|

FAC511S- FINANCIAL ACCOUNTING 101- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAm I BIA un IVERS ITY

OF SCIEnCE Ano TECHn OLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS,ACCOUNTING AND FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

COURSE:FINANCIAL ACCOUNTING 101

DATE: NOVEMBER 2023

DURATION: 3 HOURS

LEVEL:5

COURSECODE: FAC511S

SESSION:THEORY& CALCULATIONS

MARKS: 100

EXAMINER (S):

MODERATOR:

FIRST OPPORTUNITY QUESTION PAPER

Mr G Jansen, Mr P Mbangula .and Mrs. El Garas

Ms G Katula

INSTRUCTIONSTO CANDIDATES

1. This paper consists of 7 pages (excluding cover page).

2. Answer all the questions and in black or blue ink only.

3. Round off all amounts to the nearest Namibian Dollar.

4. The marks shown against the requirement(s) for every question should be regarded as an indication of the

expected length and depth of your answer.

|

2 Page 2 |

▲back to top |

QUESTION 1

MULTIPLECHOICEQUESTIONS

(60 MARKS)

Each question will carry 2 marks. Write down the number of the question with your correct

answer on your answer sheet, e.g.

1.C.

1. Recognition is the process of

(a) Incorporating an item in the financial statements

{b) Determining where an item should be presented in the statement of profit or loss

(c) Disclosing information in the notes to the financial statements

(d) Determining the amount at which an item should be shown in the financial statements

2. The primary users of general-purpose financial statements are:

(a) Investors and employees

(b) Investors and lenders

(c) Investors and customers

(d) Employees and lenders

3. A conceptual framework for financial reporting is:

(a) A set of regulations which govern financial reporting

(b) A set of items which make up an entity's financial statements

(c) A set of principles which underpin financial reporting

(d) A set of reporting standards

4. Which of the following is not a contributing factor towards faithful representation?

(a) Freedom from error

(b) Neutrality

(c) Completeness

(d) Consistency

5. Which of the following is not a purpose of the international accounting standards board's conceptual

framework?

(a) To assist the board in the preparation and review of IFRS

(b) To assist auditors in forming an opinion on whether financial statements comply with IFRSstandards

(c) To assist in determining the treatment of items not covered by the existing IFRSstandards

(d) To be authoritative where a specific IFRSstandard conflicts with the conceptual framework

2

|

3 Page 3 |

▲back to top |

6. Which of the following criteria need to be satisfied in order for an element to be recognised within the

financial statements?

(I) It meets the definition of an element of the financial statement

(II) It is probable that future economic benefits will flow to or from the enterprise

(Ill) It is certain that future economic benefits will flow to or from the enterprise

(IV) The item has a cost or value.

(V) The item has a cost or value that can be measured reliably

(a) I, Ill and V

(b) I, II and IV

(c) I, II and V

(d) I, Ill, and IV

7. The enhancing qualitative characteristics of financial statements include

(a) Understandability and faithful representation

(b) Comparability and understandability

(c) Relevance and faithful representation

(d) Relevance and timeliness

8. The fundamental qualitative characteristics of financial information are

(a) Relevance and faithful representation

(b) Relevance and comparability

(c) Faithful representation and comparability

(d) Verifiability and understandability

9. Which of the following is true,

a) A debit entry will increase non-current assets

A debit entry will increase drawings

A debit entry will increase profit

b) A credit entry will increase bank over draft

A credit entry will increase accounts payable

A credit entry will increase accounts receivable

c) A debit entry will increase profit

A debit entry will increase accounts receivable

A debit entry will decrease accounts payable

d) A debit entry will increase receivables

A credit entry will decrease non-current assets

A credit entry will increase profit

10. A credit balance on a ledger account indicates:

a) An asset or an expense

b) a liability or an expense

c) an amount owing to the organization

d) a liability or revenue

3

|

4 Page 4 |

▲back to top |

11. The main aim of accounting is to:

a) provide financial information to users of such information

b) maintain ledger accounts for every asset and liability

c) produce a trial balance

d) record every financial transaction individually

12. The Revenue (Sales) account is:

a) credited with the total of sales made, excluding value added tax

b) credited with the total of sales made, including value added tax

c) debited with the total of sales made, including value added tax

d) debited with the total of sales made, excluding value added tax

13. The accounting entries for recording N$100,000 cash introduced by the owner of a business are:

a) Debit Bank account and Credit Capital account

b) Credit Cash account and Debit Owner's account

c) Debit Cash account and Credit Investments account

d) Credit Cash account and Debit Investment in business account

14. Accounting entries for recording the payment of a telephone bill are:

a) Credit Bank Account and Debit Telephone expenses account

b) Debit Capital account and Credit Cash account

c) Debit Bank account and Credit Telephone expenses account

d) Credit Bank account and Debit Office Equipment account

15. A debit balance on a ledger account indicates:

a) An asset or an expense

b) a liability or an expense

c) an amount owing to the organization

d) a liability or revenue

16. An entity has the following liabilities and assets: Furniture's N$5 000, Bank overdraft N$3 400, Petty cash

N$1 800, Payables N$4 600, Inventory N$3 000, Receivables N$1 000, and a Loan: FNB N$2 800.

What is the capital amount?

a) N$0

b) N$3 400

c) N$10 800

d) N$6 800

e) N$7 400

17. William cc specialize in buying and selling of furniture's, the business decided to sell one of its motor vehicles

for cash. Which of the below transaction will be recorded correct?

a) Debit Motor vehicle, Credit Cash;

b) Debit Bank, Credit Motor Vehicle;

c) Debit bank, Credit Sales

d) Debit Purchases, Credit Cash

4

|

5 Page 5 |

▲back to top |

18. Which one of the following statements does not form part of the definition of income in accordance with the

Accounting Framework?

a) Inflow of economic benefits

b) That leads to an increase in assets

c) That result in a decrease in equity

d) During the accounting period

19. What is the guiding accounting principle in revenue recognition?

a) Net realizable value

b) Prudence concept

c) Perpetual inventory system

d) Accrual basis

20. Which of the following is not a step-in recognizing revenue from contracts?

a) Identify the customer in the contract

b) Identify performance obligations in the contract

c) Recognize revenue after satisfaction of performance obligation

d) Determine the transaction price

21. Which from the following steps in revenue recognition determines measurement?

a) Step 1

b) Step 3

c) Step 2

d) Step 5

22. On August 15th, 2022, Royal Bakery Ltd received an order for 2 over-the-top cakes from Golden Events, at

N$5,000 (Incl. VAT) each. The cakes are needed for an event on December 14th . Royal Bakery requires a 20%

deposit before they start working on an order. The company also gives a 2% discount on full payments done

within 7 days after delivery. Both Royal Bakery and Golden events are registered for VAT. Golden Events paid

the 20% deposit for the order on August 15th and the remaining amount on December 14 after delivery.

Using the above information, what is the contract transaction price?

a) 9,800

b) 8,695

c) 8,522

d) 6,817

23. Which of the following is not required to recognize a contract in accordance with IFRS15?

a) Each party's rights regarding the goods/services transferred can be identified

b) Identifiable payment terms

c) Contract should be in writing

d) Expectation of a change in the entity's future cash flow

5

|

6 Page 6 |

▲back to top |

24. Which of the following does not determine the cost of inventory?

a) Non-refundable import duties

b) Delivery cost

c) Inventory storage cost

d) Inventory design fees

25. Easy Baskets Ltd sells custom made baskets at 25% mark-up. They have product Bl which cost N$1,500 per

unit. They currently have 100 units of product Bl on hand. Ignore VAT. Given the above information, what is

the selling price of product Bl?

a) N$500

b) N$375

c) N$1,875

d) N$2,000

26. Which type of inventory is presented in the statement of financial position?

a) Cost of sales

b) Closing inventory

c) Opening inventory

d) Whichever is lower between cost and Net realizable value

27. On 1'1of March 2019, Ernesto Trading CC,a non-registered VAT Vendor, having considered it's 15-year output

outlook, decided to buy an additional Machinery to the value of N$ 366 000 (excl VAT) for business use, in hope

of getting production to desired levels. Installation and Supervisor training costs in order to get production

going were N$ 27 450 and N$ 13 500 inclusive of VAT, respectively. The Carrying amount of the Machinery in

the Ernesto Trading CC's books is: (2 marks)

a) N$ 406 950

b) N$ 389 870

c) N$ 393 450

d) N$ 448 350

28. Zero Rated Supplies are

a) goods or services on which VAT of 15% is claimable as Output VAT, but on which VAT of 0% is payable

to receiver as Input VAT.

b) goods or services on which VAT of 15% is claimable as Input VAT, but on which VAT of 0% is payable to

Receiver as Output VAT.

c) goods or services on which VAT of 0% is claimable as Output VAT, but on which VAT of 15% is payable

to Receiver as Input VAT

d) None of the above

6

|

7 Page 7 |

▲back to top |

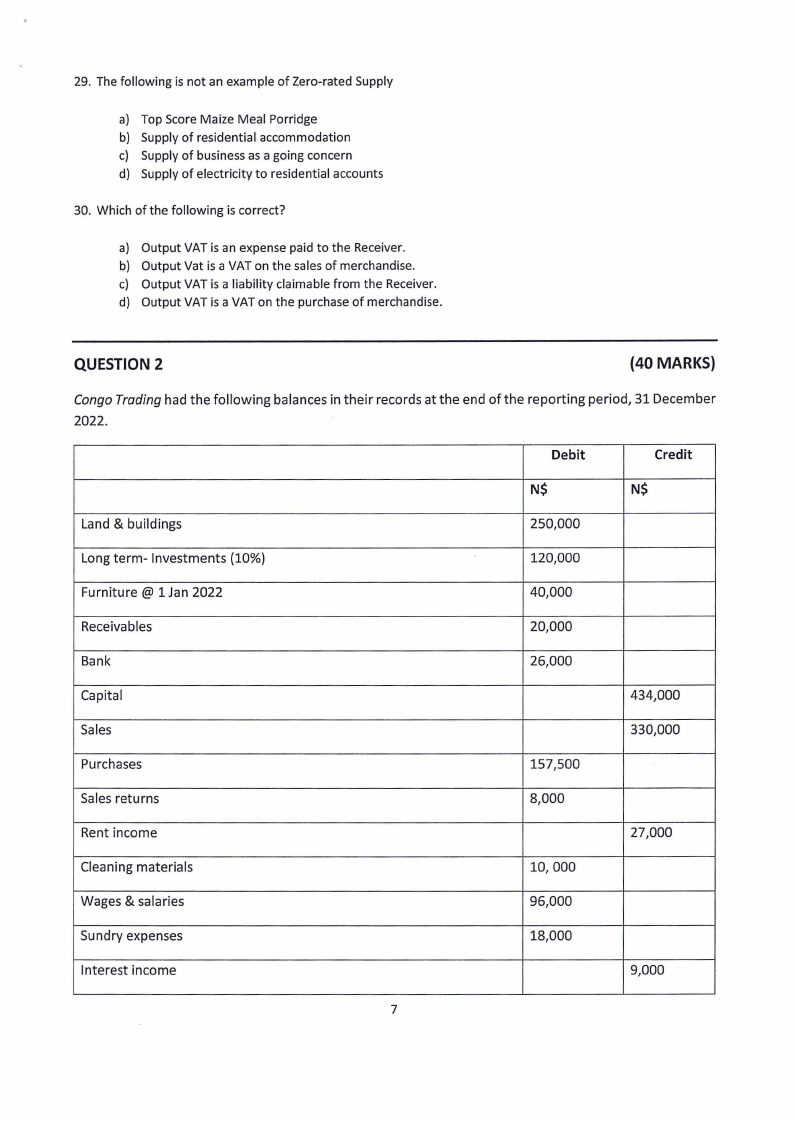

29. The following is not an example of Zero-rated Supply

a) Top Score Maize Meal Porridge

b) Supply of residential accommodation

c) Supply of business as a going concern

d) Supply of electricity to residential accounts

30. Which of the following is correct?

a) Output VAT is an expense paid to the Receiver.

b) Output Vat is a VAT on the sales of merchandise.

c) Output VAT is a liability claimable from the Receiver.

d) Output VAT is a VAT on the purchase of merchandise.

QUESTION2

(40 MARKS)

Congo Trading had the following balances in their records at the end of the reporting period, 31 December

2022.

Debit

Credit

N$

N$

Land & buildings

250,000

Long term- Investments {10%)

120,000

Furniture @ 1 Jan 2022

40,000

Receivables

20,000

Bank

26,000

Capital

434,000

Sales

330,000

Purchases

157,500

Sales returns

8,000

Rent income

27,000

Cleaning materials

10,000

Wages & salaries

96,000

Sundry expenses

18,000

Interest income

9,000

7

|

8 Page 8 |

▲back to top |

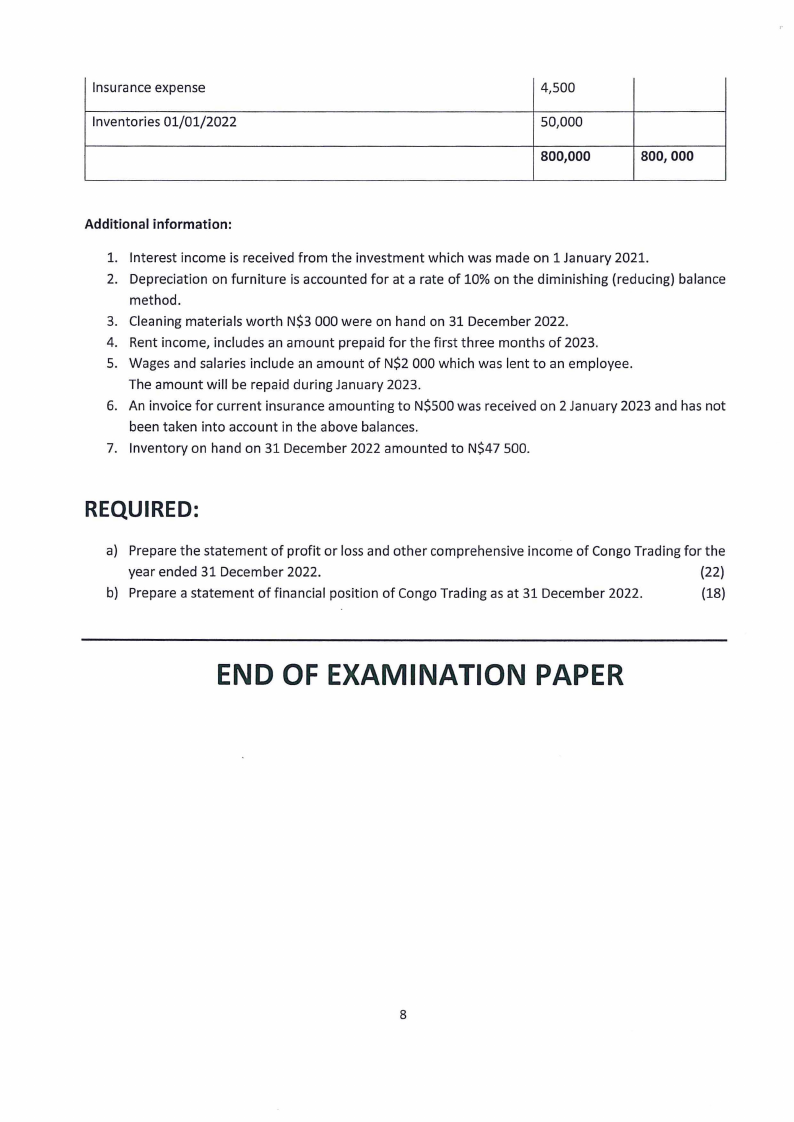

Insurance expense

Inventories 01/01/2022

4,500

50,000

800,000

800,000

Additional information:

1. Interest income is received from the investment which was made on 1 January 2021.

2. Depreciation on furniture is accounted for at a rate of 10% on the diminishing (reducing) balance

method.

3. Cleaning materials worth N$3 000 were on hand on 31 December 2022.

4. Rent income, includes an amount prepaid for the first three months of 2023.

5. Wages and salaries include an amount of N$2 000 which was lent to an employee.

The amount will be repaid during January 2023.

6. An invoice for current insurance amounting to N$500 was received on 2 January 2023 and has not

been taken into account in the above balances.

7. Inventory on hand on 31 December 2022 amounted to N$47 500.

REQUIRED:

a) Prepare the statement of profit or loss and other comprehensive income of Congo Trading for the

year ended 31 December 2022.

{22)

b) Prepare a statement of financial position of Congo Trading as at 31 December 2022.

(18)

END OF EXAMINATION PAPER

8