|

MAB611S-MONEY AND BANKING -1ST OPP- JUNE 2024 |

|

1 Page 1 |

▲back to top |

nAm I BIA un IVERSITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOR OF ECONOMICS

QUALIFICATION CODE: O7BEC0

LEVEL: 7

COURSE CODE: MAB611S

COURSE NAME: MONEY AND BANKING

SESSION: JUNE 2024

DURATION: 3 HOURS

PAPER: THEORY

MARKS: 100

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

EXAMINER(S) Ms Kasnath Kavezeri

MODERATOR: Mr Mally Likukela

INSTRUCTIONS

1. Answer ALLthe questions.

2. Write clearly and neatly.

3. Number the answers clearly.

PERMISSIBLE MATERIALS

1. Pens/pencils/erasers

2. Calculator

3. Ruler

THIS QUESTION PAPER CONSISTS OF 6 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

QUESTION 1

[25 Marks]

Select the letter that best represents your choice.

1. You just bought a new car. In this transaction, you used money as a

(a) Form of credit.

(b) Source of income.

(c) Means of payment.

(d) Standard of value.

2. The price paid for the rental of borrowed funds (usually expressed as a percentage

of the rental of the amount per year) is commonly referred to as the

(a) Inflation rate.

(b) Exchange rate.

(c) Interest rate.

(d) Aggregate price level.

3. The Ml definition of money includes

(a) Currency outside banks plus checkable deposits and Eurodollars.

(b) Currency outside banks plus checkable deposits plus retail money market deposit

accounts.

(c) Currency outside banks plus checkable deposits plus traveler's checks.

(d) Currency outside banks plus checkable deposits plus small-denomination time deposits.

4. An asset that can be quickly turned into the medium of exchangewithout taking a loss

is said to be very

(a) Accountable.

(b) Liquid.

(c) Divisible.

(d) Profitable

5. Which of the following is the least liquid?

(a) A checking account

(b) A government bond

(c) A traveler's check

(d) A money market deposit account

6. A financial crisis is

(a) Not possible in the modern financial environment.

(b) A major disruption in the financial markets.

(c) A feature of developing economies only.

(d) Typically followed by an economic boom

2

|

3 Page 3 |

▲back to top |

7. Banks are important to the study of money and the economy because they

(a) Channel funds from investors to savers.

(b) Have been a source of rapid financial innovation.

(c) Are the only important financial institution in the economy.

(d) Create inflation.

8. The management of money and interest rates is called ____

policy and is

conducted by a nation's ____

bank.

(a) Monetary; superior

(b) Fiscal; superior

(c) Fiscal; central

(d) Monetary; central

9. If the maturity of a debt instrument is lessthan one year, the debt is called

(a) Short-term.

(b) Intermediate-term.

(c) Long-term.

(d) Prima-term.

10. Which of ~e following statements about the characteristics of debt and equity is

FALSE?

(a) They can both be long-term financial instruments.

(b) They can both be short-term financial instruments.

(c) They both involve a claim on the issuer's income.

(d) They both enable a corporation to raise funds.

11. Equity holders are a corporation's ____ . That means the corporation must pay all

of its debt holders before it pays its equity holders.

(a) Debtors

(b) Brokers

(c) Residual claimants

(d) Underwriters

12. Which of the following benefits directly from any increase in the corporation's

profitability?

(a) A bond holder

(b) A commercial paper holder

(c) A shareholder

(d) A treasury bill holder

13. A financial market in which previously issued securities can be resold is called a

____

market.

(a) Primary

(b) Secondary

(c) Tertiary

(d) Used securities

3

|

4 Page 4 |

▲back to top |

14. Which of the following is not a financial institution?

(a) A mutual fund

(b) An insurance company

(c) A pension fund

(d) A mining company

15. Equity instruments are traded in the ____

market.

(a) Money

(b) Bond

(c) Capital

(d) Commodities

16. Becausethese securities are more liquid and generally have smaller price fluctuations,

corporations and banks use the ____

securities to earn interest on temporary

surplus funds.

(a) Money market

(b) Capital market

(c) Bond market

(d) Stock market

17. Collateral is____

the lender receives if the borrower does not pay back the loan.

(a) A liability

(b) An asset

(c) A present

(d) An offering

18. Bondsthat are sold in a foreign country and are denominated in a currencyother than

that of the country in which it is sold are known as

(a) Foreign bonds.

(b) Eurobonds.

(c) Equity bonds.

(d) Country bonds.

19. The concept of diversification is captured by the statement

(a) Don't look a gift horse in the mouth.

(b) Don't put all your eggs in one basket.

(c) It never rains, but it pours.

(d) Make hay while the sun shines.

20. The problem created by asymmetric information before the transaction occurs is

called ___

_, while the problem created after the transaction occurs is called

(a) Adverse selection; moral hazard

(b) Moral hazard; adverse selection

(c) Costly state verification; free-riding

(d) Free-riding; costly state verification

4

|

5 Page 5 |

▲back to top |

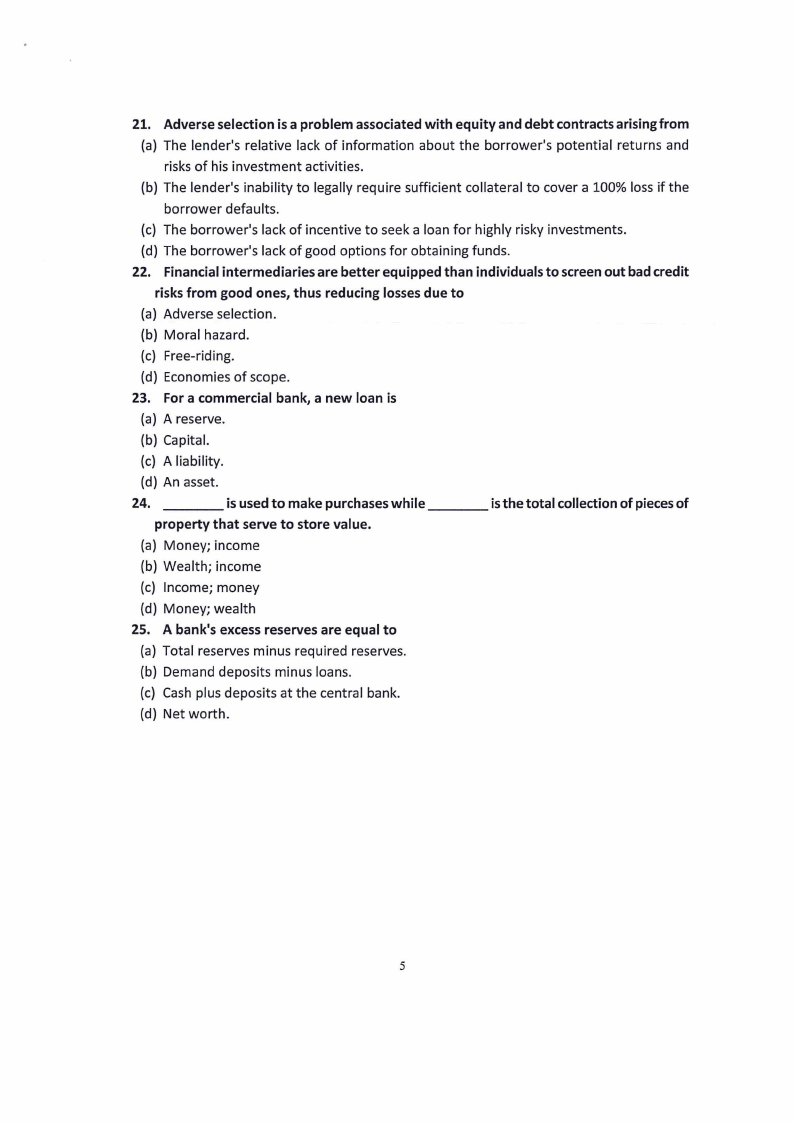

21. Adverse selection is a problem associated with equity and debt contracts arising from

(a) The lender's relative lack of information about the borrower's potential returns and

risks of his investment activities.

(b) The lender's inability to legally require sufficient collateral to cover a 100% loss if the

borrower defaults.

(c) The borrower's lack of incentive to seek a loan for highly risky investments.

(d) The borrower's lack of good options for obtaining funds.

22. Financial intermediaries are better equipped than individuals to screen out bad credit

risks from good ones, thus reducing losses due to

(a) Adverse selection.

(b) Moral hazard.

(c) Free-riding.

(d) Economies of scope.

23. For a commercial bank, a new loan is

(a) A reserve.

(b) Capital.

(c) A liability.

(d) An asset.

24. ____

is used to make purchases while ____

isthe total collection of pieces of

property that serve to store value.

(a) Money; income

(b) Wealth; income

(c) Income; money

(d) Money; wealth

25. A bank's excess reserves are equal to

(a) Total reserves minus required reserves.

(b) Demand deposits minus loans.

(c) Cash plus deposits at the central bank.

(d) Net worth.

5

|

6 Page 6 |

▲back to top |

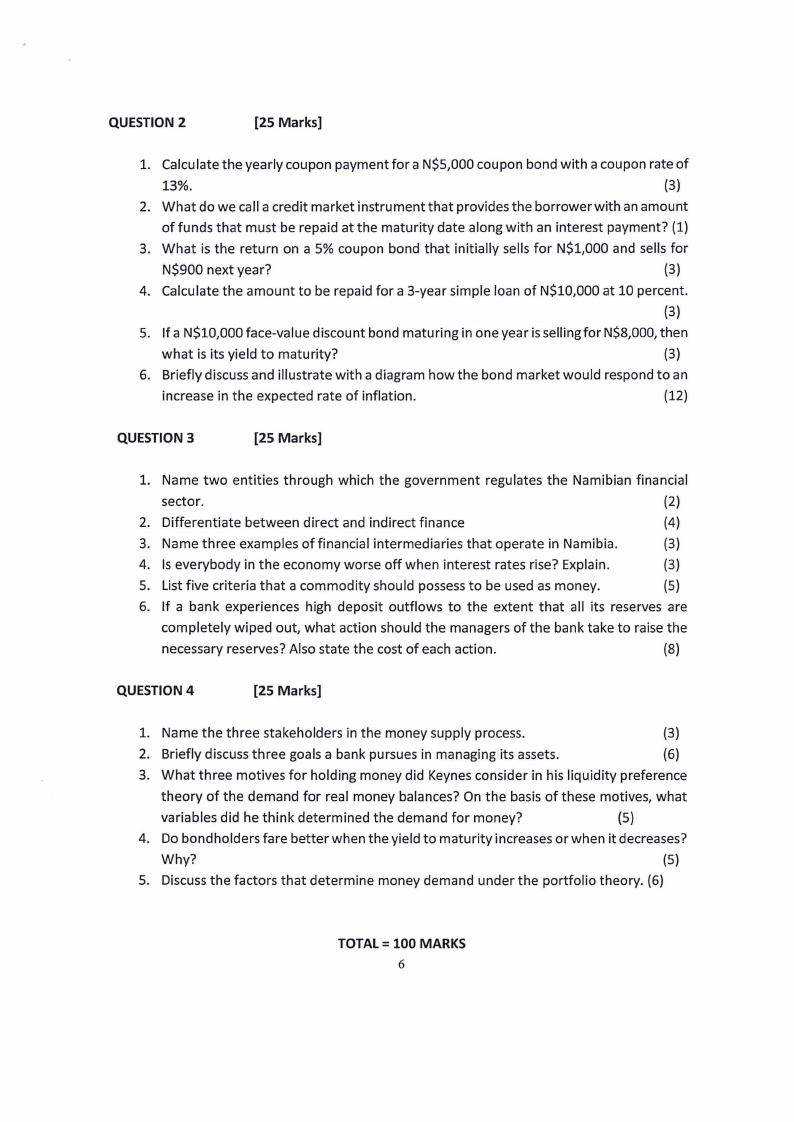

QUESTION Z

[ZS Marks]

1. Calculate the yearly coupon payment for a N$5,000 coupon bond with a coupon rate of

13%.

(3)

2. What do we call a credit market instrument that provides the borrower with an amount

of funds that must be repaid at the maturity date along with an interest payment? (1)

3. What is the return on a 5% coupon bond that initially sells for N$1,000 and sells for

N$900 next year?

(3)

4. Calculate the amount to be repaid for a 3-year simple loan of N$10,000 at 10 percent.

(3)

5. If a N$10,000 face-value discount bond maturing in one year is selling for N$8,000, then

what is its yield to maturity?

(3)

6. Briefly discuss and illustrate with a diagram how the bond market would respond to an

increase in the expected rate of inflation.

(12)

QUESTION 3

[ZS Marks]

1. Name two entities through which the government regulates the Namibian financial

sector.

(2)

2. Differentiate between direct and indirect finance

(4)

3. Name three examples of financial intermediaries that operate in Namibia.

(3)

4. Is everybody in the economy worse off when interest rates rise? Explain.

(3)

5. List five criteria that a commodity should possess to be used as money.

(5)

6. If a bank experiences high deposit outflows to the extent that all its reserves are

completely wiped out, what action should the managers of the bank take to raise the

necessary reserves? Also state the cost of each action.

(8)

QUESTION 4

[ZS Marks]

1. Name the three stakeholders in the money supply process.

(3)

2. Briefly discuss three goals a bank pursues in managing its assets.

(6)

3. What three motives for holding money did Keynes consider in his liquidity preference

theory of the demand for real money balances? On the basis of these motives, what

variables did he think determined the demand for money?

(5)

4. Do bondholders fare better when the yield to maturity increases or when it decreases?

Why?

(5)

5. Discuss the factors that determine money demand under the portfolio theory. (6)

TOTAL = 100 MARKS

6