|

FAR811S- FINACIAL ACCOUNTING AND REPORTING- 2ND OPP- JUNE 2023 |

|

1 Page 1 |

▲back to top |

nAm I BI A un IVE RSITY

OF SCIEnCE Ano TECHnOLOGY

FACULTY OF COMMERCE, HUMAN SCIENCESAND EDUCATION

DEPARTMENT OF ECONOMICS, ACCOUNTING AND FINANCE

QUALIFICATION : BACHELOR OF ACCOUNTING HONOURS

QUALIFICATION CODE: 08 BOAH

COURSE CODE: FAR 811S

SESSION: Jul/Aug 2023

LEVEL: 8

COURSE NAME: ADVANCED FINANCIAL ACCOUNTING

AND REPORTING

PAPER: THEORYAND CALCULATIONS

DURATION: 3 hours

MARKS: 100

EXAMINER(S)

SUPPLEMENTARY ASSESSMENT - 2nd Opportunity

D W Kamotho

MODERATOR: Dr E Wealth

INSTRUCTIONS

1. Answer ALL questions in blue or black ink only.

2. Write clearly and neatly.

3. Start each question on a new page and number the answers clearly.

4. No programmable calculators are allowed.

5. Questions relating to the paper may be raised in the initial 30 minutes after the start of the

paper. Thereafter, candidates must use their initiative to deal with any perceived error or

ambiguities & any assumption made by the candidate should be clearly stated.

6. Any resemblance to any people, places, organisations or anything is purely coincidental.

THIS QUESTION PAPER CONSISTS OF 5 PAGES (Including the front page)

1

|

2 Page 2 |

▲back to top |

Question 1

(20 marks)

lnvesta limited, a listed entity was incorporated on the 1st of January 2022 by issuing equity

shares to various are related shareholders.

lnvesta limited would utilise these funds to purchase various investments that would yield

investment income and potential for capital appreciation, as documented in the issuing

prospectus.

At the end of the year 31 December 2022, lnvesta Ltd had the following investment:

• 10% equity interest in F1 limited.

• 40% equity interest in A1 limited.

• 60% equity interest in S1 limited.

• 80% equity interest in S2 limited.

• 100% ownership of an investment property.

lnvesta Ltd also own a property used by the Investor limited staff as offices.

lnvesta Ltd exercises significant influence over A1 Limited in accordance with the ISA 28 and

has a controlling interest in S1 limited and S2 Limited in accordance with IFRS 10.

lnvesta Ltd has an exit strategy whereby it disposes of all investments within three years.

lnvesta Ltd carries investments in equity shares and Investment property at fair value in

accordance with IFRS 9 and IAS 40 respectively.

Owner-occupied property is accounted for using the cost model in terms of IAS 16. Higher

16in vertical limited reports to shareholders monthly using the above-mentioned values.

Required:

a. Discuss whether lnvesta limited needs to prepare consolidated annual financial

statements.

(12 marks)

b. Briefly discuss the classification and measurement in the separate financial statement of

lnvesta Ltd for the Investments listed above.

(8 marks)

2

|

3 Page 3 |

▲back to top |

Question 2

(40 marks)

Thermometer Limited (Thermometer) is a company involved in the entertainment industry.

They have a lounge on Independence Street in the CBD. Thermometer imported a range of

new lighting equipment for its dance floor costing N$ 400,000 that was delivered on 1st

January 2020.

Prior to the equipment being delivered, the loss of a major contract led Thermometer limited

to realise that the equipment was surplus to its needs and thus it entered into a contract with

the Temperature entertainment limited to lease the equipment for a lease term of 3 years

from 1st January 2020.

Temperature limited has paid rental of N$150,000 annually in advance and guaranteed the

residual value of N$20,000 at the end of the contract on 31 December 2022.The lighting

equipment was subsequently bought by Barometer Entertainers in January 2023 for N$

20,000.

The interest rate implicit in the contract was 17.08204%

The estimated useful life of the equipment was 3 years, and this is the same period over

which NAMRA (tax authority in Namibia) allows the equipment to be written off for tax

purposes.

NAMRA rules stipulate that lease instalments are taxed when received.

The current tax rate is 30% and there is no transaction tax or VAT.

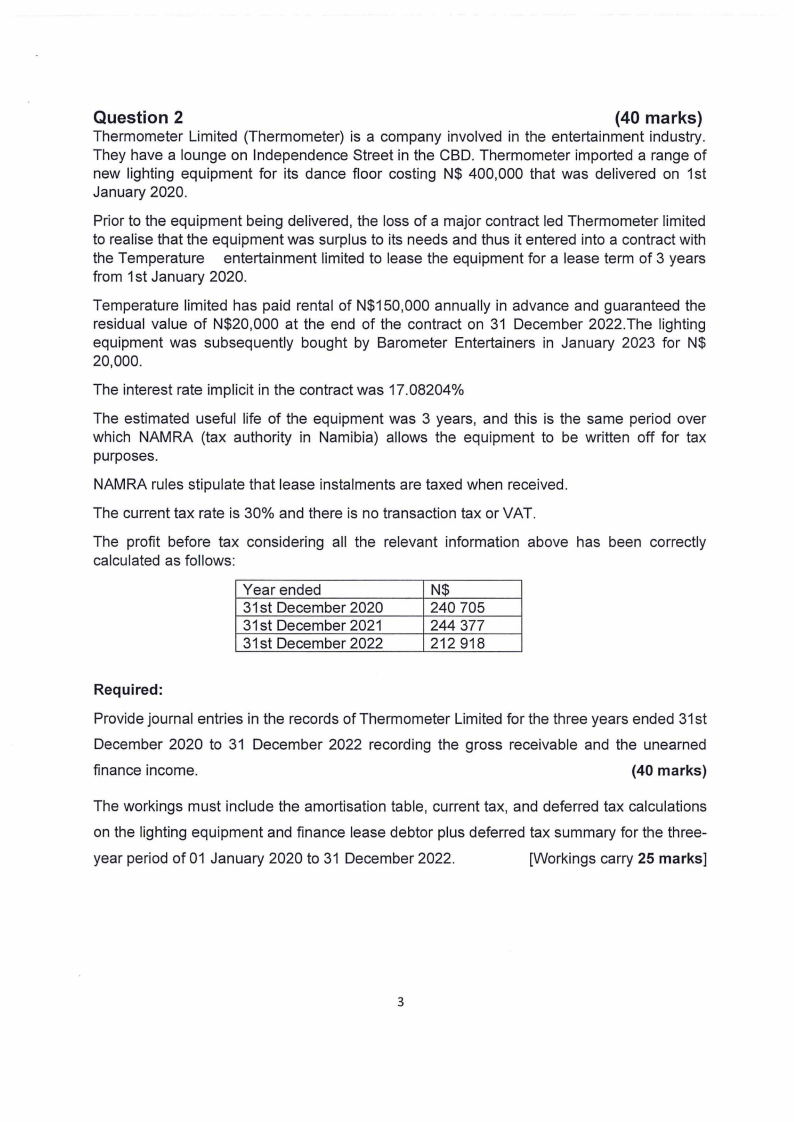

The profit before tax considering all the relevant information above has been correctly

calculated as follows:

Year ended

31st December 2020

31st December 2021

31st December 2022

N$

240 705

244 377

212918

Required:

Provide journal entries in the records of Thermometer Limited for the three years ended 31st

December 2020 to 31 December 2022 recording the gross receivable and the unearned

finance income.

(40 marks)

The workings must include the amortisation table, current tax, and deferred tax calculations

on the lighting equipment and finance lease debtor plus deferred tax summary for the three-

year period of 01 January 2020 to 31 December 2022.

[Workings carry 25 marks]

3

|

4 Page 4 |

▲back to top |

Question 3

(20 Marks)

Katutush Limited purchased 3 000 listed debentures at a price of N$ 190 per debenture.

adventure at the beginning of 2021 on 1st January 2021.

The debentures were 10% N$ 200 debentures and are redeemable at par at 31st December

2023.

Transaction costs amount to N$ 2 000. Interest is payable annually at the end of the year and

you may assume that the purchase price is at its fair value.

The debentures are held within a business model with the objective to collect contractual

cash flows that are solely of principal and interest on the principles of outstanding on the

specified dates.

Assume that interest is solely a compensation for the time value of money and credit risk

associated with the principal amount outstanding.

Required:

a. How should the debenture investments be classified and measured in the financial

statements of the company.

(2 marks)

b. Journalise the effect of the transaction for the years 2021 to 2023.

(8 marks)

c. Calculate the amortized cost of the debenture's investment for the years 2021 to 2023.

(10 marks)

Your answer should comply with the requirement of the international Financial Reporting

standards (IFRS).

4

|

5 Page 5 |

▲back to top |

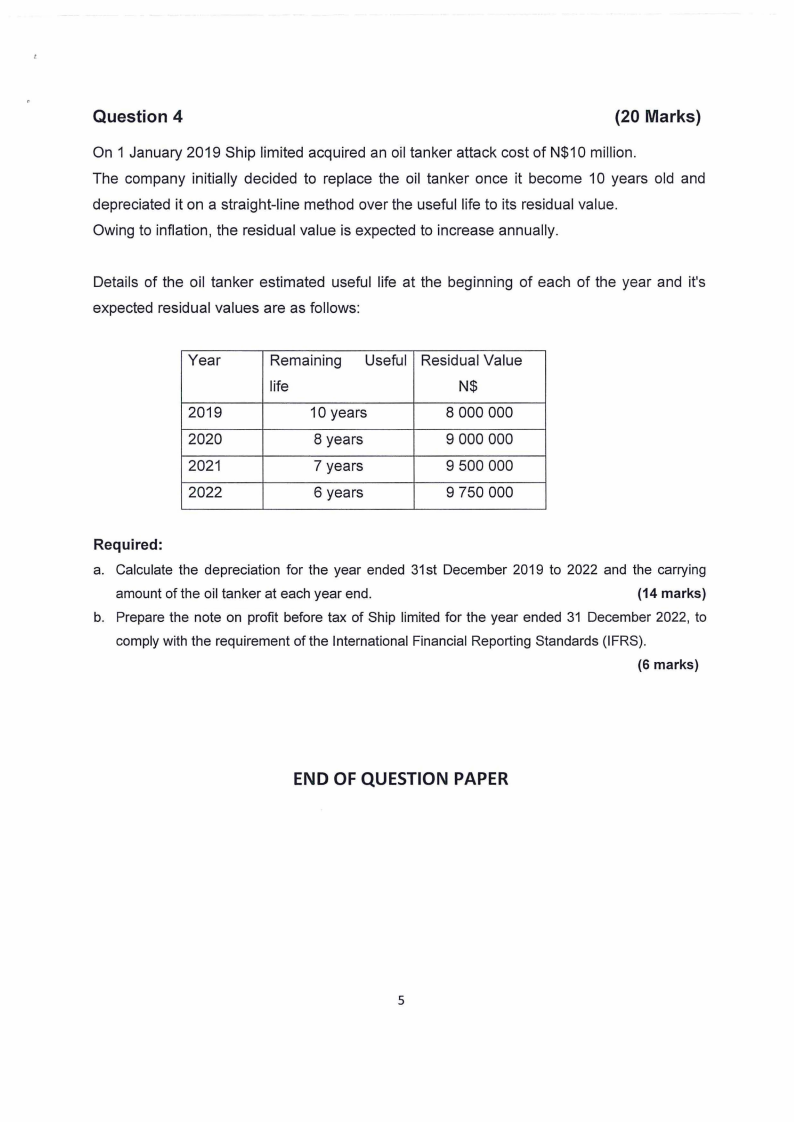

Question 4

(20 Marks)

On 1 January 2019 Ship limited acquired an oil tanker attack cost of N$10 million.

The company initially decided to replace the oil tanker once it become 1O years old and

depreciated it on a straight-line method over the useful life to its residual value.

Owing to inflation, the residual value is expected to increase annually.

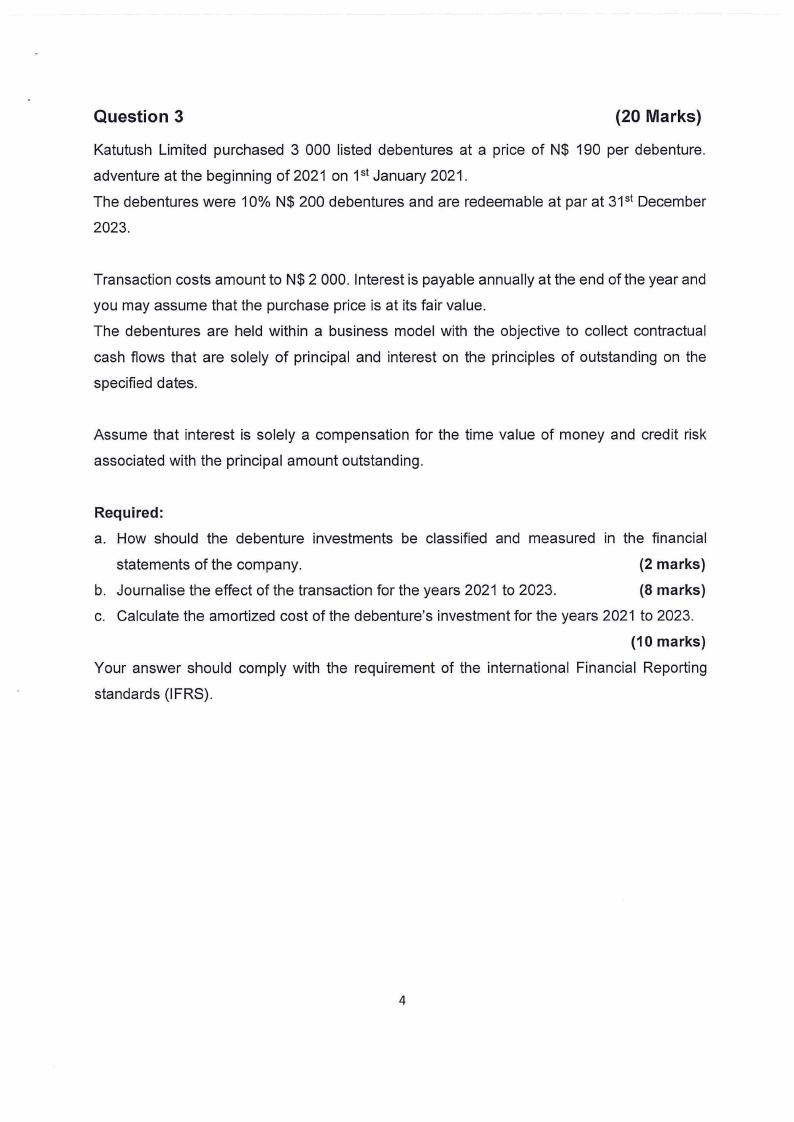

Details of the oil tanker estimated useful life at the beginning of each of the year and it's

expected residual values are as follows:

Year

2019

2020

2021

2022

Remaining Useful Residual Value

life

N$

10 years

8 000 000

8 years

9 000 000

7 years

9 500 000

6 years

9 750 000

Required:

a. Calculate the depreciation for the year ended 31st December 2019 to 2022 and the carrying

amount of the oil tanker at each year end.

(14 marks)

b. Prepare the note on profit before tax of Ship limited for the year ended 31 December 2022, to

comply with the requirement of the International Financial Reporting Standards (IFRS).

(6 marks)

END OF QUESTION PAPER

5