|

GFA711S-FINANCIAL ACCOUNTING-2ND OPP-JULY 2022 |

|

1 Page 1 |

▲back to top |

nAm I BIA un IVERSITY

OF SCIEnCE Ano TECHn OLOGY

FACULTYOFCOMMERCE,HUMANSCIENCESAND EDUCATION

DEPARTMENTOFACCOUNTINGE, CONOMICSAND FINANCE

QUALIFICATION: BACHELOROF ACCOUNTING

QUALIFICATIONCODE: BAOC

LEVEL: 7

COURSE:FINANCIALACCOUNTING310

COURSECODE: GFA7115

DATE: JULY 2022

SESSION:JULY2022

DURATION: 3HRS

MARKS: 100

EXAMINER(S)

SECOND OPPORTUNITYEXAMINATION QUESTIONPAPER

DR ANDREW SIMASIKU

MS SALMI KASITA

MODERATOR: MRS I VAN RENSBURG

THIS QUESTIONPAPERCONSISTSOF _7_ PAGES

(Including this front page)

INSTRUCTIONS

1. Answer ALLthe questions and in blue or black ink

2. Start each question on a new page in your answer booklet & show all your workings

3. Questions relating to this examination may be raised in the initial 30 minutes after the start of the paper.

Thereafter, candidates must use their initiative to deal with any perceived error or ambiguities & any assumption

made by the candidate should be clearly stated

PERMISSIBLEMATERIALS

1. Examination paper- No study materials are allowed in the

examination room

2. Examination script - The examination script should be handed to the

invigilator at the end of the examination session

|

2 Page 2 |

▲back to top |

QUESTION 1

(20 marks)

(a) Talbot Pie has in issue 5 000 000 ordinary shares throughout 2017. During 2015 the

company had given senior executives options over 400 000 shares excisable at N$1 10

at any time after May 2018. None were exercised during 2017. The average fair value of

one ordinary share during the period was N$1.60. Talbot Pie had made a profit after tax

of N$ 540 000 in 2017.

Required

What is the basic and diluted earnings per share for the year ended 31st December,

2017

(10 marks)

(b) Sinbad Pie had the same 20 million ordinary shares in issue on both 1 January 2017

and 31 December 2017. On 1 January 2017, the company issued 2 400 000 N$1 units

of 10% convertible loan stock. Each unit of stock is convertible into 8 ordinary shares on

1st January 2025 at the option of the holder. The following is the extract from Sinbad's

pie statement of profit or loss and other comprehensive income account for the year

ended 31 December, 2017.

N$ 000

Operating profit

1960

Interest payable on 10% convertible loan stock

illQl

Profit before tax

1 840

Taxation @10%

(552)

Profit after tax

1 288

Required

What is the basic and diluted earnings per share for the year ended 31 December 2017

(10 marks)

2

|

3 Page 3 |

▲back to top |

QUESTION 2

(30 marks)

(a) Mushanga limited purchased a specialised machine on 1 January 2015 for

N$10 000 000. Mushanga Limited provides for depreciation on the diminishing

balance method at 20%. The following relates to an error made by Mushanga

Limited

1. It processed depreciation of N$ 2 000 000 in both 2015 and 2016 (2 years) and

N$ 1 200 000 in 2017.

2. The error was picked up in 2017 after the current period's entries had been

processed.

The income tax is 30% and it has been unchanged for many periods.

The tax authorities allow the annual deduction of 20% of the cost of the asset

Required:

Provide the correcting journal entries for the current year ended 31 December 2017

(10 marks)

(b) Using the information provided in (a) above but the error was as follows:

1. During the current year it was discovered that the specialised machinery purchased in

2017 had in fact been expensed as a special marketing fee instead.

2. The error affected the tax calculations and the forms submitted (that is the incorrect

information was also submitted to the tax authorities).

The income tax rate is 30% and has been unchanged for many years

The tax authorities allow annual deduction of 20% on the cost of the asset

3

|

4 Page 4 |

▲back to top |

Required

Prepare the correcting journal entries for the year ended 31 December 2017 assuming :

(i) The tax authorities have indicated that they will re-open the relevant tax

assessments

(10 marks)

(ii) The tax authorities have indicated that they will make the corrections in the

current year assessment(i.e will not re-open the relevant prior tax

assessments)

(10 marks)

4

|

5 Page 5 |

▲back to top |

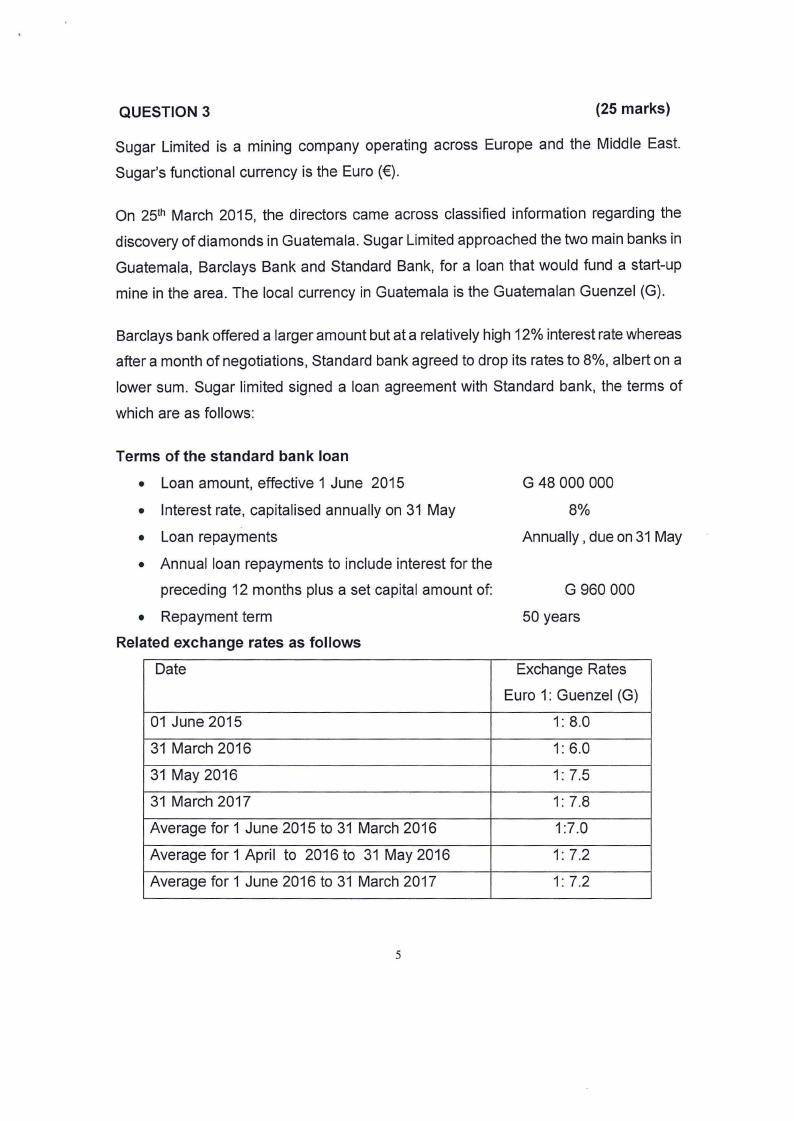

QUESTION 3

(25 marks)

Sugar Limited is a mining company operating across Europe and the Middle East.

Sugar's functional currency is the Euro (€).

On 25th March 2015, the directors came across classified information regarding the

discovery of diamonds in Guatemala. Sugar Limited approached the two main banks in

Guatemala, Barclays Bank and Standard Bank, for a loan that would fund a start-up

mine in the area. The local currency in Guatemala is the Guatemalan Guenzel (G).

Barclays bank offered a larger amount but at a relatively high 12% interest rate whereas

after a month of negotiations, Standard bank agreed to drop its rates to 8%, albert on a

lower sum. Sugar limited signed a loan agreement with Standard bank, the terms of

which are as follows:

Terms of the standard bank loan

• Loan amount, effective 1 June 2015

G 48 000 000

• Interest rate, capitalised annually on 31 May

8%

• Loan repayments

Annually, due on 31 May

• Annual loan repayments to include interest for the

preceding 12 months plus a set capital amount of:

G 960 000

• Repayment term

50 years

Related exchange rates as follows

Date

Exchange Rates

Euro 1: Guenzel (G)

01 June 2015

1: 8.0

31 March 2016

1: 6.0

31 May 2016

1: 7.5

31 March 2017

1: 7.8

Average for 1 June 2015 to 31 March 2016

1:7.0

Average for 1 April to 2016 to 31 May 2016

1: 7.2

Average for 1 June 2016 to 31 March 2017

1: 7.2

5

|

6 Page 6 |

▲back to top |

Required

Prepare the necessary journal entries in Sugar Limited's general journal for its year

ended 31 March 2016 and 31 March 2017. (Ignore tax but show all your workings)

(25 marks)

6

|

7 Page 7 |

▲back to top |

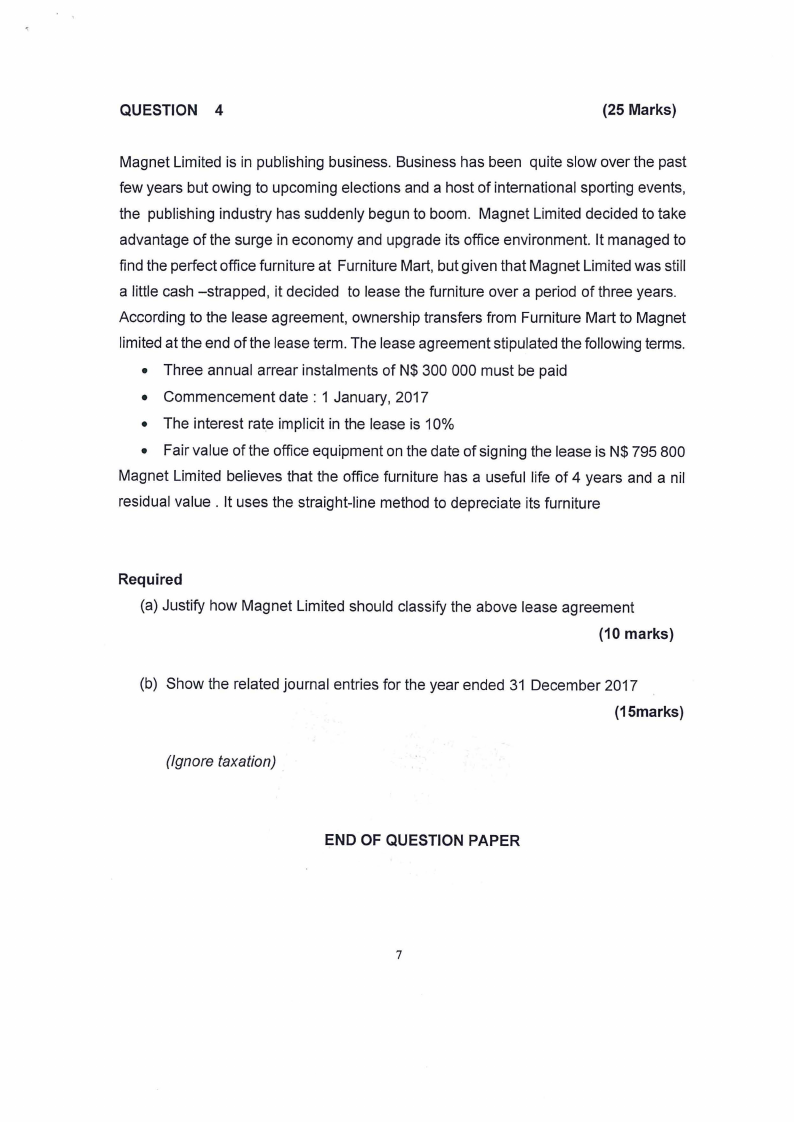

QUESTION 4

(25 Marks)

Magnet Limited is in publishing business. Business has been quite slow over the past

few years but owing to upcoming elections and a host of international sporting events,

the publishing industry has suddenly begun to boom. Magnet Limited decided to take

advantage of the surge in economy and upgrade its office environment. It managed to

find the perfect office furniture at Furniture Mart, but given that Magnet Limited was still

a little cash -strapped, it decided to lease the furniture over a period of three years.

According to the lease agreement, ownership transfers from Furniture Mart to Magnet

limited at the end of the lease term. The lease agreement stipulated the following terms.

• Three annual arrear instalments of N$ 300 000 must be paid

• Commencement date : 1 January, 2017

• The interest rate implicit in the lease is 10%

• Fair value of the office equipment on the date of signing the lease is N$ 795 800

Magnet Limited believes that the office furniture has a useful life of 4 years and a nil

residual value . It uses the straight-line method to depreciate its furniture

Required

(a) Justify how Magnet Limited should classify the above lease agreement

(10 marks)

(b) Show the related journal entries for the year ended 31 December 2017

(15marks)

(Ignore taxation)

END OF QUESTION PAPER

7