

[2]

2. The efficient market hypothesis suggests that if an unexploited profit opportunity

efficient market.

A) it will tend to go unnoticed for some time.

B) it will be quickly eliminated.

C) financial analysts are your best source of this information.

D) all profits will be eliminated through taxation.

arises in an

[2]

3. ____

occurs when market participants observe returns on a security that are larger than what is

justified by the characteristics of that security and take action to quickly eliminate the unexploited

profit opportunity.

[2]

A) Arbitrage

B) Mediation

C) Asset capitalization

D) Market intercession

4. If you buy a call option on Treasury futures at 115, and at expiration the market price is 110, the

____

will ____

exercised.

[2]

A) call; be

B) put; be

C) call; not be

D) put; not be

5.lf a N$ 1000-00 coupon bond has a coupon rate of 12% per annum, paid semiannually. The current

yield to maturity in 10%, then the coupon payment every year is.

[2]

A) N$ 120

B) N$ 60

C) N$ 100

D) N$ 50

6.Which of the following can be described as direct finance?

[2]

A) You take out a mortgage from your local bank.

B) You borrow $2,500 from a friend.

C) You buy shares of common stock in the secondary market.

D) You buy shares in a mutual fund.

|

3 Page 3 |

▲back to top |

7. ____

work in the secondary markets matching buyers with sellers of securities.

[2]

A) Dealers

B) Underwriters

C) Brokers

D) Claimants

8. In a(n) ____

market, dealers in different locations buy and sell securities to anyone who comes

to them and is willing to accept their prices.

[2]

A) exchange

B) over the counter

C) common

D) barter

9. The Namibia Stock Exchange (NSX) is a ____

market as well as a ____

market.

[2]

A) primary; money

B) secondary; money

C) secondary; capital

D) primary; capital

10. The capital allocation line will be a straight line:

[2]

A) when investors can borrow and lend at the risk-free rate

B) when investors are risk neutral

C) when securities have zero covariance

D) when the risk-free asset has the highest return of any security

11. According to the CAPM, the best capital allocation line:

[2]

A) is tangent to the efficient frontier of risky securities

B) has the highest reward to variability ratio (price of risk)

C) is comprised of efficient portfolios

D) all of the above

12. If you can get a 7.75% return on money invested for 10 years from your local bank, would it be wise

to invest in a 10 year, $1000 par value zero coupon bond that costs$ 475? (Assume both are equally

risky.)

[4]

A. Yes, the YTM is greater

B. No, the YTM is less

C. Can't tell from information given

D. The two cannot are incomparable

2

|

4 Page 4 |

▲back to top |

13. According to modern portfolio theory, which of the following is not true?

[2]

A. All systematic risk can be diversified away

B. All non-systematic risk can be diversified away

C. Diversification lowers the potential risk of the portfolio

D. None of the above

14. If your objective is to reduce the standard deviation of returns on a portfolio by the greatest

amount, you should add a security:

[2]

A) that has a lower standard deviation of returns than other securities in the portfolio

B} That has a beta less than one

C} That has returns that are uncorrelated with the returns on all other securities in the portfolio

D} That has returns that are positively correlated with the returns on other securities in the portfolio

15. If a Bank of NamibiaTreasury bill pays 5%, which of the following would not be chosen by a risk

averse investor:

[4]

A) An asset paying 10%, with probability 0.6 or 2% with probability 0.4

B} An asset paying 10% with probability 0.4 or 2% with probability 0.6

C} An asset paying 10% with probability 0.2 or 3.75% with probability 0.8

D) An asset paying 10% with probability 0.3 or 3.75% with probability 0.7

16. Suppose the return on ABC stock was 14%. If CAPM is correct and if Rf=3%, Rm=10% and ABC's

Beta=l.45, the stock was:

[4]

A} Overpriced (too high)

B} Underpriced (too low)

C} Properly priced

D} Not enough information

to answer

17. John and Jim are both risk averse and only care about the mean and standard deviation of their

portfolio's return. They agree on the opportunity set available. There are N risky assets and a riskless

asset. According to the CAPM, which of the following statements is correct?

[2]

A} John and Jim hold the same portfolio of all assets.

B} John and Jim may hold completely different portfolios of risky assets.

C} When choosing between 2 portfolios, John and Jim always prefer the one with the lowest standard

deviation.

D) John holds any two risky assets in the same ratio as Jim does in his portfolio.

3

|

5 Page 5 |

▲back to top |

QUESTION 2

[30 MARKS]

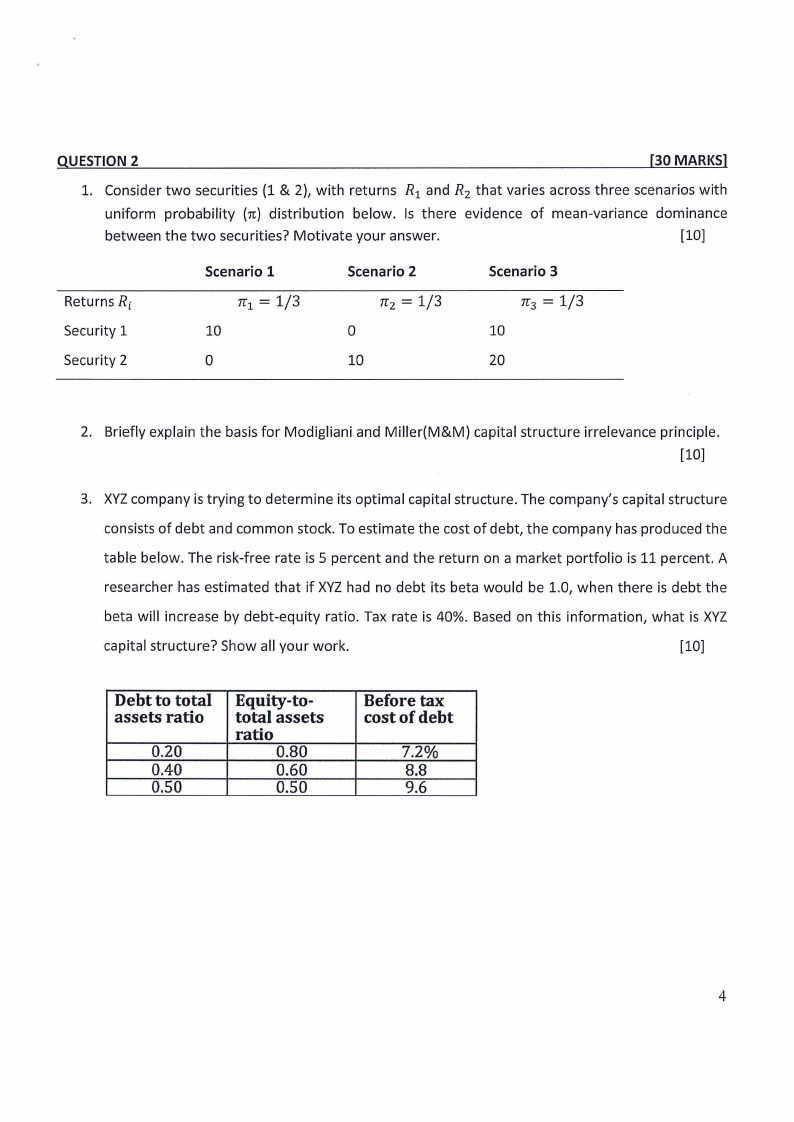

1. Consider two securities (1 & 2), with returns R1 and R2 that varies across three scenarios with

uniform probability (n) distribution below. Is there evidence of mean-variance dominance

between the two securities? Motivate your answer.

[10]

Returns Ri

Security 1

Security 2

Scenario 1

10

0

Scenario 2

rr2 = 1/3

0

10

Scenario 3

10

20

2. Briefly explain the basis for Modigliani and Miller(M&M) capital structure irrelevance principle.

[10]

3. XYZcompany is trying to determine its optimal capital structure. The company's capital structure

consists of debt and common stock. To estimate the cost of debt, the company has produced the

table below. The risk-free rate is 5 percent and the return on a market portfolio is 11 percent. A

researcher has estimated that if XYZ had no debt its beta would be 1.0, when there is debt the

beta will increase by debt-equity ratio. Tax rate is 40%. Based on this information, what is XYZ

capital structure? Show all your work.

[10]

Debt to total

assets ratio

0.20

0.40

0.50

Equity-to-

total assets

ratio

0.80

0.60

0.50

Before tax

cost of debt

7.2%

8.8

9.6

4

|

6 Page 6 |

▲back to top |

QUESTION 2

[30 MARKS)

1. Discuss the assumptions of the Capital Asset Pricing Model {CAPM) and explain how these

assumptions relate to the 'real world' investment decision process.

[10]

2. In recent years there has been substantial theoretical and empirical work on the role that

financial development play in fostering economic growth. Briefly discuss how financial

development may enhance economic growth?

[10]

3. Jackey purchased a 10% coupon par bond at a price of N$ 1000 that expires in 10 years. However,

Pauline encountered unforeseen liquidity problems that forced her to sell the bond after holding

it for 5 years. Similar bonds are currently trading at N$ 1000-00 and pay an annual coupon rate

of 12%. At what price should Pauline sell her bond?

[5]

4. Suppose a spot price of a market index is $900. After 6 months the market index is priced at 920.

The annual risk-free rate is 5%. The premium on the long put, with exercise price of 930 is $10.

Calculate the profit at expiration for a long put.

[5]

***End***

5

|

7 Page 7 |

▲back to top |

U

=

1

E(r)--ACT

2

Formulas Sheet

2

E[rJi:W;E(r;)

j,,J

i ii i ii -E~J a-;E=~P

= w;a+-; = W;W,U;, w;a+; w;w,p1_,a;a,

j,.,J

jnl Pl

j:)

i•l l"I

ni

,s~i

WACC = WDRD + WpRP + WeRe

R

e

Do(l +

=---+g Po

g)

Divident payable

RP= Market value(ex - dividend)

Px,y

=

COV(x,y)

CTxCTy

COV(x,y) = E[(X - E(X))(Y-

FV = PV(l +r?

E(Y))]

a,; £( R,Jc" R; + [E( Rm)- Rt}

/Jm

RD= Rd(l - Cr)

Re

=

W ACC

+

D

E

(W

ACC

-

RD)

R = WACC = -------- EBIT

e

Market value of Equity

/J =a'"= COV(R,,R ...J

' a;, VAR(R,,.I

p =-(-1P-M++T-y-)-+·(1P+MTy) 2

Yr ..+-(-1-P++M-Ty-)-2-

FV + PMT

(1 +

D

Re= WACC +E(WACC- RD)

P=--+1---C.+ i

C

Cl + ii

+--(-1+·+C··-05

+--(-1+-+C--i)"

F

(1 + i)"

P

=

PMT

1-

[-----

(1 + y)-n]

y

+-(-1-

FV

+ y)n

RET = -C+

P -P

t+l

t

pt

pt

C +FV-PV

YTM = FV + ~V

2

Lower bound European Call Price= S0 - Ke-TT

Lower bound European Put Price= Ke-TT - S0

Put - call - parity: c + Ke-TT= p + S0