|

FAC612S- FINANCIAL ACCOUNTING 202- 1ST OPP- NOV 2023 |

|

1 Page 1 |

▲back to top |

nAmI BI AunIVERSITY

OF SCIEnCE Ano TECHno LOGY

FACULTYOF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENTOF ECONOMICS,ACCOUNTINGAND FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATIONCODE: 07BOAC

LEVEL:6

COURSECODE:FAC612S

COURSENAME: FINANCIAL ACCOUNITNG 202

SESSION:NOVEMBER 2023

DURATION: 3 HOURS

PAPER:THEORY+ CALCULATIONS

MARKS: 100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

Mr. C MAHIN DI, Mr. C SIMASIKUand Ms. S IFUGULA

MODERATOR: DR. D KAMOTHO

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only.

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. Do not write in pencil and do not use tip-ex, as this will not be marked.

5. Questions relating to the paper may be raised in the initial 30 minutes after the start

of the paper. Thereafter, candidates must use their initiative to deal with any

perceived error or ambiguities & any assumption made by the candidate should be

clearly stated.

6. The names of people and businesses used throughout this assessment do not reflect

the reality and may be purely coincidental.

7. Show all workings!

PERMISSABLE MATERIALS

1. Non- programmable calculator

THIS QUESTION PAPERCONSISTSOF 7 PAGES(Excluding this front page)

|

2 Page 2 |

▲back to top |

Question 1

(10 marks)

For multiple choice questions, only write down the correct answer in your answer booklet.

E.g., lA

1. What is the appropriate accounting treatment for Adjusting events after the

reporting date according to IAS 10?

A. No action is required; they are not considered in financial statements.

B. They should be disclosed in the notes to the financial statements.

C. They should result in adjustments to the financial statements.

D. They should lead to changes in accounting policies.

2. Which of the following is true regarding the treatment of non-adjusting events (events

occurring after the reporting date) under International Accounting Standard 10 (IAS

10)?

A. Non-adjusting events always require adjustments to the financial statements.

B. Non-adjusting events do not require disclosure in the financial statements.

C. If a Non-adjusting event is material, it should be disclosed in the notes to the

financial statements.

D. Non-adjusting events are never considered in the preparation of financial

statements.

3. A significant customer, with a substantial accounts receivable balance, declared

bankruptcy two weeks after the reporting date. How should this event be treated

according to IAS 10?

A. Adjust the accounts receivable balance in the financial statements.

B. Disclose the event in the notes to the financial statements.

C. Both A and Bare correct.

D. Ignore the event as it occurred after the reporting date.

4. Company X's financial year-end is December 31, 2021. On January 10, 2022, it

discovers that a major customer, which accounted for 20% of its total revenue in 2021,

has declared bankruptcy and will not be able to pay its outstanding receivables. What

type of event is this, and how should it be treated according to IAS 10?

A. Adjusting event; It should be disclosed in the notes to the financial statements.

B. Adjusting event; It should result in an adjustment to the financial statements.

C. Non-Adjusting event: It should be disclosed in the notes to the financial

statements.

D. Non-Adjusting event: It should result in an adjustment to the financial

statements.

|

3 Page 3 |

▲back to top |

5. A company's financial statements for the year ended December 31, 2021, were

authorized for issue on February 15, 2022. On February 25, 2022, the company

discovered a significant error in its inventory valuation that materially affected the

financial statements. How should this error be addressed?

A. The error should be adjusted in the financial statements for the year ended

December 31, 2021.

B. The error should be disclosed in the notes to the financial statements for the

year ended December 31, 2021.

C. The error should be adjusted in the financial statements for the year ended

December 31, 2022.

D. The error should not be addressed in the financial statements.

6. A company's financial year-end is December 31. On January 10 of the following year,

the company becomes aware of a significant customer bankruptcy that occurred on

December 20 of the previous year, which was after the reporting date. How should

this event be accounted for in the company's financial statements?

A. It should be recognized as an adjustment in the current year's financial

statements.

B. It should be disclosed in the notes to the current year's financial statements if

material.

C. It should not be considered in the financial statements.

D. It should result in a restatement of the prior year's financial statements.

7. Which of the following is a non-adjusting event under IAS 10, "Events after the

Reporting Period"?

A. The discovery of a material error in the financial statements made after the

financial statements were authorized for issue.

B. A significant customer payment received on the reporting date, which was

expected but not yet received at the time of preparing the financial statements

C. A major fire at the company's warehouse that occurred two weeks after the

financial statements were authorized for issue.

D. A change in accounting policies to better reflect the economic substance of

transactions after the financial statements were authorized for issue.

8. Company XYZ has a reporting date of December 31, 2023. On January 15, 2024, they

receive notice of a lawsuit filed against them for a significant amount related to a

product liability issue arising from a product sold in December 2023. According to IAS

10, how should this event be treated in Company XYZ'sfinancial statements for the

year ended December 31, 2023?

A. It should be recognized as a liability and included in the financial statements

for 2023.

2

|

4 Page 4 |

▲back to top |

B. It should be disclosed in the notes to the financial statements for 2023.

C. It should be recognized as a contingent liability in the financial statements for

2023.

D. It should be ignored as it occurred after the reporting date.

9. Why is it important for users to know the date when financial statements were

authorised for issue?

A. Because users of the financial statements need to know the nature and extent

of non-adjusting events that took place after this date.

B. Because users of the financial statements may judge whether financial

statements were issued in time.

C. Because the financial statements do not reflect events after this date.

D. Because users of the financial statements need to know the amount of profit

or loss that the entity generated during the reporting period, covered by these

statements.

10. Which of the following non-adjusting events would not result in disclosure.

A. A major business combination after the reporting period.

B. The destruction of a major production plant by a fire after the reporting period.

C. Announcing a plan to discontinue an operation.

D. Entering into insignificant commitments or contingent liabilities

Question 2

(20 marks)

Komady Limited is a manufacturer of electrical appliances. Due to a slow-down in the

economy, Komady does not have viable business opportunities to invest in. Excess cash is

invested in two different portfolios consisting of government bonds and equity instruments

respectively.

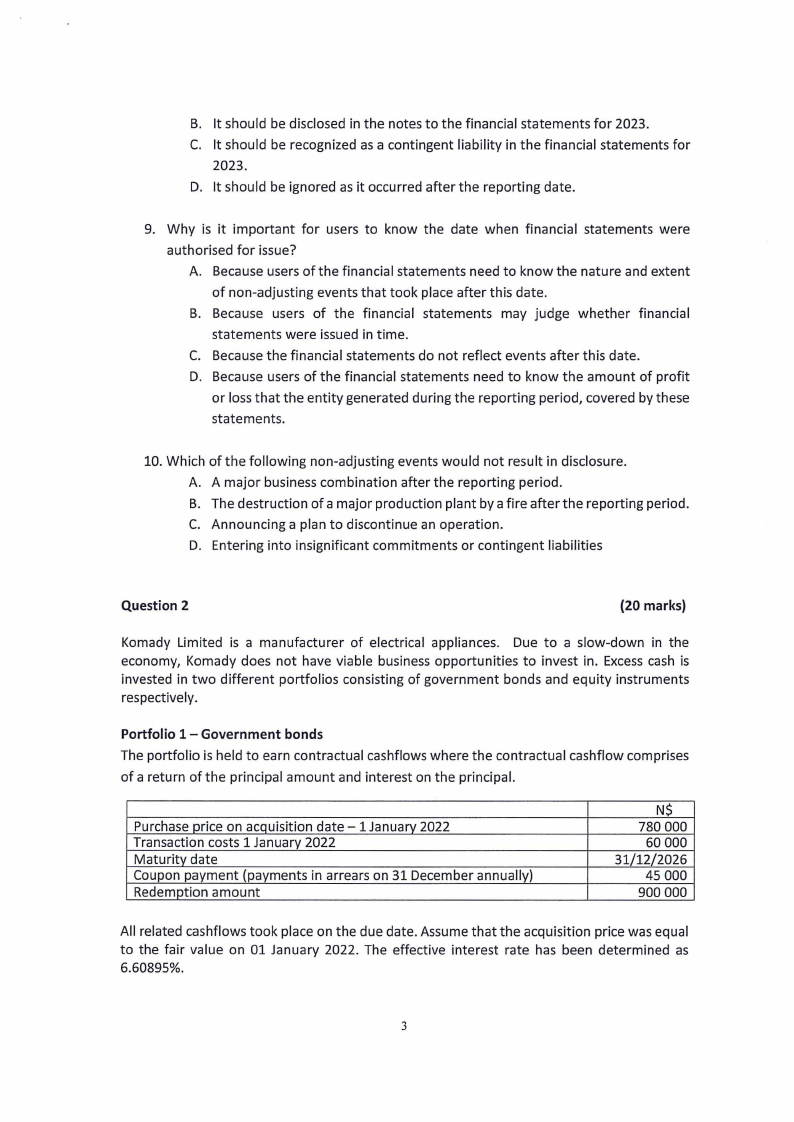

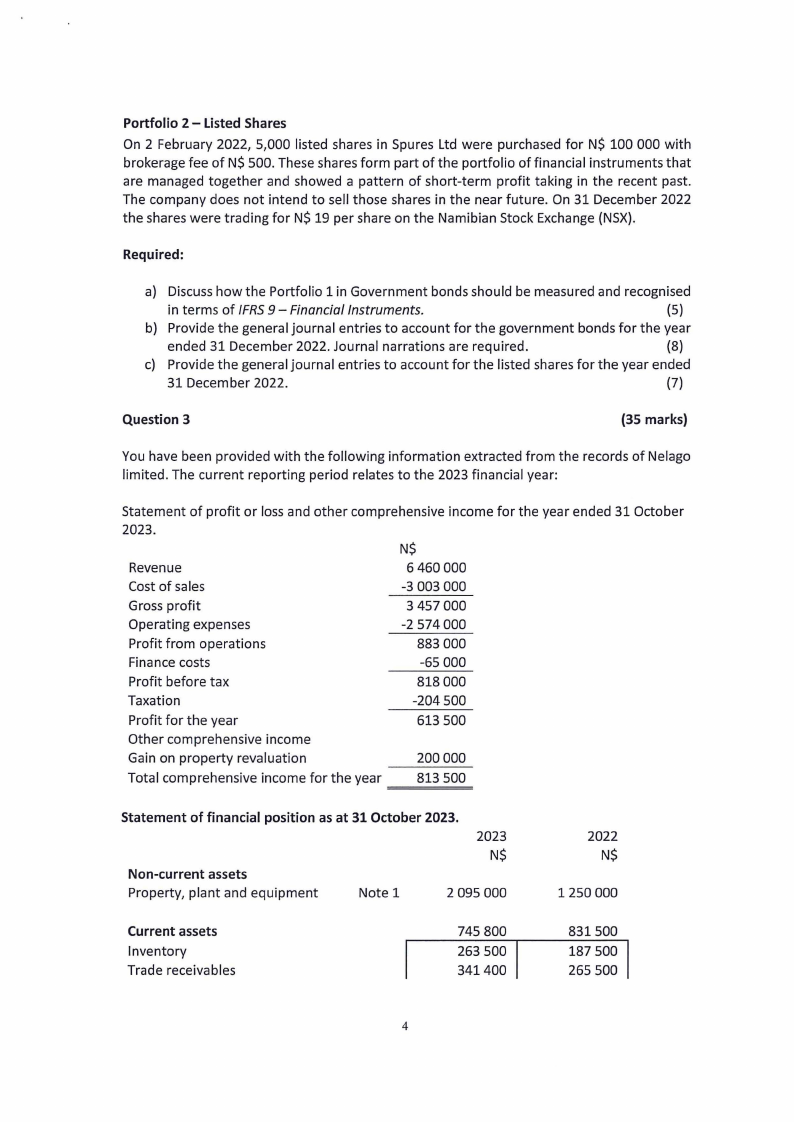

Portfolio 1 - Government bonds

The portfolio is held to earn contractual cashflows where the contractual cashflow comprises

of a return of the principal amount and interest on the principal.

Purchase price on acquisition date - 1 Januarv 2022

Transaction costs 1 January 2022

Maturity date

Coupon payment (payments in arrears on 31 December annually)

Redemption amount

N$

780 000

60 000

31/12/2026

45 000

900 000

All related cashflows took place on the due date. Assume that the acquisition price was equal

to the fair value on 01 January 2022. The effective interest rate has been determined as

6.60895%.

3

|

5 Page 5 |

▲back to top |

Portfolio 2- Listed Shares

On 2 February 2022, 5,000 listed shares in Spures Ltd were purchased for N$ 100 000 with

brokerage fee of N$ 500. These shares form part of the portfolio of financial instruments that

are managed together and showed a pattern of short-term profit taking in the recent past.

The company does not intend to sell those shares in the near future. On 31 December 2022

the shares were trading for N$ 19 per share on the Namibian Stock Exchange (NSX).

Required:

a) Discuss how the Portfolio 1 in Government bonds should be measured and recognised

in terms of IFRS9- Financial Instruments.

(5)

b) Provide the general journal entries to account for the government bonds for the year

ended 31 December 2022. Journal narrations are required.

(8)

c) Provide the general journal entries to account for the listed shares for the year ended

31 December 2022.

(7)

Question 3

(35 marks)

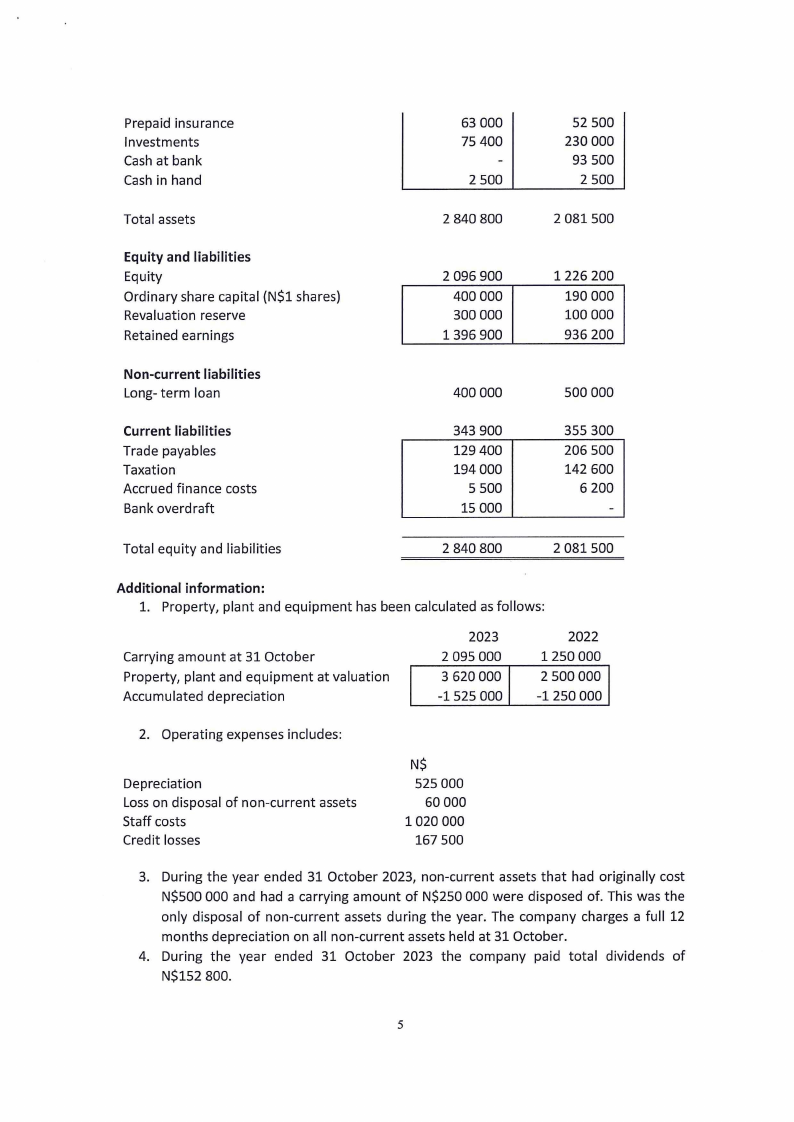

You have been provided with the following information extracted from the records of Nelago

limited. The current reporting period relates to the 2023 financial year:

Statement of profit or loss and other comprehensive income for the year ended 31 October

2023.

N$

Revenue

6 460 000

Cost of sales

-3 003 000

Gross profit

3 457 000

Operating expenses

-2 574 000

Profit from operations

883 000

Finance costs

-65 000

Profit before tax

818 000

Taxation

-204 500

Profit for the year

613 500

Other comprehensive income

Gain on property revaluation

200 000

Total comprehensive income for the year

813 500

=====

Statement of financial position as at 31 October 2023.

2023

N$

Non-current assets

Property, plant and equipment

Note 1

2 095 000

2022

N$

1250 000

Current assets

Inventory

Trade receivables

745 800

263 500

341400

831500

187 500

265 500

4

|

6 Page 6 |

▲back to top |

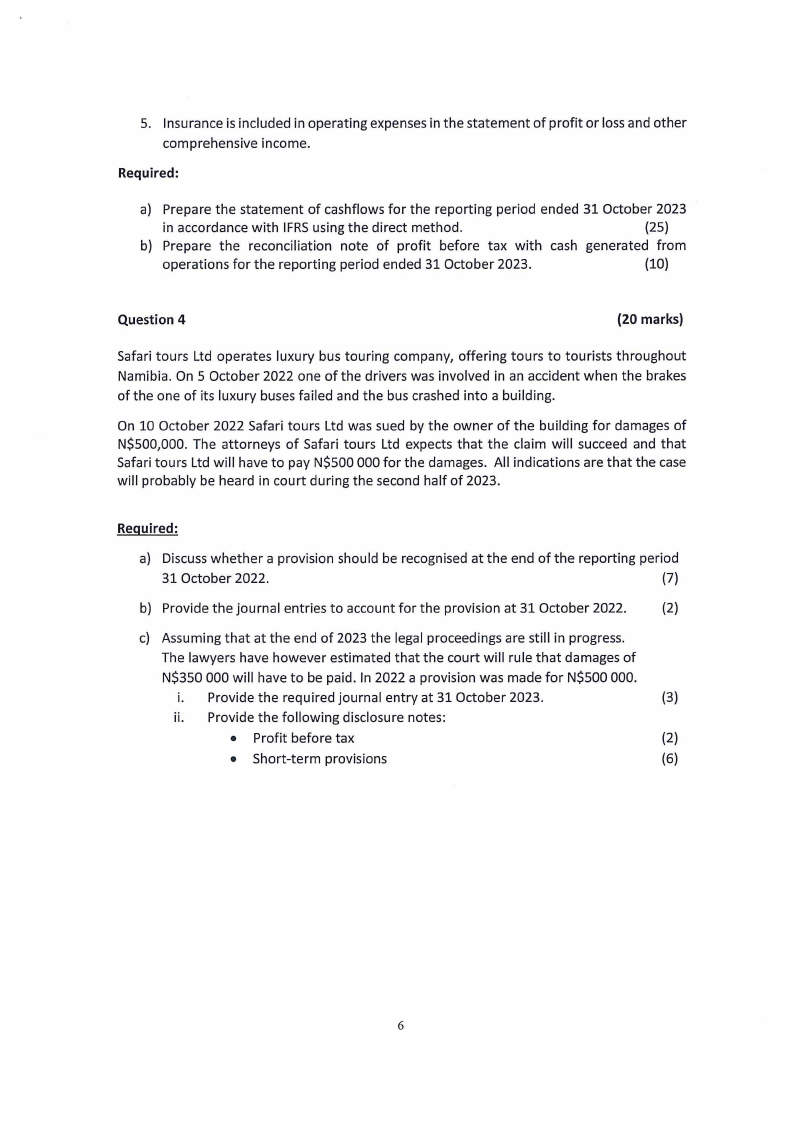

Prepaid insurance

Investments

Cash at bank

Cash in hand

63 000

75 400

2 500

52 500

230 000

93 500

2 500

Total assets

2 840 800

2 081500

Equity and liabilities

Equity

Ordinary share capital {N$1 shares)

Revaluation reserve

Retained earnings

2 096 900

400 000

300 000

1396 900

1226 200

190 000

100 000

936 200

Non-current liabilities

Long- term loan

400 000

500 000

Current liabilities

Trade payables

Taxation

Accrued finance costs

Bank overdraft

343 900

129 400

194 000

5 500

15 000

355 300

206 500

142 600

6 200

Total equity and liabilities

2 840 800

2 081500

Additional information:

1. Property, plant and equipment has been calculated as follows:

Carrying amount at 31 October

Property, plant and equipment at valuation

Accumulated depreciation

2023

2 095 000

3 620 000

-1 525 000

2022

1250 000

2 500 000

-1250 000

2. Operating expenses includes:

Depreciation

Losson disposal of non-current assets

Staff costs

Credit losses

N$

525 000

60000

1020 000

167 500

3. During the year ended 31 October 2023, non-current assets that had originally cost

N$500 000 and had a carrying amount of N$250 000 were disposed of. This was the

only disposal of non-current assets during the year. The company charges a full 12

months depreciation on all non-current assets held at 31 October.

4. During the year ended 31 October 2023 the company paid total dividends of

N$152 800.

5

|

7 Page 7 |

▲back to top |

5. Insurance is included in operating expenses in the statement of profit or loss and other

comprehensive income.

Required:

a) Prepare the statement of cashflows for the reporting period ended 31 October 2023

in accordance with IFRSusing the direct method.

(25)

b) Prepare the reconciliation note of profit before tax with cash generated from

operations for the reporting period ended 31 October 2023.

(10)

Question 4

(20 marks)

Safari tours Ltd operates luxury bus touring company, offering tours to tourists throughout

Namibia. On 5 October 2022 one of the drivers was involved in an accident when the brakes

of the one of its luxury buses failed and the bus crashed into a building.

On 10 October 2022 Safari tours Ltd was sued by the owner of the building for damages of

N$500,000. The attorneys of Safari tours Ltd expects that the claim will succeed and that

Safari tours Ltd will have to pay N$500 000 for the damages. All indications are that the case

will probably be heard in court during the second half of 2023.

Required:

a) Discuss whether a provision should be recognised at the end of the reporting period

31 October 2022.

(7)

b) Provide the journal entries to account for the provision at 31 October 2022.

(2)

c) Assuming that at the end of 2023 the legal proceedings are still in progress.

The lawyers have however estimated that the court will rule that damages of

N$350 000 will have to be paid. In 2022 a provision was made for N$500 000.

i. Provide the required journal entry at 31 October 2023.

(3)

ii. Provide the following disclosure notes:

• Profit before tax

(2)

• Short-term provisions

(6)

6

|

8 Page 8 |

▲back to top |

Question 5

(15 marks)

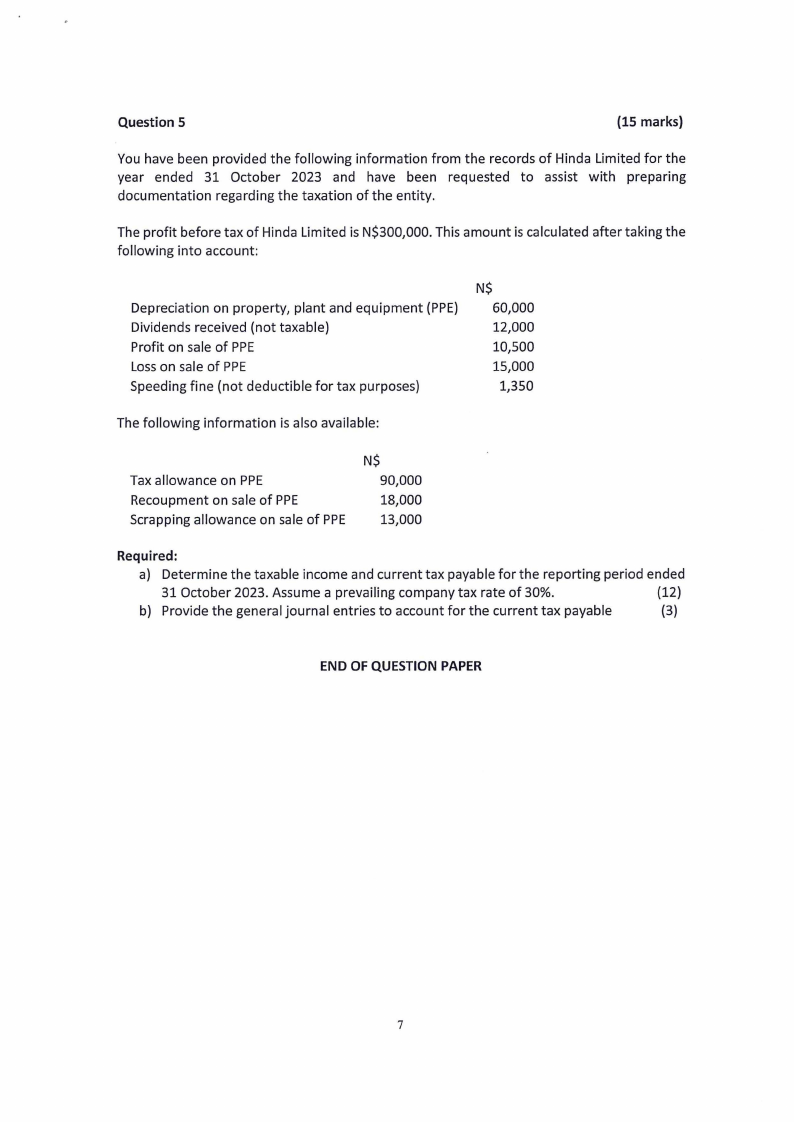

You have been provided the following information from the records of Hinda Limited for the

year ended 31 October 2023 and have been requested to assist with preparing

documentation regarding the taxation of the entity.

The profit before tax of Hinda Limited is N$300,000. This amount is calculated after taking the

following into account:

Depreciation on property, plant and equipment (PPE)

Dividends received (not taxable)

Profit on sale of PPE

Losson sale of PPE

Speeding fine (not deductible for tax purposes)

N$

60,000

12,000

10,500

15,000

1,350

The following information is also available:

Tax allowance on PPE

Recoupment on sale of PPE

Scrapping allowance on sale of PPE

N$

90,000

18,000

13,000

Required:

a) Determine the taxable income and current tax payable for the reporting period ended

31 October 2023. Assume a prevailing company tax rate of 30%.

(12)

b) Provide the general journal entries to account for the current tax payable

(3)

END OF QUESTION PAPER

7