|

FMH810S-FINANCIAL MANAGEMENT HOSPITALITY AND TOURISM-2ND OPP- JULY 2024 |

|

1 Page 1 |

▲back to top |

nAmlBIA UnlVERSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCEAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING & FINANCE

QUALIFICATION: BACHELOR OF HOSPITALITY MANAGEMENT (HONOURS)

QUALIFICATION CODE: 08BHTH

COURSE CODE: FMH810S

LEVEL: 8

COURSE NAME: FINANCIAL MANAGEMENT:

HOSPITALITY AND TOURISM

SESSION: JUNE 2024

DURATION: 3 HOURS

PAPER: PRACTICAL AND THEORY

MARKS: 100

EXAMINERS:

SECOND OPPORTUNITY EXAMINATION QUESTION PAPER

H Kangala

MODERATOR: A Okafor

INSTRUCTIONS

• This question paper is made up of four (4) questions.

• Start each question on a new page.

• Answer All the questions in blue or black ink only.

• You are advised to pay due attention to expression and presentation. Failure to do so will

cost you marks.

• Start each question on a new page in your answer booklet and show all your workings.

• Questions relating to this paper may be raised in the initial 30 minutes after the start of

the paper. Thereafter, candidates must use their initiative to deal with any perceived error

or ambiguities and any assumption made by the candidate should be clearly stated.

PERMISSIBLE MATERIALS

Non-programmable calculator

THIS QUESTION PAPER CONSISTS OF 3 PAGES (Excluding this front page)

0

|

2 Page 2 |

▲back to top |

Question 1

25 Marks

X Unlimited can sell 2,000 units of product X at the price of N$300. If the business increased

its selling price to N$400, the demand would fall to 1,000 units. According to business records,

product X has a variable cost of N$30 per unit and the business has monthly fixed costs of

N$15 000 per month.

Requirement:

a} Using the price function, calculate the 'b' variable.

2 Marks

b} Using the price function, calculate the 'a' variable.

3 Marks

c} Use the above variables to write the price function of quantity demanded for Product

X.

2 Marks

d} Write down the marginal revenue function.

2 Marks

e} How much is the marginal cost for Product X?

2 Marks

f} Find the quantity that maximises profit.

3 Marks

g) Calculate the price at the level that maximises profit.

3 Marks

h} How much is maximum profit?

4 Marks

i) Discuss the pricing strategie of price differentiation and premium pricing. 4 Marks

Question 2

15 Marks

Gondwana Collection Namibia, is a hub of travel and safari in Namibia and also offers rental

cars and accommodation (hotel, lodges, campsite and self-catering}. One of the key

responsibilities of management is to implement a new management control system (MCS}

within the organisation towards incorporating technology into their operations and improving

productivity. You are tasked to advise them on certain key areas that are needed to be done

to successful execution.

Answer the following questions:

Required:

a} Explain the meaning of the term task control.

3 Marks

b) Discuss any 2 elements of financial management.

4 Marks

c} Give 4 key differences between strategy formulation and management control.

8 Marks

|

3 Page 3 |

▲back to top |

Question 3

10 Marks

ABC Beverages manufactures and sells a popular soft drink brand called "Fizzy." Over the past

few months, the marketing team at ABC Beverages has observed a decline in sales revenue

for Fizzy. Concerned about this trend, the management team has tasked your department

with conducting a thorough analysis to understand the factors contributing to the decline in

sales.

The marketing team has provided you with the following data:

-At the normal Price of N$1.50 per can, the company sold a quantity of 10,000 cans per week.

- However, after a price increase to $1.80 per can, the quantity sold decreased to 8,000 cans

per week.

Answer the following questions:

a} Use the above information to calculate the price elasticity of demand for Fizzy.

4 Marks

b} Interpret Fizzy's price elasticity of demand.

2 Marks

c) Name and explain 2 factors that may influence the price elasticity of demand for Fizzy.

4 Marks

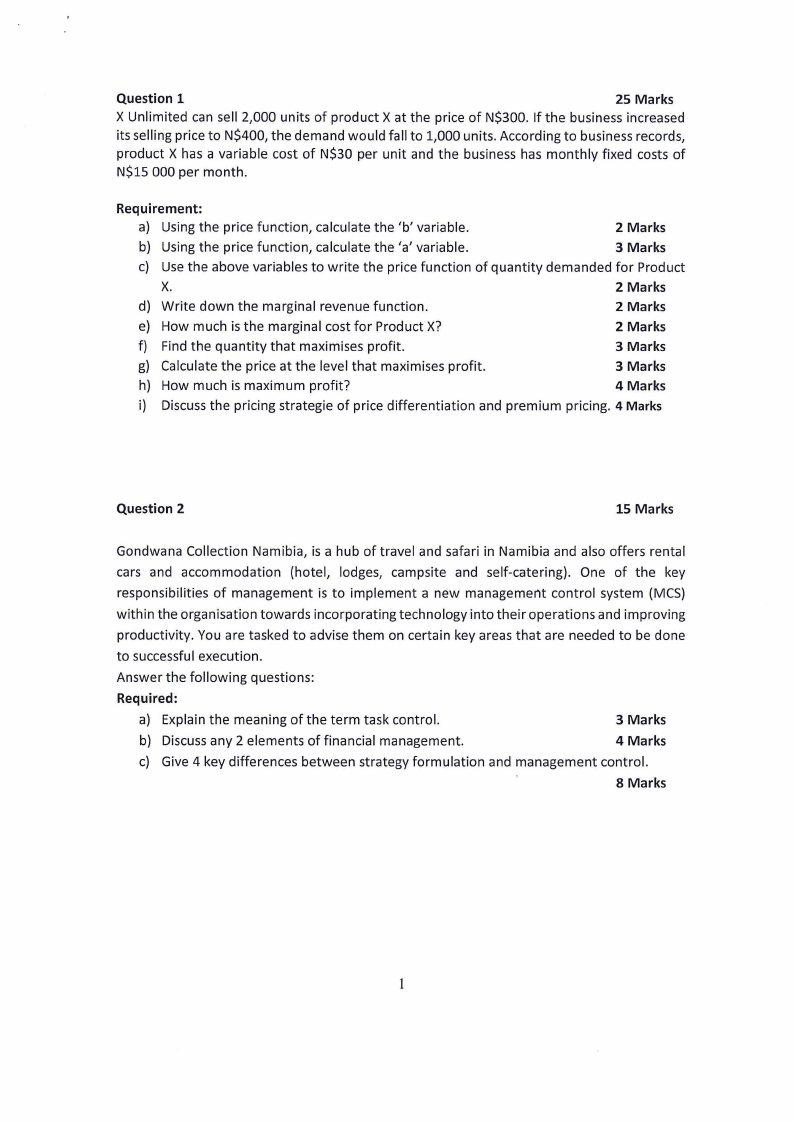

Question 4

30 marks

JJ Lodges is considering two projects. The projects are similar in nature and are expected both

operate for four years. Due to the unavailability of funds to undertake both of them, only one

project can be accepted. The cost of capital is 12%.

The following information is available:

Initial investment

Year 1

Year 2

Year 3

Year 4

Estimated scrap value at the end of year 4

Expected Cashflows

Project A

Project B

N$

N$

46 000

46000

6 500

4 500

3 500

2 500

13 500

4 500

{1 500)

14 500

4 000

4000

Depreciation is charged on a straight-line basis.

Required:

Calculate the following for both projects:

a} The payback period {answer rounded off to one decimal place)

8 Marks

b} The net present value (NPV).

8 Marks

c) The accounting rate of return {ARR}on the initial investment {round off your answer

to one decimal place).

4 Marks

2

|

4 Page 4 |

▲back to top |

d) If the two projects are mutually exclusive, discuss which project should be chosen

based on all three methods.

4 Marks

e) List three advantages of the payback period and three advantages of accounting rate

of return methods of capital appraisal.

6 Marks

Show all your workings!

Question 5

20 Marks

The following information relate to the activities of ZEE Corporation for the year ended

December 31, 2023:

ZEE Corporation is a manufacturing company that produces electronic devices. Over the

course of the year, the company experienced the following various financial activities that

impacted its cash flow.

1. At the beginning of the financial year, ZEECorporation had a cash balance of $50,000.

2. The company generated a net profit of $100,000 from its operations.

3. ZEE Corporation recorded $20,000 in depreciation expense, which represents the

allocation of the cost of its equipment over time.

4. Over the year, the company's accounts receivable increased by $10,000, indicating that

more sales were made on credit during the year.

5. The company recorded interest expense of N$6,000 in the income statement for the

year.

6. ZEECorporation also invested $5,000 to increase its inventory levels and meet customer

demands.

7. As a commitment to improve working capital, the company paid off $8,000 of its

accounts payable, reducing its short-term liabilities.

8. Zee Corporation paid interest amounting to N$4,000 during the period

9. The company received interest of N$2,500 from XY Bank

10. ZEE Corporation invested $50,000 in purchasing new equipment to improve its

manufacturing processes and expand production capacity.

11. The company generated $15,000 from the sale of certain investments it held.

12. ZEECorporation raised $30,000 by issuing new ordinary shares to investors.

13. The company paid $20,000 in dividends to its shareholders.

14. Zee Corporation received N$5,000 in dividends

Required:

Prepare the cashflow statement for ZEECorporation for the year ended December 31, 2023.

*End of Second Opportunity Exam*

3

|

5 Page 5 |

▲back to top |

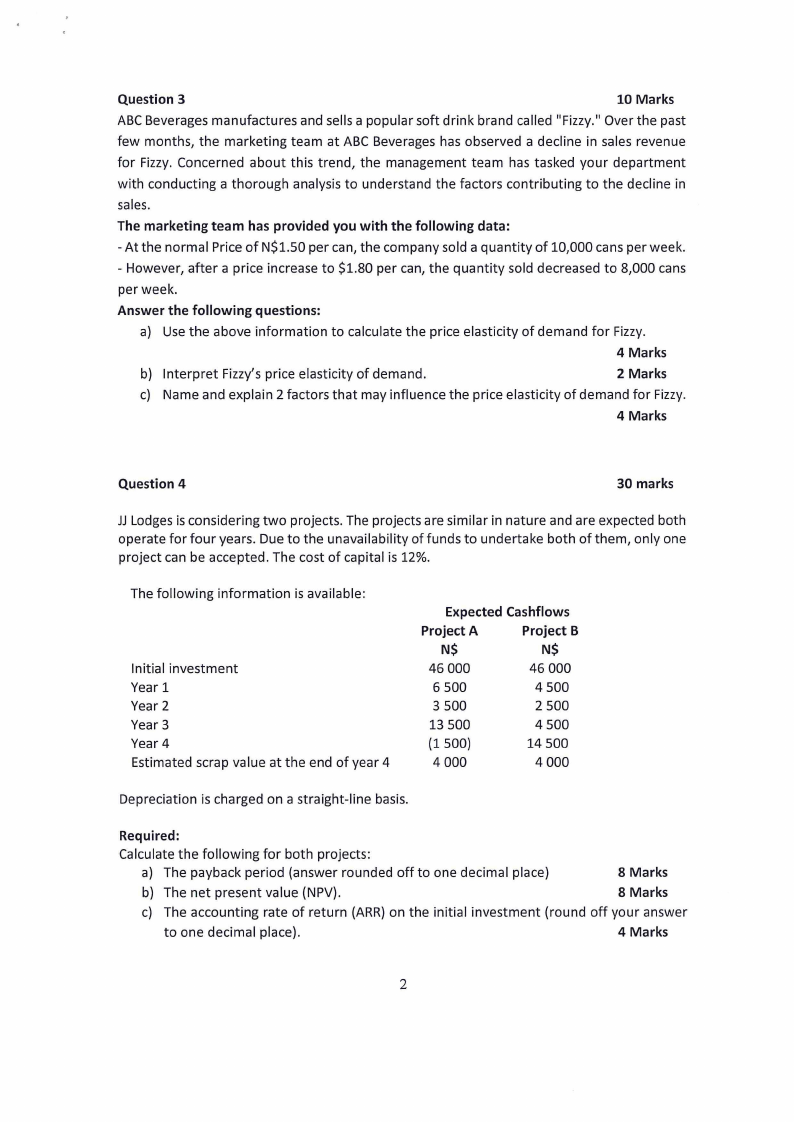

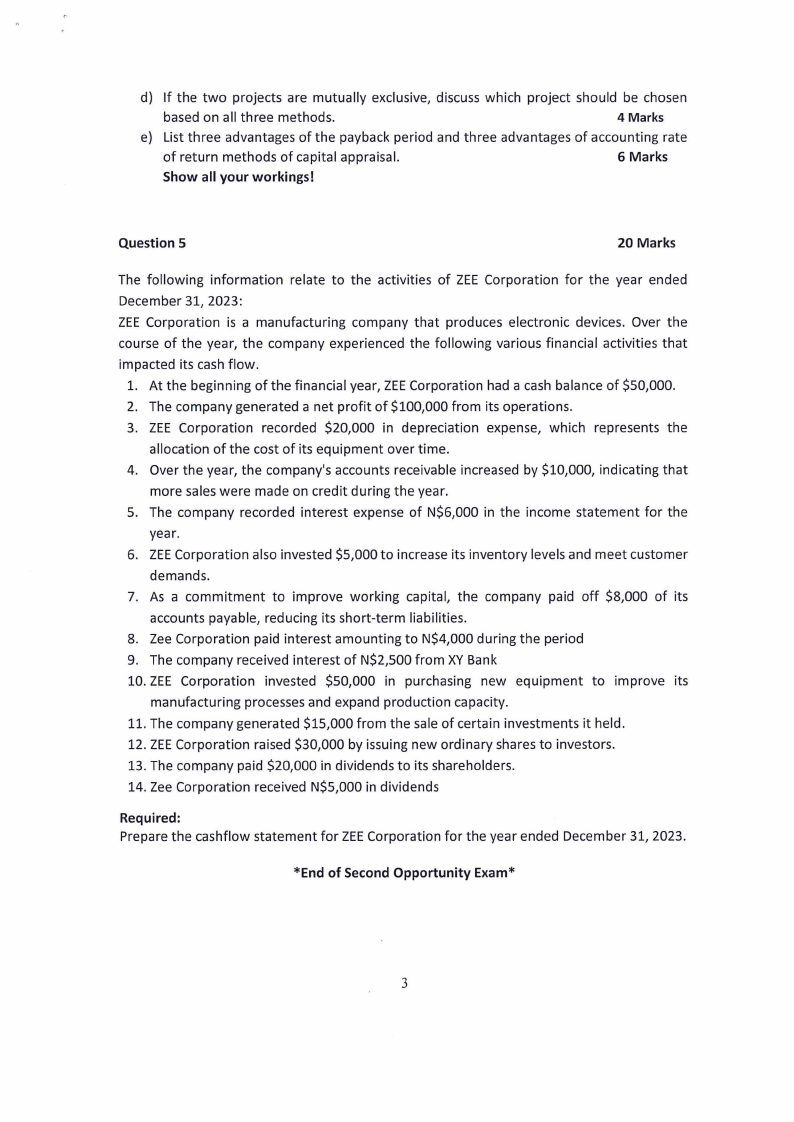

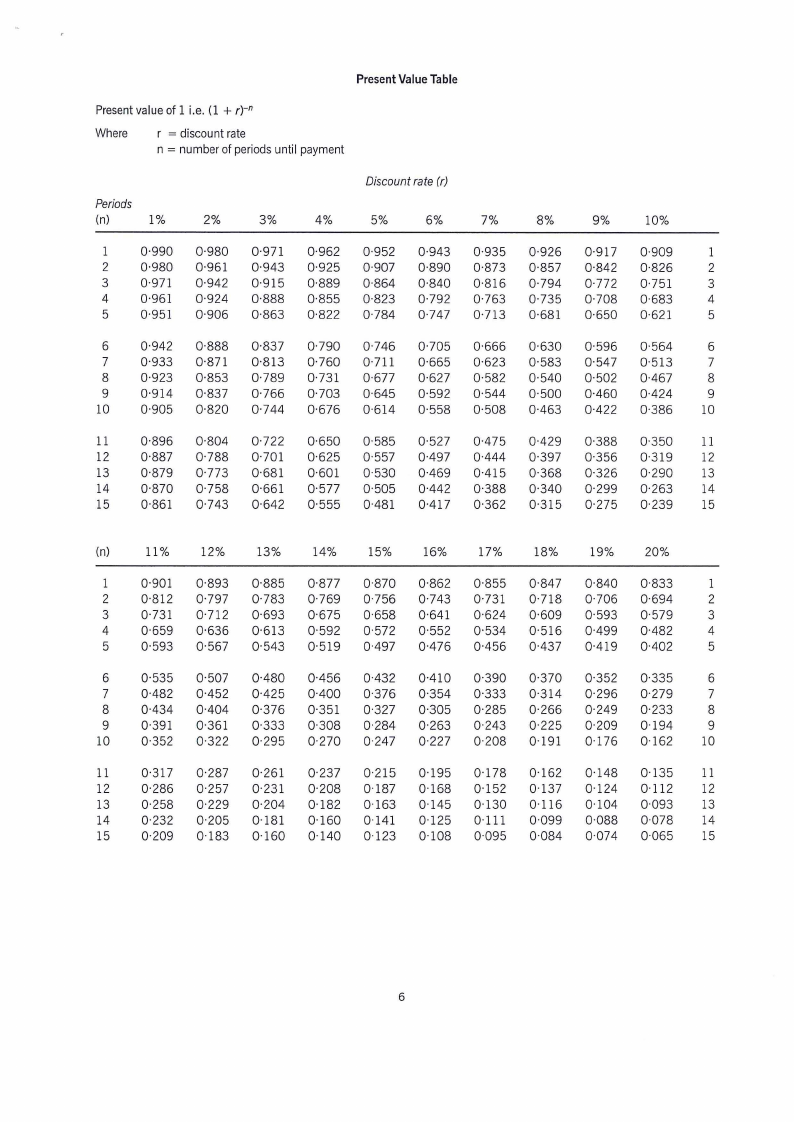

PresentValueTable

Present value of 1 i.e. (1 + r)-n

Where

r = discount rate

n = number of periods until payment

Discountrate (r)

Periods

(n)

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

1 0·990 0·980 0·971 0·962 0·952 0·943 0·935 0·926 0·917 0·909

1

2 0·980 0·961 0·943 0·925 0·907 0·890 0·873 0·857 0·842 0·826

2

3 0·971 0·942 0·915 0·889 0·864 0·840 0·816 0·794 0·772 0·751

3

4 0·961 0·924 0·888 0·855 0·823 0·792 0·763 0·735 0·708 0·683

4

5 0·951 0·906 0·863 0·822 0·784 0·747 0·713 0·681 0·650 0·621

5

6 0·942 0·888 0·837 0·790 0·746 0·705 0·666 0·630 0·596 0·564

6

7 0·933 0·871 0·813 0·760 0·711 0·665 0·623 0·583 0·547 0·513

7

8 0·923 0·853 0·789 0·731 0·677 0·627 0·582 0·540 0·502 0-467

8

9 0·914 0·837 0·766 0·703 0·645 0·592 0·544 0·500 0-460 0-424

9

10 0·905 0·820 0·744 0·676 0·614 0·558 0·508 0·463 0-422 0·386 10

11 0·896 0·804 0·722 0·650 0·585 0·527 0-475 0-429 0·388 0·350 11

12 0·887 0·788 0·701 0·625 0·557 0-497 0-444 0·397 0·356 0·319 12

13 0·879 0·773 0·681 0·601 0·530 0-469 0·415 0·368 0·326 0·290 13

14 0·870 0·758 0·661 0·577 0·505 0-442 0·388 0·340 0·299 0·263 14

15 0·861 0·743 0·642 0·555 0-481 0-417 0·362 0·315 0·275 0·239 15

(n)

11% 12% 13% 14% 15% 16% 17% 18% 19% 20%

1 0·901 0·893 0·885 0·877 0·870 0·862 0·855 0·847 0·840 0·833

1

2 0·812 0·797 0·783 0·769 0·756 0·743 0·731 0·718 0·706 0·694

2

3 0·731 0·712 0·693 0·675 0·658 0·641 0·624 0·609 0·593 0·579

3

4 0·659 0·636 0·613 0·592 0·572 0·552 0·534 0·516 0-499 0-482

4

5 0·593 0·567 0·543 0·519 0·497 0-476 0-456 0-437 0-419 0-402

5

6 0·535 0·507 0·480 0-456 0-432 0-410 0·390 0·370 0·352 0·335

6

7 0-482 0-452 0-425 0·400 0·376 0·354 0·333 0·314 0·296 0·279

7

8 0-434 0-404 0·376 0·351 0·327 0·305 0·285 0·266 0·249 0·233

8

9 0·391 0·361 0·333 0·308 0·284 0·263 0·243 0·225 0·209 0·194

9

10 0·352 0·322 0·295 0·270 0·247 0·227 0·208 0·191 0·176 0·162 10

11 0·317 0·287 0·261 0·237 0·215 0·195 0·178 0·162 0·148 0·135 11

12 0·286 0·257 0·231 0·208 0·187 0·168 0·152 0·137 0·124 0·112 12

13 0·258 0·229 0·204 0·182 0·163 0·145 0·130 0·116 0·104 0·093 13

14 0·232 0·205 0·181 0·160 0·141 0·125 0·111 0·099 0·088 0·078 14

15 0·209 0·183 0·160 0·140 0·123 0·108 0·095 0·084 0·074 0·065 15

6