|

PMV611S - PRINCIPLES AND METHODS OF VALUATION - 1ST OPP - JUNE 2023 |

|

1 Page 1 |

▲back to top |

n Am I BI A u n IVER s I TY

OF SCIEn CE Ano TECHn OLOGY

FACULTY OF ENGINEERING AND THE BUILT ENVIRONMENT

DEPARTMENT OF LAND AND SPATIAL SCIENCES

QUALIFICATION(S): BACHELOR OF PROPERTYSTUDIES

DIPLOMA IN PROPERTYSTUDIES

QUALIFICATION{S) CODE: 08BPRS

06DPRS

NQF LEVEL: 6

COURSE CODE: PMV611S

COURSE NAME: PRINCIPLESAND METHODS OF

VALUATION

EXAMS SESSION: JUNE 2023

PAPER:

THEORY

DURATION:

3 HOURS

MARKS:

100

EXAMINER(S)

FIRST OPPORTUNITY EXAMINATION QUESTION PAPER

SAM M. MWANDO

MODERATOR: SAMUEL ATO K. HAYFORD

INSTRUCTIONS

1. Read the entire question paper before answering the Questions.

2. Please write clearly and legibly!

3. The question paper contains a total of 5 questions.

4. You must answer ALL QUESTIONS.

5. Make sure your Student Number is on the EXAMINATION BOOK(S).

PERMISSIBLE MATERIALS

1. Non-programmable Scientific Calculator

THIS QUESTION PAPER CONSISTS OF 8 PAGES (Including this front page)

|

2 Page 2 |

▲back to top |

Principles and Methods of Valuation

PMV611S

Question 1

a) For each of the following statements indicate whether it is true or false. Each correct answer carries 1

(one) mark.

(10)

i) The best valuation for hospitality properties is the profits method.

(1)

ii) The term that refers to the loss of value from all causes which are outside the property itself is

known as external obsolescence.

(1)

iii) Replacement cost is the cost of constructing, using current construction methods and materials, a

substitute structure equal to the existing structure in quality and utility.

(1)

iv) While assessing the depreciation of motor vehicles, valuers consider if the car is lady driven or

male driven.

(1)

v) The Discounted Cash Flow (DCF) methodology relies on the construction of an explicit cash flow

reflecting all real receipts and payments associated with property ownership and reflecting the

valuer's understanding of market perceptions of growth and risk.

(1)

vi) The total yield is made up of a risk-free return less a risk premium.

(1)

vii) The uniqueness of properties adds to the care required in the valuation process.

(1)

viii) The purpose of an investment valuation is to provide an opinion on the capital value of the right

to receive regular streams of income for a definite or indefinite period.

(1)

ix) The age of a property based on the amount of wear and tear it has sustained is referred to as the

effective age.

(1)

x) When the market is weak and few market transactions are available, the applicability of the sales

comparison approach may not be limited.

(1)

First Opportunity Memorandum

Page 2 of 8

June 2023

|

3 Page 3 |

▲back to top |

Principles and Methods of Valuation

PMV611S

b) Multiple choice questions. Each answer carries 1 (one) mark.

i) Which formula is applicable in establishing value of a property by cost approach?

a) Cost of site+ cost of building - obsolescence - depreciation = value of the property

b) Cost of site+ cost of building+ obsolescence - depreciation= value of the property

c) Cost of materials+ cost of building - expenses= value of the property

d) Cost of money+ cost of building - obsolescence - depreciation = value of the property.

ii) Which method is best suited for the valuation of building ripe for redevelopment?

a) Cost approach

b) Accounts method

c) Residual method

d) Hospitality comparable method

iii) A property valuer is undertaking the valuation of the Central Police Station at the corner of

Bahnhof Street and Independence Avenue in the Windhoek Central Business District (CBD) in

April 2023. Which property type should he/she consider in establishing the rate of land per

square metre?

a) The land rates for similar police stations only

b) The rate being applied on commercial/business properties in the CBD

c) It is not possible because of the uniqueness of the police station

d) All of the above.

iv) For a good valuation report to be compiled, it is vital for the valuer to note the following

sources of information except for.

a) Estate agents

b) Deeds registry

c) Educated friends and relatives

d) Municipality

v) The total cost to build a house might be N$3.lm, but a valuer might subsequently value the

house at N$4.2m based on comparable market data and the characteristics of the house. The

price subsequently achieved in a sale might then be N$5.275m although one of the

unsuccessful bidders thought the house was worth only N$5.lm. There are some building

First Opportunity Memorandum

Page 3 of 8

June 2023

|

4 Page 4 |

▲back to top |

Principles and Methods of Valuation

PMV611S

materials on site that will be used to extend the same house that are worth N$500,000. Which

amount are we, valuers, concerned with?

a) N$4.5m plus N$500,000

b) N$5.775m

c) N$5.27m plus N$500,000

d) N$5.275m

vi) If a comparable property has a larger erf than the subject property, what must be done to

account for this difference?

a) The sale price of the comparable must be adjusted upward

b) The sale price of the comparable must be adjusted downward

c) The market value of the subject must be adjusted upward

d) The market value of the subject must be adjusted downward.

vii) Which of the following does not assist in determining the value of an agricultural property?

a) Location

b) The qualification of the farm owner

c) Availability of water sources

d) Topography of the land

viii) Which of the following is not one of the purposes of undertaking a valuation?

a) Tax avoidance

b) Financial reporting

c) Insurance

d) Tax evasion

ix) The sales comparison approach involves various elements of comparison. Which of the

following elements is NOT one employed in this approach?

a) Property rights conveyed

b) Cost

c) Date of sale

d) Number of bedrooms

First Opportunity Memorandum

Page4of8

June 2023

|

5 Page 5 |

▲back to top |

Principles and Methods of Valuation

x) Which of the following is an example of a special use property?

a) Double storey house

b) Office building

c) Mariental fire station

d) Retail shop

PMV611S

[20]

Question 2

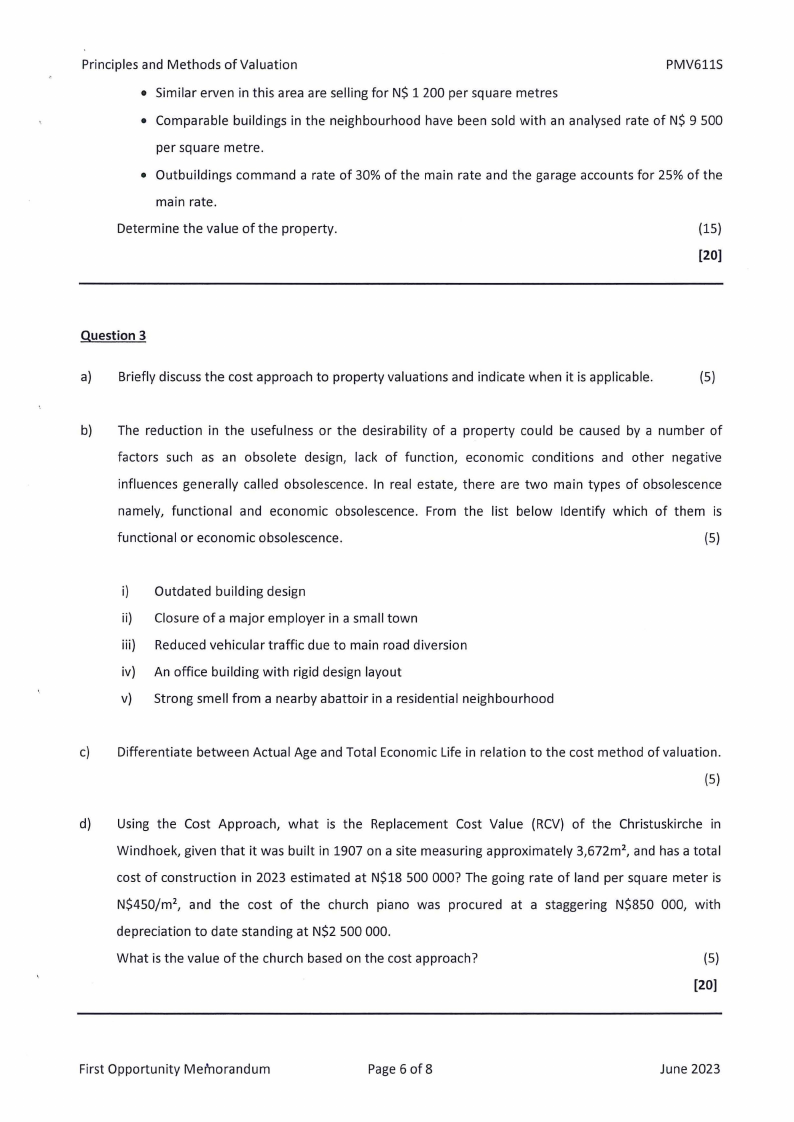

Consider the floor plan for a house below. The dimensions are represented in millimetres, for instance

7950mm is equivalent to 7.950 metres.

7950

6

r;:::c~;r::::::::::E~;;:c;-:r----,:::E~::C:=:7

J

_/ KITCHEN

-.

4

LIVING ROOM/DINl('JG

·:-·73-525

,.-----~

..f...-

' \\ CORR

I

8::;:;:

8

1

I

I

2 ~--11-,-11---tf_,_5?~__5___

,

'.-J \\N&___ ...----(

3I

I

11770

9

/

I

•I

ENT.

.

3300

.

....::i-------~1+-

1

1U

I

BEDROOM

l.'1

--,----------~----4--4-2--5---,·

1775

I

4200

I

a) Calculate the gross external area (in metres) of the house plan above.

(5)

b) Using your answer (gross external area) from question 2a) above and considering that the erf size of

this property is 350 square metres with an outbuilding measuring 65 square metres, and a detached

garage measuring 40 square metres.

You are also aware of the following information:

First Opportunity Memorandum

Page 5 of 8

June 2023

|

6 Page 6 |

▲back to top |

Principles and Methods of Valuation

PMV611S

• Similar erven in this area are selling for N$ 1 200 per square metres

• Comparable buildings in the neighbourhood have been sold with an analysed rate of N$ 9 500

per square metre.

• Outbuildings command a rate of 30% of the main rate and the garage accounts for 25% of the

main rate.

Determine the value of the property.

(15)

[20]

Question 3

a) Briefly discuss the cost approach to property valuations and indicate when it is applicable.

(5)

b) The reduction in the usefulness or the desirability of a property could be caused by a number of

factors such as an obsolete design, lack of function, economic conditions and other negative

influences generally called obsolescence. In real estate, there are two main types of obsolescence

namely, functional and economic obsolescence. From the list below Identify which of them is

functional or economic obsolescence.

(5)

i) Outdated building design

ii) Closure of a major employer in a small town

iii) Reduced vehicular traffic due to main road diversion

iv) An office building with rigid design layout

v) Strong smell from a nearby abattoir in a residential neighbourhood

c) Differentiate between Actual Age and Total Economic Life in relation to the cost method of valuation.

(5)

d) Using the Cost Approach, what is the Replacement Cost Value (RCV) of the Christuskirche in

Windhoek, given that it was built in 1907 on a site measuring approximately 3,672m 2, and has a total

cost of construction in 2023 estimated at N$18 500 000? The going rate of land per square meter is

N$450/m2, and the cost of the church piano was procured at a staggering N$850 000, with

depreciation to date standing at N$2 500 000.

What is the value of the church based on the cost approach?

(5)

[20]

First Opportunity Memorandum

Page 6 of 8

June 2023

|

7 Page 7 |

▲back to top |

Principles and Methods of Valuation

PMV611S

Question 4

a) Explain the two (2) principles relating to the investment method of valuation.

(3)

b) Oscar decides to save for 10 years so as to use the savings to buy himself a dream home. Supposing

he saves N$30 000 per annum in a bank that pays interest at 12% per annum, determine whether or

not he would be able to purchase the dream home if such homes sell for around N$1 000 000.

(3)

c) An investment valuation is calculated using the yield from the property. A freehold property on the

market has an asking price of N$200 000 and a rental income of N$600 per month. Calculate the

yield.

(3)

d) The operating statement of a prime apartment block (freehold) is as follows:

Effective Gross Income

N$ 420 000

Fixed Operating Expenses

N$ 40 300

Variable Operating Expenses

N$ 65 500

Replacement Allowance

N$ 25 200

Using the information provided above, calculate the following:

i) Total Operating Expenses

(2)

ii) Operating Expense Ratio

(2)

iii) Net Operating Income

(2)

iv) Net Operating Income Ratio

(2)

v) The value of the property given the yield for similar type of properties being 8%.

(3)

[20]

Question 5

a) List the main variables which form the following main components of the Residual Method of

Valuation:

i) Gross development value

(3)

ii) Development costs

(7)

iii) Fees and expenses on development

(3)

First Opportunity Memorandum

Page 7 of 8

June 2023

|

8 Page 8 |

▲back to top |

Principles and Methods of Valuation

PMV6115

b) Kuaima CC is looking for land in Cimbebasia that is ripe for development. They intend to build 25

residential units each of which will be sold for N$ 650 000. The cost of construction per unit is

estimated at N$ 200 000. The total cost of roads, leveling, landscaping etc. is estimated at N$1 800

000. Fees for professionals involved in the whole development are estimated at N$ 1 600 000. Cost

of finance is estimated at 10% and Developer's Profit is 20%. Determine the Residual Value of the

land.

(7)

(20]

First Opportunity Memorandum

Page 8 of 8

June 2023